Arthur Hayes warns USDT may be insolvent; why has there been a surge in FUD (Fear, Uncertainty, and Debt) recently?

- 核心观点:Arthur Hayes质疑USDT储备资产风险过高。

- 关键要素:

- 黄金与比特币占储备12.5%。

- 若两类资产跌30%,将资不抵债。

- Tether称持有70亿超额权益缓冲。

- 市场影响:引发对稳定币储备安全性的担忧。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

Following his public clash with Monad (see " A Collection of Monad Founder and Arthur Hayes's Creative Arguments" ), Arthur Hayes has unexpectedly gotten into a war of words with Tether, the king of stablecoins.

Following his public clash with Monad (see " A Collection of Monad Founder and Arthur Hayes's Creative Arguments" ), Arthur Hayes has unexpectedly gotten into a war of words with Tether, the king of stablecoins.

Arthur Hayes: USDT may become insolvent.

The incident began on November 30th when Arthur Hayes posted Tether's third-quarter reserve certificate, which was released at the end of October, on X. He analyzed that Tether's reserve assets had an excessively high proportion of volatile assets such as gold and Bitcoin, and that USDT might face the risk of "insolvency" due to the decline of these assets.

The Tether team is in the early stages of betting on a massive interest rate trade. Based on my understanding of their audit report, they believe the Federal Reserve will begin cutting interest rates, which would significantly compress their interest income. In response, they've started buying gold and Bitcoin—theoretically, these assets should rise when the "price of currency falls" (interest rate cuts). However, if their gold + Bitcoin position drops by about 30%, Tether's equity will be wiped out, and USDT will theoretically become insolvent.

