December started with a flash crash, and BTC's key support level of $80,000 is in danger.

- 核心观点:加密市场12月开局闪崩,多因素共振施压。

- 关键要素:

- 日本央行加息预期收紧全球流动性。

- 中国监管趋严,打击市场情绪。

- 衍生品市场24小时爆仓超6.5亿美元。

- 市场影响:市场情绪极度恐慌,短期波动加剧。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

The crypto market experienced a "flash crash" at the start of December.

OKX market data shows that BTC briefly fell below $85,000 last night, hitting a low of $83,833, before recovering slightly and currently trading at $86,300, a 24-hour drop of 2.45%. ETH also declined, hitting a low of $2,718, a 24-hour drop of nearly 4%, and is currently trading at $2,790. ZEC experienced an even more dramatic decline, hitting a low of $321, a drop of nearly 14%, and is currently trading at $346.

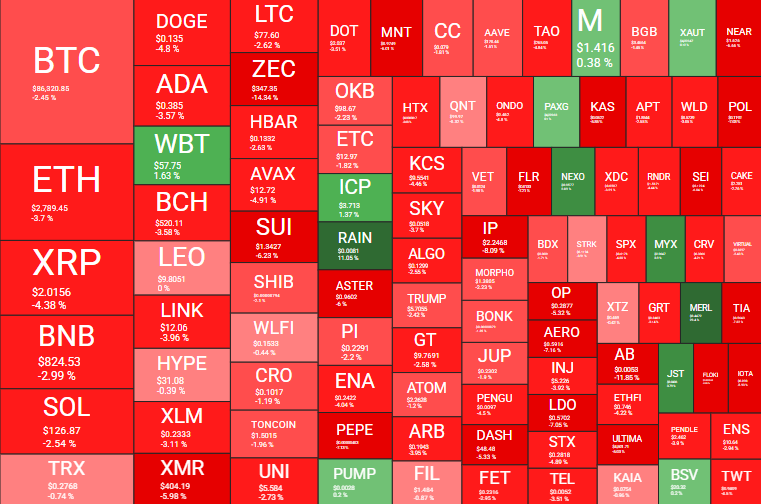

Besides mainstream cryptocurrencies, the altcoin market is also generally under pressure. According to data from Quantifycrypto , nearly 90% of the top 100 cryptocurrencies by market capitalization have recorded declines in the past 24 hours.

24-hour price change data for the top 100 cryptocurrencies by market capitalization

In the derivatives market, according to Coinglass data , the total liquidation amount across the network reached $658 million in the past 24 hours, of which long positions accounted for $536 million. BTC and ETH were the hardest hit by liquidations, amounting to $296 million and $146 million respectively.

Crypto derivatives market liquidation data

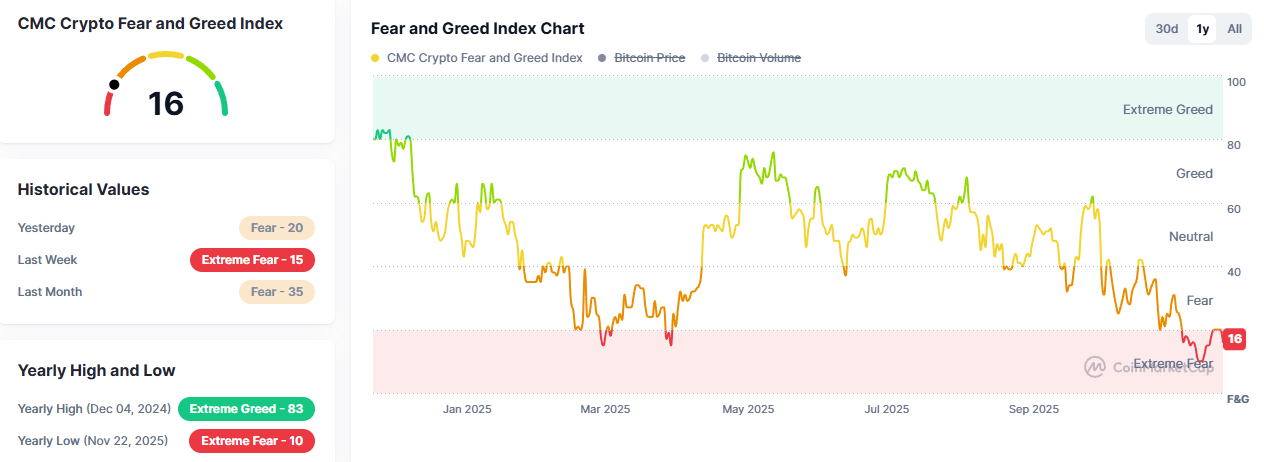

According to CoinMarketCap data , the Fear & Greed Index has risen slightly, but it has been in a state of "extreme fear" for more than half a month, and market sentiment remains at a low point.

Fear & Greed Index

Reasons for the decline: Expectations of a Bank of Japan interest rate hike + tightening domestic regulations

Bitcoin's recent decline has been driven by two key factors: firstly, global liquidity has tightened due to Japan's shift in monetary policy; secondly, domestic regulation of cryptocurrencies has once again signaled a clear tightening, suppressing market sentiment.

The disappearance of "cheap yen"

BitMex founder Arthur Hayes pointed out that Bitcoin's recent decline is closely related to the Bank of Japan's potential interest rate hike in December. With the USD/JPY exchange rate rising to the 155-160 range, the Bank of Japan was forced to adopt a more hawkish stance, a change that directly tightened global liquidity and put short-term pressure on Bitcoin.

