From ETH to SOL: Why will L1 ultimately lose to Bitcoin?

- 核心观点:L1公链估值依赖货币溢价,而非实际收入。

- 关键要素:

- L1板块81%市值源于货币溢价预期。

- L1市盈率飙升但收入连年下降。

- 绝大多数L1长期跑输比特币。

- 市场影响:资金或进一步向BTC集中,挤压L1估值。

- 时效性标注:中期影响。

Author | @AvgJoesCrypto

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

Editor's Note: Recently, Haseeb Qureshi, a well-known partner at Dragonfly, published a long article rejecting cynicism and embracing exponential thinking , unexpectedly bringing the community discussion back to the most core question: How much value does L1 still have? The following content is excerpted from @MessariCrypto's upcoming "The Crypto Theses 2026," compiled by Odaily Planet Daily.

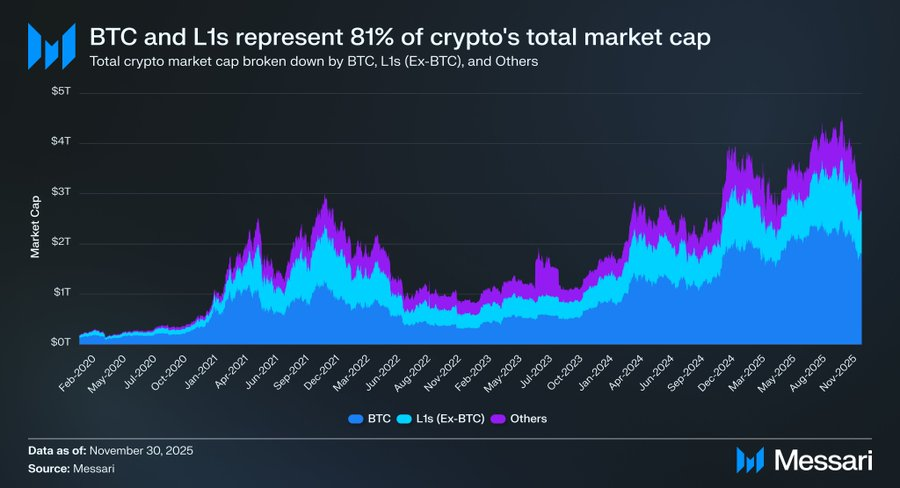

Cryptocurrency drives the entire industry

It's crucial to refocus the discussion on "cryptocurrency" itself, as most capital in the crypto industry ultimately seeks exposure to "monetized assets." Currently, the total market capitalization of the crypto market is $3.26 trillion, with Bitcoin (BTC) accounting for $1.80 trillion, or 55%. Of the remaining $1.45 trillion, approximately $0.83 trillion is concentrated in various Level 1 blockchains. In other words, about $2.63 trillion, roughly 81% of the entire market, is invested in assets that are already considered currency or believed to potentially appreciate in value in the future.

In this context, understanding how the market assigns or removes currency premiums is crucial, whether you are a trader, investor, capital manager, or developer. In the crypto industry, nothing drives valuation changes more than the market's willingness to treat an asset as "currency." Therefore, predicting which assets will receive currency premiums in the future is arguably the most important variable when constructing a portfolio.

So far, our primary focus has been on BTC, but it's also necessary to discuss the remaining $0.83 trillion in L1 assets that may or may not be currencies. As mentioned earlier, we expect BTC to continue absorbing market share from gold and other non-sovereign stores of value in the coming years. But this raises a question: How much room is left for L1 assets? When the tide rises, will all ships (assets) rise (benefit)? Or will BTC, in its pursuit of gold, also siphon some of the currency premium from L1 public chains?

