HashWhale Crypto Weekly Report | Profit-taking after positive news; Market faces short-term volatility (October 25-31)

- 核心观点:比特币上周呈现震荡走势,多空博弈激烈。

- 关键要素:

- 价格在$106,398–$116,000间宽幅波动。

- 空头清算与宏观政策主导短期行情。

- 技术指标显示市场多空力量均衡。

- 市场影响:短期波动加剧,投资者情绪趋于谨慎。

- 时效性标注:短期影响

Author: Monchi | Editor: Monchi

1. Bitcoin Market

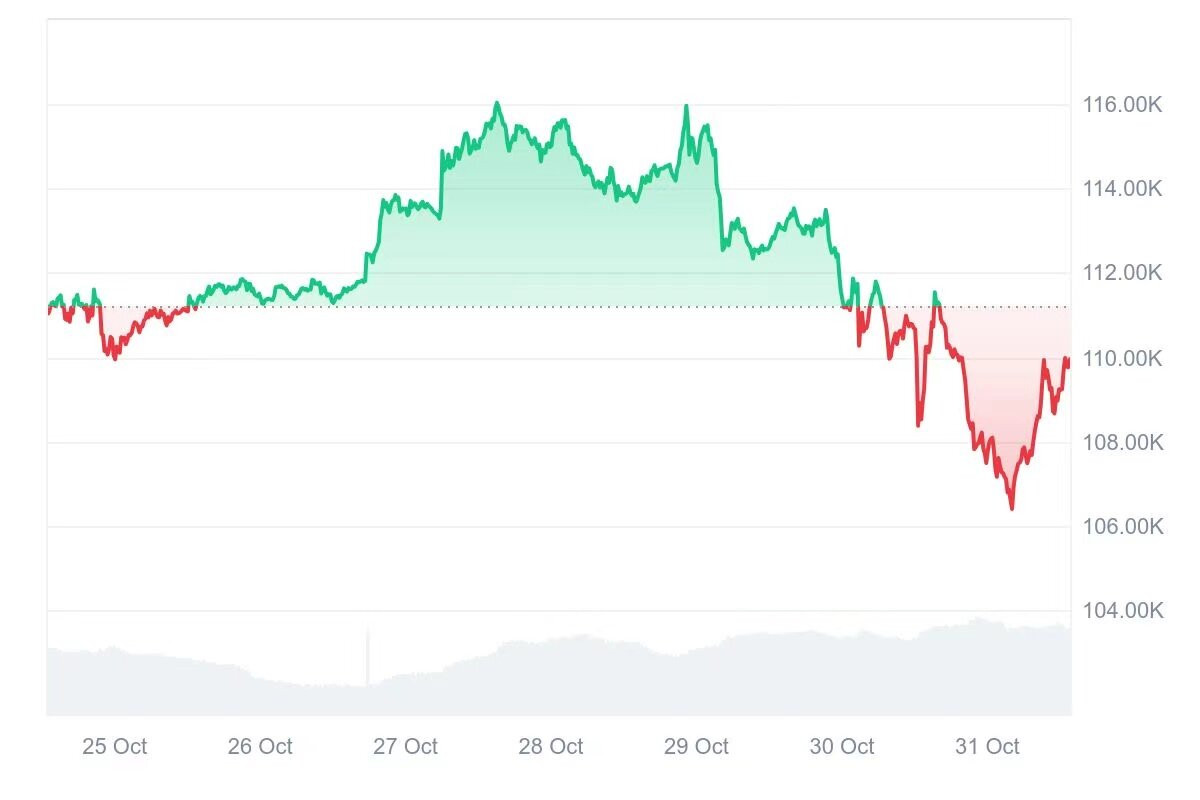

Bitcoin price movement (October 25, 2025 - October 31, 2025)

Bitcoin price movement (October 25, 2025 - October 31, 2025)

Sideways consolidation phase (October 25 to October 26)

On October 25, the price of Bitcoin gradually climbed from $110,000 to around $112,000. On October 26, the price of Bitcoin consolidated around $111,600.

Causes of the trend:

1. Improved macroeconomic expectations

The market widely expects the Federal Reserve to cut interest rates in the near future, reducing the opportunity cost of holding risky assets. Meanwhile, easing US-China trade tensions and reduced tariff risks are providing positive sentiment support for risky assets, including Bitcoin.

2. Structural technological breakthroughs

Bitcoin's breakout above the 50-day moving average (SMA50) is seen by the market as a signal that the short-term trend has shifted from sideways to upward. The breakout of the key resistance zone (approximately $112,000–$114,000) triggered leveraged short covering, and this type of "short liquidation" typically accelerates the breakout.

A period of fluctuating upward movement (October 26 to October 27)

On the evening of October 26, Bitcoin broke through the $112,000 resistance level and rose to nearly $114,000; on October 27, it continued to break through the $114,000 resistance level and continued its strong upward trend, rising to around $116,000.

Causes of the trend:

1. Short selling triggers market volatility

According to CoinGlass data, approximately $319 million in short positions were forcibly liquidated on the evening of October 26, the highest level in nearly three weeks.

After breaking through a key resistance level, stop-loss orders and forced liquidation are triggered, creating a "short squeeze," which passively pushes the price up.

After breaking through $114,000 on October 27, the second round of short covering triggered another chain reaction, causing prices to rise rapidly.

2. Favorable macroeconomic and geopolitical factors

Expectations for a Fed rate cut are strengthening: The market anticipates that the October 29 meeting will release dovish signals or initiate a rate cut to increase liquidity.

US-China trade relations improve: On October 26, US and Chinese representatives held constructive trade talks in Kuala Lumpur, easing concerns about trade tensions.

Two major factors have boosted global risk appetite for risky assets, making Bitcoin a focal point for capital allocation.

3. Technical breakout and shift in market sentiment

The price rose above the SMA50, triggering a simultaneous influx of trend-following funds and retail investors' buy orders.

The Fear & Greed Index rose from "Neutral" to "Greedy," indicating increased investor confidence and a bullish market sentiment.

A period of continued fluctuation and decline (October 28 to October 31)

On October 28th, Bitcoin gradually fell back to around $114,000, where it found support. It then briefly rebounded to $116,000 before initiating a continuous downward trend. On October 29th, it fell to around $113,000 and fluctuated. On October 30th, it continued to decline with increased volatility, closing near $108,000. On October 31st, it broke through the $108,000 support level, reaching a low of $106,398, the lowest point of the week.

Causes of the trend:

1. Weak expectations for policy/monetary easing

On October 30, the Federal Reserve announced a 25 basis point interest rate cut, but stated that further rate cuts remained uncertain. This dovish yet hawkish stance quickly cooled market sentiment, putting pressure on risk assets. The market believed that the positive news had already been priced in, or that "the next rate cut is still far off," leading to downward pressure on risk assets.

