Wintermute: The "Dinosaur Coin" rally has completely dissipated, and the market has entered a "quiet accumulation period" before mainstream coins lead the price increase.

- 核心观点:加密市场情绪改善但资金流入不足。

- 关键要素:

- DePIN板块周涨22%领跑。

- BTC距历史高点仍差16%。

- 市场广度窄,轮动快缺持续。

- 市场影响:需主流币领涨激活山寨季。

- 时效性标注:短期影响

Author | Wintermute

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

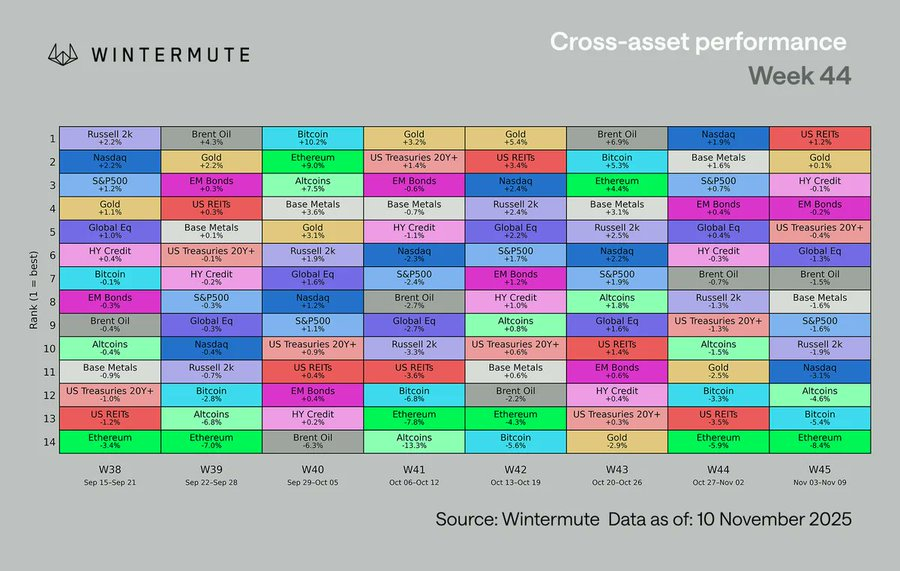

This week's market sentiment shifted more than its direction. The shock of the October crash has largely subsided, and positions have been reshuffled. While the crypto market continues to underperform broader risk assets, the overall tone is no longer as fragile.

Public opinion also played a role. Trump's proposal to issue $2,000 in "stimulus" through tariff rebates briefly boosted market sentiment. Although it was subsequently redefined as a "tax cut plan," it still achieved its purpose: reminding the market that fiscal support was still underway. Furthermore, renewed hopes for the end of the US government shutdown, along with a series of weak macroeconomic data, provided traders with reasons for selective risk-taking. Digital assets remained the worst-performing asset class, indicating that while market sentiment was improving, capital inflows had not kept pace.

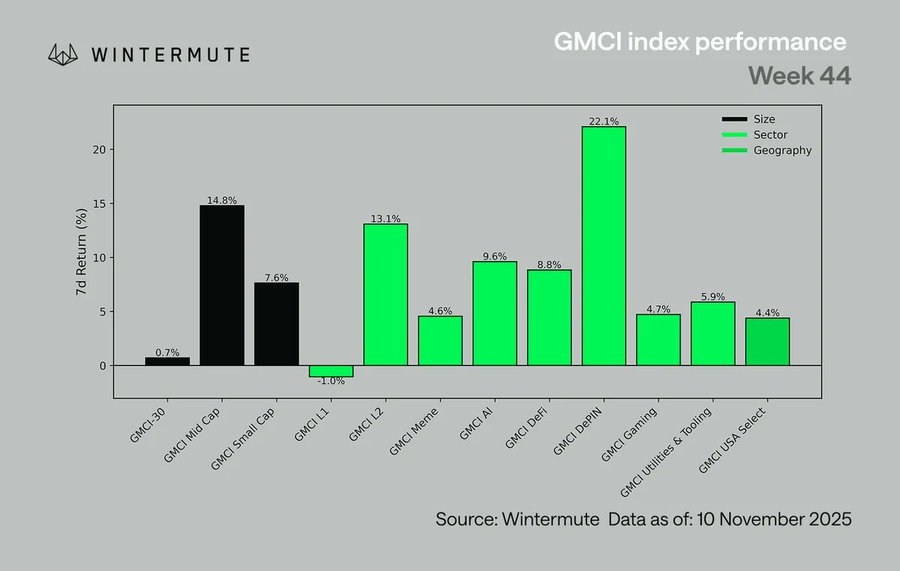

Bitcoin prices have been fluctuating between $105,000 and $107,000, while Ethereum has remained stable around $3,700. Despite a week of net outflows from ETFs, both cryptocurrencies have shown some resilience in terms of price. Altcoins rebounded on Monday, but the gains were highly divergent. According to data from @gmci_ , the GMCI-30 index rose 0.7% this week, with the following sectors leading the gains:

- DePIN: +22%

- L2: +13%

- Mid-cap tokens: +15%

- AI: +9.6%

- DeFi: +8.8%

- Utilities: +5.9%

- L1: -1%

- Memecoins: +4.6%

This round of rotation reveals the current risk appetite: investors are indeed repositioning, but remain very cautious, with only modest increases in holdings . The rise in the GMCI is more attributable to a short-term correction over the weekend than to a structural return of funds . The market's "breadth" remains narrow, with a few stocks (such as FIL and AR) contributing the majority of the gains. Calling it a breakout at this point might be a stretch, as the market is mainly concentrated in some fragile momentum areas that appear and disappear quickly.

