The Oracle Wars: The Underlying Code for the Explosion of On-Chain Prediction Markets

- 核心观点:预测市场爆发将推动预言机基础设施创新。

- 关键要素:

- Polymarket交易量48倍增长至26亿美元。

- UMA垄断主观市场但存在操纵风险。

- AI与新型预言机方案正在涌现。

- 市场影响:催生新一代去中心化预言机需求。

- 时效性标注:中期影响

Original author: Danny @IOSG

Source: IOSG Ventures

TLDR;

The on-chain prediction market is booming, and oracles are the best infra-related opportunities. As the core of the settlement mechanism, oracles determine what topics the prediction market can support and whether it can operate correctly and efficiently.

Currently, Polymarket's oracle is dominated by UMA, supporting 80% of the subjective prediction market. Chainlink has been introduced to settle the remaining 20% of the price market. Python has been introduced to solve the problem of on-chain data for the Kalshi prediction market. Other oracle solutions mainly focus on AI.

As the only subjective settlement solution, UMA has established a strong barrier to entry through product and operational experience. However, issues such as long settlement times and manipulation by large investors remain, fundamentally limiting the development of new market types for prediction markets like Polymarket. This creates room for new solutions, including the introduction of AI agents, addressing manipulation issues, continuous/combined market oracles, permissionless/long-tail market oracles, and event-driven DeFi integration for prediction markets.

background

Crypto has entered the application era. The infra projects of the previous era were driven by enabling applications. Memecoin drove Dex infra, AI agents drove Tee infra, and Yield drove Defi infra. The prediction market, which is gaining momentum, may drive Oracle infra.

The prediction market has become a new growth engine for Crypto. From 2024 to 2025, it will undergo a qualitative change from niche experiments to mainstream product-market fit (PMF) applications:

- During the 2024 US election, Polymarket's trading volume soared from US$73 million to US$2.63 billion (a 48-fold increase), and Kalshi reached US$1.97 billion (a 10-fold increase).

- The prediction market has reached a cumulative trading volume of $15.7 billion. ICE, the parent company of the New York Stock Exchange, invested $2 billion in Polymarket. Many well-known hedge funds have already entered prediction market trading or are exploring ways to participate.

- On the regulatory front, the CFTC approved Kalshi's election contract, while Polymarket, through its acquisition of QCEX, will re-enter the US market in a compliant manner via a mobile app. Polymarket has repeatedly hinted at the potential of its token and crypto ecosystem.

Various factors will serve as catalysts, and there is no doubt that the market will explode.

Prediction markets are categorized into two types. The first is subjective questions, focusing on news events related to politics, culture, economics, and sports, such as presidential elections and World Cup victories. Questions and outcomes are defined using natural language, and some conclusions are subjective. For example, the question "Is Zelensky wearing a suit?" defines what constitutes a suit.

The other type is the price market, which is similar to binary options products for cryptocurrencies/stocks, but with a simpler and easier-to-understand model. For example, “Will the price of BTC reach $XXX at a certain time?”

Currently, UMA and its optimistic oracle are the only provider of subjective market settlements. For any market with decentralized, unstructured data or requiring subjective adjudication, there is currently no other solution. UMA addresses this problem through an optimistic rollup-like approach (proposing an outcome, which is accepted by default if undisputed, and subject to further adjudication and penalties if disputed).

Structured data oracle services, primarily price data markets, can be easily resolved directly through price oracles like Chainlink. In fact, Chainlink's routing for price disputes already exists within UMA's escalation manager. Polymarket's direct collaboration with Chainlink allows for faster resolution.

Currently, prediction market oracles still require improvements in many aspects of mechanism and user experience, including settlement time, incentive models, data continuity, and permissionless settlement. Prediction markets will bring new opportunities for oracle product and architectural innovation.

Why Oracles Are Important

Settlement can be categorized as centralized or decentralized. Most early prediction markets adopted centralized solutions. Decentralized solutions are costly and difficult to implement. However, to protect prediction markets from single-point control and ensure their value as a "media of truth," decentralized settlement solutions are necessary, which in turn rely on oracles.

This bottleneck technology determines whether an on-chain prediction market can continue to operate independently and support large-scale markets. This is why BSC needs to solve the oracle problem before it can launch a prediction market project.