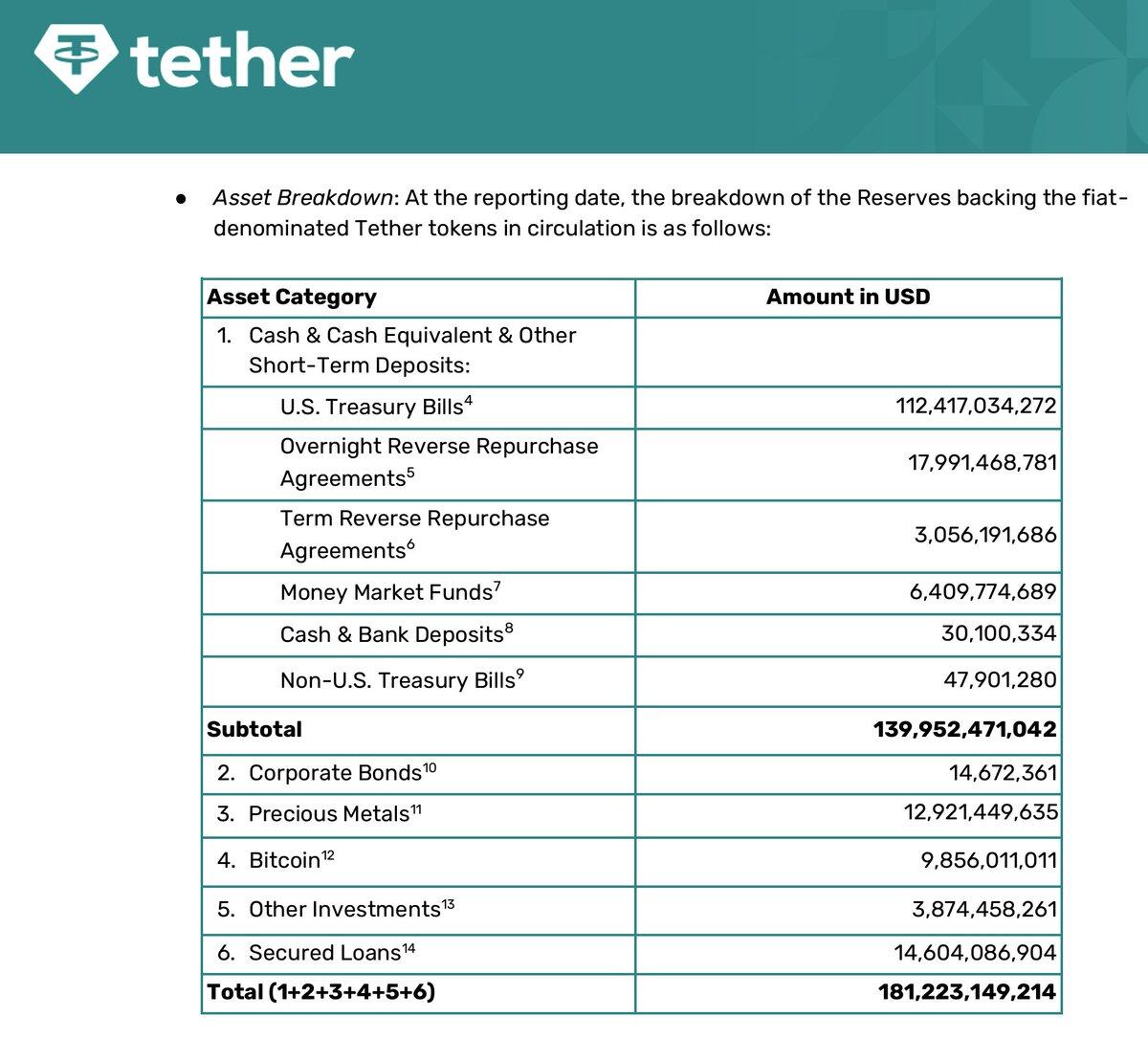

As shown in the chart above, of Tether's total reserve assets of $181.223 billion, $12.921 billion is in precious metals (7.1%) and $9.856 billion is in Bitcoin (5.4%) – these two assets together account for 12.5% of Tether's total reserve assets.

Based on Tether's reserve structure, Arthur Hayes may have simply been objectively pointing out an extreme scenario that Tether might face: if both gold and Bitcoin reserves depreciate significantly at the same time, theoretically, the value of Tether's reserve assets would not be able to fully cover the issuance size of USDT.

This point was also mentioned by the well-known rating agency S&P last week when it downgraded the stability ratings of Tether and USDT (see " S&P Gives Tether the Worst Rating, Which Other Stablecoins Does It Consider? ") – " Tether's Bitcoin reserves account for approximately 5.6% of the total circulating supply of USDT (Odaily note: S&P is comparing circulating supply here, so the percentage will be slightly higher than when comparing reserves), exceeding USDT's own over-collateralization ratio of 3.9%. This means that other low-risk reserve assets (mainly government bonds) are no longer sufficient to fully support the value of USDT. If the value of BTC and other high-risk assets declines, it may weaken the coverage of USDT's reserves, leading to insufficient collateralization of USDT."

Is USDT still safe?

Arthur Hayes is actually referring to the same situation as S&P, but the likelihood of this happening is extremely low, for two reasons.

- First, it's hard to imagine the prices of gold and Bitcoin plummeting instantly (referring to a drop of at least tens of points in a very short period of time). Even if the market continues to decline, Tether theoretically has time to replenish its reserves of low-risk assets by selling them.

- Secondly, in addition to reserve assets, Tether itself holds a huge amount of its own assets, which are sufficient to serve as a reserve buffer for USDT to maintain the operation of the cash transport business.