2. Profit-taking and realization of positive news

After the breakout on October 26-27, some profit-taking occurred, especially when the price touched around $116,000, as bulls locked in profits and some leveraged positions were liquidated.

The phenomenon of "Sell-the-news" (selling after positive news) is evident, meaning that the release of positive news triggers selling pressure.

3. The funding structure and liquidity are on the conservative side.

Although institutional funds have flowed in, there is a lack of consensus on large-scale buying, and the wait-and-see attitude is strong.

Data shows that approximately $1.1 billion in long positions were liquidated on October 30, further exacerbating downward pressure.

Continued period of wide-range fluctuations (October 31)

On October 31, Bitcoin fell to a weekly low of $106,398 before rebounding to $109,931. It then encountered resistance near the $110,000 level and fell back to $108,677. As of this writing, Bitcoin is trading at $108,923.

Causes of the trend:

1. Technical factors

When it dipped to $106,398, it touched a recent short-term support level, attracting low-level buying.

The $110,000 level above represents significant psychological and technical resistance, having been repeatedly tested but failed to break through, thus forming a resistance level.

The short-term moving averages are consolidating (around the 50-day and 200-day moving averages), resulting in confusing short-term signals and a stalemate between bullish and bearish forces.

2. Funding Factors

The deleveraging process during the downtrend has not been fully completed, and short-term funds are repeatedly entering and exiting at low levels, resulting in wide fluctuations.

During the rebound, some short-selling stop-loss orders were triggered, pushing the price up quickly to $109,931. However, the upward pressure from short sellers remains, preventing further breakthroughs.

Summarize

Over the past week (October 18th to October 24th, 2025), Bitcoin exhibited a market rhythm of "initially consolidating sideways → a strong breakout → short covering leading to accelerated price increases → priced in the positive news and subsequent pullback → wide-range fluctuations." The price primarily traded between $106,398 and $116,000, exhibiting significant volatility, indicating short-term market instability and signs of speculative trading.

2. Market Dynamics and Macroeconomic Background

Fund Flow

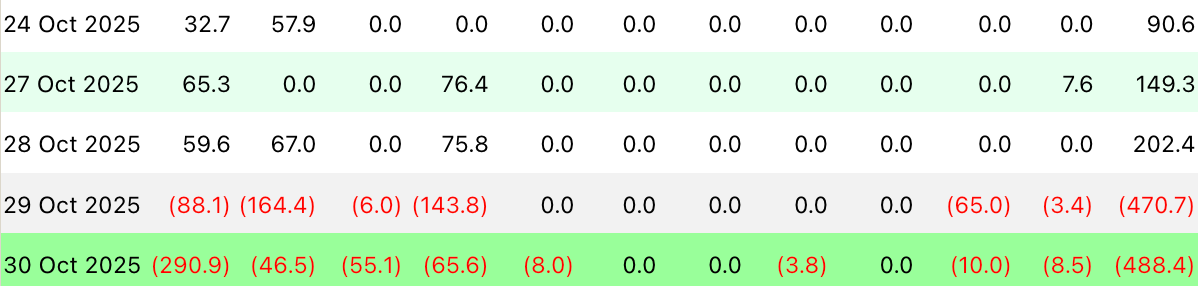

1. ETF Fund Dynamics

Bitcoin ETF fund flows this week:

October 27: +149.3 million USD

October 28: +202.4 million USD

October 29: -$470.7 million

October 30: -$488.4 million

ETF inflow/outflow data image

ETF inflow/outflow data image

Data shows net inflows in the first two days, followed by large net outflows in the next two days, indicating increased short-term capital volatility. The large net outflows in the latter two days are closely related to macroeconomic policies. Powell stated on October 29th that a December rate cut was not a certainty, weakening market expectations for a rate cut and creating a short-term impact on risk assets, prompting institutions to cautiously reduce their ETF exposure. Overall, ETF capital inflows/outflows have experienced significant short-term fluctuations, but considering on-chain and exchange capital flows, long-term institutions are still maintaining a certain level of holdings, confirming that the market is still in a phase of "reduced selling pressure + accumulation of holdings."

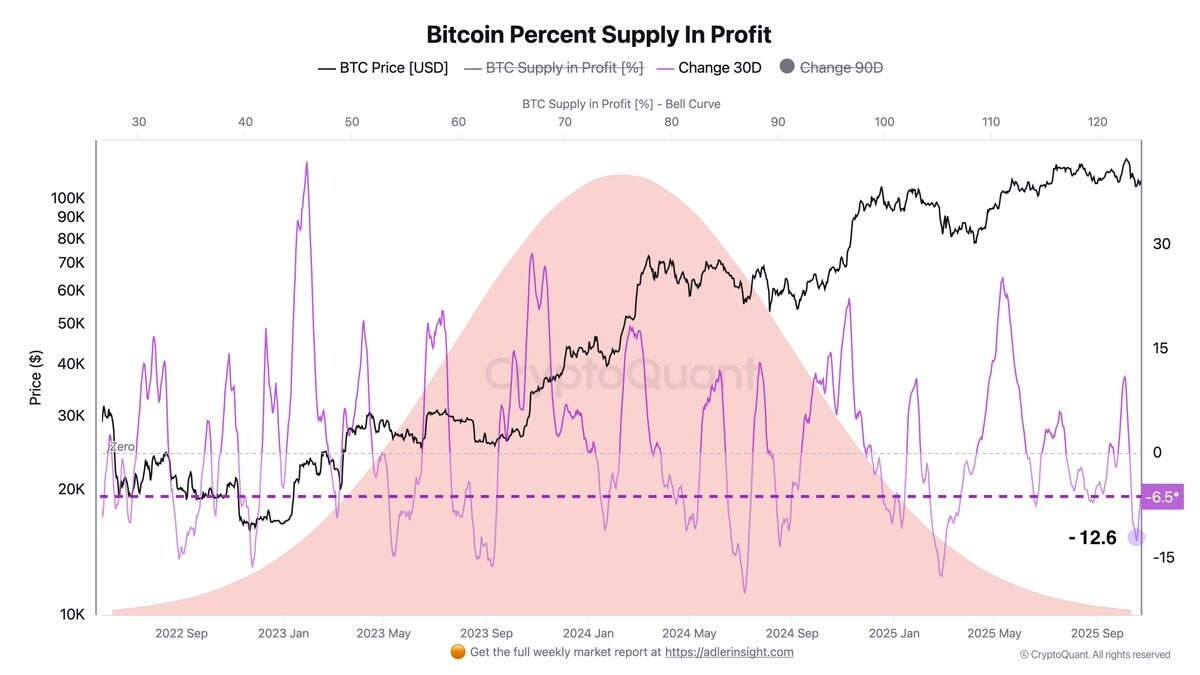

2. On-chain fund flow

Profitable Bitcoin Supply Share Rebounds: CryptoQuant analyst Axel stated that the 30-day change in Bitcoin's profit-taking supply share has rebounded from -12% to -6%, indicating that selling pressure is easing and there are buying opportunities on dips. Although the profit-taking share is still lower than it was a month ago, the negative momentum has clearly narrowed.