At the same time, for prediction market data to generate value and circulate on-chain, the help of oracles is also needed. Oracles can use prediction market results as a data source for on-chain use. The collaboration between Kalshi and Pyth focuses on this.

Using market prediction data as a primitive, on-chain application developers can create entirely new products. Examples cited by Pyth include:

- Develop futures markets based on real-world events. These protocols can use Kalshi’s real-time odds as a baseline reference, automatically adjusting prices as the source market fluctuates.

- DeFi protocols can build conditional products that react to real-world probabilities.

- insurance products tied to political outcomes;

- A series of NFTs that evolve based on election results;

- Gaming tournaments that unlock prize pools when specific events occur.

Current Prediction Market Oracles

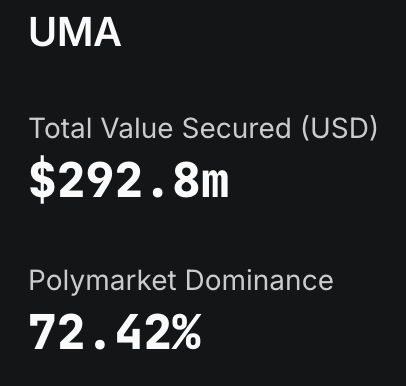

To understand UMA's current monopoly, we can measure it by TVS in the prediction market. TVS (total value secured) measures the total value secured by oracles. Currently, Polymarket holds an 80% market share, with Chainlink accounting for the remaining 20%.

▲ source: Defilamma

In terms of its business model, Stable prioritizes market share expansion over revenue in the near term , leveraging gas-free USDT payments to acquire users and build payment traffic. Long-term profitability will primarily come from within its consumer applications, supplemented by select on-chain mechanisms.

In addition to USDT, Stable also sees significant opportunities in other stablecoins. With PayPal Ventures' investment in Stable at the end of September 2025, as part of the deal, Stable will natively support PayPal's stablecoin, PYUSD, and promote its distribution, allowing PayPal users to pay "directly with PYUSD," with gas fees also paid in PYUSD. This means PYUSD will also be gas-free on the Stable chain —extending the operational simplicity of the USDT payment rail that attracted PSPs to it to PYUSD as well.

UMA

Polymarket currently uses UMA's MOOV2 (Managed Optimistic Oracle V2) to settle markets. When a market matures and needs to be settled, the market closes and the proposer submits the result. The result is considered correct as long as it remains unchallenged within the dispute window. If challenged, UMA's decentralized adjudication mechanism intervenes to render a verdict.

