Coinbase is about to launch, and the dark pool HumidiFi will be publicly offered tonight. Is there any chance to make money this time?

- 核心观点:HumidiFi在Jupiter平台公募,估值具吸引力。

- 关键要素:

- Solana头部DEX,日交易额超10亿美元。

- 公募分三轮,FDV估值5000万至6900万美元。

- 代币WET无锁仓,Coinbase已列入上币路线图。

- 市场影响:为Solana生态引入重要流动性项目,吸引市场关注。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

Tonight, HumidiFi, a dark pool DEX project within the Solana ecosystem, will officially launch its public offering on Jupiter's newly launched initial coin offering (ICO) platform. The public offering will be conducted in three rounds: the first two rounds will be open to HumidiFi community whitelist addresses and JUP staking addresses, with a FDV valuation of $50 million; the final round will be open to the public, with an FDV valuation of $69 million.

HumidiFi Positioning

HumidiFi positions itself as a liquidity engine in the internet capital markets (similar to Solana's self-positioning).

Unlike traditional Automated Market Makers (AMMs), HumidiFi is a "prop AMM" that combines on-chain execution with institutional-grade market-making logic to achieve narrower spreads, deeper liquidity, and execution quality that surpasses its DEX and CEX competitors.

Specifically, HumidiFi addresses several issues that have long plagued traditional AMM models by introducing an active liquidity framework:

- Predictive pricing : Pricing is generated based on real-time market data and internal risk indicators, rather than relying solely on formulaic curves;

- Dynamic inventory management : Continuously adjust risk exposure to mitigate the risks of over-reporting and mispricing, and maximize capital efficiency;

- On-chain settlement, off-chain intelligence : Complex calculations are performed off-chain, while asset custody, settlement, and accounting are entirely kept on the Solana chain;

- Retail/user priority : Distinguish between retail users and arbitrage or information advantage robots, thereby providing the former with better advantages and lower congestion.

