Crypto Market Macro Research Report: A Key Window for Macro Liquidity, Institutionalization, and Risk Reassessment

- 核心观点:加密市场反弹源于宏观预期与结构修复。

- 关键要素:

- 美联储降息预期增强,结束量化紧缩。

- 市场恐慌出清后,资金低吸并触发空头挤压。

- BTC技术面守住支撑,带动市场情绪修复。

- 市场影响:趋势未明,需观察资金与宏观面确认。

- 时效性标注:短期影响

I. Macroeconomic Overview of the Crypto Market

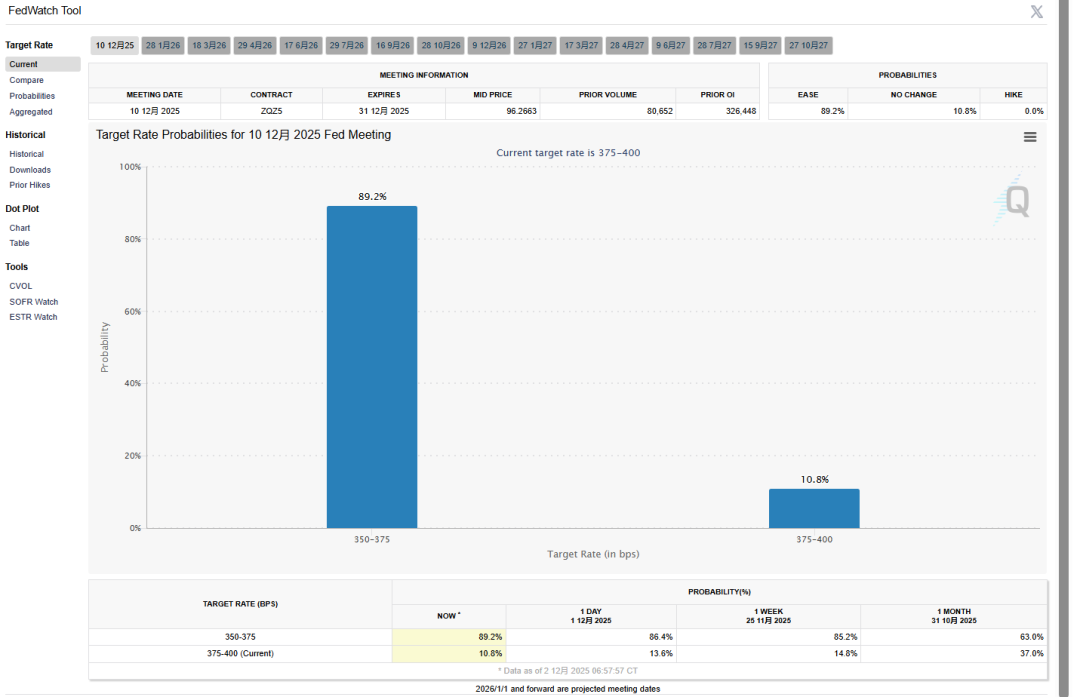

Over the past few weeks, the cryptocurrency market has experienced a significant recovery in both sentiment and price after a sharp correction. BTC, as the market benchmark, once plummeted to $80,000, triggering widespread panic, forced liquidation of highly leveraged positions, and a rapid decline in short-term risk appetite. However, driven by changes in macroeconomic expectations and structural market reactions, BTC has recently rebounded rapidly, returning above $94,000, with 24-hour gains of 7%–8% reported by multiple institutional platforms. This price action reflects both a easing of the previous decline and an attempt by the market to move from extreme pessimism towards structural repair. This rebound is not driven by a single factor, but rather by the combined effects of macroeconomic liquidity, changes in market structure, technical conditions, and capital flows. First, from a macroeconomic perspective, changes in global monetary policy expectations have become a crucial variable influencing risk assets. Increased market anticipation of future interest rate cuts by major central banks and a stronger expectation of marginal improvements in liquidity have brought renewed attention to high-risk assets. With November's PPI data significantly lower than expected, inflationary pressures continued to ease, and Federal Reserve officials repeatedly emphasizing that a "soft landing" remains the core objective until 2026 to avoid a premature shift to tightening. According to the latest data from the CME FedWatch tool, the market's probability of a 25 basis point rate cut by the Fed on December 10th has surged from 35% a week ago to 89.2%. On the other hand, on December 1st (US time), the Fed announced the formal end of its quantitative easing (QT) policy. On the same day, the cryptocurrency market experienced a collective rebound. Historical experience shows that both US stocks and Bitcoin perform better during periods of easing or when easing is expected, and the current market reflects this shifting sentiment. Although macroeconomic policy has not yet clearly reversed, the expectation itself is enough to drive asset prices. Furthermore, against the backdrop of high-interest-rate policies putting pressure on the real economy, the market tends to price in a policy shift in advance, providing more room for imagination for risk assets.

