The nascent stage of Info Finance: How can the market evolve from "betting on the future" to "influencing the future"?

What's your first reaction when you hear "prediction market"?

Most people would certainly associate prediction markets with sports betting and financial speculation, and this impression is not unfounded. However, since the beginning of this year, prediction markets have been visibly evolving into a new type of social information medium. In the "prediction market," the outcome of the game itself is the most widely priced and most equitable "social information source."

Especially in traditional prediction markets, the participation mechanism and settlement process are often shrouded in an opaque black box, while the emergence of on-chain technology has, for the first time, given "prediction" a public and verifiable structure.

As Ethereum co-founder Vitalik Buterin stated at the ETHShanghai 2025 main forum, the fact that many people participated in predictions through Polymarket during the US election is itself a success, proving that prediction markets can efficiently aggregate the public's true beliefs (further reading: " The Moment Prediction Markets Go Global: ICE Enters the Market, Hyperliquid Increases Investment, Why Are Giants Competing for 'Pricing Uncertainty'? ").

This article will also attempt to reveal this hidden yet gradually emerging possibility, and explore how the forecasting market is moving from pricing uncertainty to a future trend that inversely impacts the real world.

I. From "Betting" to "Prediction" = More Accurate Information Sources

Ultimately, the traditional betting market, which was previously limited to a very few areas such as sports, is essentially just a "vote on the future." People decide who to bet on based solely on their own judgment or odds, and its core value is limited to entertainment and gambling.

On-chain prediction markets, on the other hand, are more like "transactions of cognition." Their rise in the information age stems from solving two major pain points of traditional information channels:

On the one hand, traditional media are often dominated by a small number of people who control the issues and public opinion, making it difficult to accurately reflect the importance of events and public perception. On the other hand, traditional polls and surveys lack economic incentives, and participants can answer at will, lacking the motivation to disclose their true beliefs (the 2016 US election is a typical example of a serious discrepancy between polls and reality).

Source: Xinhua News Agency

Prediction markets perfectly circumvent the aforementioned shortcomings. They use the universal and quantifiable language of "price" to aggregate the judgments of individuals scattered around the world with real economic motivations. Therefore, through price signals, they can capture real-world trends in a faster and more dynamic way, which makes them not just a "financial product" but also a new information medium.

When we look back at predictions for the 2024 US presidential election or crypto policy, we find that predictions from platforms like Polymarket are often closer to the final outcome than polls. This includes recent betting on a possible pardon for CZ; before official confirmation, the probability of betting on CZ's pardon steadily increased.

These market signals are often more forward-looking and accurate than subjective guesses or unmotivated comments.

Furthermore, with the support of AI, the prediction market can be extended to smaller, more micro-level events, because AI models can become active participants in the market, including continuously acquiring data, updating probabilities, and automatically generating predictions.

This means that future prediction markets will no longer be just a arena for human competition, but may become a cognitive network co-built by "humans + AI", greatly improving the breadth and accuracy of information prediction.

II. A Trustless "Social Pricing Mechanism"

From this perspective, the biggest innovation or breakthrough in the current prediction market is not in getting people to place bets, but in making betting credible, transparent, and combinable.

While the creation, trading, and settlement logic of prediction markets may not be entirely executed through smart contracts, their core mechanism is based on blockchain to achieve preliminary trustlessness and the most widespread application of participation/settlement logic.

- Smart contracts ensure that the creation and settlement logic of the market cannot be tampered with, and oracles guarantee the (relative) fairness of the outcome – although oracles themselves still need improvement, they are at least an effort toward decentralization.

- Cryptocurrency deposits and withdrawals allow people from anywhere in the world to participate in the market in a relatively low-barrier way, bringing together a broader collective wisdom.

Prediction markets thus become an information aggregation mechanism based on algorithmic trust, making prices a transparent coordinate reflecting consensus.

Source: Vitalik Blog

This actually constitutes a prototype of information finance, meaning that prediction markets are not only standalone applications but can also be combined with DeFi modules to form the concept of information finance. Vitalik Buterin once suggested that prediction markets are just an early form of information finance, and in the future, any uncertain event can be priced in the market.

This means that prediction markets are no longer limited to politics or sports, but can be embedded in broader scenarios such as governance, scientific research, climate, and AI model evaluation. "Start with the facts you want to know, and then design a market to elicit that information in the best way," including:

- DAO governance: Members can establish prediction markets based on the results of proposals, using market prices to reflect group expectations;

- Scientific Research and Innovation: Using the market to price the credibility of scientific research conclusions;

- AI and Algorithms: AI can participate in low-liquidity prediction tasks by automatically updating probabilities through models;

This has transformed the prediction market from a financial product into a "social pricing mechanism".

In addition, another important change is the trend of assetization in the prediction market, such as directly integrating DeFi yield logic on-chain: market liquidity is driven by AMM, and users can earn transaction fees like DeFi liquidity pools; or prediction positions (such as YES/NO shares) can be tokenized and freely traded in a wider secondary market; in future designs, these tokens may even be incorporated into lending protocols to achieve compound yields.

In other words, the prediction market can not only price the future, but also enable holders to obtain continuous returns, turning betting into an asset behavior with cash flow.

Third, predicting the future of the market may change the future.

Given this trend, prediction markets may also begin to influence the course of the real world.

Of course, this is a trend that is still quite hidden at present and not many people are discussing it, but it is worth being wary of. As more and more funds and heavyweight players gather at the prediction market table, it will naturally spread to the real world and in turn have the ability to influence the real world.

