CoinW Research Weekly Report (Dec 29, 2025 - Jan 4, 2026)

- Core View: The overall cryptocurrency market is recovering, with varying levels of activity across public chain ecosystems.

- Key Elements:

- The total cryptocurrency market cap grew by 5.23%, reaching $3.22 trillion.

- On-chain activity on Solana (DEX trading volume, active addresses) showed significant growth.

- U.S. spot Bitcoin ETFs saw a net inflow of $459 million this week.

- Market Impact: Continued capital inflows indicate a recovery in market confidence.

- Timeliness Note: Short-term impact

Key Takeaways

The total global cryptocurrency market capitalization is $3.22 trillion, up approximately 5.23% this week from $3.06 trillion last week. As of press time, the cumulative net inflow for U.S. Bitcoin spot ETFs is approximately $57.08 billion, with a net inflow of $459 million this week; the cumulative net inflow for U.S. Ethereum spot ETFs is approximately $12.5 billion, with a net inflow of $161 million this week.

The total stablecoin market capitalization this week is $312 billion, down 0.32% from $313 billion last week. Among them, USDT's market cap is $187 billion, accounting for 59.9% of the total stablecoin market cap; followed by USDC with a market cap of $75.44 billion, accounting for 24.2%; and DAI with a market cap of $5.36 billion, accounting for 1.7%.

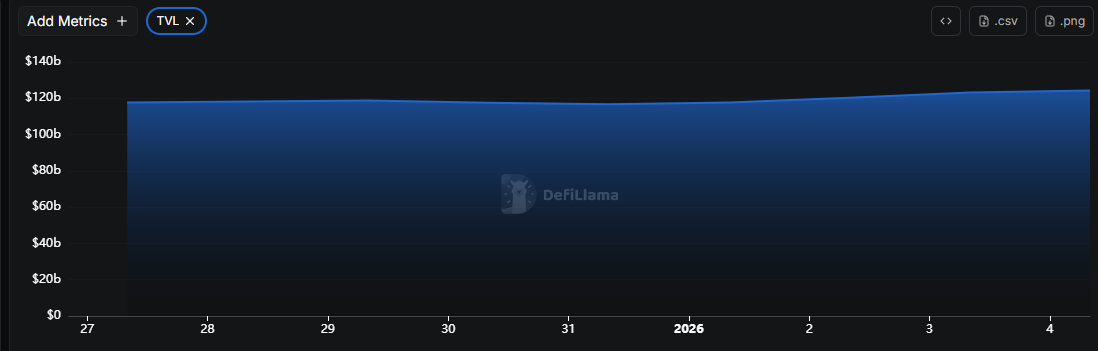

According to DeFiLlama data, the total DeFi TVL this week is $124.3 billion, up approximately 5.16% from $118.2 billion last week.

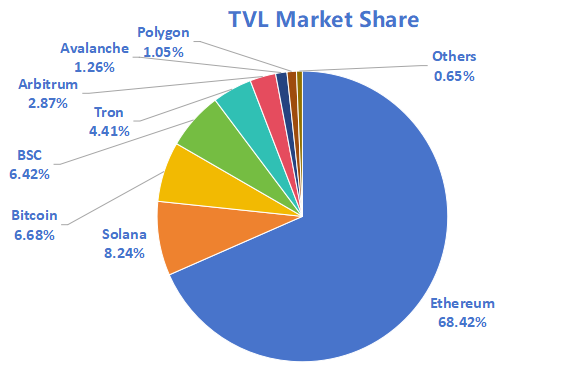

Segmented by public chains, the three public chains with the highest TVL are Ethereum, accounting for 68.42%; Solana, accounting for 8.24%; and Bitcoin, accounting for 6.68%.

