Is it worth participating in Infinex, which is backed by Peter Thiel, which is about to go public?

- 核心观点:Infinex以3亿美元估值进行公募。

- 关键要素:

- 计划出售5%代币,募资1500万美元。

- 公募设一年锁仓,可提前解锁。

- 初始流通比例低,或影响价格。

- 市场影响:考验市场对创新DeFi项目接受度。

- 时效性标注:短期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

On November 27, Infinex, a new project created by Synthetix founder Kain Warwick, officially announced that it will soon conduct a TGE and plans to conduct a public offering on Sonar with a FDV of $300 million, planning to sell 5% of the INX token supply, with a target of raising $15 million.

Infinex: A Full-Stack DeFi Service

Regarding Infinex, Odaily previously introduced the project when it was first launched and when the "Talk-and-Robo" activity was initiated. For details, please refer to " Raising Over $50 Million on the First Day: A Brief Analysis of Infinex, the New Project of Synthetix Founder " and " Infinex, which Raised $60 Million, Joins Talk-and-Robo: A Quick Guide to the Rules and Interaction Methods of the Four Modules ".

From a positioning perspective, it's difficult to find a concrete application category to define Infinex. Based on Infinex's own description, you can think of it as a full-stack DeFi service window—first, Infinex itself is a non-custodial wallet covering multiple chains; second, users can access various integrated DeFi services through Infinex; and most importantly, throughout the entire Infinex usage process, a series of complex concepts such as wallet addresses, cross-chain bridging, mnemonic phrases, and gas are all abstracted, allowing users to seamlessly access DeFi applications like CeFi products without needing to master or even know these concepts.

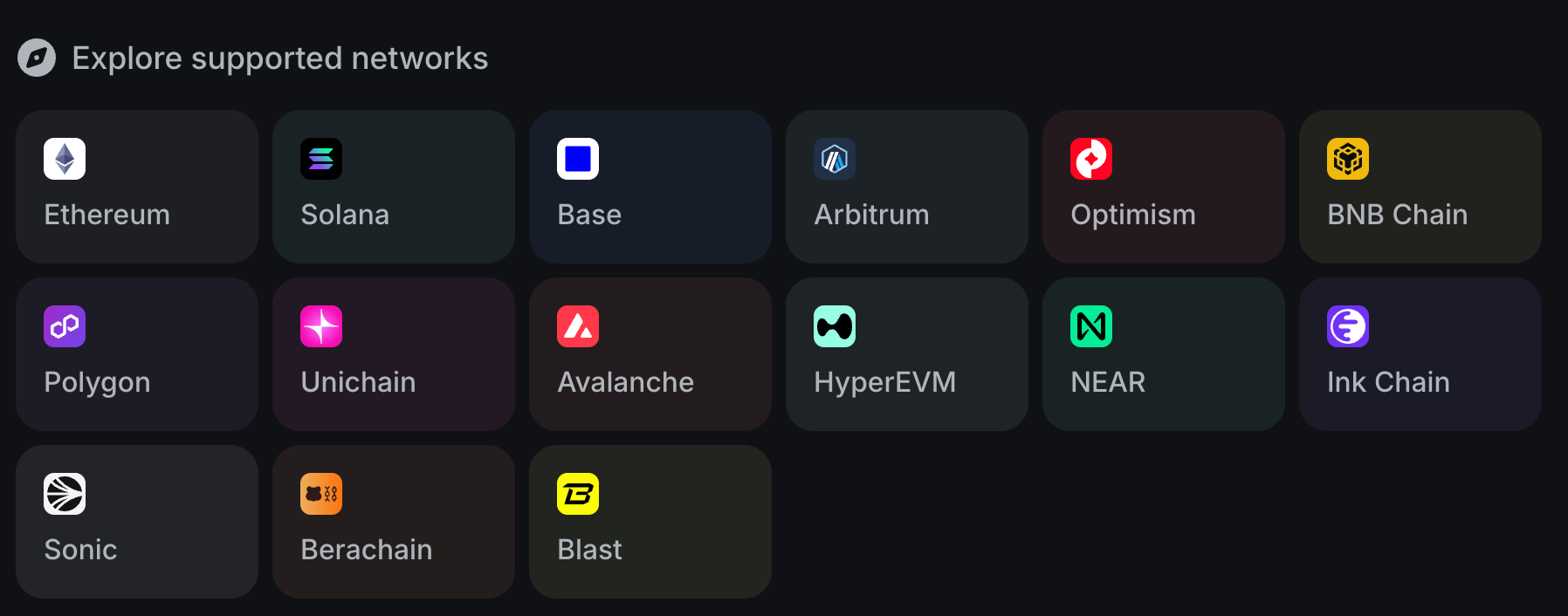

As of this writing, Infinex has integrated with 15 networks including Ethereum, Solana, and Base, and its DeFi services cover multiple categories such as cross-chain transactions (Swidge), perpetual contracts (Perp), liquidity staking and other interest-bearing services (Earn).