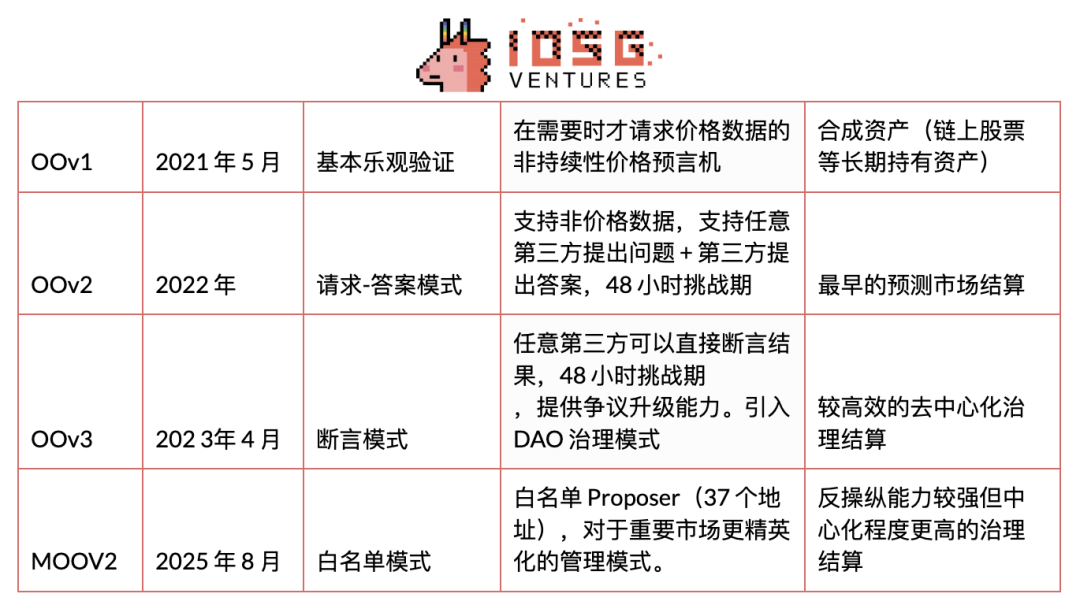

The UMA optimistic oracle has gone through four versions, from its initial focus on synthetic assets to its continuous evolution to adapt to the prediction market:

Polymarket now supports MOOV2 contracts. This change follows the UMA's adoption of the UMIP-189 governance proposal on August 6th. Previously, a problem with MOOV2 was that many proposals were submitted prematurely and without experience, often leading to disputes and delaying market settlements for up to several days.

Risk Labs, the entity behind UMA, has released an initial whitelist of 37 addresses. The whitelist includes employees of Risk Labs and Polymarket, as well as users with more than 20 proposals with an accuracy rate exceeding 95%. This is the current prototype of UMA's "meritocratic" governance.

As the most widely used oracle, UMA's multiple iterations demonstrate its deep understanding of prediction market use cases and its robust ecosystem and infrastructure. However, UMA's current performance is not perfect, primarily due to two issues:

- Risk of manipulation by large investors

- Long time to finalize the results

Regarding manipulation risk, UMA's DVM (Data Verification Mechanism) relies on token holders to vote on data outcomes. This is ensured by a minimum voting amount (GAT, approximately 5 million UMA) and a voting consistency threshold (SPAT, 65% consensus) to ensure safety.

However, due to the low market capitalization and highly concentrated distribution of tokens, large investors can easily influence voting results. In 2024, on the Polymarket platform, a market on whether Ukraine would sign a mining agreement with the United States was ruled "yes" by UMA, despite the fact that this was not the case in the real world.

On-chain data shows that a single large investor, across multiple addresses, staked approximately 5 million UMA, accounting for approximately 25% of the total voting power; just two large investors control over half of the effective voting rights. This centralized structure encourages small voters to "follow the large investors" to avoid penalties. UMA's penalty for incorrect voting is only approximately 0.1%, which is extremely low, significantly increasing the actual risk of manipulation by large investors. UMA's current MC is 100 million, but the OI of the polymarket it supports is over 200 million. This reflects the asymmetry of economic relations and creates opportunities for malicious manipulation.

Secondly, UMA's dispute resolution process is relatively lengthy in terms of result confirmation speed. Any data request must undergo an "active period" after submission, automatically confirming if no one challenges it. If challenged, it enters the Distributed Virtual Machine (DVM) voting phase, which typically lasts 48 to 96 hours. If the threshold is not met, a new round of voting is required, potentially extending settlement to several days.

This delay is particularly noticeable in scenarios requiring fast settlement, such as prediction markets and leveraged products. User funds are locked up and cannot be reused, increasing the arbitrage opportunities caused by information lags.

While UMA offers advantages in decentralization and censorship resistance, its high token concentration and long settlement cycles pose manipulation risks and efficiency bottlenecks. Further optimization is needed to enable UMA to serve as a mainstream data oracle in a wider range of forecasting scenarios.

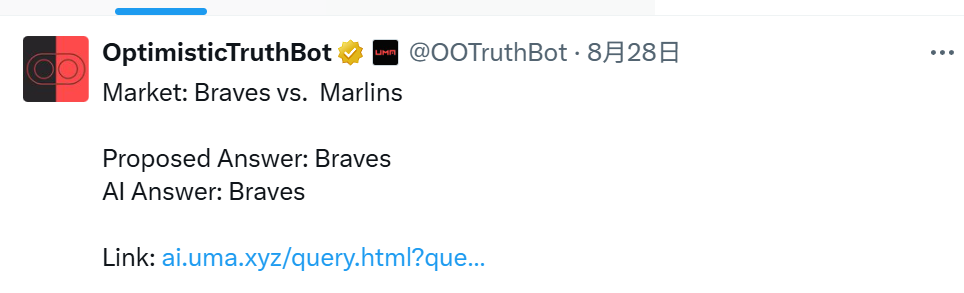

UMA is also exploring disruptive new architectures. It is collaborating with EigenLayer to research and explore leveraging EigenLayer's staking system to develop next-generation oracles. It is also exploring new AI initiatives. The Optimistic Truth Bot is a proposer agent in prediction markets. It listens to Polymarket questions 24/7, immediately proposing the most likely answer and waiting for challenge, significantly reducing settlement times. You can find specific markets through the @OOTruthBot Twitter account.