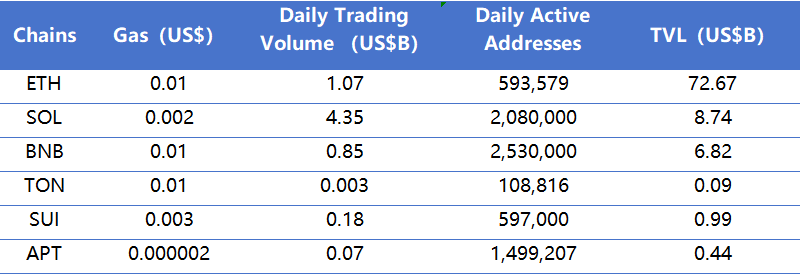

This week, on-chain activity across public chains showed significant divergence, with trading and user activity continuing to concentrate towards high-frequency ecosystems. In terms of daily on-chain DEX trading volume, Solana saw the largest increase, up approximately 45.5%; BNB Chain saw the largest decrease, down approximately 42.2%; Ethereum rose about 27.4%; Ton saw slight growth but its volume remains low; Sui and Aptos decreased by approximately 30.8% and 12.5% respectively. Regarding transaction fees, overall Gas levels remained stable, with only Sui seeing a slight increase, while other public chains remained largely flat compared to last week. In terms of daily active addresses, Solana saw the largest increase, up approximately 9.5%; Aptos saw the largest decrease, down approximately 10.2%; Ton also declined by about 9.6%; Ethereum and BNB Chain grew by approximately 8.8% and 5.9% respectively; Sui saw slight growth. In terms of TVL, Sui showed the most significant increase, up approximately 7.6%; Ethereum rose 6%; Solana and BNB Chain saw slight growth; Ton and Aptos remained largely stable overall.

New Projects to Watch: Kumbaya is a DEX built on MegaETH, with a core positioning centered around cultural consensus and community cohesion, focusing on the issuance, discovery, and trading of cultural tokens; Reflect is a synthetic currency trading protocol based on Solana, aiming to provide global users with high-yield, low-volatility "dollarized" financial products; CipherOwl is a programmable intelligence layer for institutional-grade crypto applications, positioned to provide public institutions, financial institutions, and protocol developers with automated, controllable, and transparent compliance infrastructure.

Table of Contents

Key Takeaways

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Dominance

2. Fear & Greed Index

3. ETF Inflow/Outflow Data

4. ETH/BTC and ETH/USD Exchange Rates

5. Decentralized Finance (DeFi)

6. On-Chain Data

7. Stablecoin Market Cap and Issuance

II. This Week's Hot Money Movements

1. Top 5 Gaining VC Coins and Meme Coins This Week

2. New Project Insights

III. Industry News

1. Major Industry Events This Week

2. Upcoming Major Events Next Week

3. Important Fundraising from Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Dominance

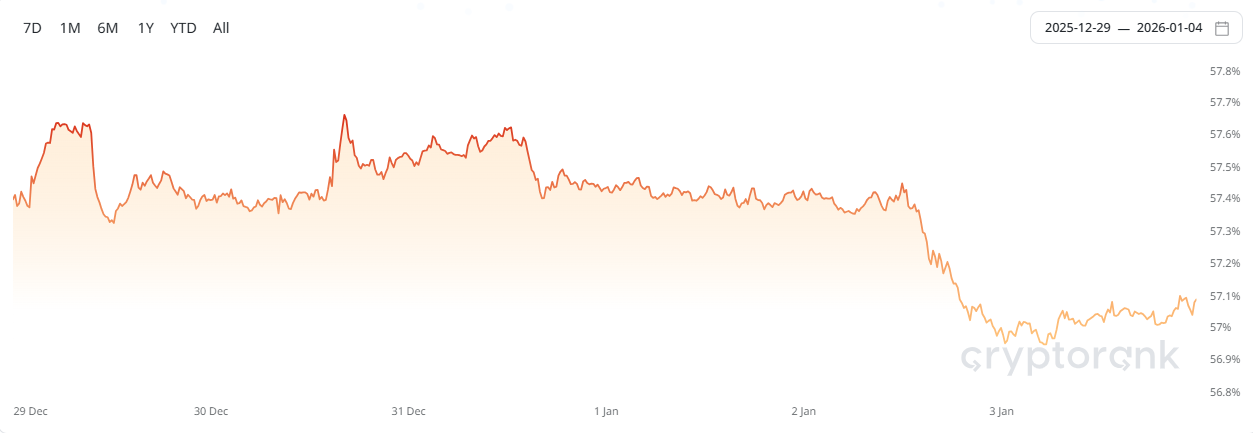

The total global cryptocurrency market capitalization is $3.22 trillion, up approximately 5.23% this week from $3.06 trillion last week.