On-chain flow of BTC on exchanges: From October 25th to October 31st, multiple exchanges showed net inflows/outflows of BTC, with outflows exceeding inflows (for example, Binance's 30-day SMA was negative), indicating that more holders chose to leave exchanges rather than sell, and their willingness to accumulate funds increased.

Related images

Related images

3. Exchange and market fund flows

Spot trading is active: Cointelegraph reports that Bitcoin spot trading volume reached $300 billion in October, with Binance accounting for 58% of that. Traders shifted from risk markets to spot markets after the market correction, indicating that there is still active buying and selling demand in the market.

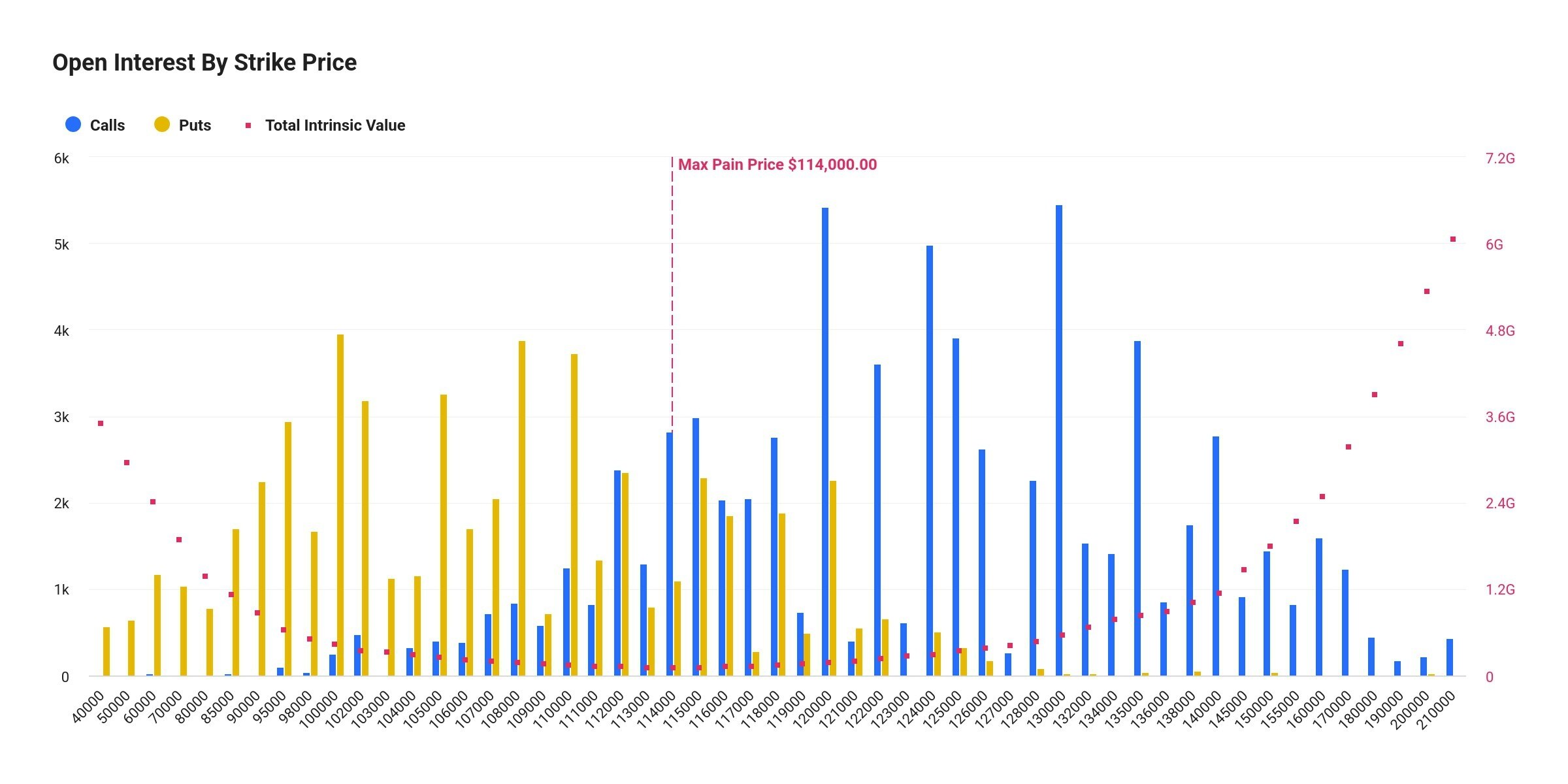

Options Expiration Events: This Friday (16:00 Beijing time, October 29th), 127,000 BTC will expire, with a notional value of $14.42 billion, a maximum price ceiling of $114,000, and a put/call ratio of 0.76. Ethereum options will expire with a notional value of $2.56 billion, a maximum price ceiling of $4,100, and a put/call ratio of 0.7. These large expiration events typically have a certain impact on short-term capital flows and price volatility.

Related images

Related images

4. Credit and Institutional Fund Flows

The BTC lending market is recovering: Ledn reports that its loan issuance has surpassed $1 billion this year, with $392 million in BTC-collateralized loans issued in the third quarter and annual recurring revenue of $100 million. As of the end of September, Ledn's loan portfolio totaled $836.2 million, with an average LTV of 42.7%, and it has released proof of reserves. Data shows that cryptocurrency holders are obtaining liquidity through BTC collateral, indicating that market liquidity demand remains and the credit market is gradually recovering.

