Can Lighter, which is about to launch its own cryptocurrency, surpass Hyperliquid?

- 核心观点:Lighter交易量激增但资金沉淀不足,增长依赖激励。

- 关键要素:

- 交易量领先但TVL偏低,资金沉淀不足。

- 零手续费与空投预期驱动高频交易,用户留存存疑。

- 专用zk-rollup架构提升性能但曾现宕机风险。

- 市场影响:考验去中心化衍生品DEX激励退坡后的真实竞争力。

- 时效性标注:中期影响

Recently, Lighter's trading volume in the decentralized perpetual contract (DEX) market has risen rapidly, with its daily, weekly, and monthly cumulative trading volume surpassing Hyperliquid, making it the fastest-growing DEX in the current phase. However, from a capital structure perspective, Lighter's TVL and open interest have not expanded in tandem with trading volume, showing a significant deviation between trading activity and capital accumulation, reflecting the current stage characteristics of its user structure and trading behavior. Meanwhile, Lighter completed a $68 million funding round in November, receiving support from Founders Fund, Ribbit Capital, and Robinhood, among others. With the combined effect of capital inflows and the approaching TGE (Time for Geographical Indication), its points system and airdrop expectations are becoming major catalysts for increased user activity. Against this backdrop, CoinW Research Institute will conduct a systematic analysis of Lighter's current development from the perspectives of trading performance, mechanism design, and potential risks.

I. Lighter continues to lead in transaction volume

1. Daily/weekly/monthly trading volume ranks among the top in the industry.

According to DefiLlama data, Lighter currently ranks first among decentralized perpetual contract (DEXs) in both daily and weekly trading volume. Its daily trading volume is approximately $11.9 billion, and its weekly trading volume exceeds $64.3 billion. In the past 30 days, Lighter, with approximately $297.7 billion in perpetual contract trading volume, surpassed Hyperliquid's $251.1 billion, firmly maintaining its leading position in the sector.

Source: defillama, https://defillama.com/perps

2. The total TVL size is relatively low.

Despite Lighter's recent rapid increase in trading volume, its total capital tied up remains relatively limited. Data shows that Lighter's total TVL (TVL) is $1.22 billion, significantly lower than Hyperliquid's $4.28 billion and Aster's $1.4 billion. Compared to its high trading volume, this relatively low TVL indicates that Lighter exhibits characteristics of amplified trading but insufficient capital accumulation. This discrepancy between its TVL and trading volume is likely closely related to Lighter's current incentive structure. Lighter employs a zero-fee model and has not yet implemented TGE (Trading for Tokens). Driven by the expectation of points and potential airdrops, some users and strategic traders tend to increase their participation weight through high-frequency trading. This makes the platform's trading activity largely dependent on rapid capital turnover rather than long-term capital accumulation.

3. Abnormal ratio of trading volume to open interest (OI)

Despite a significant increase in trading volume and a relatively low total value (TVL), Lighter's trading volume to open interest (OI) ratio shows a clear difference from its competitors. OI is typically used to measure the actual open interest of perpetual contract platforms, reflecting capital accumulation and trading continuity. Therefore, the trading volume/OI ratio can objectively measure the platform's trading behavior structure. Currently, Lighter's OI is approximately $1.683 billion, and its trading volume is approximately $11.9 billion, resulting in a trading volume/OI ratio of approximately 7.07, significantly higher than Hyperliquid's 1.72 (OI $5.92 billion, trading volume $10.2 billion) and Aster's 3.02 (OI $2.62 billion, trading volume $7.92 billion). This discrepancy suggests that the platform's trading behavior leans more towards a short-term, high-turnover, high-frequency trading model. As TGE approaches, subsequent changes to the incentive structure will directly affect the matching degree between transaction volume and OI. Whether the transaction volume/OI ratio can fall back to a healthier range (generally below 5) will become an important indicator for judging Lighter's real user retention, transaction quality, and long-term sustainability.

