Is the moat of public blockchains only 3 points? Alliance DAO founder's comments ignite debate in the crypto community.

- 核心观点:区块链护城河有限,公链评分仅3/10。

- 关键要素:

- 流动性非绝对护城河,易流失。

- 以太坊十年主导地位证明护城河。

- 护城河应含技术、生态、网络效应。

- 市场影响:引发对行业核心价值与可持续性的深度反思。

- 时效性标注:中期影响。

Original article by Odaily Planet Daily ( @OdailyChina )

Author/ Wenser ( @wenser2010 )

Recently, qw ( @QwQiao ), the founder of Alliance DAO, put forward a surprising view: "Blockchain moats are limited," and rated the moat of the L1 public chain as only 3/10.

This statement quickly ignited a firestorm in the overseas crypto community, sparking heated discussions among crypto VCs, public chain builders, and KOLs. Dragonfly partner Haseeb angrily retorted that his rating of "blockchain moats at 3/10" was utterly absurd, and even Aave founder Santi, who is disgusted by the gambling atmosphere in the industry, has never believed that blockchain "has no moats."

Debates about the significance, value, and business models of blockchain and cryptocurrencies resurface repeatedly throughout the cycle. The crypto industry oscillates between ideals and reality: people cherish the initial ideals of decentralization while yearning for the status and recognition of traditional finance, yet are also deeply mired in self-doubt, wondering if it's merely a packaged casino. The root of all these contradictions may lie in its size—the total market capitalization of the crypto industry has hovered around $3-4 trillion, still insignificant compared to traditional financial giants with scales of hundreds of billions or even trillions of dollars.

As practitioners, we all share a contradictory psychology of both arrogance and inferiority. The arrogance stems from our initial commitment to Satoshi Nakamoto's ideals of fiat currency decentralization and the spirit of decentralization, and from the fact that the crypto industry has indeed become a burgeoning financial sector, gradually gaining mainstream attention, acceptance, and participation. The inferiority complex arises from the feeling, perhaps, that what we're doing isn't entirely honorable, filled with cutthroat competition, zero-sum games, blood, tears, bitterness, and pain. In short, the limitations of the industry's scale give rise to this cyclical anxiety about identity, self-doubt, and self-denial.

Today, we'll take the topic of "moat business rating" proposed by qw as an example to discuss the existing problems and core advantages of the crypto industry.

The debate begins with the question: Is liquidity the moat of the crypto industry?

This heated industry debate about whether a moat exists in the crypto industry actually originated from a statement by Frankie, a research member of the Paradigm team: "The greatest trick the devil ever pulled was convincing crypto users that liquidity is a moat." (Odaily Planet Daily note: The original quote is "the greatest trick the devil ever pulled was convincing crypto people that liquidity is a moat. ")

It's clear that Frankie, a "purebred" VC, is somewhat dismissive of the current crypto industry's prevailing "liquidity is everything" mentality. After all, investors and research experts with advantages in funding and information often prefer to invest their money in projects and businesses with real business support, generating real cash flow and consistently providing financial returns.

This viewpoint was also echoed by many in the comments section:

- Multicoin partner Kyle Samani directly responded with "+1";

- Ethereum Foundation member binji believes that "trust is the real moat. Even if trust may shift due to opportunities in the short term, liquidity will always remain where trust is placed."

- Chris Reis of Circle's Arc blockchain team also pointed out : "TVL always seems to be the wrong North Star metric (business guidance target)."

- Justin Alick of the Aura Foundation quipped , "Liquidity is like a fickle woman; she can leave you at any moment."

- DeFi researcher Defi peniel bluntly stated : "Liquidity alone is not a moat; hype can disappear overnight."

Of course, many people also disagreed.

- DFDV COO and CIO Parker commented : "What are you talking about? USDT is the worst stablecoin, yet it dominates the market. Bitcoin is the worst blockchain (in terms of performance experience), yet it dominates the market."

- KD, a former Sequoia Capital investor and current Folius Ventures investor, countered with a rhetorical question : "Isn't that right?"

- Fabric VC investor Thomas Crow points out : "In exchanges, liquidity is a moat—the deeper the liquidity, the better the user experience; this is the most important characteristic in this vertical industry without exception. That's why the main innovations in crypto asset trading focus on solving the problem of insufficient liquidity (which leads to a worse user experience). Examples include Uniswap, which uses LPs to obtain liquidity for long-tail assets, and Pump.Fun, which attracts pre-token liquidity through standardized contracts and bonding curves."