Technical indicator analysis

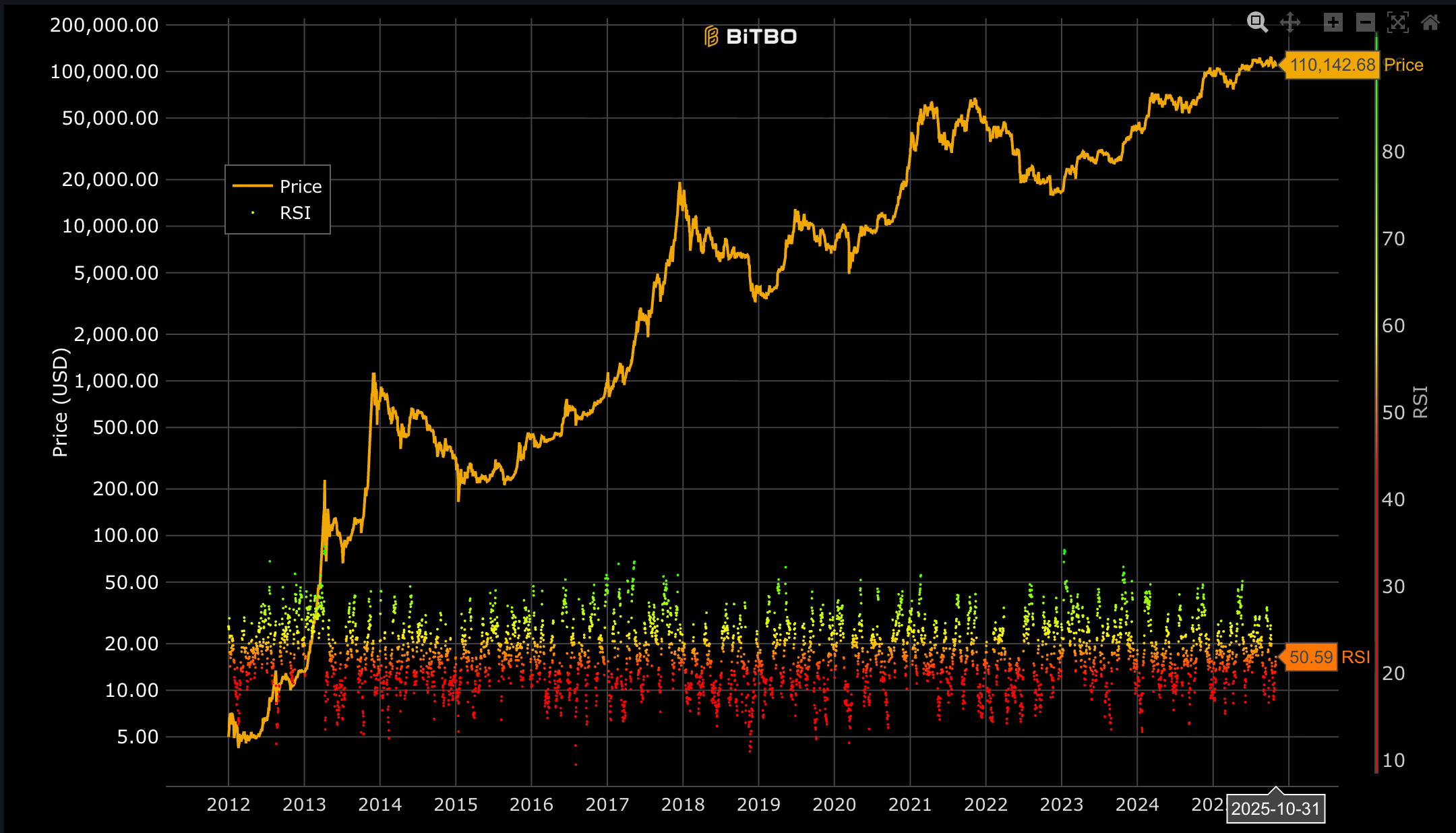

1. Relative Strength Index (RSI 14)

According to Bitbo data, as of October 31, 2025, Bitcoin's 14-day RSI was 50.59. The RSI index is in the neutral zone (around 50), showing neither significant overbought (>70) nor oversold (<30), indicating that the market is currently relatively balanced between bullish and bearish forces.

Recent price action shows the RSI fluctuating around 50, indicating a lack of clear direction in Bitcoin's short-term trend and a wait-and-see attitude among investors. A sustained break above 60 could signal stronger upward momentum in the short term; conversely, a drop below 45 would increase the risk of downward pressure in the short term.

Bitcoin 14-day RSI data image

Bitcoin 14-day RSI data image

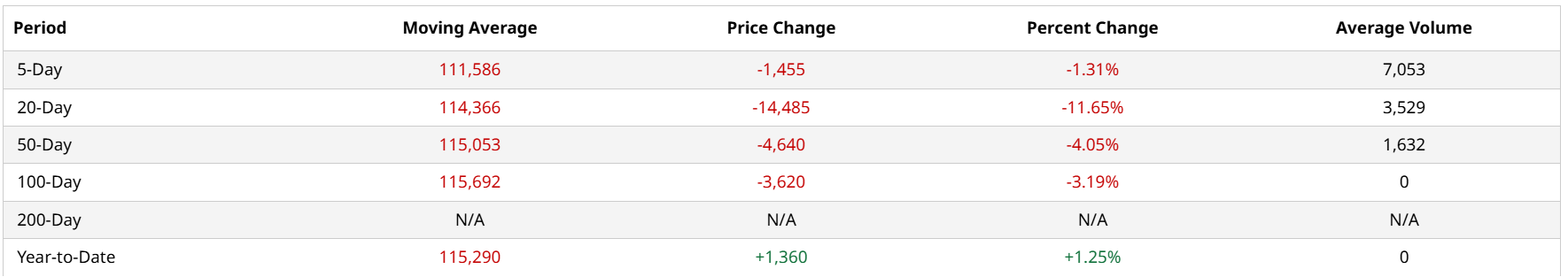

2. Moving Average (MA) Analysis

MA5 (5-day moving average): $111,586

20-day moving average (MA20): $114,366

MA50 (50-day moving average): $115,053

100-day moving average (MA100): $115,692

Current price: $109,244

MA5, MA20, MA50, MA100, M200 data images

MA5, MA20, MA50, MA100, M200 data images

The current price is below all short- and medium-term moving averages, indicating that Bitcoin is in a downward pressure zone in the short term.

The arrangement of MA5 < MA20 < MA50 < MA100 indicates a bearish trend, with a clear downward trend in the short-term moving averages and insufficient bullish momentum in the short term.

If the price can break through the MA20 level around $114,366, it is expected to open up room for a short-term rebound and further attack the key moving averages of MA50 and MA100.

Based on long-term moving averages, if the Bitcoin price remains above the MA100, it will still have support in the medium term. However, the current price is significantly deviated from the MA100, so attention should be paid to the risk of a technical rebound or a pullback under pressure.

3. Key support and resistance levels

Support levels: In the short term, the key support areas for Bitcoin are mainly located around $106,000 and $108,000.

Resistance levels: Short-term resistance is mainly concentrated around $109,000, with further resistance levels at $112,000, $114,000, and $116,000. A break above these resistance levels could trigger a new round of upward momentum.