Data Source: Cryptorank,https://cryptorank.io/charts/btc-dominance

Data as of January 4, 2026

As of press time, Bitcoin's market capitalization is $1.83 trillion, accounting for 56.95% of the total cryptocurrency market cap. Meanwhile, the stablecoin market cap is $312 billion, accounting for 9.7% of the total cryptocurrency market cap.

Data Source: Coingecko,https://www.coingecko.com/en/charts

Data as of January 4, 2026

2. Fear & Greed Index

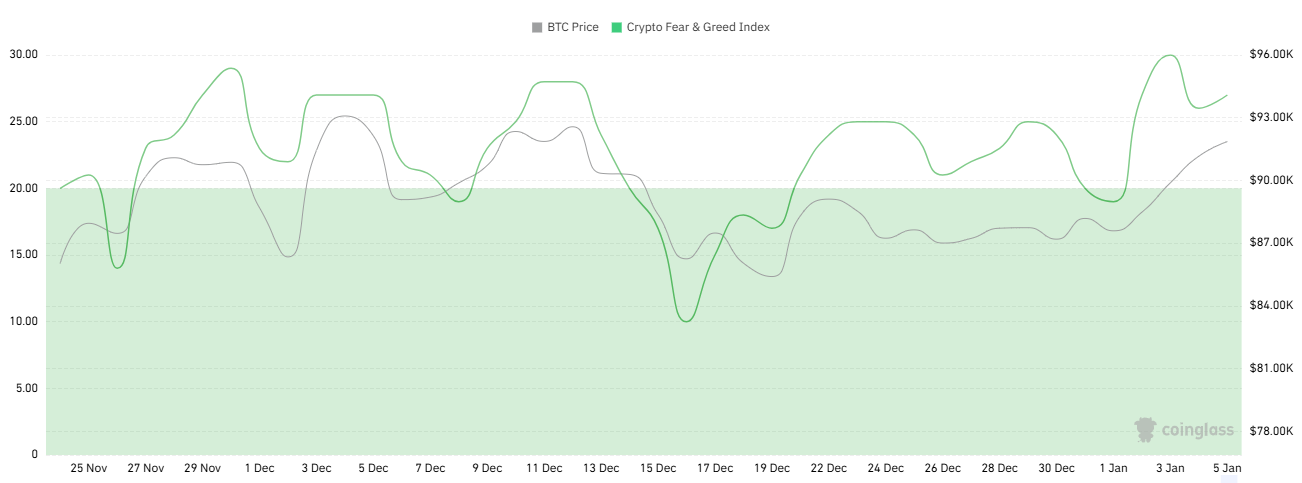

The Cryptocurrency Fear & Greed Index is 27, indicating Fear.