- Pantera investor Mason Nystrom retweeted and commented, "Liquidity is absolutely a moat." He then gave different examples to illustrate this: Among public blockchains, Ethereum's current leadership is due to DeFi liquidity (and developers); CEXs such as Binance and Coinbase; lending platforms such as Aave and MakerDAO; stablecoins such as USDT; and DEXs such as Uniswap and Pancakeswap.

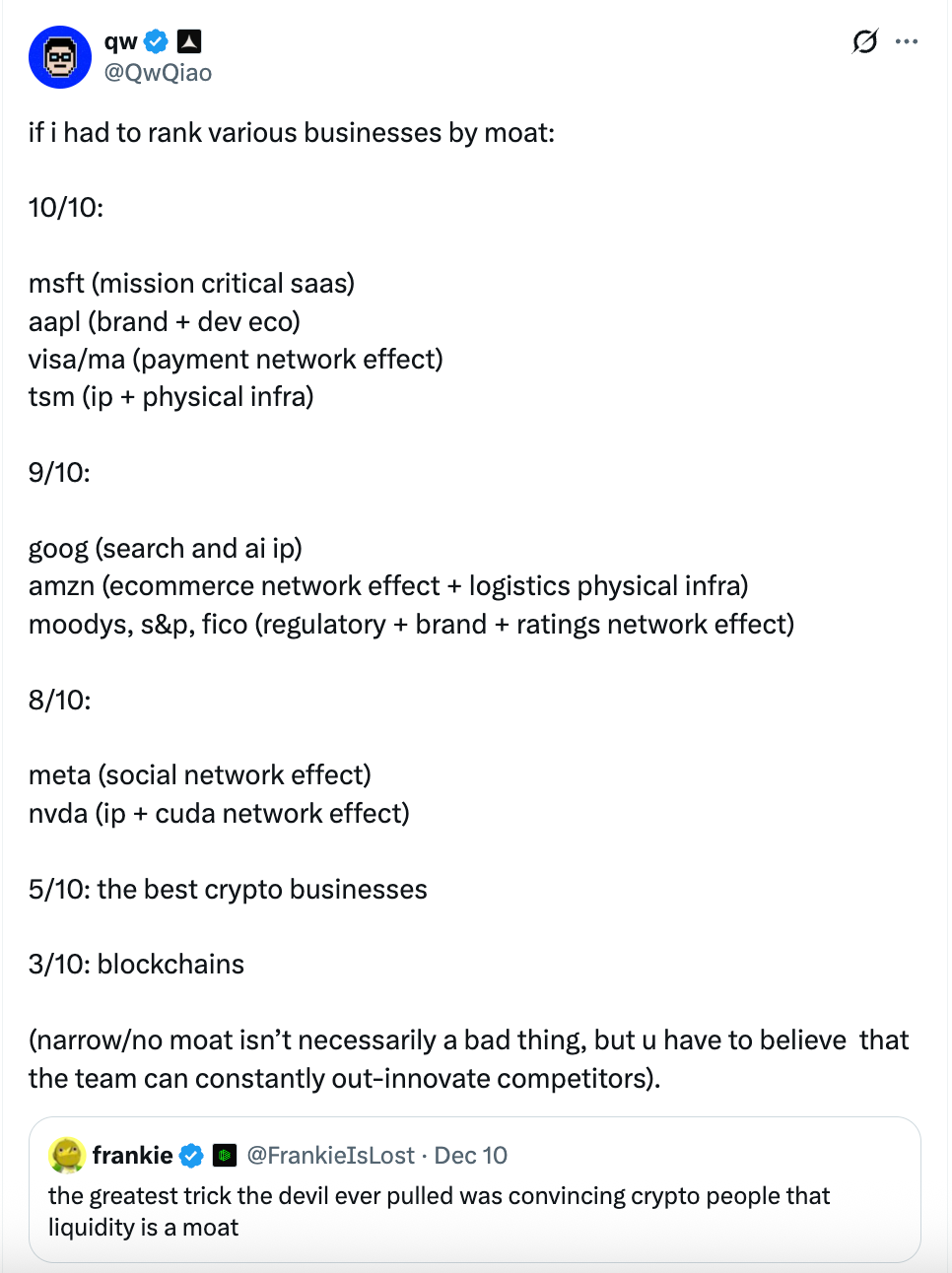

Then came the Alliance DAO founder qw's tweet about "moat rating" :

In his view, the moat of blockchain (public chain) itself is very limited, and the score is only 3/10.

- It is believed that Microsoft (key SaaS), Apple (brand + development ecosystem), Visa/Mastercard (payment network effect), and TSMC (IP + physical infrastructure) can be rated as 10/10 (the strongest moat).