The current price is approaching a short-term resistance level, and the market may face short-term fluctuations or a slight pullback.

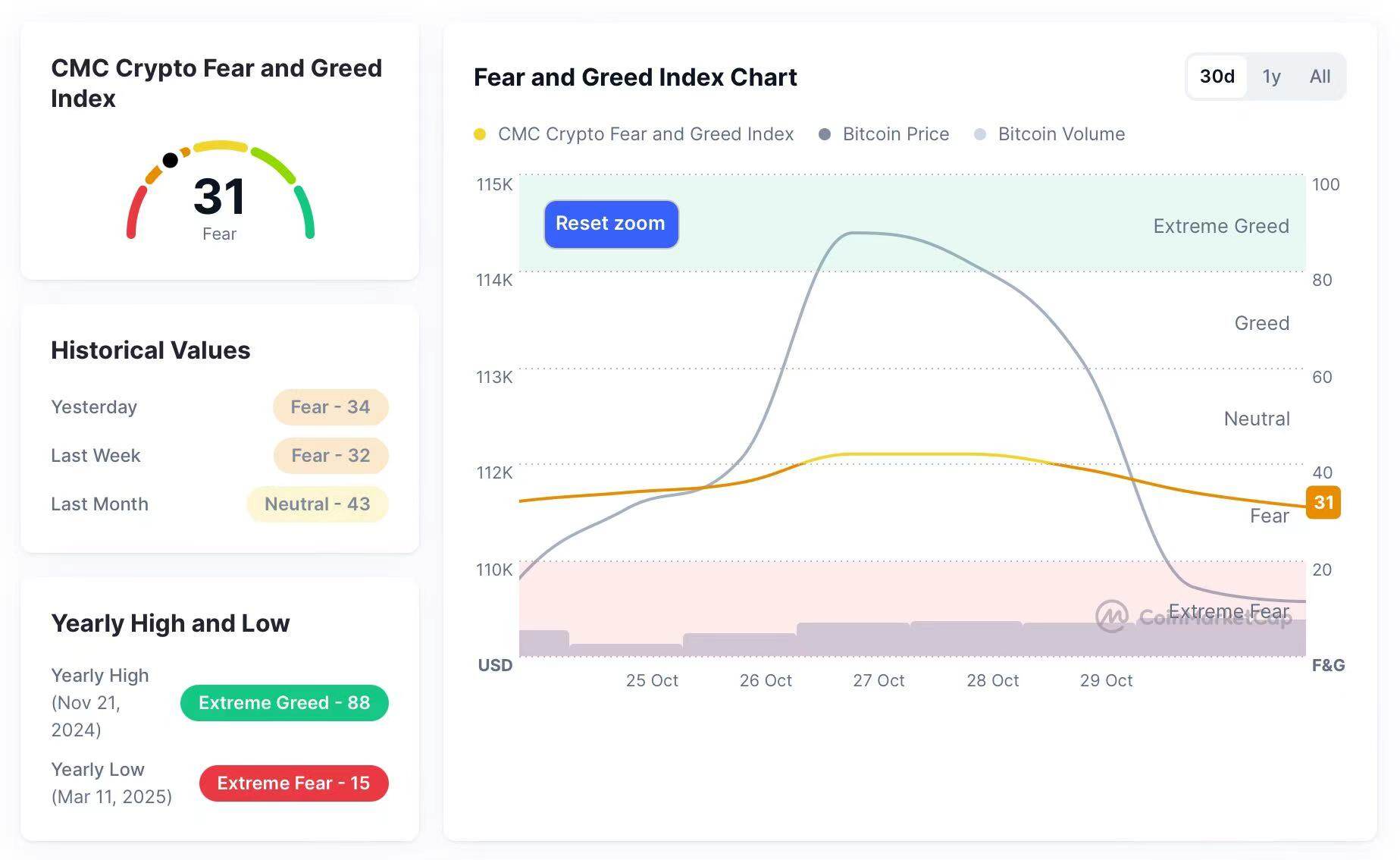

Market sentiment analysis

As of October 24, the Fear & Greed Index stood at 31 points, in the "Fear" range, indicating that overall market sentiment was cautiously bearish.

Looking back at this week (October 25th – October 30th), the daily values of the Fear & Greed Index were: 34 (Fear), 36 (Fear), 42 (lower neutral level), 42 (lower neutral level), 39 (Fear), and 34 (Fear). The overall range was between 34 and 42 points, indicating continued low-level fluctuations and a lack of significant market optimism.

Analysis suggests that fear is the dominant sentiment. Considering both technical indicators and sentiment indices, the market remains in a wait-and-see and volatile phase. Short-term trading should focus on support and resistance levels, and avoid chasing highs.

Fear and Greed Index Data Image

Fear and Greed Index Data Image

Macroeconomic Background

1. Federal Reserve meeting, October 28-29

At the Federal Open Market Committee (FOMC) meeting held on October 28-29, the Federal Reserve announced a 25 basis point cut to the target range for the benchmark federal funds rate, bringing it to 3.75%-4.00%. At the same time, Federal Reserve Chairman Jerome Powell emphasized at the press conference that while this rate cut was expected, the next rate cut (such as at the December meeting) is by no means a certainty.

In addition, the meeting minutes and announcement also showed that the Federal Reserve plans to terminate its quantitative tightening (QT) of its balance sheet starting December 1, that is, to stop further reducing the size of its securities holdings.

In the market, the US dollar index rebounded and bond yields (especially in the medium term) rose after the news was released, while Bitcoin, although it briefly rebounded before the rate cut news, subsequently fell back.

Related images

Related images

2. Fluctuations in geopolitical relations

Around October 25th, senior officials from both sides held talks in Kuala Lumpur, Malaysia, and there were signs that the US and China had reached a "framework agreement" on areas such as tariffs, rare earth export controls, agricultural product purchases, and control of digital platforms (such as TikTok). US Treasury officials stated that China agreed to postpone the implementation of a new licensing system for rare earth exports; the US also suspended its threat to impose 100% tariffs on Chinese goods. This provided a short-term boost to market risk appetite.

Subsequently, on October 30, Trump and Xi Jinping met in Busan, South Korea, and announced a substantive cooperation framework: the United States would reduce its average tariffs from approximately 57% to 47%, China would resume purchasing US soybeans and postpone the implementation of rare earth export restrictions, and both sides pledged to cooperate in combating the inflow of fentanyl precursor chemicals. While these achievements did not constitute a comprehensive trade agreement, they significantly reduced the risk of a "full-scale trade war escalation."