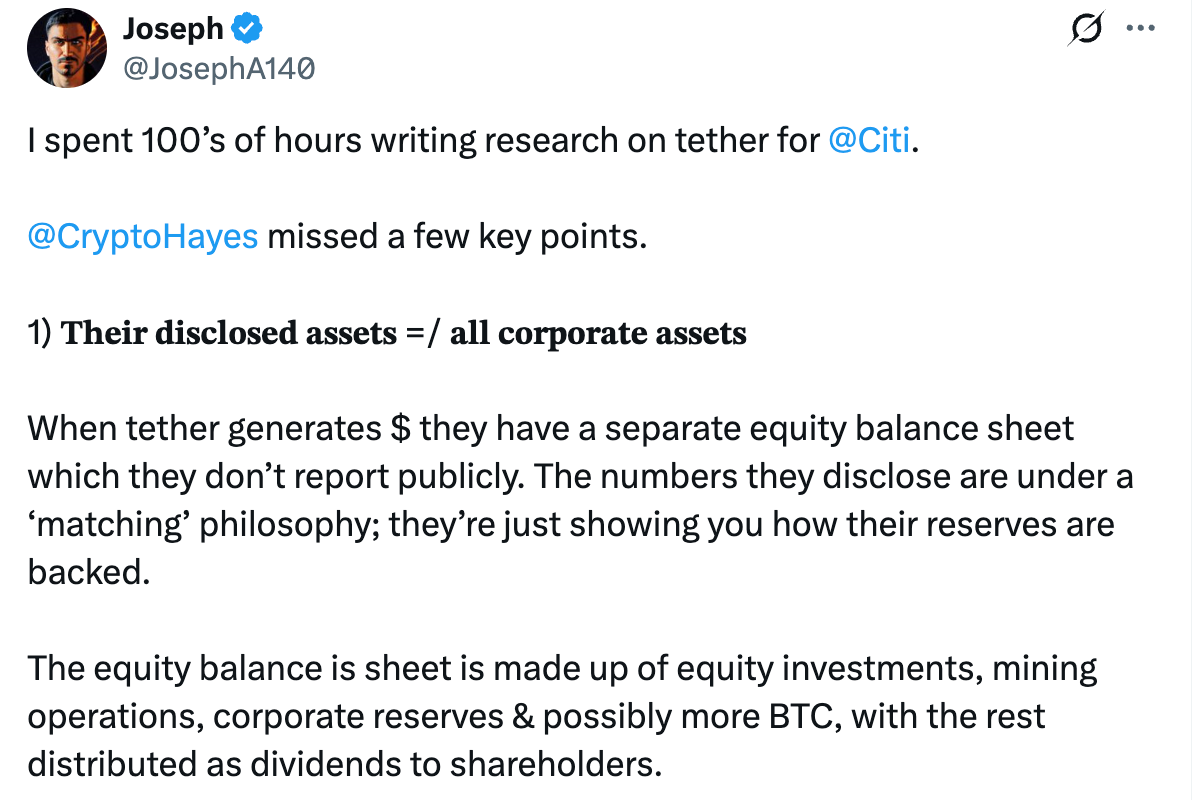

Joseph, former head of cryptocurrency research at Citigroup, also stated regarding the second point that Tether's disclosed assets do not represent all of its holdings —when Tether generates revenue, they have a separate equity balance sheet, which is not publicly disclosed along with its reserves; Tether is extremely profitable and its equity value is very high, so they can cover any gaps on their balance sheet by selling equity; Tether will not go bankrupt; on the contrary, they own a money-printing machine.