Data Source: Coinglass,https://www.coinglass.com/pro/i/FearGreedIndex

Data as of January 4, 2026

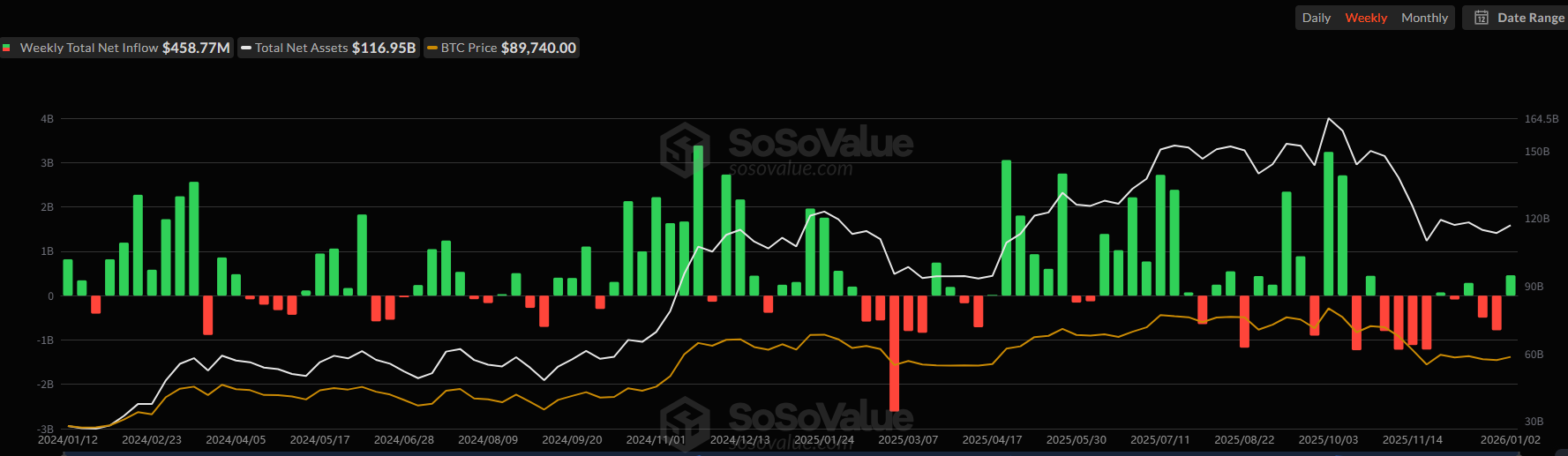

3. ETF Inflow/Outflow Data

As of press time, the cumulative net inflow for U.S. Bitcoin spot ETFs is approximately $57.08 billion, with a net inflow of $459 million this week; the cumulative net inflow for U.S. Ethereum spot ETFs is approximately $12.5 billion, with a net inflow of $161 million this week.

Data Source: Sosovalue,https://sosovalue.com/zh/assets/etf

Data as of January 4, 2026

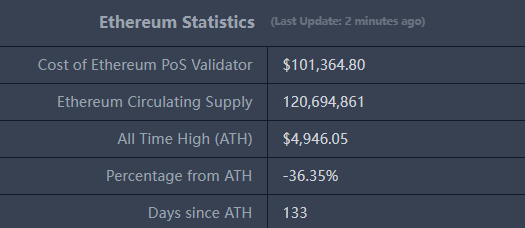

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $3,168, all-time high $4,946.05, down approximately 36.35% from ATH.

ETHBTC: Currently 0.03434, all-time high 0.1238.

Data Source: Ratiogang,https://ratiogang.com/

Data as of January 4, 2026

5. Decentralized Finance (DeFi)

According to DeFiLlama data, the total DeFi TVL this week is $124.3 billion, up approximately 5.16% from $118.2 billion last week.

Data Source: Defillama,https://defillama.com

Data as of January 4, 2026

Segmented by public chains, the three public chains with the highest TVL are Ethereum, accounting for 68.42%; Solana, accounting for 8.24%; and Bitcoin, accounting for 6.68%.

Data Source: CoinW Research, Defillama,https://defillama.com

Data as of January 4, 2026

6. On-Chain Data

Layer 1 Related Data

Primarily analyzes data for major Layer 1s including ETH, SOL, BNB, TON, SUI, and APT based on daily on-chain DEX trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research, Defillama,https://defillama.com