Chainlink

Chainlink is a long-established DeFi oracle service provider. Its product capabilities proactively acquire and aggregate off-chain data (such as prices) from multiple sources, delivering it on-chain through a network of nodes. Currently, Polymarket and Chainlink are collaborating to serve the price data prediction market.

Chainlink routing has already been involved in UMA's Escalation Manager dispute escalation system. This means that Polymarket has already been a Chainlink user, and the current integration with Chainlink makes this even more direct.

Python

Pyth is currently collaborating with Kalshi, primarily to disseminate Kalshi data. Kalshi data is regulated by the CFTC, so its value lies in disseminating compliant data, primarily sports and economic data, as a data source. This is similar to a compliant casino selling its real-time sports event data to downstream users.

New Players

The vast majority of the focus is on providing verification services through AI. Currently, the agent's role is more focused on submitting settlement intentions. However, since AI is available 24/7, it can ensure efficient settlement in any market, especially high-frequency markets created without permission. As mentioned earlier, UAM is exploring solutions resulting from AI participation through OO Agent.

Solana's XO Market is a good example. It uses AI models to extract and analyze data from trusted APIs (such as real-time news and sports data sources) and quickly resolve yes/no questions through pattern recognition, achieving a relatively high success rate. Some of the oracle projects on BSC, which CZ recently mentioned, are also exploring this direction.

What opportunities do oracles have?

The explosive growth of prediction markets has placed higher demands on oracles, including their scope of support, intelligence, real-time performance, and incentive design. Currently, mainstream oracles still face bottlenecks: UMA's settlement time is 24-48 hours, with an average dispute resolution cycle of several days, a high settlement dispute rate, and the concentration of voting power among large stakeholders. There is still room for optimization in terms of centralization and efficiency, and the types of markets they can support are still limited by their architecture. This may be the biggest obstacle to Polymarket's innovation in market types.

AI-assisted

AI's ability to understand natural language makes it highly applicable in markets like politics, sports, and social events. Previously, human judgments were subject to numerous semantic discrepancies and subjective factors, leading to frequent disputes. AI Oracle significantly improves this through multi-source verification and neutral language models.

Anti-manipulation

UMA token holders are both voters and stakeholders, creating a structural conflict. A single large holder can sway voting outcomes with just 5 million UMA. Regarding token design, how can we ensure sufficient economic security? Beyond token design, how can we establish anti-manipulation mechanisms (such as real-time flagging of malicious addresses and detection of group malicious behavior)?

Multi-period and subjective forecasts, real-time data and continuous price feeds

Prediction markets have long focused on binary settlement, resulting in significant information reduction. Future socially aware oracles will need to access a wider range of data sources and employ dynamic models for comprehensive evaluation of diverse data. Through discussions with Polymarket's DeFi projects, we've realized there's significant design potential for dynamic settlement data during market activity. Supporting more sustained prediction markets, such as real-time, in-game trading for sports events, presents significant opportunities in continuous price markets or combinational markets like parlay, but current oracles don't support this.

Permissionless expansion and the long tail market

In the future, permissionless prediction markets will reach asset creation rates similar to those of PumpFun. The massive market settlement demands will render UMA's current manual review and upgrade model unworkable. Rapidly addressing the creation, settlement, and liquidity fragmentation issues of this long-tail market may require a top-down approach from the perspective of oracles.

Event-driven DeFi integration

When prediction markets are integrated with DeFi, the on-chain recording of event probabilities can directly impact lending and derivative pricing. For example, when the probability of an interest rate hike exceeds 90%, lending leverage can be automatically reduced. The combination of oracles and prediction markets may bring innovation to the DeFi space.