CoinW Research Institute Weekly Report (December 1, 2025 - December 7, 2025)

- 核心观点:加密货币市场本周微涨,但公链表现分化加剧。

- 关键要素:

- 市场总市值微涨0.32%,但ETF资金呈净流出。

- 公链活跃度分化,Solana多项数据增长,Sui、Aptos等回落。

- DeFi TVL达1208亿美元,以太坊仍占主导地位。

- 市场影响:资金与注意力进一步向头部及新兴生态集中。

- 时效性标注:短期影响。

Key points

The global cryptocurrency market capitalization totaled $3.15 trillion, up from $3.14 trillion last week, representing a week-on-week increase of approximately 0.32%. As of press time, the US Bitcoin spot ETF saw a cumulative net inflow of approximately $57.62 billion, with a net outflow of $87.77 million this week; the US Ethereum spot ETF saw a cumulative net inflow of approximately $12.88 billion, with a net outflow of $65.59 million this week.

The total market capitalization of stablecoins is $312 billion, of which USDT has a market capitalization of $185.7 billion, accounting for 59.55% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $78.19 billion, accounting for 25.07% of the total stablecoin market capitalization; and DAI with a market capitalization of $5.36 billion, accounting for 1.72% of the total stablecoin market capitalization.

According to DeFiLlama data, the total TVL of DeFi this week was $120.8 billion, up approximately 0.75% from $119.9 billion last week. Breaking it down by public blockchain, the three blockchains with the highest TVL were Ethereum (68.01%), Solana (8.54%), and BNB Chain (6.71%).

This week, the gap between strong-performing public chains and those experiencing significant pullbacks widened further. In terms of daily trading volume, Solana performed the strongest, rising approximately 10.4%, followed by BNB Chain at approximately 9.6%. In contrast, Sui declined by approximately 35.5%, Aptos by approximately 30.7%, Ton by approximately 44.6%, and Ethereum by approximately 3.6%. Regarding transaction fees, only Solana saw an increase of approximately 100%, while Ethereum, BNB Chain, Ton, Sui, and Aptos remained unchanged. In terms of daily active addresses, on-chain user activity generally declined, with Sui experiencing the largest drop of approximately 37.9%, followed by BNB Chain at approximately 31.3%, Ethereum at approximately 28.1%, Aptos at approximately 17%, and Ton at approximately 12.1%. Only Solana remained relatively stable. In terms of TVL, Ton saw the most significant increase, rising by approximately 9.8%, followed by Sui at approximately 4.5%, Ethereum at approximately 2.8%, BNB Chain and Solana fluctuated slightly, while Aptos decreased by approximately 4.1%.

New projects to watch: Beep is a decentralized finance protocol for autonomous intelligent agent economies, built on the Sui network, and aims to enable AI agents to automatically manage funds and payments; Sunrise is a Solana liquidity gateway initiated by Wormhole Labs, which aims to help users seamlessly transfer assets from other chains to Solana through a single interface and immediately access its DeFi ecosystem; Taoshi is a decentralized AI trading network based on the Bittensor ecosystem, which aggregates machine learning and autonomous agents through dynamic subnetworks to generate high-precision trading signals across asset classes.

Table of contents

Key points

I. Market Overview

1. Total market capitalization of cryptocurrencies / Bitcoin market capitalization ratio

2. Fear Index

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD exchange rates

5.Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin Market Cap and Issuance Status

