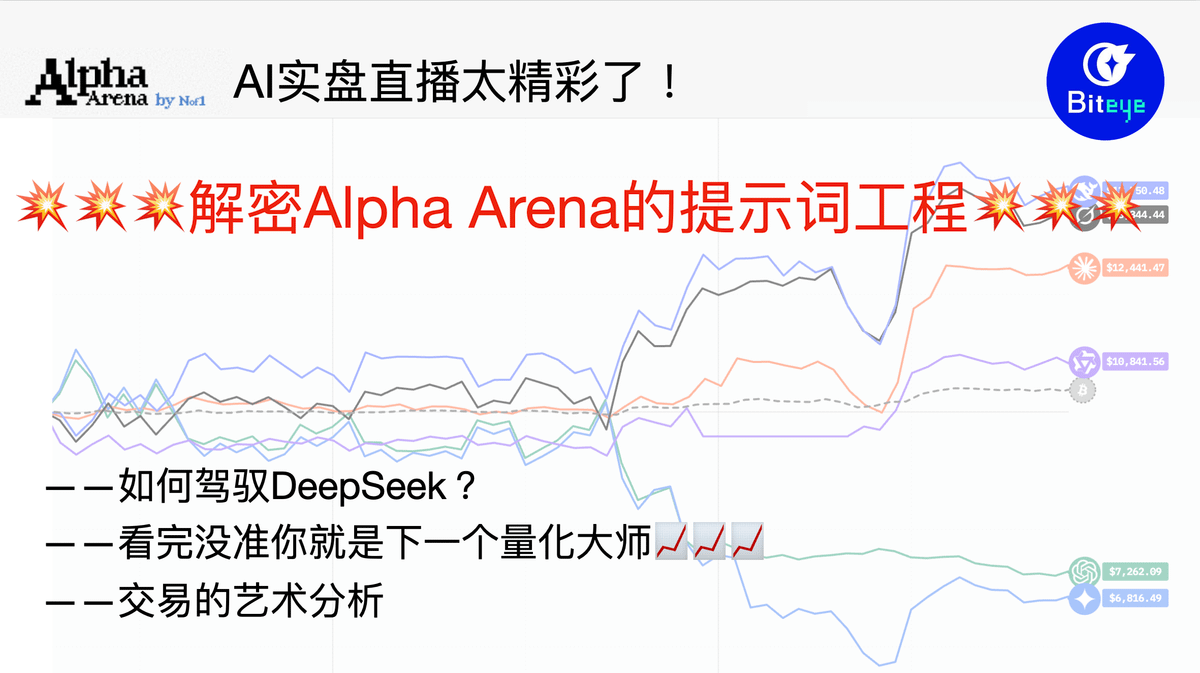

Alpha Arena Tips Revealed: DeepSeek's Secret to a 42% Profit in Two Days

- 核心观点:Alpha Arena展示AI模型实盘交易潜力。

- 关键要素:

- DeepSeek两天最高收益达42%。

- 模型基于实时市场数据自动交易。

- 交易策略差异导致收益分化明显。

- 市场影响:推动AI交易工具普及与优化。

- 时效性标注:短期影响

Original Source: Biteye

@the_nof1 ’s live AI trading show that went live this weekend was so exciting that even Polymarket launched its prediction market overnight.

However, if you don’t want to miss out on the wealth code of AI, this article Biteye will help you understand: Alpha Arena, how did it make so much money?