Valuation Status and Token Economic Model

Infinex's token economic model is relatively unique, and many long-term users who have participated in the project have always been confused about it. Here is a brief overview.

Last September, Infinex sold 43,244 Patron NFTs to the community through multiple rounds of so-called "sponsored" funding, raising a total of $67.696 million. Founders Fund, Wintermute Ventures, Framework Ventures, and Solana Ventures under Peter Thiel, as well as angel investors such as Ethereum co-founder Vitalik Buterin, Solana co-founder Anatoly Yakovenko, and Aave founder Stani Kulechov, all participated in the NFT subscription.

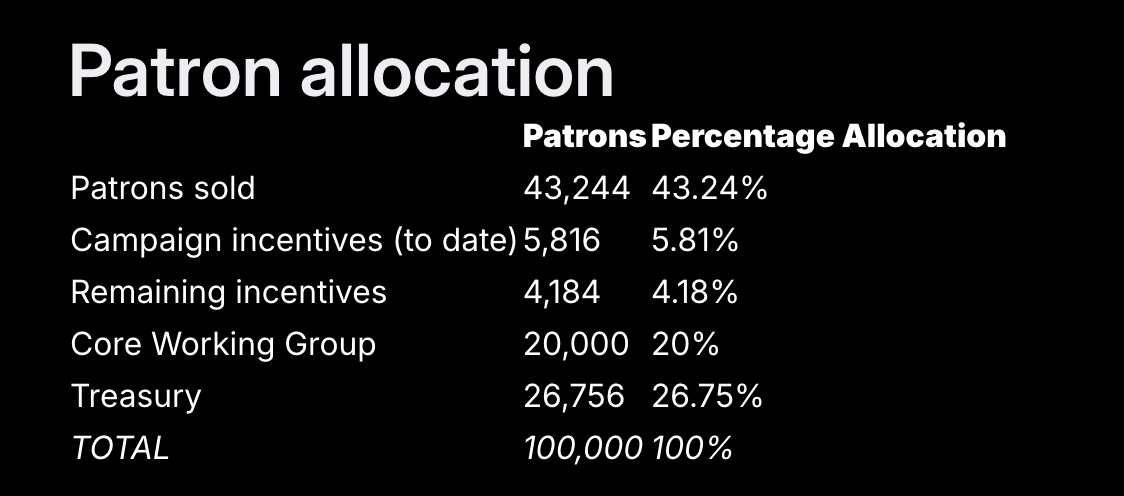

According to Infinex's official documentation and Kain Warwick's own explanation, the total supply of Patron NFTs is 100,000, and the total supply of INX tokens is 10 billion. Each Patron NFT corresponds to 100,000 INX tokens. After the NFT sponsorship event concluded, Infinex released the distribution of Patron NFTs, as follows:

- Patron NFTs sold: 43,244 (43.24%)

- Activity incentives (including the portion already distributed and the remaining portion): 10,000 (10%).

- Core working groups: 20,000 (20%)

- Vault: 26,756 (26.75%). This percentage may change in the future as unclaimed incentives will be returned to the vault.

- A total of 100,000 (100%).

Simply put, you can think of Patron NFTs as another form of Infinex tokens . This includes both sold Patron NFTs and other undistributed Patron NFTs (such as the 5% of tokens that will be offered in the public offering). Patron NFTs will also be subject to different types of lock-up and release rules, just like regular tokens.

To add to that, some people may have noticed that Infinex distributed µPatron during community events. µPatron can be understood as split Patron NFTs, with 1 million µPatrons equaling 1 Patron NFT.

As of this writing, Patron NFT's floor price on the NFT trading market is temporarily reported at 1.79 ETH, equivalent to approximately $5,372 USD. This also means that the current market valuation of Infinex's FDV is approximately $537 million USD.