- Google (search and AI IP), Amazon (e-commerce network effects + logistics infrastructure), Moody's, S&P, FICO and other rating agencies (regulatory drive + brand + rating network effects), and large-scale cloud computing (AWS/Azure/GCP, etc.) can achieve a score of 9/10;

- Meta (social network effect) and NVIDIA (IP + CUDA network effect) received scores of 8/10;

- The best crypto businesses in the industry are rated 5/10;

- The public blockchains are rated only 3/10 (with a narrow moat).

qw further stated that a lower moat score isn't necessarily a bad thing, but it means the team must be able to consistently lead in innovation, otherwise they will be quickly replaced. Subsequently, perhaps feeling the initial rating was too hasty, they added some supplementary ratings in the comments section:

- The three major cloud service providers received a score of 9/10.

- BTC's moat rating is 9/10 (Odaily Planet Daily note: qw points out that no one can replicate the founding story of the BTC public chain and the "Lindy effect," but deducted 1 point because it is unclear whether it can cope with security budgets and quantum threats).

- Tesla 7/10 (Odaily Planet Daily note: qw believes that autonomous driving and other automation IPs are incredibly ambitious, but the automotive industry is a commercialized industry, and humanoid robots may be similar.)

- 10/10, a manufacturer of lithography machines.

- AAVE's moat rating is likely higher than 5 out of 10. qw's reasoning is: "As a user, you must trust that their smart contract security testing is sufficient to prevent you from losing your funds."

Of course, seeing qw so grandly assuming the role of a "critical commentator," besides the debate on the "moat system," some in the comments section also offered irrelevant sarcasm and ridicule towards qw's remarks. One person even asked, "What about those terrible token launch platforms you invested in?" (Odaily Planet Daily note: After investing in pump.fun , Alliance DAO's subsequent investments in one-click token launch platforms (such as Believe) performed poorly; he himself didn't even want to rate them.)

It was this highly contentious topic that prompted Dragonfly partner Haseeb to subsequently speak out angrily.

Dragonfly Partner's Inner Thoughts: Utter nonsense! I've never seen such a shameless person.

In response to qw's "moat rating system," Dragonfly partner Haseeb angrily retorted : "What? 'Blockchain moat: 3/10'? That's a bit absurd. Even Santi doesn't believe that public chains 'have no moat'."

Ethereum has dominated for 10 consecutive years , with hundreds of challengers raising over $10 billion in an attempt to seize market share. After a decade of competitors trying to defeat it, Ethereum has successfully defended its throne each time. If this doesn't demonstrate that Ethereum has a moat, then I really don't know what a moat is.

In the comments section of this tweet, qw also gave his opinion: "What you said is all about looking back ('the past decade') and is factually incorrect (Ethereum is no longer on the throne on multiple metrics)."

The two then debated for several rounds on the questions of "What exactly is a moat?" and "Does Ethereum even have a moat?" qw even brought up a post he made in November, pointing out that his idea of a "moat" was actually revenue/profit . However, Haseeb immediately offered a counterexample—once-popular crypto projects like OpenSea, Axie, and BitMEX, while generating substantial revenue, didn't actually have a moat. The real moat should be judged by whether it can be replaced by competitors .

Marissa, Head of Asset Management at Abra Global, also joined the discussion : "I agree (with Haseeb's point of view). qw's statement is a bit strange—switching costs and network effects can be a strong moat—Solana and Ethereum have these, and I think they will be stronger than other public chains over time. They both have strong brands and development ecosystems, which are obviously part of the moat. Perhaps he was referring to other public chains that do not have these advantages."

Haseeb continued his sarcasm: "qw is just making excuses and asking for trouble."

Based on the above discussion, perhaps we should break down the "real moat" of public blockchains in the cryptocurrency industry and identify what aspects it actually includes.

The 7 key components of a public blockchain's competitive advantage: from people to business, from origin to network.

In my opinion, the reason why qw's "moat rating system" is somewhat inconsistent is mainly because:

Firstly, its scoring criteria only consider current industry position and revenue, neglecting multi-dimensional evaluation. Whether it's infrastructure companies like Microsoft, Apple, and Amazon Web Services, or payment giants like Visa and Mastercard, the main reason QW gives high scores is their strong revenue model. This clearly oversimplifies and superficializes the competitive advantage of a giant company. Moreover, it goes without saying that Apple's global market share is not dominant, and payment giants like Visa also face challenges such as shrinking markets and declining regional business.

