Bitcoin has prematurely "surrendered," and the market awaits Nvidia's "performance."

- 核心观点:AI泡沫恐慌与利率不确定性引发风险资产抛售。

- 关键要素:

- 纳指跌超6%,比特币跌破9万美元。

- AI投资过热引发泡沫破裂担忧。

- 美联储降息预期呈五五开局面。

- 市场影响:科技股与加密货币短期承压震荡。

- 时效性标注:短期影响

Original author: Bootly

Original source: BitpushNews

Before the market even awaited Nvidia's earnings report, global risk assets had already reacted: sentiment shifted from panic to "stampede" panic.

On Tuesday, the Dow Jones Industrial Average fell 499 points, or 1.07%; the S&P 500 fell for the fourth consecutive day, marking its longest losing streak since August; and the Nasdaq has fallen more than 6% since hitting a record high in October, wiping out approximately $2.6 trillion in market capitalization.

The cryptocurrency market, considered a bellwether for high-risk assets, experienced a "bloodbath": Bitcoin briefly fell below $90,000, the first time in seven months; Ethereum fell below the $3,000 mark.

Behind the simultaneous plunge in US stocks and cryptocurrency markets, investors' panic over an "AI bubble" and uncertainty about the Federal Reserve's monetary policy are creating a double whammy.

Ahead of Nvidia's earnings report, discussions about the AI bubble reached a fever pitch.

This time, the decline in US stocks is closely related to the topic of AI.

Earlier today, Nvidia and Microsoft announced plans to invest up to tens of billions of dollars in Anthropic for the next round of computing power competition. This was intended to be positive news symbolizing future industry growth, but it failed to significantly boost the market.

In the past six months, major technology companies have seen exponential growth in their investment in AI infrastructure—data center construction, energy capacity expansion, and GPU procurement are all in the tens of billions of dollars. Nvidia's market capitalization once soared to $5 trillion, and the weight of AI companies in the S&P 500 is rapidly approaching one-third.

This has made the panic in the market, with cries of "the bubble is accelerating," even more jarring.

In an interview with the BBC, Alphabet CEO Sundar Pichai pointed out that the current AI hype contains "irrational elements." He warned, "If the AI bubble bursts, no company will be able to escape unscathed, including us."

"AI is revolutionary, but that doesn't mean valuations can be detached from fundamentals," Wharton Business School professor Jeremy Siegel said in a Bloomberg TV interview this week.

This statement, to some extent, captures the current ambivalent sentiment among investors: they are deeply convinced of the future of AI, but also worried that the gains of the past year have overdrawn future growth.

Therefore, before Nvidia's earnings report was released, some funds chose to withdraw and reassess the risk-reward ratio of the AI sector.

In her analysis report, Carson Group Global Macro Strategist Sonu Varghese pointed out: "The technology sector has been on a strong upward trend this year, so volatility is not unexpected. The increased volatility in tech stocks also stems from highly concentrated risk – a characteristic reflected in both index composition and investor holdings. Despite substantial gains, investors heavily invested in AI-related stocks remain cautious, as any pullback could trigger a chain reaction. More seriously, when stock prices begin to fall, the simultaneous attempts by many investors to diversify risk can exacerbate market volatility."

Macroeconomic variables: Missing data is about to be filled in, but the interest rate outlook remains the biggest uncertainty.

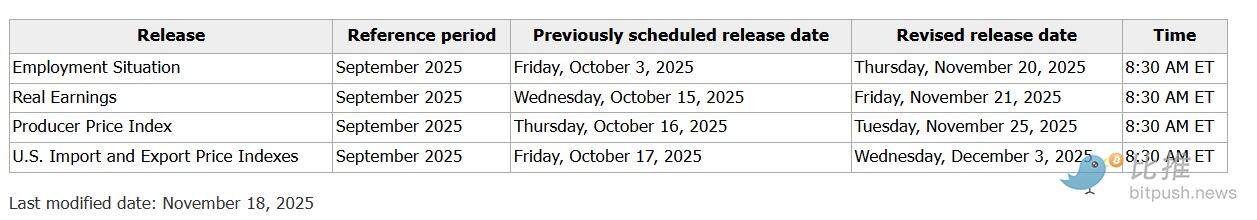

Key economic data missing due to the government shutdown is being rapidly restored. The U.S. Department of Labor confirmed that all missing weekly initial jobless claims data will be released by Thursday, and the September PPI and import/export price indices will be released on November 25 and December 3, respectively.

However, the market's core anxiety is not about whether the data is missing, but about what interest rate path it will lead to once the data is complete.

According to the CME FedWatch tool (as of November 19th, Beijing time): the probability of the Federal Reserve cutting interest rates by 25 basis points in December is 48.9%, and the probability of keeping rates unchanged is 51.1%.

In other words, market expectations for a near-term interest rate cut are almost evenly split, making interest rate expectations particularly sensitive and fragile.

Technology stocks and crypto assets both belong to an asset class reliant on high valuations and strong growth expectations, making them extremely sensitive to interest rate changes. If upcoming data reinforces narratives of "sticky inflation" or "stronger-than-expected resilience in the job market," leading to a further postponement of interest rate cuts, then the pressure of tightening liquidity will continue to weigh on risk assets.

Industry insiders: Is it a "deep correction" or a "perfect bottom-fishing"?

Over the past few years, the correlation between Bitcoin and US tech stocks, particularly the Nasdaq 100 index, has been steadily increasing. Recent data shows that the 30-day correlation between Bitcoin and the Nasdaq has reached approximately 0.80, a new high since 2022.

Industry insiders generally believe that Bitcoin's performance is increasingly resembling that of a "leveraged tech stock," which surges during bull markets but is simultaneously sold off when risk aversion is high, with the decline amplified.

Opinions within the crypto industry are divided in response to Bitcoin's pullback:

- Long-term profit-taking: Analysts such as Gerry O'Shea of Hashdex Asset Management believe that Bitcoin's struggle is partly due to long-term holders taking profits and locking in huge gains from recent years.

- Technical Alert: FxPro's Chief Market Analyst, Alex Kuptsikevich, points out that Bitcoin's break below the 50-week moving average confirms the breakdown of its two-year bull market trend. His predicted scenario is that Bitcoin could further decline to the 200-week moving average (approximately $60,000 to $70,000).

- A sign of "extreme fear": CoinMarketCap's sentiment index shows that crypto investors are currently in a state of "extreme fear." However, OKX Global Managing Partner Haider Rafique believes that the market's performance in the coming days will determine whether this is merely a "sharp, temporary pullback" or will evolve into a "deeper reset."

- Optimists are calling for entry: Ryan Rasmussen of Bitwise Asset Management and others remain optimistic, believing that when the market is at its extreme "fear," it is the "perfect opportunity" for investors to establish existing positions or enter the market. Geoffrey Kendrick, Head of Digital Asset Research at Standard Chartered, pointed out in his latest research report that the current Bitcoin pullback is a healthy adjustment within the cycle, and if it can hold the $100,000 area, Bitcoin will form new structural support.

In summary, the market is currently in a typical "wait-and-see" period. Investors are advised to control their positions and avoid chasing highs or panic selling. Technology stocks and crypto assets may continue their weak and volatile trend in the short term. The market is awaiting new directional anchors, including fundamental data, policy signals, and validation of the AI narrative. Until then, risk assets will enter a more restrained consolidation phase.