Data as of January 4, 2026

Daily On-Chain DEX Trading Volume and Transaction Fees: Daily on-chain DEX trading volume and transaction fees are core metrics for measuring public chain activity and user experience. In terms of daily on-chain DEX trading volume, Solana saw the largest increase, up approximately 45.5%; BNB Chain saw the largest decrease, down approximately 42.2%; Ethereum rose about 27.4%; Ton saw slight growth but its volume remains low; Sui and Aptos decreased by approximately 30.8% and 12.5% respectively. Regarding transaction fees, overall Gas levels remained stable, with only Sui seeing a slight increase, while other public chains remained largely flat compared to last week.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of a public chain, while TVL reflects user trust in the platform. In terms of daily active addresses, Solana saw the largest increase, up approximately 9.5%; Aptos saw the largest decrease, down approximately 10.2%; Ton also declined by about 9.6%; Ethereum and BNB Chain grew by approximately 8.8% and 5.9% respectively; Sui saw slight growth. In terms of TVL, Sui showed the most significant increase, up approximately 7.6%; Ethereum rose 6.0%; Solana and BNB Chain saw slight growth; Ton and Aptos remained largely stable overall.

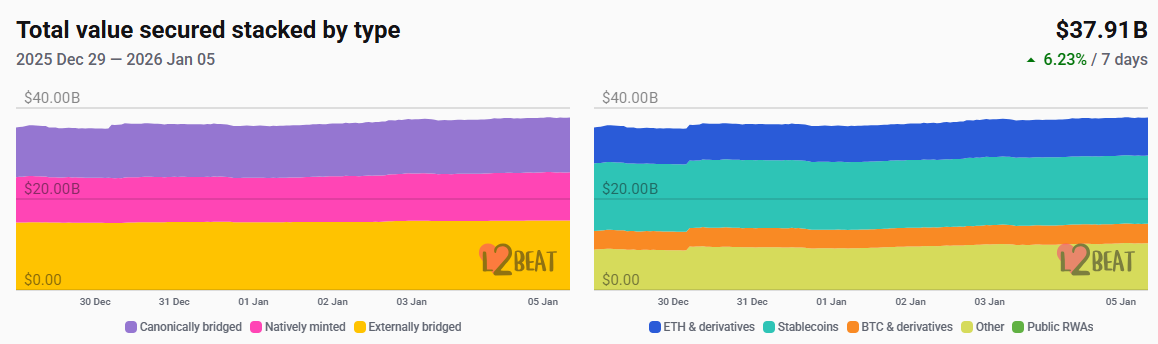

Layer 2 Related Data

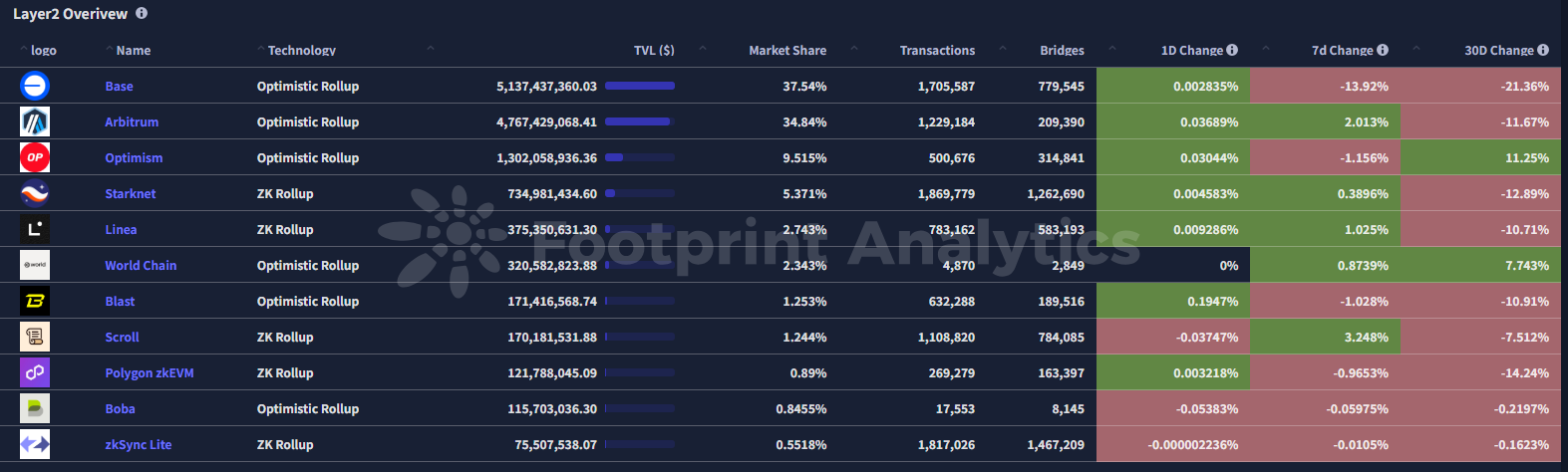

According to L2Beat data, the total TVL of Ethereum Layer 2 is $37.91 billion, up approximately 6.23% this week from $35.82 billion last week.

Data Source: L2Beat,https://l2beat.com/scaling/tvs

Data as of January 4, 2026

Base and Arbitrum occupy the top spots with market shares of 37.54% and 34.84% respectively, with Base ranking first in Ethereum Layer 2 TVL this week.

Data Source: Footprint,https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

7. Stablecoin Market Cap and Issuance

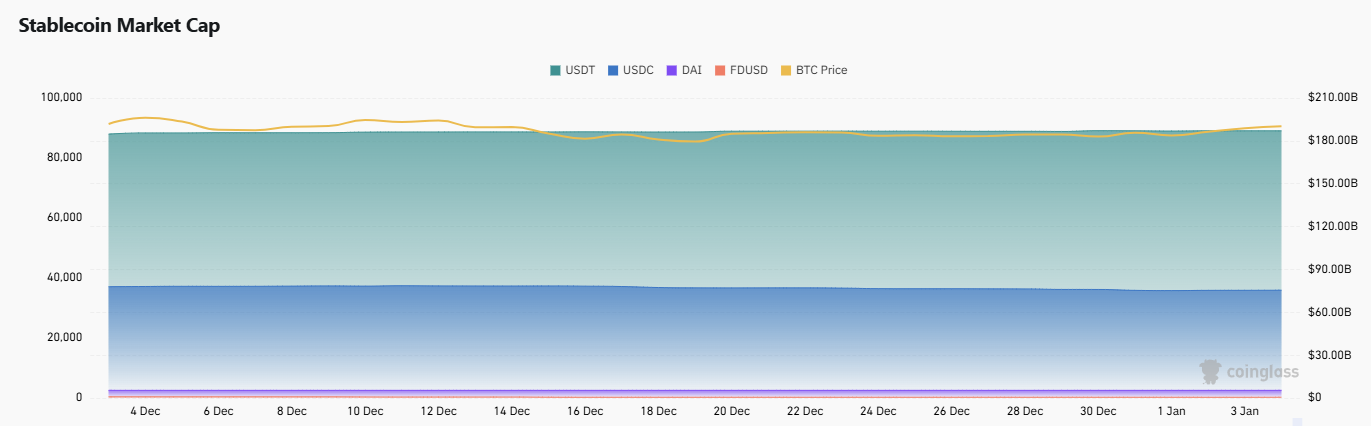

According to Coinglass data, the total stablecoin market capitalization this week is $312 billion, down 0.32% from $313 billion last week. Among them, USDT's market cap is $187 billion, accounting for 59.9% of the total stablecoin market cap; followed by USDC with a market cap of $75.44 billion, accounting for 24.2%; and DAI with a market cap of $5.36 billion, accounting for 1.7%.