Analysis of Public Fund Rules

As mentioned earlier, this public offering will be conducted with a FDV of $300 million (offering a profit margin compared to the market's current value of $540 million), aiming to raise $15 million and sell 5% of INX. The platform chosen is Sonar . According to sources, although Sonar's parent project, Echo, was acquired by Coinbase for $375 million in October of this year, Sonar will maintain independent operation for self-custodied token sales, so the rules will not be the same as those for Coinbase's recently completed Monad IPO.

According to Infinex's official introduction, there will be two ways to participate in this public offering: guaranteed allocation and lottery allocation.

The protection quota is for users holding Patron NFTs in a liquid (unlocked) state, and the specific protection policy is as follows:

- 1 Patron NFT: $2,000 quota;

- 5 Patron NFTs: $15,000 quota;

- 25 Patron NFTs: $100,000 quota;

- 100 Patron NFTs: $500,000 quota;

- The allocation follows an additive mechanism. For example, if you hold 32 Patron NFTs in liquid state, your quota will be: 100,000 + 15,000 + 2,000 + 2,000 = $119,000.

The lottery allocation is open to all users, and anyone can apply to participate. The specific rules are as follows:

- The minimum subscription amount is US$200, and the maximum subscription amount is US$5,000.

- If the subscription quantity exceeds the subscription limit, the orders will be allocated by lottery;

- Each order has an equal probability of being selected, and if selected, the subscription amount will be fully allocated.

- Unfulfilled orders will be automatically refunded.

Here's the most crucial point: this public offering will have a one-year lock-up period , but it includes an early unlocking clause. The specific design for early unlocking is as follows:

- At the time of TGE, if one chooses to unlock early, it will become a subscription at a price of $1 billion FDV;

- During the one-year lock-up period, the price will linearly fall back to the initially set $300 million;

- If the trading price of INX after listing is higher than the real-time early unlock price, some public offering participants may choose to unlock early, thus making the unlock curve smoother.

Is it worth participating?

After Infinex disclosed its public offering rules, the section on lock-up restrictions sparked considerable controversy. After all, it is rare in the industry to require a one-year lock-up period for a public offering that is entirely aimed at retail investors.

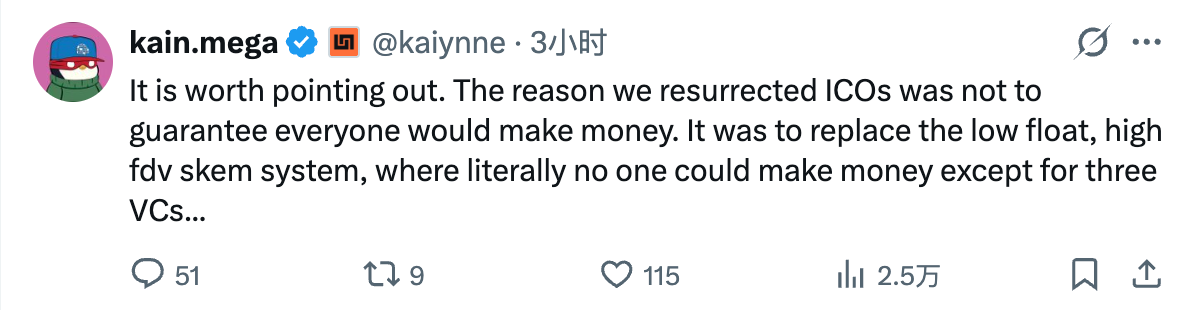

Kain Warwick later responded to the public offering-related questions on his personal account, but the content seemed rather strange: " It's worth mentioning that the purpose of our revival ICO is not to guarantee that everyone can make money , but to replace the low-liquidity, high-FDV arbitrage model. Under this model, almost no one can profit except for the three venture capital firms..."

Returning to the public offering itself, according to community user nanhan (@airdrop_nanhan), the initial circulating supply of INX after TGE may be less than 5%. The low circulating supply may mean that INX has the potential to perform well in the early stages of its launch. However, due to the lock-up restrictions, public offering participants cannot cash out at the ideal subscription price of $300 million.

In summary, Infinex's public offering is clearly best suited for users who are bullish on Infinex's future or confident in Kain Warwick's ability to generate returns; conversely, it is completely unsuitable for users who are particularly sensitive to immediate liquidity and prefer quick in-and-out trading. For the broader user group in the middle, if you intend to participate in the public offering, my personal advice is that instead of waiting passively, you should keep a close eye on the price movement of INX after its listing and unlock the shares at a premium (relative to the $300 million FDV) when it is confirmed to be profitable, thus securing your profits as early as possible.