Secondly, it overlooks the complexity and uniqueness of public blockchains and crypto projects compared to traditional internet businesses. As challengers to the fiat currency system, cryptocurrencies and blockchain technology, and even the subsequent public blockchains and crypto projects, are based on the inherent "anonymity" and "node-based" nature of decentralized networks, which are often unattainable by traditional revenue-driven businesses.

Based on this, I believe the competitive advantage of public blockchain businesses lies primarily in the following seven aspects, which include:

1. Technological Philosophy. This is also the biggest advantage and differentiating feature of the Bitcoin network, Ethereum network, Solana network, and countless public chain projects. As long as humanity remains wary of centralized systems, authoritarian governments, and fiat currency systems, and accepts the concept of sovereign individuals and related viewpoints, the real demand for decentralized networks will always exist.

2. Founder Charisma. Satoshi Nakamoto disappeared after inventing Bitcoin and ensuring the smooth operation of the Bitcoin network, remaining unmoved despite possessing hundreds of billions of dollars in assets; Vitalik Buterin, from a gamer obsessed with World of Warcraft who suffered at the hands of the game company, became the co-founder of Ethereum, resolutely embarking on his arduous journey of decentralization; Solana founder Toly and others were originally elites from major American companies, but unwilling to stop there, they began their path of building a "capital internet," not to mention the various public chains built on the legacy of the Meta Libra network using the Move language. The personal charisma and appeal of the founders are especially important in the crypto industry. This explains why countless crypto projects have received VC favor, community support, and a flood of funding because of their founders, only to ultimately fade into obscurity due to the founders' departure or unforeseen circumstances. A good founder is the true soul of a public chain and even a crypto project;

3. Developer and User Network. As emphasized by the Metcalfe effect and the Lindy effect, the stronger and longer-lasting the network effect of something, the more sustainable it is. The developer and user network is the cornerstone of public blockchains and many crypto projects, because developers are arguably the first and longest-lasting users of a crypto public blockchain or project.

4. Application Ecosystem. A tree with only roots but no branches and leaves will struggle to survive, and the same applies to crypto projects. Therefore, a rich, self-sustaining application ecosystem that generates synergistic effects is crucial. The reason public chains like Ethereum and Solana have survived the economic downturn is inseparable from the various application projects they have consistently built. Furthermore, the richer the application ecosystem, the more sustainable its ability to generate revenue and support the public chain.

5. Token Market Cap. If the previous points were the inner workings and foundation of a "moat," then token market cap is the external form and brand image of a public blockchain and a crypto project. Only when you "look expensive" will more people believe you "have a lot of money," and that your site is a "gold mine." This applies to individuals and projects alike.

6. Openness to the outside world. Besides building their own internal ecosystems, public blockchains and other crypto projects also need to maintain openness and operability and exchange value with the external environment. Therefore, openness to the outside world is crucial. For example, Ethereum and Solana facilitate easy and scalable connections with traditional finance, user fund inflows and outflows, and various industries through payment and lending mechanisms.

7. Long-Term Roadmap. A truly solid moat not only needs to provide support in the short term, but also requires continuous updates and innovation to maintain its vitality and sustainability in the long run. For public blockchains, a long-term roadmap is both a North Star indicator and a powerful tool to incentivize continuous development and innovation both within and outside the ecosystem. Ethereum's success is inextricably linked to its long-term roadmap planning.

Based on the above elements, a public blockchain can gradually grow from scratch, from nothing to something, and eventually enter a mature and iterative phase. Correspondingly, liquidity and user stickiness will naturally follow.

In conclusion, the crypto industry has not yet reached the stage where "talent is the deciding factor."

Recently, Moore Threads, known as the "Chinese version of Nvidia," successfully listed on the Hong Kong Stock Exchange, achieving a milestone of 300 billion yuan on its first day of trading. In the following days, its stock price soared, reaching another astonishing breakthrough of over 400 billion yuan in market value today.

Compared to Ethereum, which took 10 years to reach a market capitalization of $300 billion, Moore's Thread has covered one-seventh of the former's journey in just a few days. And compared to US stock market giants with market capitalizations of trillions, the crypto industry is even smaller.

This forces us to reiterate that, with a significantly smaller scale of funding and user involvement compared to traditional finance and the internet industry, we are far from reaching the point where we need to rely on innate talent. The only current pain point for the crypto industry is that we don't have enough people, attract enough funding, or involve a wide enough range of industries. Instead of worrying about macro-level, all-encompassing "moats," perhaps we should be focusing on how cryptocurrencies can meet the real needs of a wider market of users more quickly, at a lower cost, and more conveniently.