CoinW Research Institute Hot Report: Analysis of Uniswap's Major Buyback Proposal - Can UNI Initiate a Value Reassessment?

- 核心观点:Uniswap提案推动UNI转向通缩模型。

- 关键要素:

- 开启协议费,年回购销毁4.6-5亿美元。

- 一次性销毁1亿UNI,占总量16%。

- 统一收费口径,增强收入稳定性。

- 市场影响:为UNI提供长期价格支撑。

- 时效性标注:长期影响

I. Uniswap's Major Proposal: In-Depth Analysis

Uniswap CEO Hayden Adams recently announced his first governance proposal, which includes measures such as enabling protocol fees, burning UNI tokens, and increasing Unichain fees, aiming to shift UNI towards a deflationary model. If the proposal passes, the Uniswap protocol is expected to generate approximately $460 million to $510 million annually for UNI buybacks, a scale that will provide strong support for the token price. The specific details of the proposal are as follows:

1. Enable protocol fees; all revenue from the protocol side will be used to repurchase and burn UNI.

This is the core value capture mechanism of this proposal. It fundamentally changes UNI's token model, transforming it from a pure governance token into a "productive asset" backed by direct cash flow. This is similar to a listed company using profits to buy back shares, providing a long-term and solid value floor for the token price and serving as the core engine driving it into a "deflationary appreciation" flywheel. This is the essence of value capture. UNI will transform from a governance token with no cash flow into a "productive asset" backed by direct income, similar to a stock buyback.

2. Unichain sequencer fees are incorporated into the destruction pool.

This move aims to consolidate the value generated by the entire Uniswap ecosystem into the UNI token. Sequencer fees are an inherent revenue of the Unichain Layer 2 blockchain. Including them in the burning process means that the value of UNI no longer depends solely on DEX trading, but is deeply tied to the prosperity of the entire Uniswap ecosystem (including its public chain), thus broadening its value base.

3. One-time destruction of 100 million UNI (retroactive destruction of historical unpaid fees).

This is a strong deflationary signal and a measure to boost market confidence. The one-time burning of 16% of the total supply will immediately increase the scarcity of the remaining tokens. Its "retroactive compensation" logic aims to fairly reward early supporters and attempt to "make up" for past failures to generate returns for holders, which is expected to have a significant short-term positive impact on market sentiment.

4. Launch PFDA: Offer traders a "commission discount" through auctions while keeping MEV earnings within the protocol.

This is an innovative mechanism that kills two birds with one stone. By auctioning off the right to discount transaction fees, it cleverly reclaims the value of MEV that would otherwise be captured by third-party searchers back into the protocol. Ultimately, this revenue will support UNI's buyback program, enhancing the robustness of the entire economic model.

5.v4 Aggregator Hook: Aggregates external DEX liquidity and collects protocol fees.

This means Uniswap is evolving from a "liquidity provider" to a "liquidity aggregation layer and fee gateway." Even if a trade doesn't occur in Uniswap's own liquidity pool, the protocol can capture fees as long as it's routed through its hook. This significantly expands Uniswap's feeable market and represents a strategic breakthrough in its revenue ceiling.

6. Unified pricing: No additional fees will be charged for the interface/wallet/API; revenue will be unified at the protocol layer.

This move aims to solidify the core position of the protocol layer and strengthen the competitive advantage of the business model. It prevents various front-end components (such as the official website and third-party interfaces) from engaging in a "zero-cost" internal war, thereby eroding the revenue base of the entire ecosystem. Unified pricing ensures the visibility, predictability, and stability of protocol revenue, which is a crucial guarantee for the long-term healthy operation of the economic model.

7. Governance and Organization: Labs merged with the Foundation, with an annual budget of 20 million UNI for growth.

This reflects Uniswap's pursuit of a balance between short-term financial returns and long-term ecosystem development. The merger improves decision-making efficiency, while establishing a clear growth budget indicates that the team is not only focused on the current token price, but will continue to invest in ecosystem building, including developers and liquidity, to ensure the protocol remains vibrant and leading in the competition over the next decade.

8. Asset Migration: Unisocks liquidity is migrated to Unichain v4, and the LP position is destroyed.

This move carries significant strategic symbolism. It signifies that the team is clearing out old assets and fully shifting resources and attention to a next-generation strategy centered on Unichain and v4. It can be seen as a "metabolism" of the ecosystem, symbolizing a break from the old model and a focus on building the future.