Related images

Related images

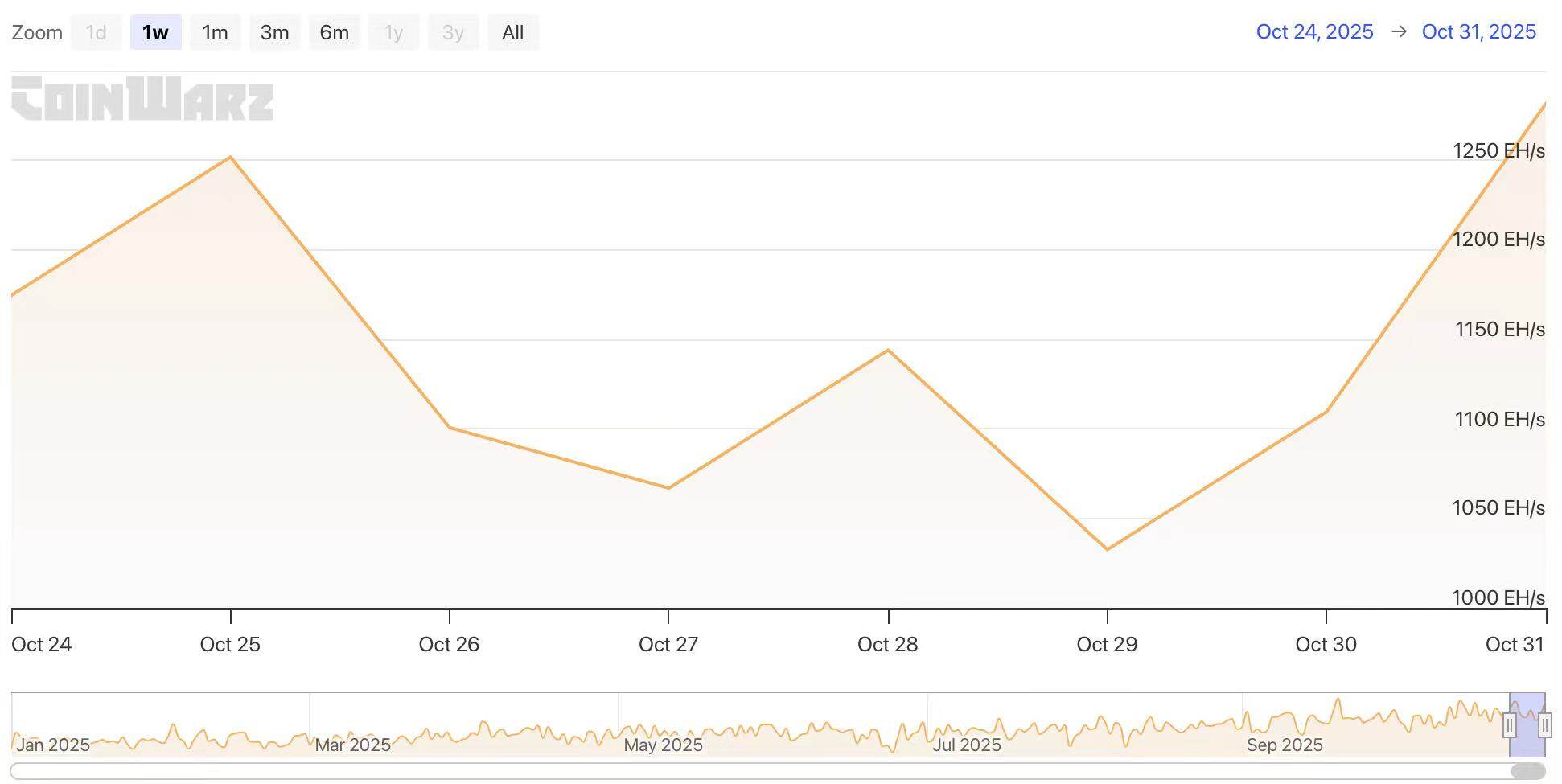

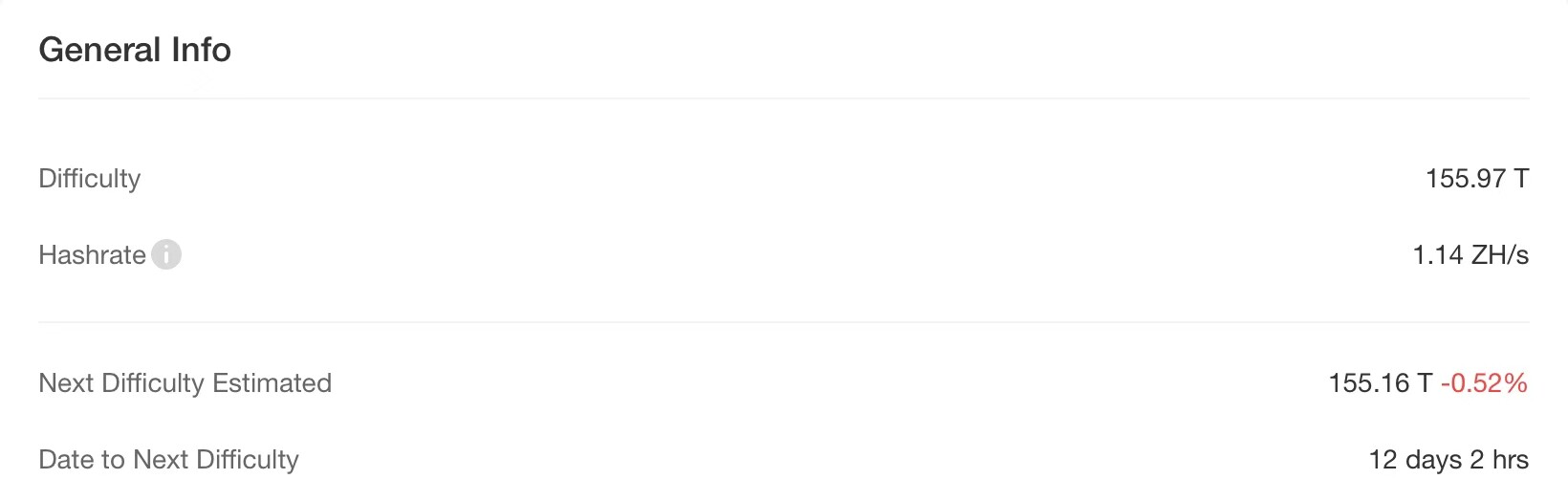

3. Mining Dynamics

Hash rate change

Over the past seven days, the Bitcoin network hashrate has fluctuated, remaining at a relatively high level this week, ranging from 1032.58 EH/s to 1281.76 EH/s.