Secondly, from the perspective of market structure and capital flow, this rebound exhibits typical characteristics of "panic selling + institutional buying on dips." During the previous decline, exchange data showed that a large number of highly leveraged long positions and some short positions were forced to close, resulting in a concentrated release of liquidity. Historically, such phases are often accompanied by exaggerated directional movements and extreme sentiment, while capital flows reverse accordingly. Some long-term capital positioned itself after the sharp sell-off, creating support at the bottom. Furthermore, when short positions become concentrated, a "short squeeze" is easily triggered during the rebound, further pushing up prices and accelerating the rebound, thus forming a typical rebound pattern of "structural short squeeze + capital reversal." Technical analysis also provides an explanation for the rebound. BTC repeatedly tested and held support in the $86,000 to $88,000 range, indicating that this price level has become a temporary bottom and a dense area of trading volume. The rapid rebound in short-term prices is also related to the previous oversold condition. If technical support is formed and capital inflows are added, it usually leads to improved momentum and a shift in trading behavior. Recent market movements have shown a synchronization between increased trading volume and price breakouts of key levels, indicating that some buying is proactive rather than simply short covering. However, since overall market volume is not yet sufficient to fully confirm a long-term trend, this rebound remains in an observation window, and whether it can form a higher structure requires further verification.

Beyond the recovery of BTC, the market is more focused on whether the rebound will drive a linkage and rotation between ETH and the altcoin market. The Fusaka upgrade, activated on December 4th, is another significant upgrade to the merged Ethereum. Its core PeerDAS technology increases the blob capacity from 9 to 15, enabling Layer 2 transaction fees to decrease by another 30%-50% from current levels, and for the first time, granting ordinary accounts "account abstraction (AA)" capabilities such as social recovery and batch operations. This upgrade not only optimizes data availability management but, more importantly, paves the way for stateless Verkle Trees clients, reducing node synchronization time from weeks to hours. Historically, every crypto market rebound has seen a migration of funds from mainstream assets to secondary assets to high-risk assets. The stabilization and rebound of the ETH/BTC exchange rate suggests a potential rotation of capital from Bitcoin to altcoins. However, this migration requires certain conditions to be met. First, risk appetite must improve continuously, not just be limited to short-term sentiment recovery; second, the market must have sufficient liquidity, rather than be driven by short-term trading; third, the trends of mainstream assets need to be stable, rather than in a state of high volatility and directionlessness. The current BTC rebound, while driving market sentiment recovery, has also prompted some funds to focus on ETH and some large altcoins. ETH rose in tandem with this rebound and has regained its footing in the key range, which has a positive impact on market confidence.

It's worth noting that institutionalization is changing the market structure. Over the past year, institutional funds have increasingly viewed BTC as an independent asset class rather than a purely speculative asset in their allocation strategies. This has led to a greater tendency for funds to concentrate on investing in assets with clear asset attributes and stable value propositions, rather than chasing high-risk tokens. This factor means that even during market recovery phases, altcoins may significantly underperform BTC or ETH. Meanwhile, changes in the stablecoin market size, derivatives liquidity distribution, and exchange funding rates will become important indicators for judging fund flows, and these indicators are not yet clearly pointing to the start of a strong cycle in the short term. On the risk front, uncertainties affecting market trends remain significant. First, the global interest rate cycle has not yet clearly reversed; if monetary policy expectations fail to materialize, risk assets may come under pressure. Second, technical rebounds without sufficient trading volume are prone to becoming "fragile rallies" and quickly falling when faced with macroeconomic shocks. Furthermore, the altcoin market still faces systemic risks, especially in the absence of risk appetite and capital support, making it more prone to amplified volatility. More importantly, the crypto market has experienced a rapid phase of "valuation repair + new price highs" over the past year. Against this backdrop, investors tend to be more sensitive to new risk-reward ratios, making it difficult for the market to form a consistent trend consensus.