Image source: Uniswap founder (Hayden Adams)

Researcher's View: The core of this proposal lies in building a value flywheel of "protocol revenue → buyback and burn → token deflation and appreciation." If it operates smoothly, it will provide UNI with continuous discounted cash flow and price support.

II. Proposal Approved: Repurchase Calculation and Agreement Revenue Analysis

We conducted our calculations based on historical data and publicly available proposal parameters. This proposal involves directly burning 100 million tokens (16% of the total supply), with the core assumption being a daily repurchase transaction volume of 0.05%. That is, protocol fees (0.3%) - LP rewards (0.25%) = repurchase (0.05%).

1. Analysis of core revenue sources

1. Core DEX Business: Based on the annualized trading volume of approximately $1 trillion for versions V2 and V3, and calculated at a fee rate of 0.05%, it is expected to generate $500 million in annualized protocol revenue.

2. v4 aggregator business: As an incremental source, it is expected to contribute 10%-20% of the core transaction volume, resulting in a potential annual revenue of $50 million to $100 million.

3. PFDA and MEV capture: Although these are important innovative revenue streams, they are currently difficult to quantify precisely and are not included in this calculation. Unichain sequencer fees: Still in the early stages of development and relatively small in scale, they are also not included at this time.

2. Summary of annualized repurchase funds

Conservative scenario (including only core DEX business): Annual buyback funds are approximately $500 million.

Optimistic scenario (including v4 aggregator revenue): Annual buyback funds are projected to be between $550 million and $600 million.

Researcher's View: Based on market consensus and this report's calculations, the daily allocation of 0.05% for buybacks could potentially achieve an annualized deflationary rate of 1.5%-2%. At current trading volumes, Uniswap's annual funds available for UNI buybacks are estimated to be between $500 million and $550 million, a relatively conservative estimate. This equates to $35 million to $42 million in sustained buying support per month, providing solid support for its long-term value.

III. Market Reaction: Expectations of Huge Buying Drive Prices Soar

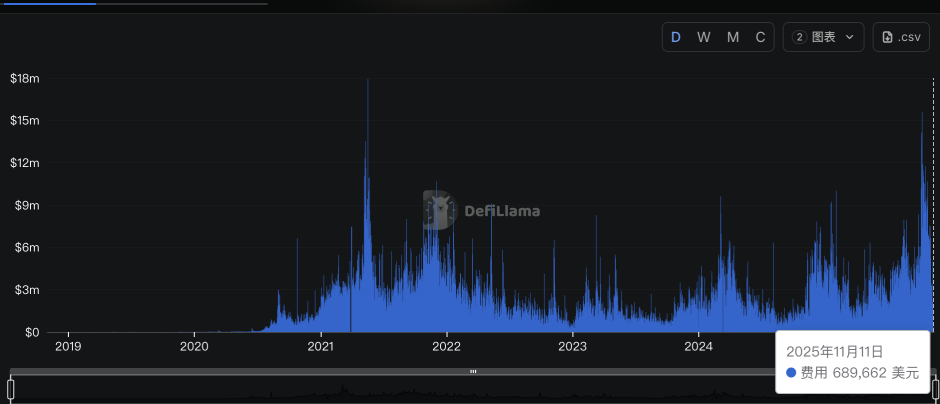

The proposal was met with swift and positive feedback from various market participants. Alexander, CEO of Dromos Labs, the development team behind DEX Aerodrome, a leading player in the Base ecosystem, pointed out that based on Uniswap's current trading volume, approximately $460 million in transaction fees are expected to be used for buybacks and burns annually, providing strong and sustainable buying support for $UNItoken.

CryptoQuant CEO Ki Young Ju also pointed out that the fee conversion mechanism could drive Uniswap's price in a parabolic upward trend. He analyzed that even considering only versions v2 and v3, the protocol's annual trading volume reaches $1 trillion, meaning that the value of UNI burned annually would reach approximately $500 million. Furthermore, trading platforms only hold $830 million worth of UNI, meaning that future unlocking and selling pressure will be relatively limited. Driven by this optimistic expectation, UNI surged nearly 50% within hours of the proposal's announcement.