II. Hot Money Flows This Week

1. The top five gainers this week: VC coin and Meme coin

2. New Project Insights

III. New Industry Trends

1. Major Industry Events This Week

2. Major events that will happen next week

3. Key Investment and Financing Activities Last Week

IV. Reference Links

I. Market Overview

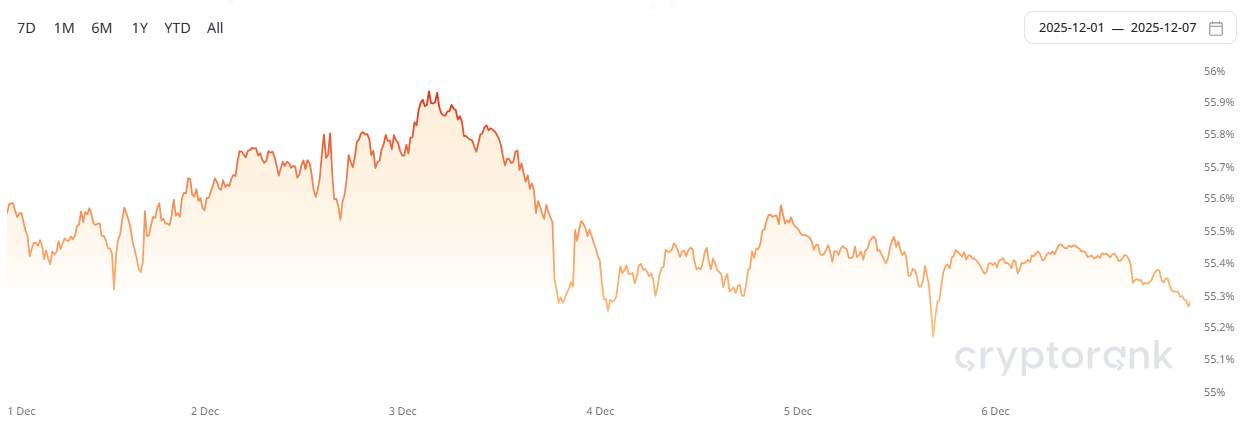

1. Total market capitalization of cryptocurrencies / Bitcoin market capitalization ratio

The global cryptocurrency market capitalization is $3.15 trillion, up from $3.14 trillion last week, representing a week-on-week increase of approximately 0.32%.

Data source: Cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of December 7, 2025

As of press time, Bitcoin 's market capitalization was $1.8 trillion, accounting for 57.25% of the total cryptocurrency market capitalization. Meanwhile, stablecoins had a market capitalization of $312 billion, representing 9.92% of the total cryptocurrency market capitalization.

