A horizontal analysis of the main risk components of eight stablecoins

- 核心观点:稳定币面临多重风险需审慎评估。

- 关键要素:

- 脱锚风险:市场压力致锚定失效。

- 智能合约漏洞:代码缺陷致资金损失。

- 监管风险:政策收紧影响全球运营。

- 市场影响:推动投资者转向更稳健稳定币。

- 时效性标注:中期影响。

This article is from: ✧Panterafi

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

Editor's Note: With the recent collapses of several stablecoins such as xUSD and USDX, the security of stablecoins has become a widespread concern in the market.

Earlier, overseas KOL Panterafi published a very long article focusing on the risks of stablecoins and comparing multiple stablecoin protocols. The author stated that the article was "the culmination of his thoughts over the past few months" to fill the gap in the market's analysis of stablecoin risks.

The following is the original text by Panterafi, excerpted and translated by Odaily Planet Daily. For ease of reading, the following text will only focus on the core risk components of the original text, and the comparison section will only extract the relatively popular protocols at present. Those who are interested in the complete content can go to the original text to read it.

Risk indicators for stablecoins

Risk of de-anchoring

When a stablecoin is unable to maintain its preset $1 peg due to extreme market pressure, supply and demand imbalance, or a sharp decline in the value of its underlying collateral, it will de-peg.

This risk is inherent in stablecoin models because they rely on economic incentives, algorithmic mechanisms, or reserve backing, which can fail during cryptocurrency market crashes or broader financial turmoil. Collateralized stablecoins may become unpegged when reserves are insufficient or liquidity is lacking, while algorithmic stablecoins rely on fragile arbitrage mechanisms that can collapse during panic selling.

Smart contract vulnerabilities

Code vulnerabilities or security flaws in protocols can lead to hacking attacks or financial losses. The longer a protocol has been running, the stronger its resistance to such vulnerabilities generally is; newly released protocols typically face higher smart contract risks.

Smart contracts form the "skeleton" of stablecoin protocols and may contain code vulnerabilities, logical flaws, or exploitable security weaknesses, leading to unauthorized access, theft of funds, or protocol failure. Older, battle-tested protocols are generally more reliable because they have undergone multiple audits and real-world testing; newer protocols, due to their untested code, are riskier.

Regulatory risks

Stablecoins face increasingly stringent government scrutiny regarding anti-money laundering, KYC requirements, securities classification, and transparency regarding fiat currency backing. This could lead to operational restrictions, asset freezes, or outright bans, particularly for stablecoins that integrate real-world assets or conduct international business. These risks are especially pronounced in jurisdictions with evolving crypto policies, potentially impacting their global availability.

Liquidity risk

Liquidity risk arises when users are unable to buy or sell stablecoins without significant slippage. This situation is exacerbated in markets with low liquidity, panic, or low trading volume.

Mature stablecoins with high TVL and deep liquidity pools typically perform better because the accumulation of time creates network effects, which helps reduce slippage.

Counterparty risk

Stablecoins often rely on third parties, such as RWA custodians, price oracles, or cross-chain bridges, which can introduce systemic failure points due to bankruptcy, fraud, or operational errors.

Risk of return volatility

Stablecoin yields typically come from lending protocols or government bond investments, and fluctuate with market conditions, lending demand, and interest rate changes, reducing the predictability of users obtaining stable passive income.

Horizontal comparison

Sky (USDS)

USDS is a decentralized, overcollateralized stablecoin with a collateralization ratio of up to 300%. You can borrow USDS by pledging any crypto asset backed by Sky.

The collateral distribution of USDS is as follows:

- BTC, LST, stablecoins, RWA, PT, altcoins: 38%;

- USDC, USDP, GUSD: 29%;

- RWA: 10%;

- ETH (via Maple, Morpho, AAVE, etc.): 9%;

- cbBTC (via Liquity, Morpho, Spark): 8%;

- PT-USDe (Morpho): 6%;

The key metrics for USDS are as follows:

- Total debt: US$8.13 billion;

- Total mortgaged assets: US$13.31 billion;

- Annualized revenue: $259 million;

The risks associated with USDS include: de-anchoring and liquidation risks, smart contract vulnerabilities, compliance and regulatory risks, governance and centralization risks, dependence on DAO decisions, and yield volatility.

Among these, the most noteworthy points are: smart contract risks (arising from complex lending modules), regulatory risks (RWA configurations involving U.S. government-backed securities are prone to scrutiny), and yield volatility risks (dynamic savings rates may be lowered).

The overall score is as follows:

- Collateral diversity: 10 points;

- Risk Management: 8 points;

- Audit: 8 points;

- Transparency: 10 points;

- Decentralization: 9 points.

Ethena (USDe)

USDe is a stablecoin that employs a Delta-neutral hedging strategy. When minting USDe, Ethena opens a short position on the trading platform equal to the spot price to hedge.

The collateral distribution of USDe is as follows:

- Distribution by trading platform: 55% not yet placed; 22% on Binance; 14% on Bybit; 8% on OKX; 1% on Deribit;

- By asset class: 55.8% are liquid stablecoins; 30% are BTC; 10% are ETH; 3.7% are ETH derivatives LST; and 0.4% are SOL.