Data source: defillama

Researcher's opinion: This proposal undoubtedly provides a strong safety net for UNI's long-term value. Its core mechanism lies in two aspects: in the short term, it creates a deflationary shock by destroying 100 million UNI (16% of the circulating supply); in the long term, it relies on continuous buybacks of approximately $38 million per month (annualized $400-500 million) to provide stable buying pressure. This dual deflationary model provides strong support for the price.

IV. Competitive Comparison: Repurchase Rate Ranks Among the Top Tier

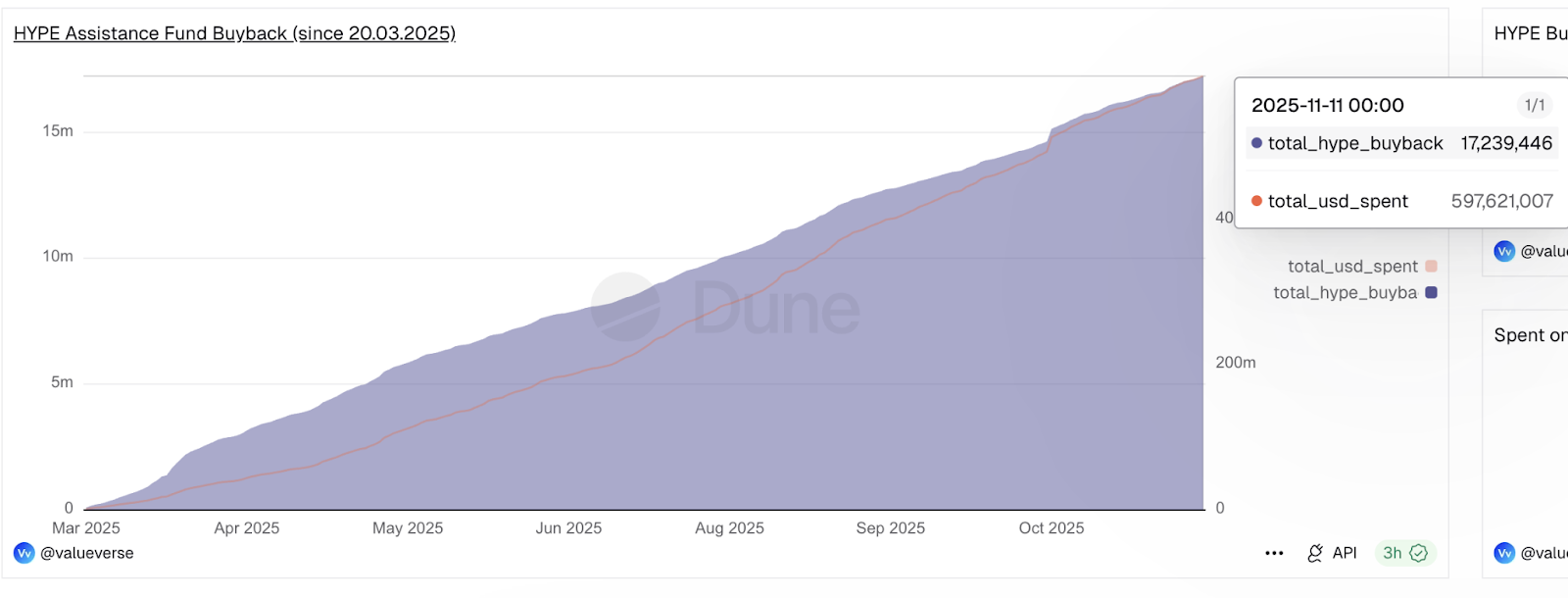

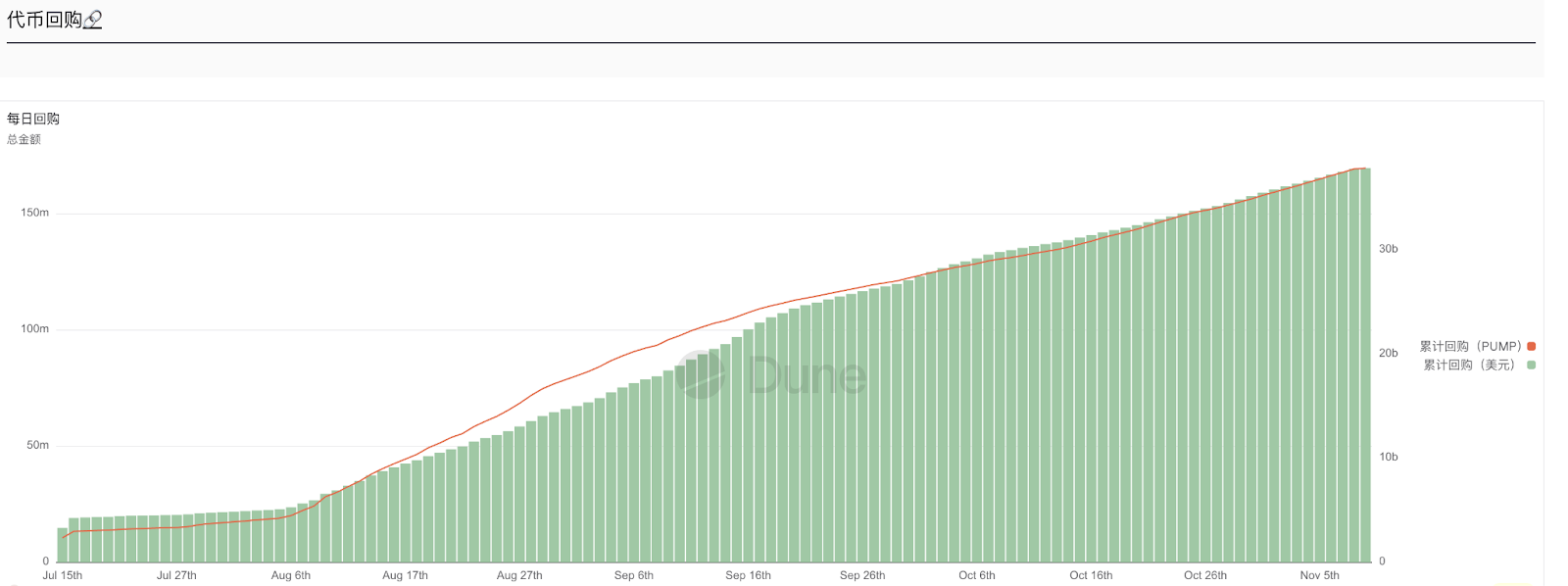

According to the proposal mechanism, Uniswap plans to split its original 0.3% LP fee, with 0.25% remaining with liquidity providers and 0.05% allocated to the protocol for UNI buybacks. Based on its annualized fee revenue of approximately $28 billion, this translates to about $38 million in dedicated buyback funds per month. This scale places it firmly in the position among tokens with buyback mechanisms: significantly surpassing PUMP ($35 million/month) and approaching the current leader, HYPE ($95 million/month).

Image source: DUNE (HYPE)

,

,

Image source: DUNE (PUMP)

Researcher's opinion: Previously, UNI's massive trading volume did not directly benefit its token holders. However, the annual buyback program worth hundreds of millions of dollars is equivalent to initiating continuous "shareholder returns." This not only has the potential to catch up with competitors but also represents a return of the protocol's value to its token holders.

V. Future Outlook: Success or Failure Hinges on the Anchor of Liquidity Providers (LPs)

If Uniswap's proposal passes, it will bring long-term benefits to UNI, essentially establishing a "floor mechanism" for the token price. However, its success depends entirely on one core element: whether liquidity providers (LPs) will stay.

Success Path: The proposal reduces LP fees from 0.3% to 0.25% (a 17% decrease). LPs will only remain if new revenue streams such as PFDA and MEV internalization fully compensate for their losses. LP stability ensures sufficient liquidity pool depth and a smooth trading experience, guarantees sustainable protocol fee revenue, and allows the buyback and burn mechanism to function effectively.

Risk path: Conversely, if LPs withdraw due to declining returns, it will lead to a contraction in liquidity and a loss of trading volume, ultimately causing the agreement's revenue and repurchase funds to shrink simultaneously, making the bottom-line mechanism impossible.

Therefore, for ordinary users, there are two key points to focus on. Short-term: governance voting results and contract launch time. Long-term: LP retention rate and liquidity pool depth, the stability of the $38 million monthly buyback program, the actual effectiveness of PFDA and MEV internalization, and changes in competitor market share.