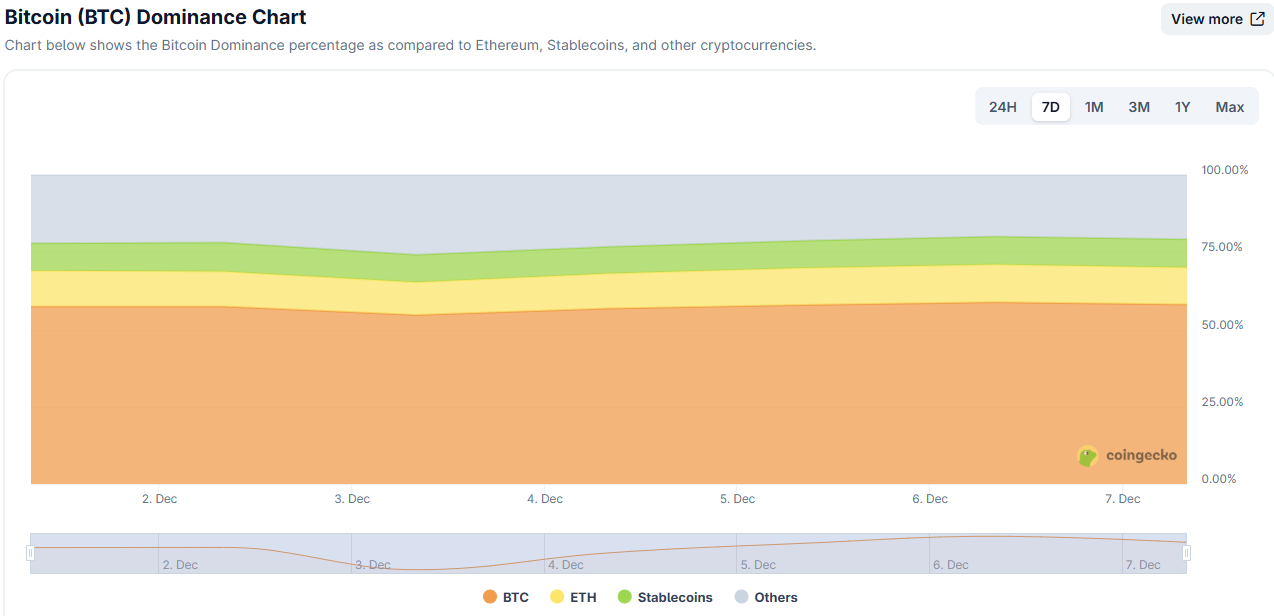

Data source: Coingeck, https://www.coingecko.com/en/charts

Data as of December 7, 2025

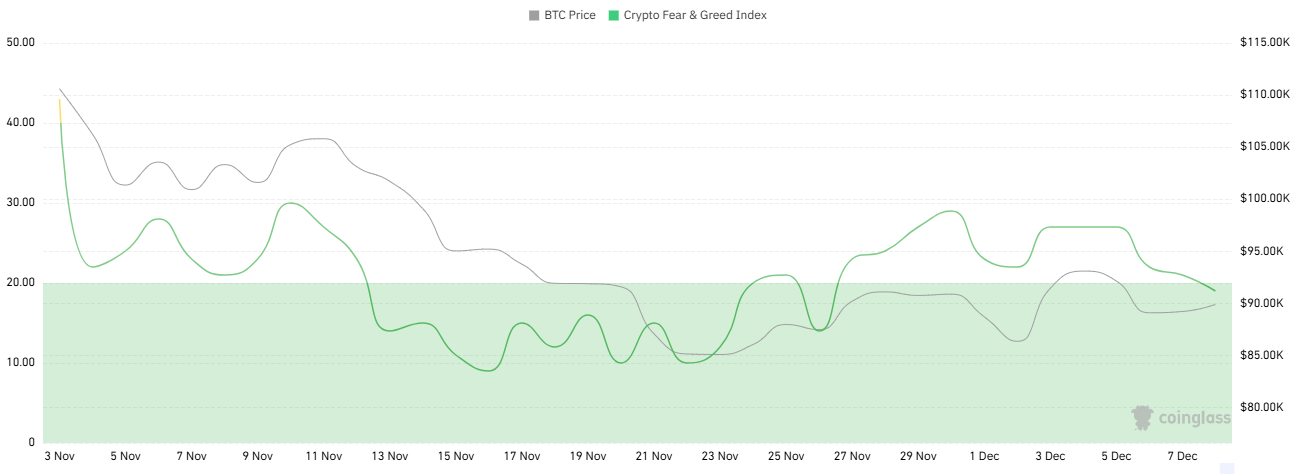

2. Fear Index

The cryptocurrency fear index is 19, indicating extreme fear.

Data source: Coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of December 7, 2025

3. ETF Inflow and Outflow Data

As of press time, the total net inflow into U.S. Bitcoin spot ETFs was approximately $57.62 billion, with a net outflow of $87.77 million this week; the total net inflow into U.S. Ethereum spot ETFs was approximately $12.88 billion, with a net outflow of $65.59 million this week.

Data source: Sosovalue, https://sosovalue.com/zh/assets/etf

Data as of December 7, 2025

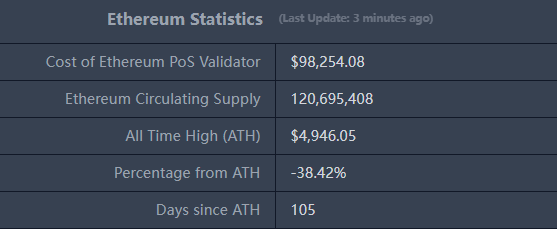

4. ETH/BTC and ETH/USD exchange rates

ETHUSD: Current price $3,068, all-time high $4,946.05, down approximately 38.42% from the high.

ETHBTC: Currently at 0.033928, with an all-time high of 0.1238.