Especially after news broke that Trump Media Group was entering the prediction market business, it indicated that prediction markets would undoubtedly become more deeply embedded in real economic activities.

Source: Trump Media

To give an extreme example: if the vast majority of rational economic agents in a market bet on a particular candidate to win, not only will market prices be driven up, but real-world voting behavior may also be influenced by price signals. Once the outcome is swayed by huge sums of money, the prediction market gains the ability to change the result.

To put it bluntly, prediction markets are pushing everyone, under the assumption of "rational economic man," to the forefront of destiny. In the process of reaching a consensus through transactions, they are also unintentionally interfering with the direction of that consensus. When it is profitable to "influence the outcome with money," they gain the ability to change the facts.

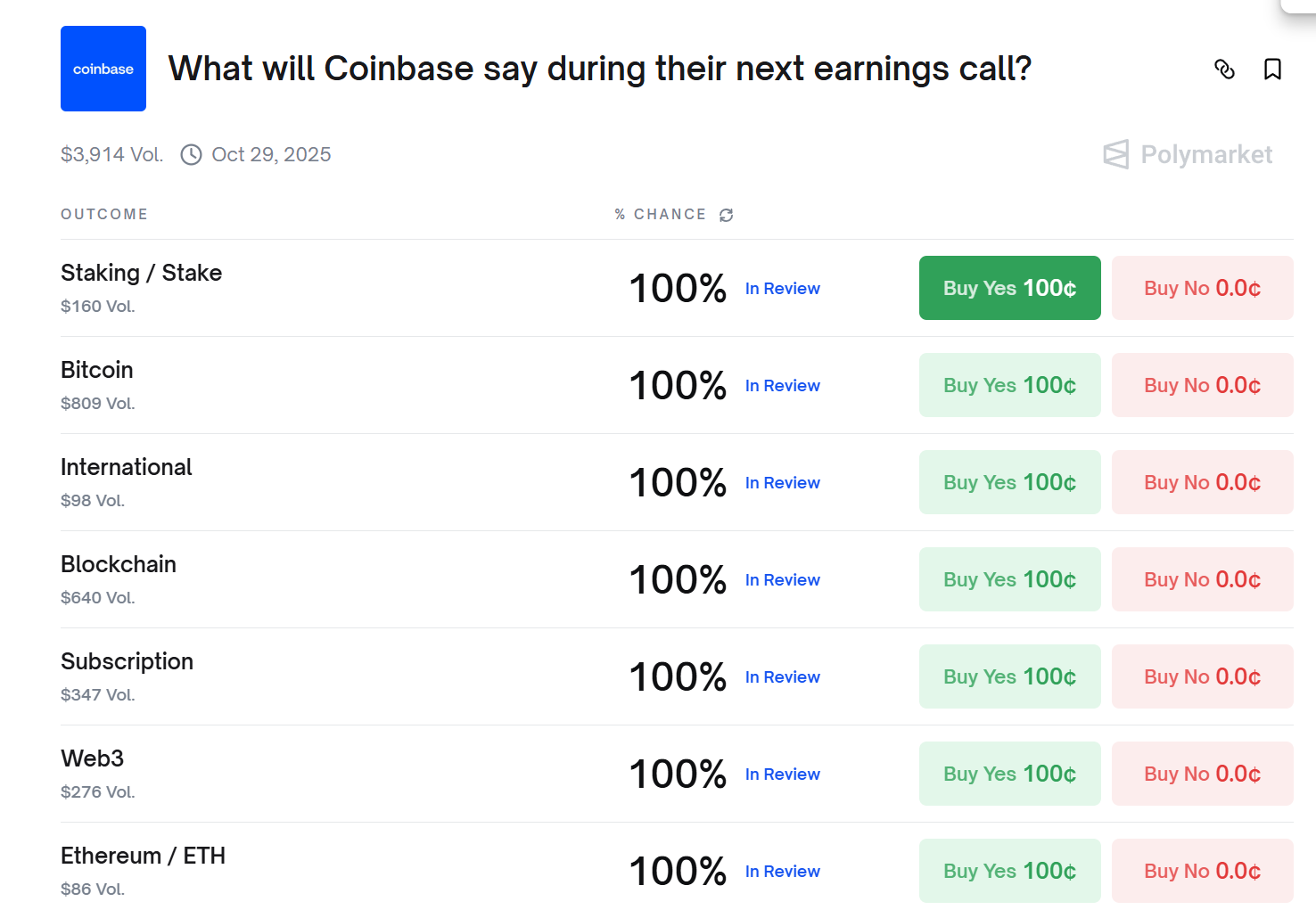

Interestingly, during the just-concluded Coinbase Q3 earnings call, Coinbase co-founder and CEO Brian Armstrong staged a live experiment that could be described as "performance art of prediction markets."

When the analyst finished asking questions, he chuckled and said, "I've noticed some people are betting on predictions. Should I mention certain keywords on the conference call today?" He then rattled off all the keywords in one breath—and as a result, all the related bets on Polymarket saw their odds of winning skyrocket!

This is both a joke and a small footnote and a foreshadowing:

Predicting the future of the market may no longer be just about predicting the future, but rather about using prices as signals that could in turn change the world, thus gaining the ability to influence the future.

- 核心观点:预测市场正演变为新型社会信息媒介。

- 关键要素:

- 链上机制确保公开可验证性。

- 价格信号聚合全球真实认知。

- AI参与提升预测广度精度。

- 市场影响:推动信息金融发展,重塑定价机制。

- 时效性标注:长期影响