II. Lighter's Innovation and Differentiation

1. Strategies for zero fees and paid APIs

In terms of fee structure, Lighter adopts a different approach from mainstream decentralized perpetual contract platforms, which is one of its innovative features. Lighter implements a zero-fee policy for ordinary users, charging no transaction fees for either placing or taking orders, significantly lowering the entry barrier and overall transaction costs. At the same time, Lighter hasn't completely abandoned revenue generation, but rather focuses its fees on professional needs. For ordinary users, the system defaults to placing orders with a latency of approximately 200 milliseconds, and taking orders with an execution latency of approximately 300 milliseconds, with both placing and taking orders incurring zero fees. Professional traders and market makers sensitive to execution speed can choose a premium account, accessing a low-latency matching channel via a paid API. Premium accounts accessed via API offer stronger execution performance, reducing order placement and cancellation latency to 0 milliseconds, and taking order latency to approximately 150 milliseconds, while incurring a 0.002% fee for placing orders, a 0.02% fee for taking orders, and a corresponding trading volume quota.

The zero-fee strategy effectively drove user growth in the early stages, but it also raised concerns about the sustainability of its business model. Its approach is somewhat similar to traditional zero-commission brokerages: attracting users by lowering the barrier to entry at the front end, and monetizing through advanced services or order flow in the back end. For example, Robinhood's main revenue doesn't come from charging retail investors commissions, but from fees paid by market makers for order flow and priority in execution. In this model, although retail investors don't see the fees on the surface, market makers typically cover costs by slightly widening the gap between the buy and sell prices (i.e., the spread), resulting in a slightly lower actual execution price for retail investors; this difference is the hidden spread cost. However, unlike traditional securities markets, crypto perpetual contract users trade more strategically and are significantly more sensitive to spreads, slippage, and execution speed. If a platform compromises its matching resource allocation to maintain zero fees, leading to wider spreads or lower execution quality compared to competitors, it could weaken the retention of professional users. Meanwhile, although APIs are considered an important source of revenue for Lighter in the future, based on current community feedback, its API documentation, access process, and release schedule still need improvement. Whether the charging system can be successfully established and generate stable revenue remains to be seen.

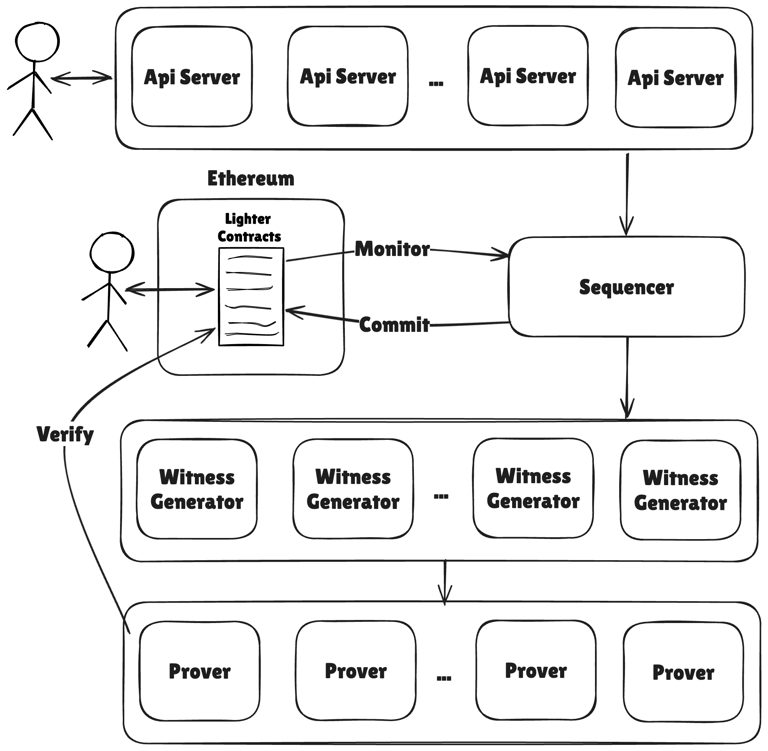

2. Dedicated zk-rollup architecture

In its choice of technology, Lighter did not adopt a general-purpose Layer 2 architecture, but instead built a zk-rollup architecture specifically optimized for trading scenarios. It encapsulates the core logic of matching, clearing, and equalization within its self-developed "Lighter Core," and generates zk-SNARK proofs through a proof engine customized for trading workloads, then submits the compressed on-chain state to the Ethereum mainnet. Compared to the general-purpose zkVM, this architecture sacrifices some generality, but is more targeted in terms of proof generation speed, latency stability, and execution efficiency of high-frequency order books. Its design goal is to achieve processing speeds close to centralized exchanges while ensuring verifiability, that is, to complete order matching and provide verifiable execution results in milliseconds.