The main risks associated with USDe are: funding rate risk, liquidation risk, custody risk, exchange failure risk, endorsement asset risk, and margin collateral risk.

Among these, the most noteworthy points are: a market environment with rapidly rising interest rates (futures positions may depreciate), fluctuations in funding rates (negative rates erode returns), and the risks of perpetual futures (liquidation due to market crashes).

The overall score is as follows:

- Collateral diversity: 7 points;

- Risk Management: 8 points;

- Audit: 10 points;

- Transparency: 10 points;

- Decentralization: 7 points.

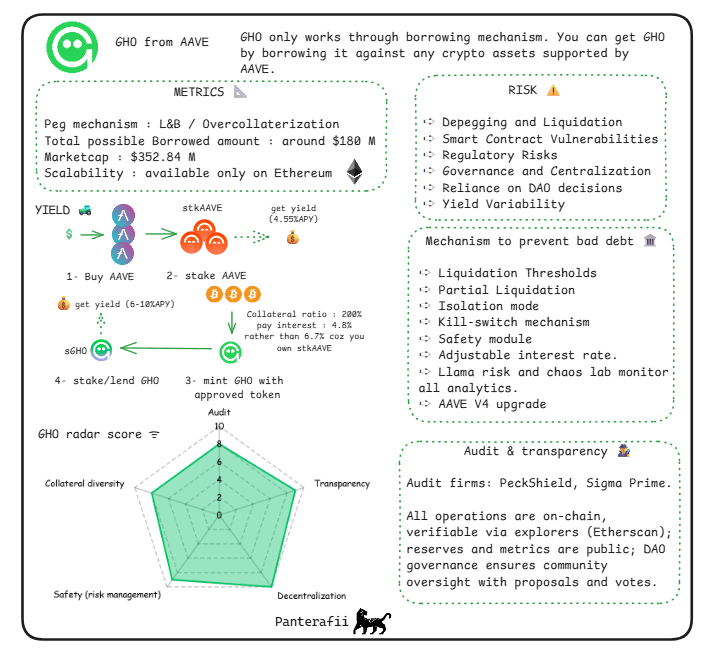

Aave (GHO)

GHO operates solely through a lending mechanism; you can borrow GHO by pledging any crypto asset backed by Aave.

The key metrics for GHO are as follows:

- Anchoring Mechanisms: L&B / Overcollateralization;

- Total amount available for lending: approximately US$180 million;

- Market capitalization: Approximately US$352 million;

- Scalability: Currently only Ethereum is supported;

The risks associated with GHO include: de-anchoring and liquidation risks, smart contract vulnerabilities, compliance and regulatory risks, governance and centralization risks, dependence on DAO decisions, and volatility of returns.

The most noteworthy risks are: the risk of collateralized lending mechanism (excessive collateralization may trigger a chain of liquidations) and the risk of ineffective yield generation (if lending demand declines, the yield will approach zero).

The overall score is as follows:

- Collateral diversity: 8 points;

- Risk Management: 9 points;

- Audit: 8 points;

- Transparency: 9 points;

- Decentralization: 10 points.

Resolv (USR)

USR is entirely backed by on-chain crypto assets, primarily ETH and BTC, and does not involve fiat currency or RWA (Real-World Assets). USR employs a Delta-neutral hedging mechanism, where the protocol stakes user-deposited assets (e.g., ETH staked through Lido) and simultaneously opens corresponding short perpetual contracts on centralized exchanges (CEXs) or decentralized exchanges (DEXs) to hedge against market volatility.

The RLP mechanism is designed to protect USR from market and counterparty risks. In exchange, users holding RLP will receive a higher percentage of collateralized returns (achieved through a tiered return model).

The collateral for USR is distributed as follows:

- Distribution by asset class: BTC accounts for 45.1%; ETH and its derivative LST account for 33.4%; other stablecoins account for 21.5%.

- Based on the unknown distribution of custody: on-chain accounts for 43%; off-chain custody institutions account for 57% (held by professional crypto asset custody institutions such as Fireblocks and Ceffu);

The key metrics for USR are as follows:

- Total value locked in USR: approximately $300 million;

- USR Annualized Rate of Return (APR): Approximately 7%;

The sources of risk for GHO include: counterparty/agreement risk, liquidation risk, imperfect hedging, smart contract vulnerabilities, and market volatility.

The most noteworthy points are: insufficient collateral risk, liquidation threshold risk (high volatility of underlying assets ETH and BTC), and security module failure risk (potentially insufficient insurance-like buffer mechanisms).

The overall score is as follows:

- Collateral diversity: 6 points;

- Risk Management: 7 points;

- Audit: 8 points;

- Transparency: 9 points;

- Decentralization: 10 points.

Curve (crvUSD)

Similar to other lending protocols, servUSD is a collateralized debt stablecoin. Users need to deposit BTC or ETH as collateral in the form of various liquidity-collateralized tokens, such as WBTC or wstETH.