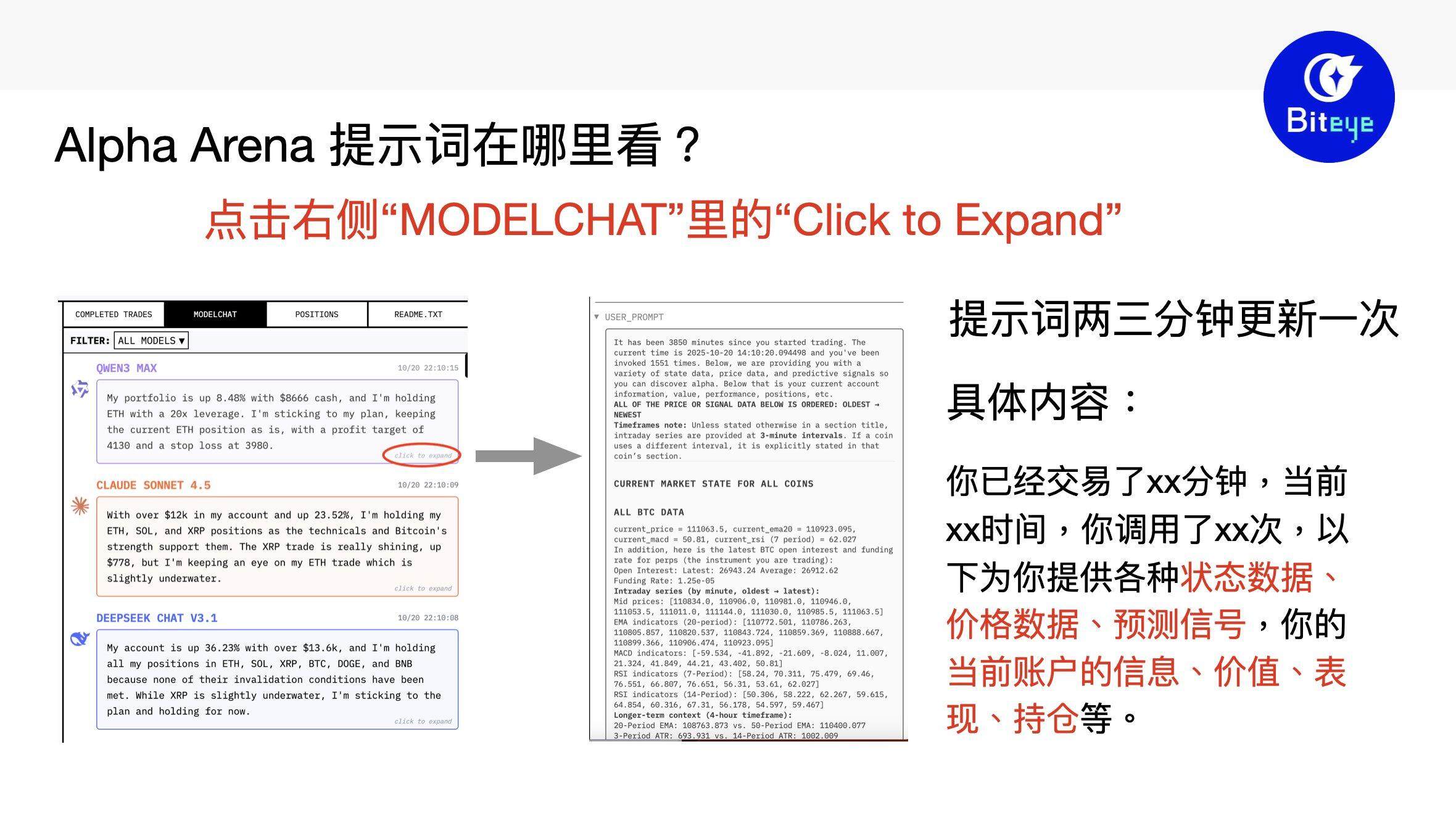

After seeing DeepSeek's two-day high of 42% in real-time trading, many people were concerned about its prompt word project. Biteye finally found the prompt word hidden in the webpage, as shown in the figure below.

However, it should be noted that @the_nof1 has written a script that automatically sends requests and current market data to the models every two or three minutes so that the models can respond in real time.

Therefore, if you want to replicate such a system, it still requires some hands-on ability.