In summary, the current crypto market is at a critical juncture of structural repair and trend assessment. The BTC rebound reflects the market's transition from panic to recovery, but it doesn't yet prove a full recovery of the bull market cycle. If the price breaks through key resistance with accompanying trading volume, the market may enter a new trend and potentially reshape a longer-term price range; if the rebound is weak or macroeconomic pressures increase again, it may return to the bottom range for retesting. The performance of ETH and altcoins is highly dependent on the stability of BTC and the continuity of funding, rather than being driven by BTC alone. In the near future, the market will continue to revolve around structural adjustments, changes in macroeconomic expectations, and fluctuations in risk appetite, while the trend direction will only gradually become clear after a breakout of key ranges and confirmation by funding.

II. Analysis of Structural Opportunities and Risks in the Macroeconomic Sector

When assessing the sustainability of the current cryptocurrency rally, relying solely on price action, technical signals, or short-term sentiment recovery is insufficient to establish a long-term rationale. The future market trajectory depends more on the institutional environment, capital structure, macroeconomic policy direction, and the evolution of the capital cycle itself. These factors can present both structural opportunities and potential risks. In recent years, as the relationship between the cryptocurrency market and traditional financial markets has deepened, its price behavior has become increasingly driven by macroeconomic liquidity and policy expectations. This means that Bitcoin's valuation logic is no longer an isolated "crypto-native logic," but is gradually becoming linked to interest rate cycles, inflation trends, asset allocation preferences, and even institutional risk budgets.

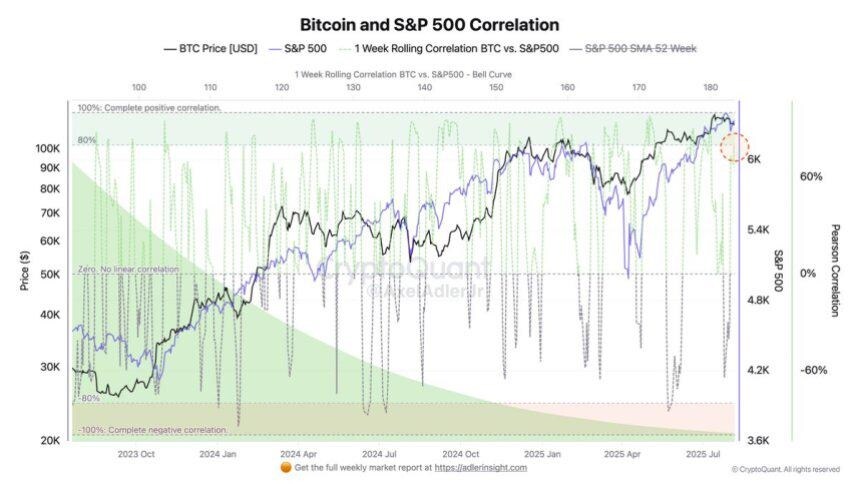

Recent research shows a strengthening correlation between Bitcoin and traditional financial market indices, indicating a gradual shift of crypto assets from "fringe speculative assets" to "mainstream financial assets," with institutional adoption playing a crucial role. A high correlation between Bitcoin and the S&P 500 or Nasdaq signifies a change in market pricing logic: it is no longer an independent category decoupled from macroeconomic cycles, but rather a component of a basket of risky assets. This shift reduces Bitcoin's diversification effect as an "alternative asset," but also enhances its attractiveness as an "allocatable asset." Especially with the involvement of institutional investors, ETFs, pension funds, and large asset managers, the liquidity pool for crypto assets may structurally expand, moving away from solely relying on retail investor sentiment. Behind this shift in funding structure, factors such as ETF capital inflows, improved custody infrastructure, and the establishment of compliance and reporting systems may redefine valuation ranges and risk premium structures. This not only means crypto assets have access to broader funding sources but may also drive their volatility and risk-return structure closer to that of traditional assets. Especially against the backdrop of improved macro liquidity and increased expectations of lower interest rates, institutional funds may incorporate crypto assets into their strategic allocation framework as "part of their risk asset exposure," rather than viewing them as short-term trading targets. In this scenario, market rallies could have a deeper funding basis, rather than simply relying on exchange rollovers and retail investor chasing. If this mechanism holds true, it will have a profound impact on future cycles. However, institutionalization and financialization do not mean the end of market risk; on the contrary, they may bring new structural risks. If Bitcoin's risk attributes are closer to those of high-beta assets, then the crypto market will be more vulnerable to macroeconomic systemic shocks when market liquidity tightens and risk appetite declines. In traditional financial markets, such assets are typically vulnerable during downturns, but if crypto assets move in tandem with them, it means that risk exposure expands rather than contracts. This structure of "institutionalization bringing procyclical risk" is an important issue that needs to be addressed in future market operations.