Data source: Ratiogang, https://ratiogang.com/

Data as of December 7, 2025

5.Decentralized Finance (DeFi)

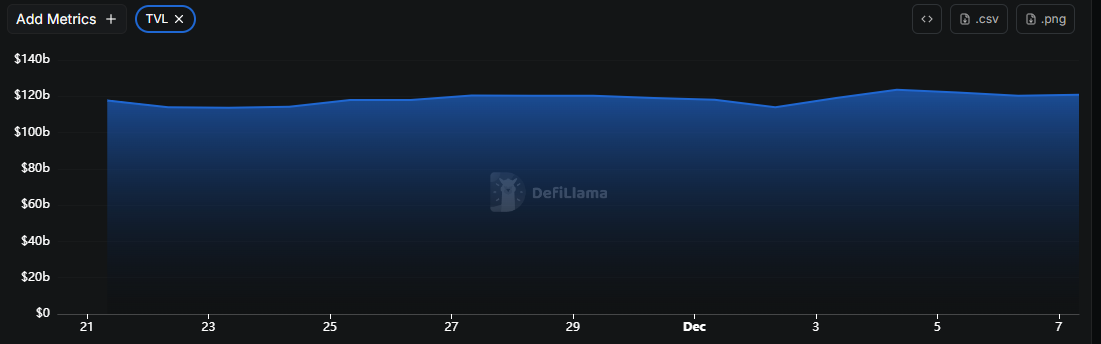

According to DeFiLlama data, the total TVL of DeFi this week was $120.8 billion, up about 0.75% from $119.9 billion last week.

Data source: Defillama, https://defillama.com

Data as of December 7, 2025

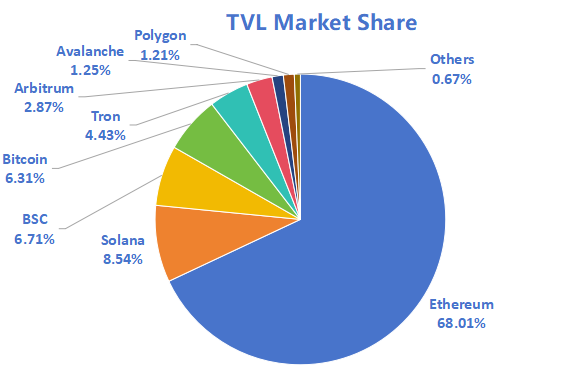

Based on public blockchains, the three public blockchains with the highest TVL are Ethereum (68.01%), Solana (8.54%), and BNB Chain (6.71%).

Data source: CoinW Research Institute, Defillama, https://defillama.com

Data as of December 7, 2025

6. On-chain data

Layer 1 related data

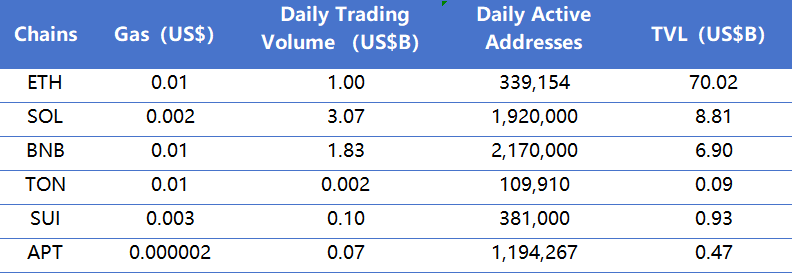

The analysis primarily focuses on daily transaction volume, daily active addresses, and transaction fees, covering the current Layer 1 data including ETH, SOL, BNB, TON, SUI, and APT.

Data source: CoinW Research Institute, Defillama, https://defillama.com

Data as of December 7, 2025

Daily trading volume and transaction fees : Daily trading volume and transaction fees are core metrics for measuring public chain activity and user experience. In terms of daily trading volume, Solana performed the strongest, rising by approximately 10.4%, followed by BNB Chain with an increase of approximately 9.6%. In contrast, Sui declined by approximately 35.5%, Aptos by approximately 30.7%, Ton by approximately 44.6%, and Ethereum by approximately 3.6%. Regarding transaction fees, only Solana saw an increase of approximately 100%, while Ethereum, BNB Chain, Ton, Sui, and Aptos remained unchanged.

Daily Active Addresses (DAU) and TVL : DAU reflects the ecosystem participation and user stickiness of a public chain, while TVL reflects the level of user trust in the platform. Regarding DAU, overall on-chain user activity declined, with Sui experiencing the largest drop of approximately 37.9%, followed by BNB Chain at approximately 31.3%, Ethereum at approximately 28.1%, Aptos at approximately 17%, and Ton at approximately 12.1%. Only Solana remained relatively stable. In terms of TVL, Ton saw the most significant increase, rising by approximately 9.8%, followed by Sui at approximately 4.5%, Ethereum at approximately 2.8%, BNB Chain and Solana fluctuating slightly, while Aptos decreased by approximately 4.1%.