Data Source: CoinW Research, Coinglass,https://www.coinglass.com/pro/stablecoin

Data as of January 4, 2026

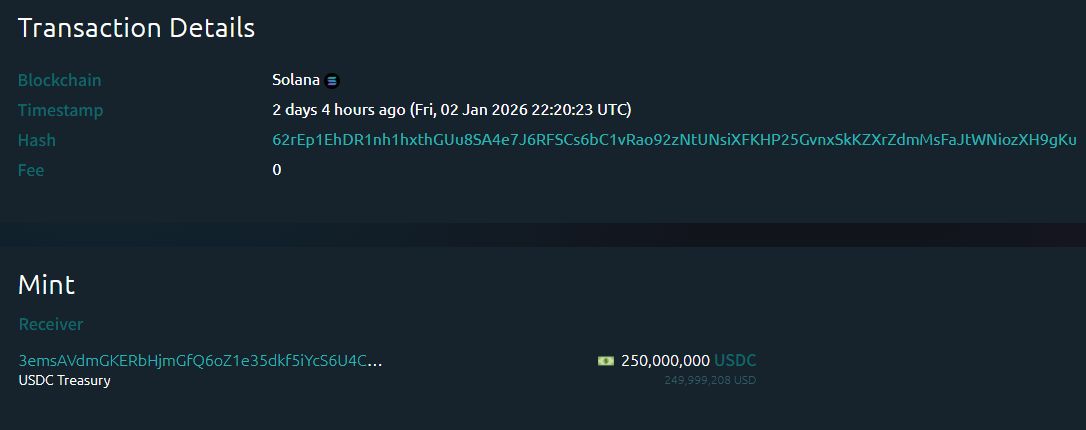

According to Whale Alert data, the USDC Treasury issued a total of 1.111 billion USDC this week, and the Tether Treasury issued a total of 1 billion USDT. The total stablecoin issuance this week was 2.111 billion, up approximately 5.1% from last week's total issuance of 2.008 billion.

Data Source: Whale Alert,https://x.com/whale_alert

Data as of January 4, 2026

II. This Week's Hot Money Movements

1. Top 5 Gaining VC Coins and Meme Coins This Week

Top 5 Gaining VC Coins in the Past Week

Data Source: CoinW Research, Coinmarketcap,https://coinmarketcap.com/

Data as of January 4, 2026

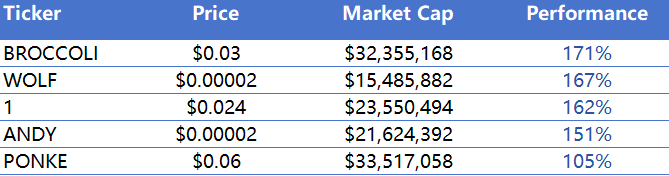

Top 5 Gaining Meme Coins in the Past Week

Data Source: CoinW Research, Coinmarketcap,https://coinmarketcap.com/

Data as of January 4, 2026

2. New Project Insights

Kumbaya is a DEX built on MegaETH. Its core positioning is not as a traditional liquidity-driven trading platform but rather revolves around cultural consensus and community cohesion, focusing on the issuance, discovery, and trading of cultural tokens. Kumbaya attempts to merge Launchpad and DEX functionalities, lowering the barrier to creating culture and narrative-driven assets and providing a native trading venue for early communities.

Reflect is a synthetic currency trading protocol based on Solana, aiming to provide global users with high-yield, low-volatility "dollarized" financial products. Reflect's differentiation lies in its foundation on liquid staking tokens (LSTs), combined with perpetual contract strategies to construct a Delta-Neutral synthetic currency mechanism. This aims to capture both native staking yields and derivative funding rate yields while maintaining a neutral risk exposure as much as possible, thereby achieving a stable and attractive yield structure. Reflect was founded in 2022 and has completed approximately $3.75 million in funding, with core investors including a16z CSX and Solana Ventures.

CipherOwl is a programmable intelligence layer for institutional-grade crypto applications, positioned to provide public institutions, financial institutions, and protocol developers with automated, controllable, and transparent compliance infrastructure. By modularizing, codifying, and making compliance logic programmable, CipherOwl enables key functions such as KYC, AML, transaction monitoring, and compliance reporting to be executed efficiently through on-chain and off-chain coordination. This allows for meeting the rigid regulatory compliance demands of institutions without sacrificing system flexibility or privacy boundaries.

III. Industry News

1. Major Industry Events This Week

The second phase of the Stable pre