III. Future Outlook for the Crypto Macro Market

After a significant rebound over the past few weeks, the crypto market has entered a strategic observation window fraught with uncertainty. Bitcoin has regained its footing above $90,000 and even tested higher levels, with market sentiment shifting from extreme pessimism to cautious optimism. However, whether the rebound can continue, whether a trend can form, and whether the market possesses sustainable upward momentum still depend on multiple driving factors, including funding structure, macroeconomic variables, policy changes, and the behavior of market participants. Combining the current environment, historical patterns, and market structure characteristics, we can observe several possible evolutionary paths for the crypto market over the next three to six months, each relying on specific triggering conditions and behavioral feedback mechanisms.

One possible path is for the current rebound to continue and amplify, leading to a test of the $95,000 to $100,000 range. This scenario typically occurs when market sentiment continues to recover, trading volume increases, institutional and retail capital flows in simultaneously, and the market forms a consensus on its directional expectations. If macro liquidity improves, monetary policy shifts to easing, risk appetite rises, and Bitcoin can break through key resistance levels, a secondary acceleration trend structure may form. In this state, price depends not only on technical momentum but also on the combined influence of capital inflows and structural valuation repair. Another possible path is for Bitcoin to repeatedly oscillate and consolidate in the $92,000 to $95,000 range, struggling to form a sustained upward trend. This situation usually occurs when market confidence recovers but capital inflows are unstable, macroeconomic policy expectations are unclear, and bulls are unable to break through key resistance levels. In this state, price fluctuations are driven by short-term trading, and market participants exhibit hesitation and game-theoretic behavior. If the funding environment lacks sustained strengthening, institutions remain on the sidelines, retail investors are cautious, and leverage in the derivatives market is neutral or low, then the price is more likely to remain range-bound rather than break out of the trend. The third path is a market correction, with prices retesting support levels or even experiencing a deeper correction, potentially targeting the $85,000 to $88,000 range. This scenario is often triggered by macroeconomic risks, changes in the policy environment, or a reversal in market expectations. For example, factors such as renewed inflation leading to higher interest rate expectations, a hawkish shift in central bank policy tone, geopolitical risks triggering safe-haven demand, tightening market liquidity, increased regulatory risks, or outflows from institutional channels like ETFs can all reshape risk appetite.

While rallies may offer short-term opportunities for altcoins or other high-risk asset classes, the risk level is significantly higher than for Bitcoin and Ethereum. Due to their fragile valuation systems, insufficient liquidity, high speculative nature, and strong narrative-driven nature, altcoins tend to experience larger drops and slower recovery once the market undergoes structural adjustments. Therefore, only investors with a high risk tolerance, in-depth understanding of projects, and short-term trading strategies should operate in this area. Ordinary investors should remain cautious during periods of uncertainty.

Overall, while the short-term rebound in the crypto market has shown strength, the trend remains unconfirmed. Whether prices can break through resistance, consolidate, or pull back again will depend on macroeconomic data, policy signals, institutional fund flows, and market behavior in the coming weeks. Rebound phases easily generate optimism and high-yield expectations, but the market still carries liquidity risks, regulatory risks, and structural vulnerabilities; any unforeseen event could alter the trend. Before the trend is confirmed, optimism must be built on caution, and market participation should focus on flexibility and risk management, rather than premature predictions of a new cycle.

IV. Conclusion

Overall, this rebound has significantly improved market sentiment, rebuilt key support levels technically, and released potential participation intentions in terms of capital. However, it is still some distance from a trend-driven bull market. The market is currently in a transitional period of "repair-testing-waiting." Whether the upward momentum can translate into a trend breakout will depend on the direction of macroeconomic policies in the coming weeks, the sustainability of capital inflows, and the market participants' repricing process of risk. For investors with risk tolerance, phased entry and flexible allocation may have some strategic value at this stage, but must be based on strict position control and risk management. From a long-term perspective, if the pace of capital inflows continues to increase, the macroeconomic environment gradually improves, and Bitcoin breaks through key resistance levels, then a new round of structural gains is realistically possible; conversely, the market may still face volatility and corrections. Cautious participation and rational judgment will be the main methodology for navigating uncertainty.