From a trend perspective, while the overall network hashrate remains high, the fluctuation range has widened, reflecting the flexible scheduling by some large mining farms in response to fluctuations in electricity prices and operating costs. Recently, lower temperatures and more stable electricity supply and demand in parts of North America have led some mining companies to restore more hashrate online; meanwhile, some small and medium-sized miners have chosen to temporarily shut down high-energy-consuming equipment due to rising energy costs and a period of sideways movement in Bitcoin prices, resulting in short-term fluctuations in overall hashrate.

Weekly Bitcoin network hashrate data

Weekly Bitcoin network hashrate data

As of October 31, the total network hashrate reached 1.14 ZH/s, with a mining difficulty of 155.97 T. The next difficulty adjustment is expected to take place on November 12, with an estimated decrease of approximately 0.52%, bringing the difficulty to approximately 155.16 T. The current mining difficulty of 155.97 T is at a relatively high level in the past three months. Since the beginning of August, except for the first half of October, the mining difficulty has generally been on a continuous upward trend, reflecting the continuous deployment of new-generation high-performance mining machines and the expansion of network hashrate. The next adjustment is expected to be slightly lower, reflecting the temporary withdrawal of some hashrate under the pressure of high difficulty and energy consumption.

Bitcoin mining difficulty data

Bitcoin mining difficulty data

miners' income

According to YCharts data, the average daily total revenue of Bitcoin miners this week (including block rewards and transaction fees) fluctuated between $46.37 million and $59.56 million.

October 25: $58.06 million

October 26: $52.69 million

October 27: $55.38 million

October 28: $59.56 million

October 29: $46.37 million

Overall, miners' income this week was basically flat compared to the previous period, and the overall profitability of the mining industry remained in a stable range.

4. Policy and Regulatory News

Central Bank of Ghana: Plans to implement regulations for Bitcoin and cryptocurrencies by the end of 2025.

On October 25th, according to market sources, the Central Bank of Ghana announced plans to enact regulations related to Bitcoin and cryptocurrencies by the end of 2025, making Ghana the ninth African country to adopt digital asset law. (Bitcoin Archive)

Related images

Related images

For the first time, the South Korean National Assembly has proposed a bill to include stablecoins under the regulation of the Foreign Exchange Transactions Act.

On October 28, Yonhap News Agency reported that Park Sung-hoon, a lawmaker from the People Power Party of South Korea, will propose a bill to amend the Foreign Exchange Transactions Act to include stablecoins within the scope of legally recognized means of payment.

The bill aims to amend Section 3, Paragraph 1, "Definitions," classifying stablecoins alongside government banknotes, banknotes, and coins as means of payment. Representative Park stated that while the possibility of stablecoins pegged to fiat currency as a new means of payment is acknowledged, their different nature from existing fiat currencies and their exclusion from the Foreign Exchange Transactions Act create a regulatory blind spot, potentially leading to illegal foreign exchange transactions and tax evasion. The Bank of Korea has previously expressed similar concerns, noting that dollar-denominated stablecoins could be used in cross-border current account and capital transactions without the required reporting procedures under the Foreign Exchange Transactions Act, and warning that the proliferation of stablecoins could facilitate illegal transactions circumventing foreign exchange controls. The Ministry of Strategy and Finance of Korea endorses the bill, stating that it is consulting with the Financial Services Commission, the Bank of Korea, and other relevant agencies regarding specific regulatory plans.

The Alternative for Germany (AfD) party urged the German government to view Bitcoin as a strategic asset.

On October 29, Cointelegraph reported that Germany's main opposition party, the Alternative for Germany (AfD), has submitted a formal motion to the Bundestag opposing excessive regulation of Bitcoin. The motion, submitted on October 23, argues that Bitcoin is fundamentally different from other crypto assets and should not be included in the European Uniform Crypto Asset Market Regulatory Framework (MiCA).

The Alternative for Germany (AfD) party, in its motion, pointed out that while the current tax treatment of Bitcoin is generally positive, legal uncertainties remain, hindering long-term private investment. The party also called on German lawmakers to consider classifying Bitcoin as a strategic asset for the national reserve, advocating for maintaining the current 12-month holding period tax-free gains, keeping Bitcoin exempt from VAT, and ensuring individual self-custody rights.

Related images

Related images

5. Bitcoin-related news

Global Corporate and National Bitcoin Holdings (This Week's Statistics)

1. El Salvador

On October 26, it was reported that El Salvador added 8 Bitcoins to its holdings over the past 7 days, bringing its total Bitcoin holdings to 6,361.18, with a total value of approximately $710 million.

2. Prenetics (a US-listed company)

On October 25, Prenetics announced the launch of a public offering of Class A common stock and warrants to strategically increase its Bitcoin holdings. As of October 24, it held 272 BTC.

On October 28, Prenetics announced that it had completed a $48 million oversubscribed funding round, with plans to purchase 1 BTC per day and aiming to achieve $1 billion in assets within five years.

3. B HODL (a UK-listed company)

On October 26, B HODL announced that it had increased its holdings by 6 Bitcoins, bringing the company's total Bitcoin holdings to 148 BTC.

4. Bitplanet (a South Korean listed company)

On October 27, Bitplanet announced the launch of its daily Bitcoin accumulation program, having purchased 93 BTC last week, with a future goal of building a 10,000-BTC treasury.

On October 29, the company spent another $1.09 million to acquire 9 more BTC, bringing its total holdings to 110.67 BTC.

On October 30, it was reported that 9 new BTC were purchased, bringing the total holdings to 119.67 BTC.

5. American Bitcoin Corp. (NASDAQ: ABTC)

On October 27, American Bitcoin added 1,414 BTC to its holdings, bringing its total holdings to approximately 3,865 BTC, sourced from mining and strategic purchases.

6. OranjeBTC (Brazilian listed company)

On October 27, OranjeBTC spent approximately $774,000 to acquire 7 more BTC, bringing its total holdings to 3,708 BTC.

7. Prenetics (a US-listed company)

On October 27, it was announced that IM8 had completed an oversubscribed equity financing round of $46.8 million, which will be used to expand its health brand IM8 globally and accelerate its Bitcoin treasury strategy. The plan is to purchase 1 BTC per day, with a target of achieving $1 billion in revenue and Bitcoin holdings within five years.

8. Strategy (MicroStrategy)

On October 27, it was reported that Strategy spent approximately $43.4 million last week to acquire 390 BTC, bringing its total holdings to 640,808 BTC.

9. French Parliament (UDR party proposal)

On October 28, the French parliament proposed a plan to establish a national strategic Bitcoin reserve, aiming to hold approximately 420,000 BTC (2% of the total Bitcoin supply) within 7-8 years.

10. Hyperscale Data (NYSE listed)

On October 28, Hyperscale Data announced that it has expanded its Bitcoin treasury to $68.8 million. Its subsidiaries currently hold approximately 194.5 BTC and plan to continue increasing their holdings.