The macroeconomic environment remains favorable. A global rate-cutting cycle has begun, quantitative tightening (QT) has largely ended, and loose liquidity continues. SOFR rates continue to decline, generally following the trend of policy rates, albeit with a slight lag . However, the crypto market's reaction differs from other risks: speculative activity has decreased, rebounds are limited and highly volatile, and funds are more inclined to remain in mainstream cryptocurrencies rather than fringe assets.

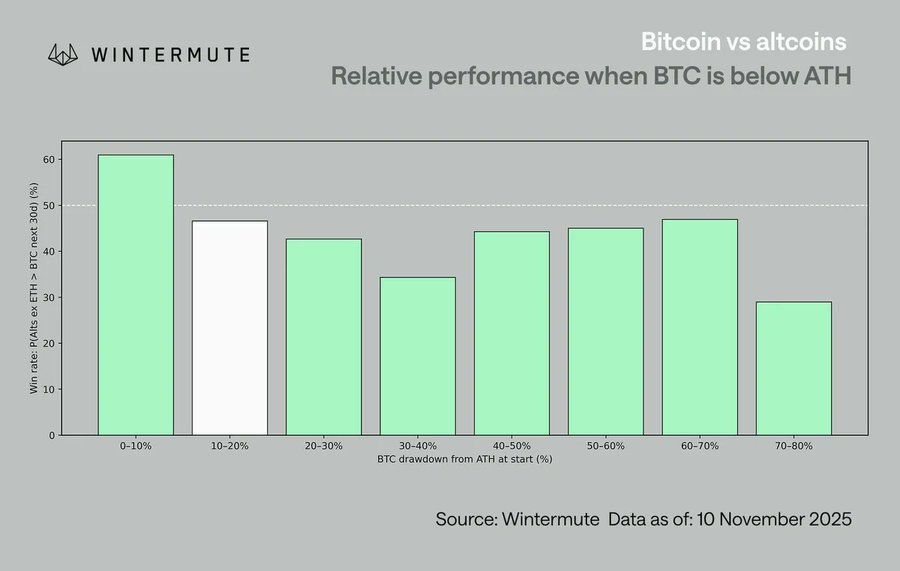

Judging from the current trading situation of mainstream cryptocurrencies, it's still too early to say that altcoin season has begun . Historically, altcoin strength has often occurred when mainstream cryptocurrencies are near their all-time highs, triggering a "wealth spillover effect." When BTC is 10-20% away from its all-time high (currently around 16%), the probability of Bitcoin outperforming altcoins is about 54%; and when BTC falls back to near the $100,000 range, this probability even rises to 58% .

This data confirms the existence of the "spillover effect" and explains why last week's "dinosaur coin rally" (such as FIL, ICP, FET, etc.) was so fragile—as the market failed to confirm a trend continuation signal from Bitcoin , the momentum of this rebound has completely dissipated.

However, this does not mean that the world outside of mainstream cryptocurrencies is completely stagnant. A few blue-chip stocks with clear catalysts (such as HYPE, ENA, and UNI) continue to outperform the market due to their relative strength. This is partly due to the gradual clarification of expectations for US regulation and the increasing discussion surrounding the "reopening of the US domestic market".

However, overall, the altcoin sector still resembles an options market: short-lived momentum and lack of sustainability. Unless BTC itself enters a trend, it will be difficult to generate sustained capital inflows.

Until mainstream cryptocurrencies regain market leadership, it's difficult to call this sporadic rebound a true "alt market season."

The macroeconomic backdrop remains robust, and market momentum is recovering, boosting confidence in the continuation of the rally. The key going forward lies in whether major cryptocurrencies can be the first to rebound to higher levels – only then can market breadth potentially reopen.

Positions have been rebalanced, and sentiment has improved significantly. After weeks of consolidation, the market is finally appearing more balanced. While crypto assets remain the worst-performing category among all risk assets, the overall tone has shifted: the impact of the October crash has largely passed, and selective risk is returning. The rebound in DePIN, L2, and AI sectors indicates continued market demand for these areas, although the spread is limited and the market structure remains relatively fragile.

For the next upward surge, mainstream cryptocurrencies need to lead the way . Historical experience shows that altcoin rallies are only truly activated when BTC prices approach their all-time highs. Currently, BTC is trading at approximately $105,000 (about 16% below its all-time high), which hasn't yet triggered this rotation. Rather than saying the market is stagnant, it's more accurate to say it's in a transitional phase with a clearer structure, a more favorable macroeconomic environment, and renewed momentum. With news of the impending reopening of US regulations imminent, the next round of volatility is likely to stem from policy and political factors , rather than position fluctuations.