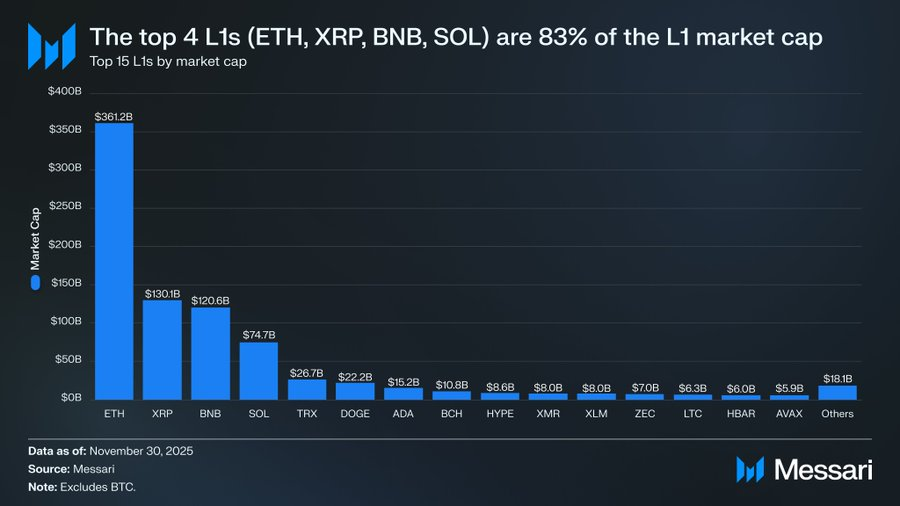

To answer these questions, we first need to look at the current valuation landscape of Level 1 cryptocurrencies. The top four L1 cryptocurrencies by market capitalization—ETH ($361.15 billion), XRP ($130.11 billion), BNB ($120.64 billion), and SOL ($74.68 billion)—have a combined market capitalization of $686.58 billion, accounting for 83% of the entire L1 sector. Beyond these top four, the market capitalization gap is significant (for example, TRX is $26.67 billion), but the smaller tiers still represent a considerable size. L1 cryptocurrencies ranked outside the top 15 still have a total market capitalization of $18.06 billion, representing 2% of the total L1 market capitalization.

More importantly, L1 market capitalization is not simply a matter of "currency premium." There are three main valuation frameworks for L1:

(i) Monetary Premium

(ii) Real Economic Value (REV)

(iii) Economic Security Demand

Therefore, the market value of a project is not determined solely by the market's perception of it as currency.

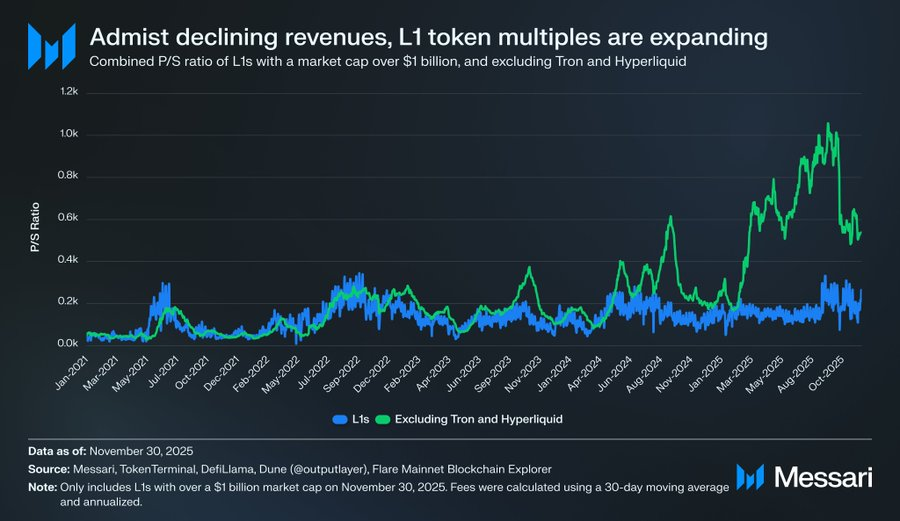

What drives L1 valuations is the currency premium, not income.

Despite the existence of various valuation frameworks, the market increasingly tends to evaluate L1 stocks from a " currency premium " perspective rather than a "revenue-driven" one. Over the past few years, the overall price-to-earnings ratio (P/E ratio) of all L1 stocks with a market capitalization exceeding $1 billion has generally remained between 150 and 200. However, this overall figure is misleading because it includes TRON and Hyperliquid. In the past 30 days, TRX and HYPE contributed 70% of the revenue in this group, yet only accounted for 4% of the total market capitalization.

After removing these two outliers, the real story emerges. Despite continued revenue decline, L1 valuations are rising. The adjusted price-to-earnings ratio shows a clear upward trend :

- November 30, 2021: 40 times

- November 30, 2022: 212 times

- November 30, 2023: 137 times

- November 30, 2024: 205 times

- November 30, 2025: 536 times

From a REV perspective, one might argue that the market is pricing in future revenue growth. However, this explanation doesn't hold true because, within the same group (excluding TRON and Hyperliquid), L1 revenue has been declining almost every year.

- 2021: US$12.33 billion

- 2022: US$4.89 billion (down 60% year-on-year)

- 2023: US$2.72 billion (down 44% year-on-year)

- 2024: US$3.55 billion (YoY +31%)

- 2025: $1.7 billion annualized (down 52% year-over-year)

In our view, the simplest and most direct explanation is that these valuations are primarily driven by currency premiums, rather than current or future revenue.

L1 has consistently underperformed Bitcoin.

If L1 valuations are primarily driven by market expectations of their currency premiums, the next question is: what shapes these expectations? A simple approach is to compare them to BTC's price performance. If changes in currency premiums mainly reflect BTC's movements, then these assets should perform similarly to BTC's "beta"; if currency premiums stem from unique factors specific to each L1 asset, then their correlation with BTC should be weaker, and their performance more individualistic.