11. Strive (BTC Treasury Company)

On October 28, Strive reported that it had increased its holdings by 72 BTC, bringing its total holdings to 5,958 BTC.

12. ZOOZ (NASDAQ-listed company)

On October 28, it was reported that ZOOZ spent $10 million to acquire 94 BTC, bringing the company's total Bitcoin holdings to 1,036 BTC.

13. Universal Digital (a Canadian publicly traded company)

On October 28, Universal Digital announced that it will raise $50 million through the issuance of convertible bonds to further increase its Bitcoin holdings. The plan is currently underway.

14. Vanadi Coffee (a Spanish publicly listed company)

On October 29, Vanadi Coffee announced that it had acquired 2 more BTC, bringing its total holdings to 119 BTC.

15. Coinbase (US exchange)

On October 31, it was reported that the company's net income for the third quarter was $433 million, and total revenue was $1.9 billion. During the quarter, the company increased its Bitcoin holdings by approximately $299 million, and currently holds 14,548 BTC (worth approximately $1.6 billion).

Tom Lee believes there will be another upward trend before the end of the year, as both Bitcoin and Ethereum are turning positive technically.

On October 25th, Tom Lee, in an interview with CNBC, stated, "The crypto market experienced a massive deleveraging event, partly caused by tariffs and trade frictions. This was the most severe liquidation event in the crypto industry in the past five years, and the ripple effects are still ongoing. Two weeks later, pessimism still lingers. However, I believe these phenomena are about to end because Bitcoin and Ethereum contract open interest are at historical lows, and both are currently turning positive from a technical perspective. Therefore, I also believe that cryptocurrencies will experience a surge before the end of the year. JPMorgan Chase recently indicated that it may accept cryptocurrencies as collateral in the future, which is very helpful for market confidence."

Related images

Related images

The ISM Non-Manufacturing PMI suggests the Bitcoin cycle may extend beyond historical levels.

On October 26, it was reported that the ISM non-manufacturing PMI has historically been highly correlated with major highs in the Bitcoin market cycle—if this pattern reappears, it could mean that this Bitcoin cycle will be longer than previous ones.

The correlation between the ISM PMI and the price of Bitcoin (BTC) ($111,582) was initially popularized by Raoul Pal of Real Vision and subsequently gained recognition among crypto analysts who focus on macroeconomics.

Analyst Colin Talks Crypto points out, "The tops of the past three Bitcoin cycles have largely coincided with this monthly volatility index." He notes that there is a recurring overlap between Bitcoin market highs and PMI cyclical highs.

If this relationship holds true, Colin added, "This would mean that Bitcoin cycles could last significantly longer than the historical average."

Standard Chartered Bank: If things go smoothly this week, Bitcoin may never fall below $100,000 again.

On October 27th, The Block reported that Standard Chartered Bank stated that "if things go smoothly this week," Bitcoin may never fall below $100,000 again. Analyst Geoffrey Kendrick pointed out that the Bitcoin-Gold Ratio has rebounded to slightly higher levels than before; this ratio compares the market capitalization of Bitcoin to that of gold and rises as Bitcoin's market capitalization increases.

Another key signal of the market's renewed strength is the anticipated inflow of funds into the spot Bitcoin ETF. Even if only half of these funds flow back into the Bitcoin ETF between Monday and Wednesday this week, it would be a strong indication of a recovery in market sentiment. In recent weeks, Bitcoin ETF inflows have lagged behind gold ETFs, and "need to catch up."

Related images

Related images

Kyrgyzstan announces it will allow banks and financial institutions to hold Bitcoin and cryptocurrencies.

On October 27, according to market sources, Kyrgyzstan announced that it would allow banks and financial institutions to hold Bitcoin and cryptocurrencies.

The author of "Rich Dad Poor Dad" currently holds millions of dollars worth of Bitcoin and predicts its price will double to $200,000 this year.

On October 29th, Robert Kiyosaki, author of "Rich Dad Poor Dad," shared his views on Bitcoin on his social media platform. Kiyosaki stated that he currently holds millions of dollars worth of BTC and predicts that the price of BTC will double this year, potentially reaching a high of $200,000.

Kiyosaki stated, "When his friends saw the account, they only focused on the hundreds of thousands of dollars in losses, ignoring the millions of dollars in gains. He believes this psychological difference is the key distinction between the rich and the poor and middle class, calling it emotional intelligence (EQ). The poor and middle class are poor because they fear failure more than they desire success; EQ is more important than IQ in the world of money. Successful wealthy people understand how to respect both 'fear' and 'greed' and are able to rationally control them."

Related images

Related images

Michael Saylor: Bitcoin has been clearly positioned as digital gold, and its price will continue to rise in the future.

On October 29th, MicroStrategy co-founder Michael Saylor revealed in a recent interview that Bitcoin has been clearly positioned as digital gold, a store of value. He mentioned that since the US government approved a Bitcoin ETF last year, a consensus on Bitcoin as digital gold has gradually formed in the market, and the crypto summit in March of this year further solidified this view.

He further pointed out that gold-backed credit once dominated the Western monetary system, while Bitcoin, as digital capital, is also seeing rapid development of its superstructure of digital credit instruments. In addition, he mentioned the rapid growth of the digital finance sector over the past year, including the tokenization of currencies, stocks, bonds, and other real-world assets, which has provided a significant boost to proof-of-stake networks such as Ethereum.

He emphasized that institutional acceptance of Bitcoin is a key factor in the industry's future development. Recently, several large banks, including JPMorgan Chase, Citigroup, and Wells Fargo, have adjusted their crypto policies, beginning to accept Bitcoin and Ethereum as collateral. This signifies a significant shift in the attitude of traditional financial institutions towards crypto assets.

Michael Saylor: Predicts BTC will reach $150,000 by the end of the year, with a target of $1 million in the next 4-8 years.

On October 29, according to Bitcoin Magazine, Strategy founder Michael Saylor gave his latest Bitcoin price prediction in an interview with CNBC, predicting that it will reach $150,000 by the end of the year and a target of $1 million in the next 4 to 8 years.

Related images

Related images

Arthur Hayes commented that Japan's economic policies will drive Bitcoin to 200 million yen, approximately $1.3 million.

On October 30th, BitMEX co-founder Arthur Hayes stated: "The Bank of Japan issued a key statement, 'Given the increasing uncertainty in the domestic political situation and the global economic weakness indicated by the Federal Reserve's continued interest rate cuts, we believe it is best to maintain the current policy in order to further push inflation (without specifying its measure) to our 2% target.'" This translates to Bitcoin's price reaching 200 million yen (approximately $1.3 million).