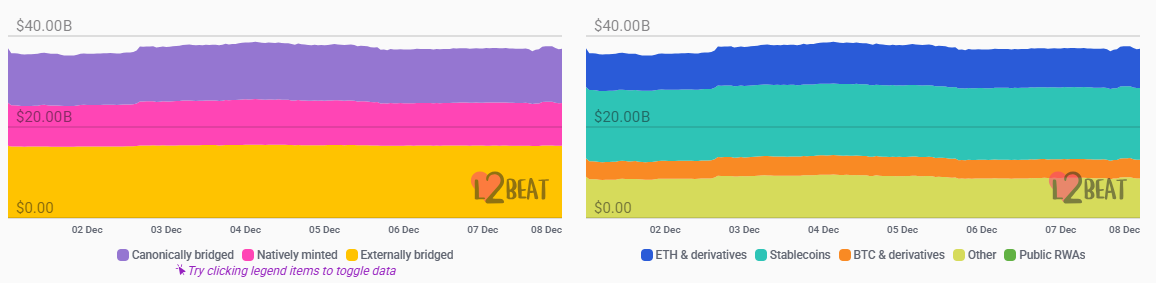

Layer 2 related data

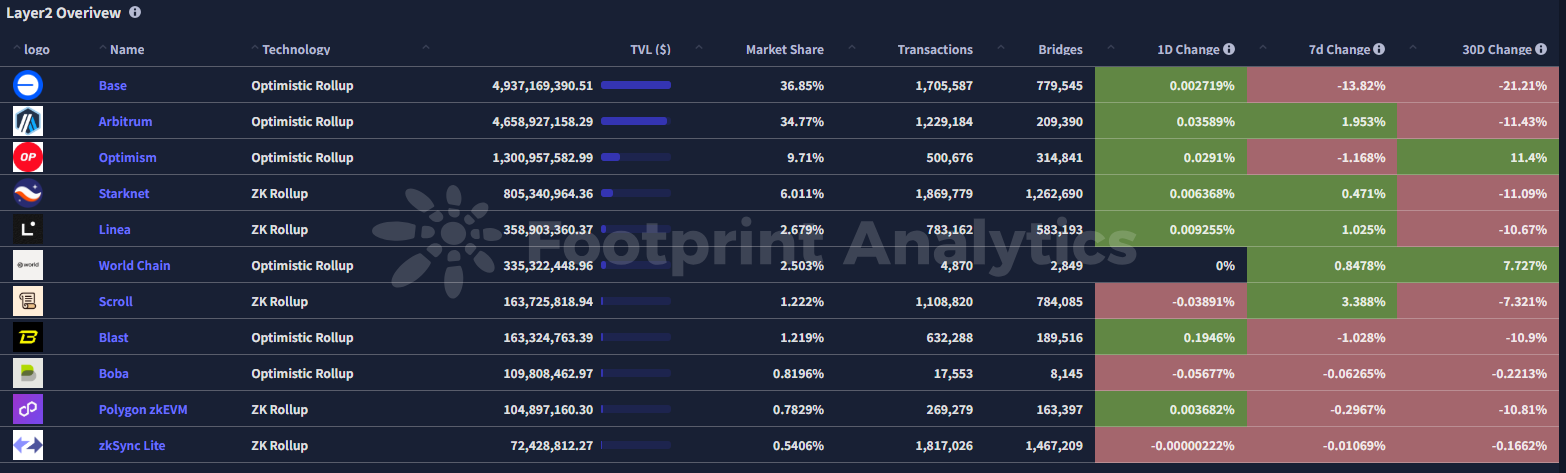

According to L2Beat data, the total TVL of Ethereum Layer 2 is $37.17 billion, up about 2.65% from $36.21 billion last week.

Data source: L2Beat, https://l2beat.com/scaling/tvs

Data as of December 7, 2025

Base and Arbitrum hold the top positions with market shares of 36.85% and 34.77% respectively. This week, Base ranked first in the TVL of Ethereum Layer 2.