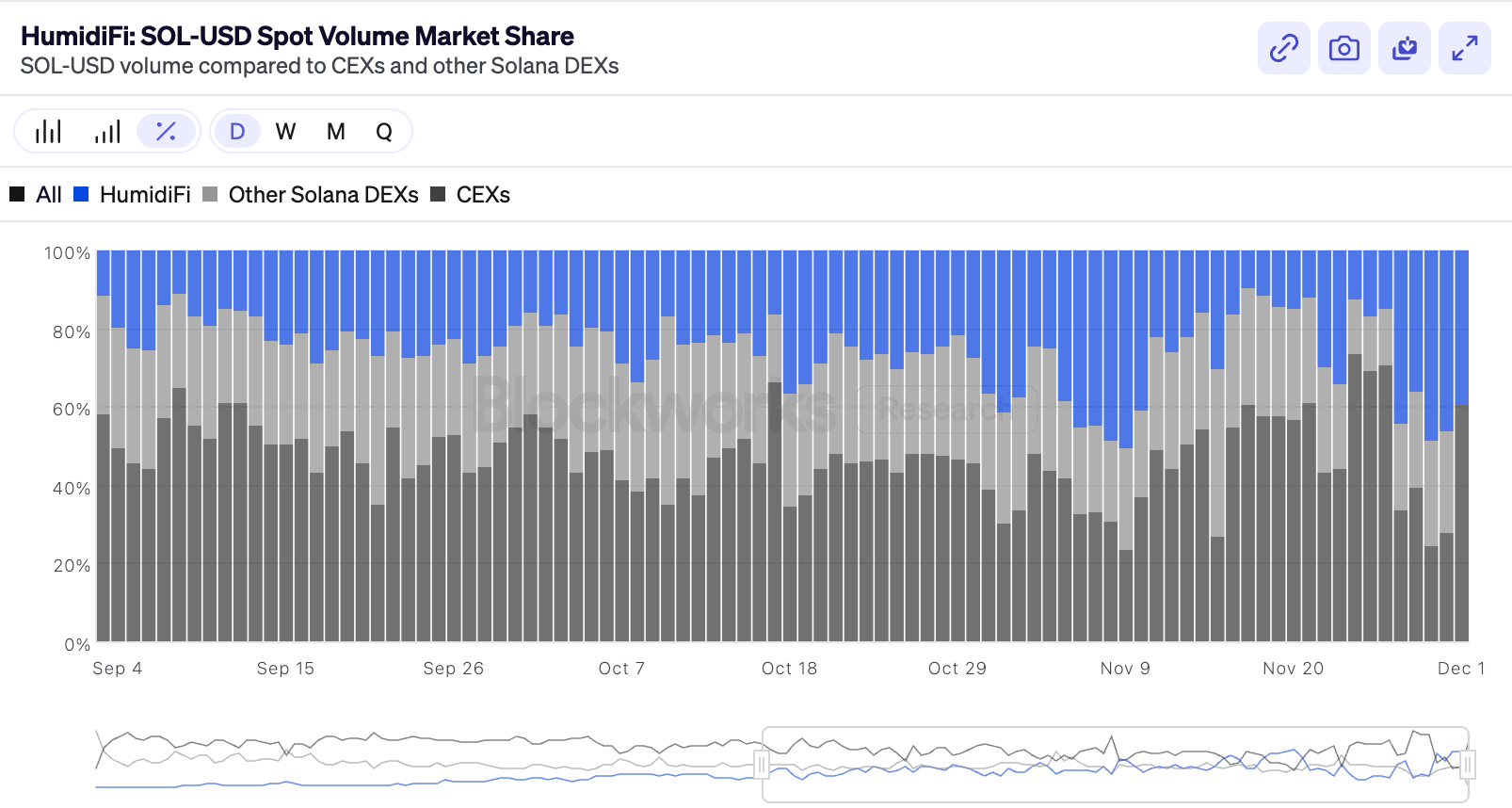

Currently, HumidiFi has become the decentralized exchange (DEX) with the largest actual trading volume on the Solana chain , processing more than $1 billion in transactions daily—accounting for approximately 35% of all spot DEX trading activity on Solana, and about 4% of Solana's daily revenue comes from these transactions.

Blockworks data analyst Sharples provided an even more striking figure: HumidiFi settles approximately 30-40% of global SOL-USD spot trading volume, and recently its weekly SOL-USD spot trading volume has even surpassed Binance. Currently, about 95% of HumidiFi's spot trading volume comes from SOL-USD, but it has recently begun to expand to BTC, ETH, and ZEC.

Token economic model

Yesterday, HumidiFi officially announced the economic model for its token WET. The total supply of WET is 1 billion, distributed as follows:

- 10% is allocated to the pre-sale activities on the Jupiter DFT platform, with no lock-up restrictions;

- 40% will be allocated to the Foundation, of which 8% will be unlocked at TGE, and the remaining portion will be unlocked in installments over 24 months, every 6 months.

- 25% will be allocated to the ecosystem, with 5% unlocked at TGE and the remainder unlocked in installments over 24 months, every 6 months.

- 25% is allocated to the team (Labs), with no tokens unlocked at TGE, and then unlocked in installments over 24 months, every 6 months.

Of the highly anticipated 10% pre-sale allocation, 6% will be allocated to the whitelist within the HumidiFi ecosystem (including HumidiFi users, active and contributing HumidiFi participants, and HumidiFi Discord community members), 2% will be allocated to JUP staking users, and 2% will be allocated to the public sale.

IPO rules and benefit assessment

Back in late October, Jupiter confirmed that HumidiFi would be the first project on its newly launched IPO platform, DTF. Data shows that HumidiFi is closely tied to Jupiter – over 90% of HumidiFi's order flow originates from Jupiter, making it Jupiter's most relied-upon order fulfillment path.

This morning, Jupiter opened the dedicated interface for this public offering ( https://dtf.jup.ag/launch/wet ). As shown in the image below, the public offering is divided into three rounds, and users can connect to the address to check their eligibility for each round.

- Whitelist round (open tonight at 11:00 PM): FDV is valued at $50 million (1 WET = 0.05 USDC), and plans to raise $3 million. Quotas are available on a first-come, first-served basis.

- JUP staking round (opens tomorrow at 11:00 AM): FDV valued at $50 million (1 WET = 0.05 USDC), with a planned fundraising of $1 million, available on a first-come, first-served basis.

- Public float (opens tomorrow night at 11:00 PM): FDV is valued at US$69 million (1 WET = 0.069 USDC), with a planned fundraising of US$1.4 million, available on a first-come, first-served basis.

This morning, Coinbase announced that Humidifi (WET) has been included in its listing roadmap, which may benefit WET's price performance after its listing.

In summary, considering the project's current data performance and discussion level, Humidifi's valuation in this public offering is not high, and there should be room for appreciation. Furthermore, there are no lock-up restrictions, eliminating capital tied up in the offering, making participation more appealing . However, the total offering amount is not high, and due to the first-come, first-served mechanism, competition is expected to be fierce— the real question might be whether you can even get a spot, rather than whether it's worth participating.