Yesterday, the yield on Japanese 2-year government bonds rose to 1% for the first time since 2008, marking the official end of Japan's more than a decade-long era of zero and negative interest rates and yield curve control (YCC). For over a decade, near-zero-cost yen capital outflows have been a major driver of global risk asset price increases. Now, with interest rates rising to 1%, this long-standing channel for cheap liquidity is gradually closing.

In the new interest rate environment, institutions can no longer borrow yen at near-zero cost to allocate assets such as US Treasury bonds, Asian stock markets, gold, or Bitcoin. As the Japan-US interest rate differential narrows and the yen strengthens, carry trade positions are forced to close, and funds begin to flow back to Japan, leading to a simultaneous tightening of global liquidity. Over the past decade, the rise in US stocks, Asian stock markets, and even part of Bitcoin's gains has been driven by "cheap Japanese money," but this hidden pillar is now withdrawing.

As a global risk asset highly sensitive to liquidity conditions, Bitcoin often reacts first to tightening liquidity. The withdrawal of arbitrage funds triggered by expectations of a yen interest rate hike has made Bitcoin the first to bear the brunt of the pressure.

China tightens regulations on the cryptocurrency market again.

At the same time, China has further strengthened its regulatory efforts in the cryptocurrency market, further impacting market sentiment.

The People's Bank of China convened a meeting of its coordination mechanism for combating speculation in virtual currencies on November 28, noting a recent resurgence of such speculation and related illegal activities. The meeting reiterated that virtual currencies lack legal tender status and specifically emphasized that stablecoins, as a form of virtual currency, currently have shortcomings in customer identification and anti-money laundering measures, potentially leading to their use for money laundering, fraud, and illegal cross-border fund transfers. All departments will continue to adhere to the "prohibitory policy" towards virtual currencies, focusing on key aspects such as information and capital flows to continuously combat related illegal financial activities.

This joint effort by multiple departments to strengthen regulation, and the explicit inclusion of stablecoins within the scope of virtual currency regulation, along with warnings about related risks, has further dampened confidence in the already fragile crypto market.

Future trend of the crypto market

VC: The "10.11" liquidation event and macroeconomic headwinds are putting pressure on the crypto market, which is in a phase of "initial stabilization but no reversal".

Several venture capitalists, in interviews, stated that the current ongoing correction in the crypto market is primarily driven by two factors: the concentrated liquidation event on October 10th and a tighter macroeconomic environment. Rob Hadick, a partner at Dragonfly, pointed out that the combination of low liquidity, inadequate risk management, and flawed oracle or leverage design led to large-scale deleveraging, triggering market uncertainty. Boris Revsin, a partner at Tribe Capital, also described the event as a "leveraged shakeout," which has had a ripple effect across the entire market.

Meanwhile, cooling expectations for short-term interest rate cuts, sticky inflation, weak employment data, escalating geopolitical risks, and sluggish consumption have put overall pressure on risk assets over the past two months. Anirudh Pai, a partner at Robot Ventures, pointed out that some leading indicators of the US economy have begun to decline, a trend similar to that seen during previous periods of "recession fears," making it difficult to determine whether this will worsen into a full-blown recession.

At this stage, VCs generally believe the market has entered a "preliminary stabilization period," but this is insufficient to declare a bottom. Bitcoin has rebounded from around $80,000, and ETF inflows have improved slightly, but overall, the market remains sensitive to interest rates, inflation, and AI earnings reports.

Tom Lee: Currently, the risk-reward ratio of BTC versus ETH is more attractive.

Tom Lee, Chairman and CEO of BitMine, stated that while the cryptocurrency market has seen a recent price decline, the fundamentals are still improving, as evidenced by factors such as wallet numbers, on-chain activity, fees, and asset tokenization. He believes that with the price correction diverging from fundamental progress, the risk-reward profile of BTC and ETH is becoming more attractive.

Bitfinex report: BTC is nearing a local bottom and has the foundation to enter a stabilization phase.

A Bitfinex Alpha report indicates that, from a time perspective, the market is nearing a local bottom, although whether prices have truly bottomed out remains to be seen. However, given the significant decrease in leverage, the sell-off by short-term holders, and signs of exhausted selling pressure, the market currently has the foundation to enter a stabilization phase. Furthermore, the continued contraction in open interest alongside rising spot prices suggests short covering rather than new speculative risk-taking, potentially laying the groundwork for a sustained recovery in the fourth quarter.

Greeks.live: Traders are closely watching the key support level of $80,000 for Bitcoin.

Greeks.live released a briefing in its Chinese community, stating that the group is generally bearish, believing the market has entered a bear market phase. Traders are closely watching the key support level of $80,000 for Bitcoin, with most members believing this level is about to be breached and predicting that BTC may test the $65,000-$74,000 range. A clear divergence of opinion has emerged: some members believe in adding to short positions on rallies, while a few traders attempted to buy the dip at $86,900, but this was immediately met with skepticism.

Bernstein: Despite weak market performance, the fundamentals of cryptocurrency companies remain strong.

A team of Bernstein analysts, led by Gautam Chhugani, stated that while the cryptocurrency market remains weak and searching for a bottom, cryptocurrency companies are executing "transformative" changes not seen in previous corrections. Examples include Coinbase's expanding product line, token issuance activities, and emerging consumer applications. The industry's overall operating performance contrasts sharply with market prices, highlighting ongoing business model reforms and favorable regulatory environment as evidence of its potential resilience. Analysts believe the industry is entering a new phase, with companies implementing strategies previously constrained by regulatory uncertainty and expanding beyond cyclical trading revenue.