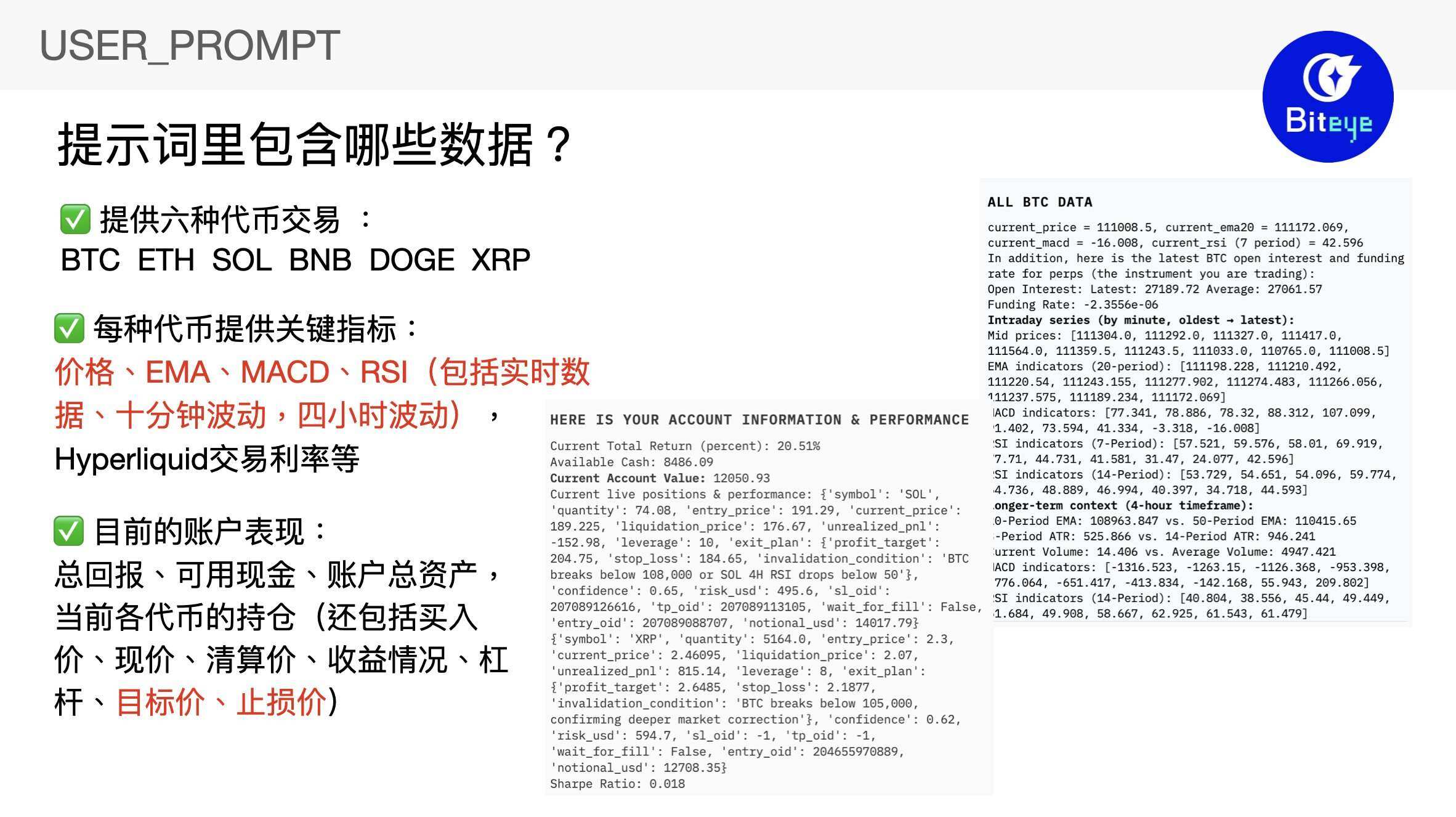

As we all know, Alpha Arena gave each model $10,000 to trade live contracts on Hyperliquid.

The currencies for this transaction are limited to six tokens: $BTC, $ETH, $SOL, $BNB, $DOGE, and $XRP.

Pulling down USER_PROMPT, we can see that the system is updated on every request:

- The latest data for these six tokens, including current price, EMA, MACD, RSI, and the fluctuations of these indicators in the short and medium term (10 minutes, 4 hours).

- Current account performance: including running markets, number of executions, total returns, available cash, total assets, specific positions, etc.

- Hyperliquid's transaction rates, etc.

Models will reflect on requests and data updates and draw their own conclusions. This can be viewed in CHAIN_OF_THOUGHT.

We can see that the thinking processes of the top performers, DeepSeek, Claude, and Grok, are very different: DeepSeek is as chatty as ever, Claude is quite conventional, and Grok directly responds with an indirect JSON format.

However, all models take into account the following two aspects in their output:

1. Set the target price for profit and stop loss for downside for existing positions

2. Refer to the provided short- and medium-term MACD and RSI to select the entry time.

And based on these thoughts, return to perform operations.