Tether's response

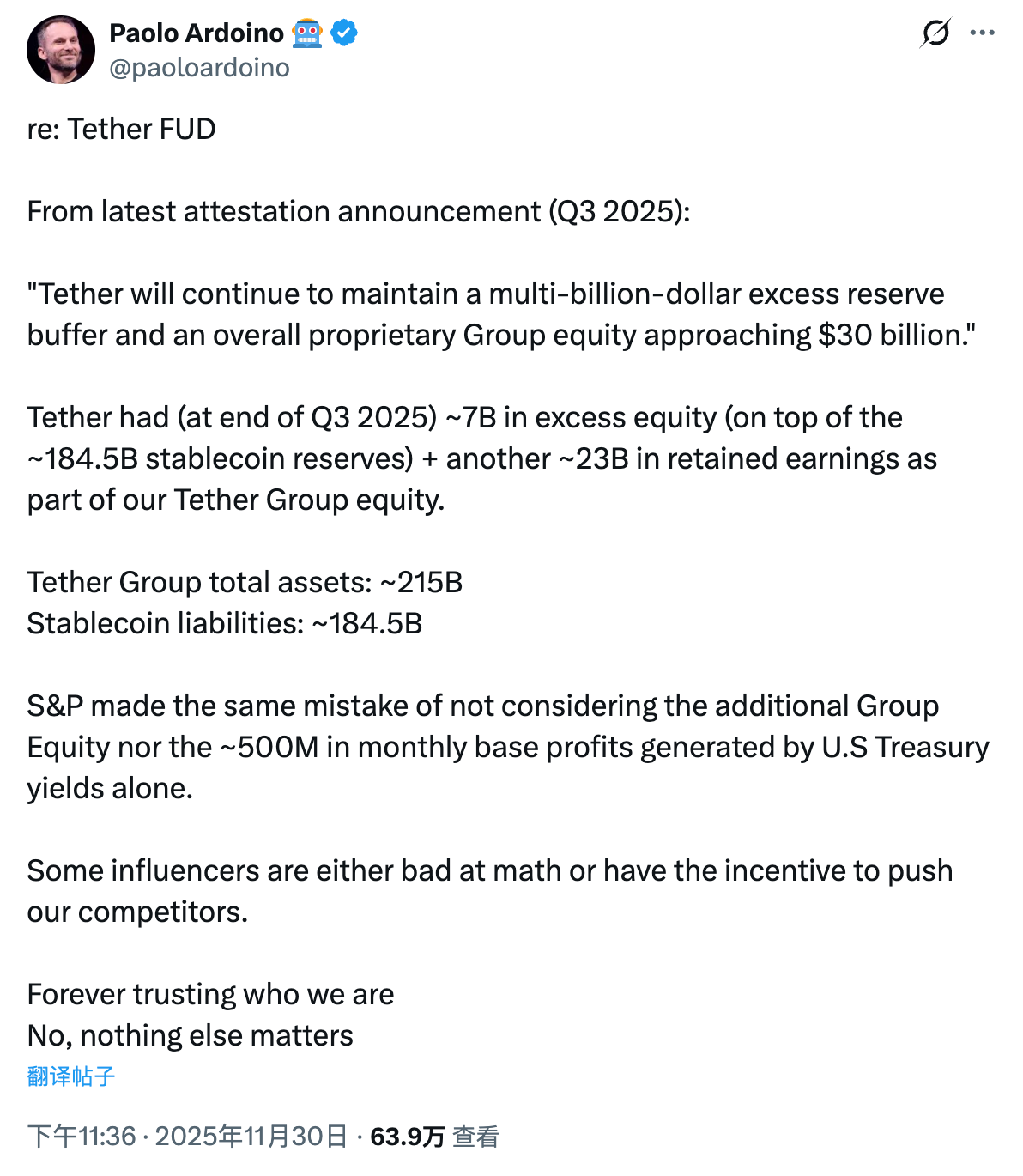

Last night, as the related FUD (Fear, Uncertainty, and Doubt) situation escalated, Tether CEO Paolo Ardoino responded in a post, stating that as of the end of the third quarter of 2025, Tether had approximately $7 billion in excess equity (in addition to approximately $184.5 billion in stablecoin reserves) and an additional approximately $23 billion in retained earnings, which together constitute the equity of the Tether Group.

The comparison between assets and liabilities is clear at a glance:

- Tether Group's total assets: approximately US$215 billion;

- Stablecoin liabilities: approximately US$184.5 billion;

S&P made the same mistake, failing to account for these additional group interests and the approximately $500 million in underlying profit that could be generated monthly from U.S. Treasury yields alone.

Interestingly, Paolo Ardoino added at the end: "Some internet celebrities are either bad at math or have impure motives."

- Odaily Note: Arthur Hayes and his family-run investment firm Maelstrom are among the major investors in the interest-bearing stablecoin Ethena (USDe), and have repeatedly predicted that USDe will become the stablecoin with the largest issuance size.

After Paolo Ardoino's direct response, Arthur Hayes replied again, but his comments were somewhat sarcastic: " You guys are making a lot of money, I'm so jealous. Do you have a specific dividend policy? Or a target over-collateralization ratio set according to asset type (at its volatility discount)? Obviously, there's no problem when your liabilities are in US dollars and your assets are US Treasury bonds, but if your assets are illiquid private investments, people might question your claim of over-collateralization in the event of unforeseen circumstances."

After this exchange, neither party responded further. Arthur Hayes did post another update this morning, but it was just a call for a market rebound.

Judging from the photos posted by Arthur Hayes, he seems to be in a good mood after criticizing Monad and Tether...