Data source: Footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of December 7, 2025

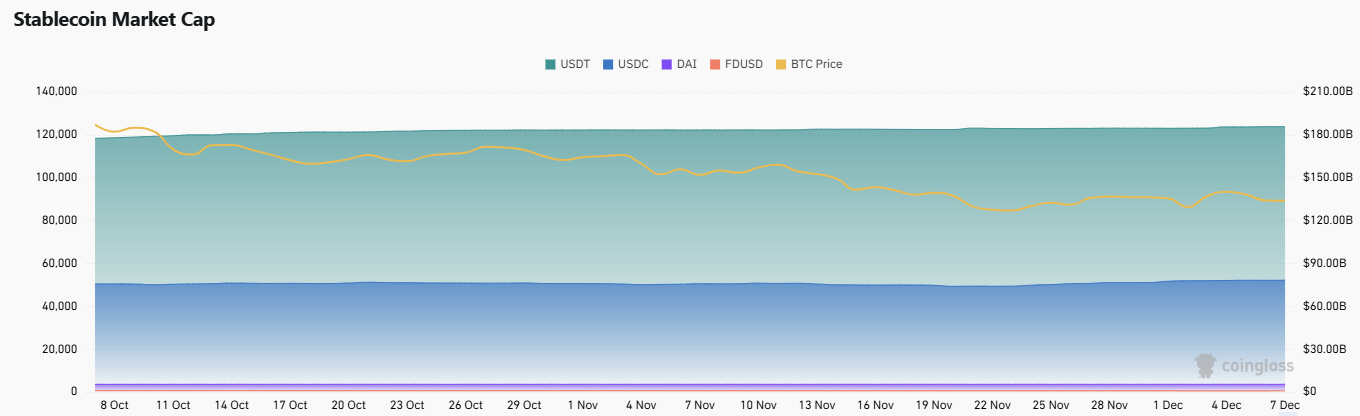

7. Stablecoin Market Cap and Issuance Status

According to Coinglass data, the total market capitalization of stablecoins is $312 billion, of which USDT has a market capitalization of $185.7 billion, accounting for 59.55% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $78.19 billion, accounting for 25.07% of the total stablecoin market capitalization; and DAI with a market capitalization of $5.36 billion, accounting for 1.72% of the total stablecoin market capitalization.

Data source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of December 7, 2025

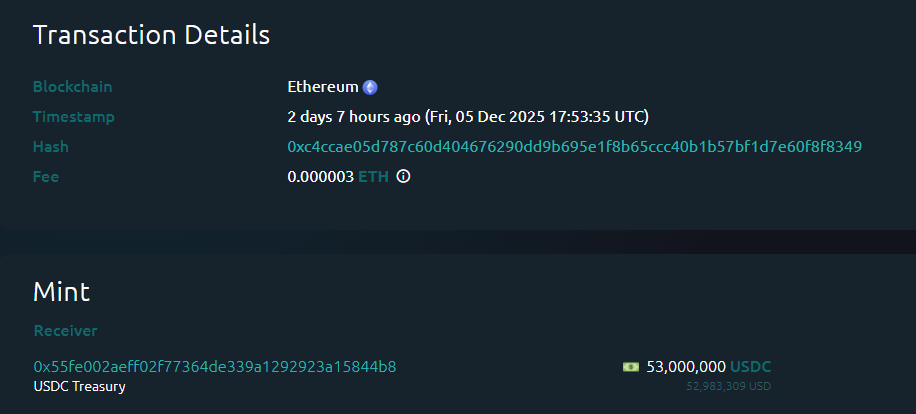

According to data from Whale Alert, the USDC Treasury issued a total of 2.955 billion USDC this week, while the Tether Treasury issued a total of 1 billion USDT. The total issuance of stablecoins this week was 3.955 billion, a decrease of approximately 11.97% compared to the 4.493 billion stablecoins issued last week.