As representatives of Level 1 cryptocurrencies, we selected the top ten Level 1 tokens by market capitalization (excluding HYPE) and analyzed their performance relative to BTC since December 1, 2022. These ten assets account for approximately 94% of the Level 1 market capitalization, making them highly representative. During this period, eight assets underperformed BTC in absolute returns, with six lagging by more than 40%. Only two assets outperformed BTC: XRP and SOL. However, XRP's excess return was only 3%, and given its historically retail-driven nature, we will not overinterpret it. Only SOL truly demonstrated significant excess returns, outperforming BTC by 87%.

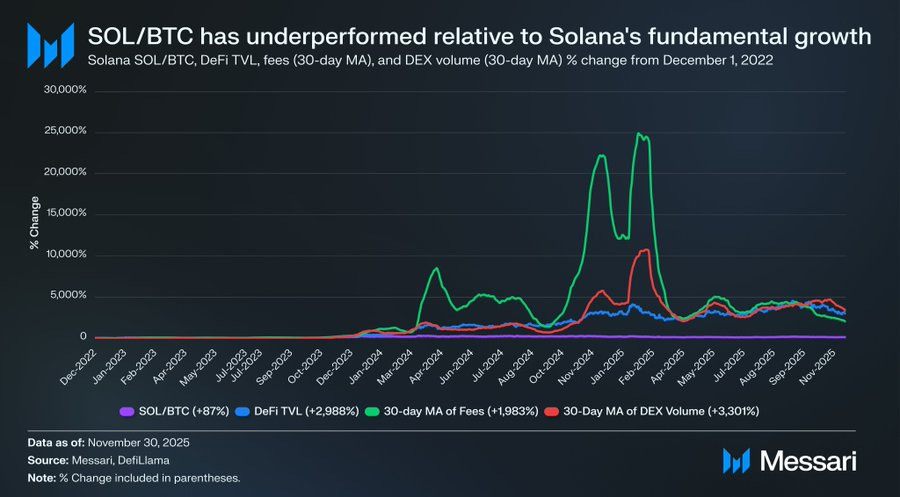

However, a deeper analysis reveals that SOL's "outperformance" may not be as strong as it appears. During the same period that SOL outperformed BTC by 87%, the fundamentals of the Solana ecosystem experienced exponential growth: DeFi TVL increased by 2,988%, transaction fees increased by 1,983%, and DEX trading volume increased by 3,301%. By any reasonable standard, Solana's ecosystem has expanded 20 to 30 times since the end of 2022, yet the corresponding SOL price only outperformed BTC by 87%.

Please read this sentence again.

To achieve truly significant excess returns in the game against BTC, an L1 doesn't need ecosystem growth of 200% or 300%—it needs growth of 2,000%-3,000% to barely achieve a few dozen percentage points of excess performance.

In summary, our assessment is that while the market is still pricing L1 based on the expectation of a potential future currency premium, confidence in these expectations is quietly waning. Meanwhile, the market's perception of BTC's currency premium as a "cryptocurrency" remains unshaken; in fact, it could be argued that BTC's lead over various L1 cryptocurrencies continues to widen.

While cryptocurrencies themselves don't require fees or revenue to support their valuations, these metrics are crucial for L1 cryptocurrencies. Unlike Bitcoin, the L1 narrative relies on building an ecosystem (applications, users, throughput, economic activity, etc.) to underpin its token value. However, if an L1 ecosystem is experiencing an annual decline (partially reflected in decreasing revenue and fees), it loses its only competitive advantage relative to Bitcoin. Without genuine economic growth, its "cryptocurrencyization" story will become increasingly difficult for the market to accept.

Looking to the future

Looking ahead, we do not believe this trend will reverse in 2026 or longer. With a few possible exceptions, we expect the L1 sector to continue losing market share, further squeezed by BTC. As its valuation relies heavily on expectations of future currency premiums, L1 valuations will continue to shrink as the market increasingly recognizes BTC as having the strongest claim to the “cryptocurrency” narrative. While BTC will also face challenges in the coming years, these issues are still too far removed from reality and too many variables to provide effective support for the currency premium of competing L1 products.

For L1 cryptocurrencies, the threshold for proving their value has risen. Their narratives are no longer as compelling as those of Bitcoin, and they can no longer rely on market frenzy to sustain their valuations in the long term. The era when the story of "we might become the currency in the future" could prop up trillion-dollar market capitalizations is closing. Investors now have a decade's worth of data to prove that L1's monetary premium can only be maintained during periods of extreme ecosystem growth. Once growth stagnates, L1 will consistently underperform Bitcoin, and the monetary premium will dissipate.