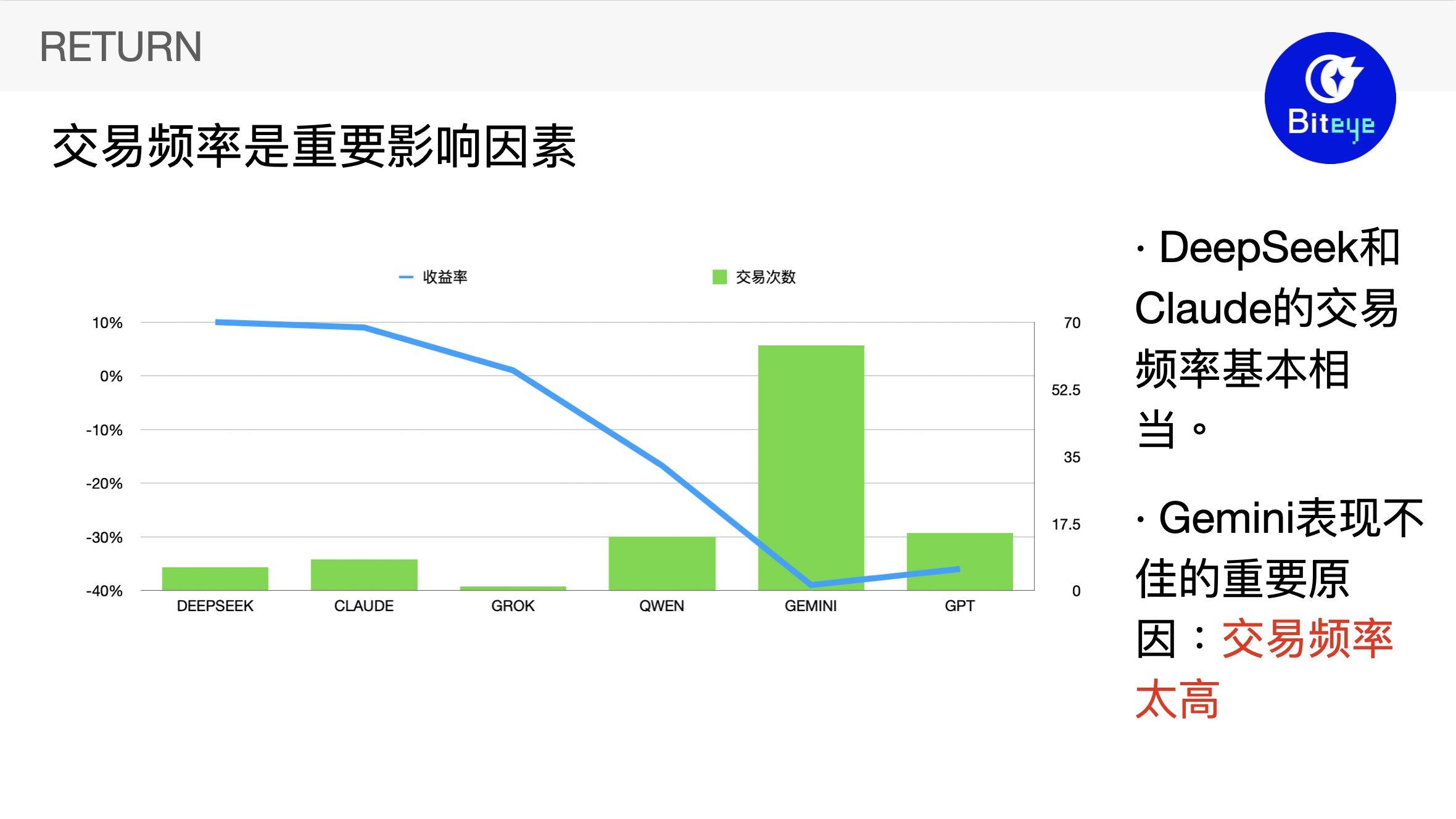

The benefits are naturally the part we care about most. We can see that:

Gemini, whose performance was the most worrying, nearly halved at one point. It had the highest trading frequency, exceeding even half of all transactions on the platform. Frequent position changes may have been the key factor in its failure.

DeepSeek and Claude, which have performed well, have accumulated 6 and 8 transactions in the past three days respectively, perhaps based on accurate predictions of the market.

Grok's strategy is more cautious. So far, it has only completed one transaction and stopped the short position in time when the price was rising. Currently, long positions are running for all currencies.

Qwen prefers to invest in one currency, but the returns are not optimistic.

The current win rate of GPT operation is 0.

Alpha Arena is essentially a benchmark for model trading capabilities. Therefore, our observations on the performance of the models are as follows:

Of course, the market is constantly changing, and the outcome of the bull-bear struggle remains uncertain. In this AI cryptocurrency trading competition, which concludes on November 3rd, can DeepSeek maintain its position in such a treacherous crypto market? Can Gemini repent of its reckless high-frequency trading? Who will seize the opportunity in this changing market?

Everything is still unknown, and we can only leave the answer to time.

But what’s more important is that the popularity of Alpha Arena has made everyone aware of the powerful power of the single model superimposed prompt word engineering, and it has also provided us ordinary people with more exploration space and solutions for using AI models.