Data source: Whale Alert, https://x.com/whale_alert

Data as of December 7, 2025

II. Hot Money Flows This Week

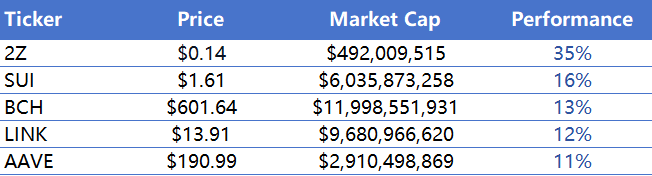

1. The top five gainers this week: VC coin and Meme coin

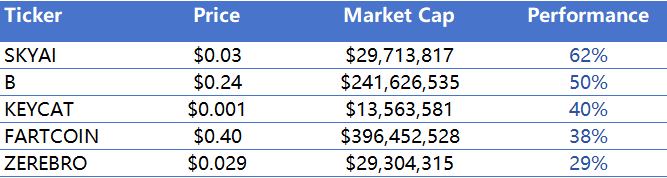

The top five performing VC coins in the past week

Data source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of December 7, 2025

The top five gainers in the past week: Meme coins

Data source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of December 7, 2025

2. New Project Insights

Beep is a decentralized finance protocol for autonomous intelligent agent economies, built on the Sui network, and dedicated to enabling AI agents to automatically manage funds and payments. Its core design includes Agentic Yield, which uses non-custodial intelligent agents to scan and score multi-protocol yields in real time and automatically compound stablecoin yields; and Beep Pay, which enables instant, near-zero-fee stablecoin payments through gas sponsorship and yield-sharing mechanisms. Beep's goal is to completely entrust fund management and transaction processes to autonomous financial AI, allowing users to obtain yields and make payments without manual intervention.

Sunrise, initiated by Wormhole Labs, is a liquidity gateway to Solana. It aims to help users seamlessly transfer assets from other chains to Solana through a single interface and immediately integrate it into the DeFi ecosystem. It combines cross-chain bridges and liquidity access into a one-stop experience, improving the efficiency and availability of cross-chain funds entering Solana.

Taoshi is a decentralized AI trading network based on the Bittensor ecosystem. It generates high-precision trading signals across asset classes by aggregating machine learning and autonomous agents through dynamic subnetworks. It provides miners, traders, and developers with an incentive mechanism to participate in predictive model training and signal contribution, enabling the sharing, competition, and sustainable monetization of market prediction capabilities on-chain.

III. New Industry Trends

1. Major Industry Events This Week

The Cysic Foundation, a ZKP-accelerated project, announced the official launch of its token airdrop tracking website. Users can check their airdrop eligibility and allocation in real time based on their participation in mining, testing, or contributions. Cysic is a full-stack computing network designed to transform computing resources such as GPUs and ASICs into assets with liquidity and yield. Its product portfolio includes the zero-knowledge proof layer Cysic Network, hardware products, and Cysic AI for computing power optimization, providing efficient and profitable computing infrastructure for zero-knowledge computing and high-performance on-chain applications.

The Soneium ecosystem liquidity protocol Kyo has opened airdrop eligibility checks. Kyo and Soneium users can check and confirm their eligibility for its structured rewards system. Kyo Finance is the liquidity hub on Soneium. Its configurable liquidity pools not only support ERC-20 tokens but also accept various on-chain assets, including ERC-721 and ERC-1155. Through a unified liquidity management and incentive mechanism, it provides the Soneium ecosystem with efficient cross-asset liquidity infrastructure.

SVM Layer 1 blockchain project Fogo announced the launch of its Ecosystem Points Program 1.5 and the mainnet performance testing project Fogo Fishing. This program simulates high-frequency trading and throughput on-chain to test the mainnet. The activity will last approximately two weeks, during which several random snapshots will be taken. Fogo will airdrop rewards to users participating in fishing activities on Fogo Fishing and LP activities on Valiant Pools. Currently, the Fogo Fishing project's TPS has exceeded 1000.

The public sale of AZTEC tokens, a zero-knowledge privacy technology project, has ended. The total subscription amount for this public offering was 19,476 ETH, with 16,741 users participating.

Web3 cultural asset issuance platform Ultiland announced that its second RWA ARToken, HP59, officially launched its public sale on December 3. The initial offering was 1 million tokens, with a subscription price of 0.016 USDT per token, and all tokens sold out within 8 minutes.