This dedicated solution provides the technical foundation for Lighter's verifiable matching and fair execution, but it also increases system complexity and introduces more potential risks. For example, after the Lighter public mainnet launched on October 2nd, it experienced a severe outage during the market volatility of October 10th. Core components such as the database failed one after another, and some users were unable to submit orders or adjust their positions during extreme market conditions, resulting in losses of tens of millions of dollars in trading and LP (Limited Partner) transactions. Lighter subsequently announced technical fixes and points compensation, but the market remains highly concerned about its stability under extreme TPS (Transactions Per Second) and the sustainability of its self-developed rollup architecture.

Source:Lighter, https://docs.lighter.xyz/

3. LLP Dual-purpose

In terms of liquidity design, Lighter adopts a public liquidity pool (LLP) model similar to Hyperliquid's HLP. Users deposit assets into LLP and receive LP shares, participating proportionally in the platform's market-making revenue, transaction fees, and funding fees. For ordinary users, the advantage of LLP is that they don't need to actively make markets, yet they can share in the platform's growth returns while bearing some counterparty risk. Notably, Lighter plans to further expand the uses of LLP in future iterations, including LP shares in the margin system. This means the same capital can serve two roles simultaneously: participating in market making to earn returns and serving as margin for users opening positions, achieving two uses from one source. This design aims to improve capital efficiency and allow for more efficient asset circulation within the protocol.

However, this dual use can also bring greater risks. In a one-sided market, LLPs, acting as counterparties, may face unrealized losses, causing a decrease in the net value of the liquidity pool. If, at this time, some users use LLP shares as margin for trading, their position losses will be further deducted from the LLPs by the system, thus amplifying the decline in the liquidity pool. In other words, market-making losses and margin losses can overlap and amplify, easily creating a negative cycle, and in extreme cases, potentially even affecting the overall solvency of the protocol. Therefore, most mature perpetual protocols separate the LP liquidity pool from margin assets to prevent the same funds from being used repeatedly. For Lighter, if it plans to truly open up the dual use of LLPs in the future, it must establish more prudent and transparent rules regarding collateral ratios, risk buffers, and emergency mechanisms for extreme market conditions to avoid systemic risks.

III. Incentive-Driven Transaction Peaks and Retention Uncertainty

1. With airdrop expectations, Lighter still awaits market validation.

Currently, Lighter's trading volume is largely driven by its points system and the anticipated airdrop. Zero transaction fees reduce participation costs, while the anticipated TGE (Trading for Energy) further reinforces users' short-term trading behavior. Combining the previous analysis of TVL (Total Value Limit) and the ratio of OI (Online Inquiry) to trading volume, it's evident that there's a significant gap between Lighter's daily trading volume and capital accumulation, suggesting it's currently more driven by incentives than by natural demand. This growth model, dominated by short-term incentives, makes current trading volume and activity levels difficult to directly reflect the platform's true retention. Therefore, Lighter's key observation window will emerge after TGE. As the airdrop expectation materializes, user behavior may change. If trading volume and activity remain stable after the incentive reduction, it indicates that its product experience, matching performance, and fee structure continue to attract users; conversely, if core metrics decline significantly after TGE, it suggests that early data contained a high proportion of incentive components, and user stickiness still needs further cultivation.

2. The Next Stage of the Decentralized Perpetual Contract (DEX) Battle

As the user base of decentralized perpetual contracts (DEXs) matures, growth driven solely by points or airdrops is gradually weakening. For example, after the incentive phase-out, the market began reassessing Aster's trading depth, order execution quality, and stability under volatile market conditions. Lighter, still in the pre-TGE phase, needs further evaluation to determine its trading performance and user retention after TGE. Furthermore, it's worth noting that for larger trading volumes, slippage control, matching latency, and system availability in extreme environments are more decisive than the incentive mechanism itself. This means that differences in platform fundamental capabilities will be further amplified in subsequent cycles. Against this backdrop, the next phase of competition in perpetual contract DEXs may no longer be primarily determined by airdrops and other incentive measures, but rather by each platform's ability to provide stable and predictable trading channels for large, continuous funds. For Lighter, still in the pre-TGE phase, its ability to effectively absorb higher-quality fund inflows after the incentive phase-out will be a crucial indicator of its long-term competitiveness.