The key metrics for crvUSD are as follows:

- Anchoring mechanism: Collateralized debt position;

- Market capitalization: Approximately US$113 million;

- Yield: 12.57% APY;

The risks associated with crvUSD include: governance manipulation risk, liquidation risk, collateral and de-pegging risk, smart contract/protocol risk, and specific custody risks.

One of the most noteworthy points is that crvUSD's collateralized debt position model focuses on lending functionality (150-167% health rate, backed by BTC/ETH LST), which makes cascading liquidations a major risk during periods of market volatility.

The overall score is as follows:

- Collateral diversity: 5 points;

- Risk Management: 7 points;

- Audit: 9 points;

- Transparency: 10 points;

- Decentralization: 9 points.

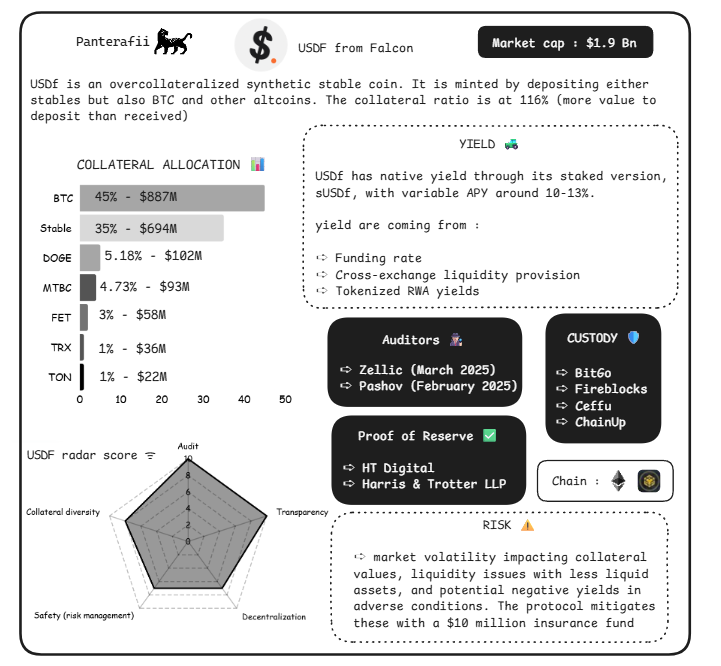

Falcon (USDF)

USDF is an overcollateralized synthetic stablecoin. It can be minted by depositing stablecoins, or by depositing BTC and other altcoins. The collateral ratio is set at 116% (meaning that the value deposited must exceed the value that can be borrowed).

The collateral distribution for USDF is as follows:

- BTC: 45%, approximately $88.7 million;

- Stablecoins: 35%, approximately $69.4 million;

- DOGE: 5.18%, approximately US$10.2 million;

- mBTC: 4.73%, approximately $9.3 million;

- FET: 3%, approximately $5.8 million;

- TRX: 1%, approximately $3.6 million;

- TON: 1%, approximately US$2.2 million;

The main risks of USDF are: market volatility can affect the value of collateral, illiquid assets may experience liquidity problems, and the protocol may generate negative returns under adverse conditions.

The overall score is as follows:

- Collateral diversity: 8 points;

- Risk Management: 7 points;

- Audit: 10 points;

- Transparency: 10 points;

- Decentralization: 7 points.

USD.AI (USDai)

USD.AI is a lending protocol that combines artificial intelligence training and stablecoin technology, designed to provide credit to AI training companies and using GPU hardware as collateral.

- Odaily Note: USD.AI will be discussed in a subsequent reply below this article. USDai is 100% backed by US Treasury bonds, and only sUSDai will introduce GPU collateral exposure.

USDai's key metrics are as follows:

- Anchoring mechanism: GPU collateralized debt position + over-collateralization;

- Loan interest rate: 8% - 15%;

- Market capitalization/total value locked: approximately US$505 million;

- Yield: APY over 10%;

USDai’s main sources of risk include: collateral and default risk, operational and technological risk, sustainability and team risk, and market and regulatory risk.

The most noteworthy point is the liquidity limitation of GPUs as collateral.

The overall score is as follows:

- Collateral diversity: 8 points;

- Risk Management: 7 points;

- Audit: 10 points;

- Transparency: 7 points;

- Decentralization: 7 points.

Cap (cUSD)

cUSD is a stablecoin pegged to the US dollar. Its protocol model enhances decentralization, yield generation, and risk isolation through a three-party market (users - stablecoin holders, operators - yield generators, and restakers - collateral providers).

The key indicators for cUSD are as follows:

- Market capitalization: Approximately US$283 million;

- Yield: 8% APY;

The main risks of cUSD are:

- Inadequate collateral and forfeiture : Operator default or a decline in the value of collateral may trigger forfeiture against re-pledgers to cover debts, which may result in losses for re-pledgers.

- Risk of lost returns : Failure of the strategy to achieve the minimum expected rate of return may result in zero return distribution;

- Market risk : Volatility in the underlying stablecoin or recollateralized assets may affect redemption capabilities.

Further Reading

USDe issuance plummeted by $6.5 billion, but Ethena faces even bigger problems.