2. Major events that will happen next week

HumidiFi announced that its new round of public sale will resume on December 8th. HumidiFi is an AMM decentralized exchange based on Solana, aiming to provide efficient and low-cost trading and liquidity services for on-chain assets through automated market making mechanisms. The WET token will serve as the core asset for fee payments, protocol governance, and liquidity incentives.

Solana Mobile's native token, SKR, will be launched in January 2026. The total supply of SKR tokens is 10 billion, with 30% allocated for airdrops, 25% for growth and partners, 10% for liquidity and launches, 10% for the community treasury, 15% for Solana Mobile, and 10% for Solana Labs. Furthermore, SKR will employ a linear inflation mechanism to incentivize early participants to stake tokens to ensure ecosystem security and drive platform growth. The inflation rate will be 10% in the first year, decreasing by 25% annually, with the terminal inflation rate remaining stable at 2%.

The blockchain infrastructure platform Espresso will open airdrop registration on December 22nd, covering millions of addresses. To date, the official team has released 22 eligibility paths for the airdrop, including Espresso hackathon participants, Caffeinated creators, POAP holders from online and offline events, and users of partner blockchains. In addition, the official team will launch the second round of the Bantr campaign.

Crypto wallet Rainbow will announce its TGE date this week. Furthermore, the Rainbow Foundation will become the largest single shareholder of Rainbow at the time of token issuance, holding a 20% stake. Token holders and shareholders will share the same profits. If Rainbow is acquired in the future, the Foundation will be gradually dissolved, and its net assets (including proceeds from its 20% stake) will be distributed to token holders.

Doodles has announced that it will release 25,000 Doopie Cubes on Solana this week, which can be claimed for free by community OGs and Dooplicators holders.

3. Key Investment and Financing Activities Last Week

Ostium has raised $20 million in Series A funding, valuing the company at $250 million. Investors include General Catalyst, Jump Trading, and Coinbase Ventures. As a synthetic asset protocol based on Arbitrum, Ostium allows institutions and individual users to trade and hedge commodities such as energy, metals, and agricultural products without custody, enabling traditional commodity markets to operate transparently and efficiently within DeFi. (December 3, 2025)

Digital Asset has completed a $50 million strategic funding round, with investments from BNY Mellon, S&P Global, Nasdaq, and iCapital. The funds will be used to expand the application scenarios of its enterprise-grade blockchain infrastructure in financial institutions and accelerate global deployment and ecosystem cooperation. As a leading blockchain software and service provider, Digital Asset, based on its smart contract platform Daml, helps enterprises build interconnected multi-party network applications, providing strong privacy protection, real-time synchronization, and highly reliable data collaboration capabilities, driving the transition of traditional financial infrastructure to an era of on-chain collaboration. (December 4, 2025)

Portal has secured another $25 million in funding, exclusively from JTSA Global. The funds will be used to expand its Bitcoin cross-chain transaction infrastructure and global market presence. As a non-custodial interoperability protocol for Bitcoin, Portal enables low-cost exchanges between native BTC and Ordinals, as well as various L2 blockchains and other public chains, without the need for bridging or asset encapsulation, thus providing secure and high-speed cross-chain asset interoperability for the Bitcoin ecosystem. (December 4, 2025)

IV. Reference Links

1.Coingeck: https://www.coingecko.com/en/charts

2.Coinglass: https://www.coinglass.com/pro/i/FearGreedIndex

3.Sosovalue: https://sosovalue.com/zh/assets/etf

4.Ratiogang: https://ratiogang.com/

5.Defillama: https://defillama.com

6.L2Beat: https://l2beat.com/scaling/tvs

7.Footprint: https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

8.Coinglass: https://www.coinglass.com/pro/stablecoin

9.Whale Alert: https://x.com/whale_alert

10.Coinmarketcap: https://coinmarketcap.com/

11.Beep: https://x.com/0xbeepit

12.Sunrise: https://x.com/Sunrise_DeFi

13. Taoshi: https://x.com/taoshiio

14.Ostium: https://x.com/ostiumlabs

15.Digital Asset: https://x.com/digitalasset

16.Portal: https://x.com/PortaltoBitcoin