From a 520-fold oversubscription to a 70% plunge and delisting from Binance: A complete analysis of the Astra Nova sell-off

- 核心观点:Astra Nova项目方涉嫌恶意抛售套利。

- 关键要素:

- 上线后项目方地址抛售致币价暴跌76%。

- 空投规则突变,社区质疑榜单操控。

- 链上分析显示抛售资金转入中心化交易所。

- 市场影响:损害交易所信誉,加剧投资者信任危机。

- 时效性标注:短期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

On October 18th, the launch of Astra Nova (RVV), a new coin on Binance Alpha, sparked widespread controversy. Within hours of its launch, wallets associated with the project were found to be continuously selling tokens, causing the price of RVV to plummet from a high of approximately $0.03 to $0.007, a 76% drop. Such blatant selling of tokens after a Binance listing is rare in the crypto industry. Why did Astra Nova become such a typical example?

AI, Saudi Arabia, and the opening remarks of the "grand narrative"

Astra Nova, based in Riyadh, Saudi Arabia, claims to be an AI-powered Web3 entertainment ecosystem focused on games, NFTs, and creator tools. Founded in 2020, it is positioned as "the Kingdom's first AI entertainment ecosystem," with a vision to fuse AI-generated content, blockchain, and player narratives to create a "digital entertainment kingdom for the new era."

On October 16th, Binance announced the launch of its RVV token presale . The goal was to raise 172.1 BNB, but the token received 90,612 BNB, exceeding the target by 520 times . For a time, RVV seemed to have become a "star project."

Astra Nova also announced the completion of $48.3 million in funding , including $41.6 million in its latest strategic round. Participation reportedly included family offices and institutional investors from Saudi Arabia, the UAE, and Bahrain. These figures are quite attractive in the current fundraising environment.

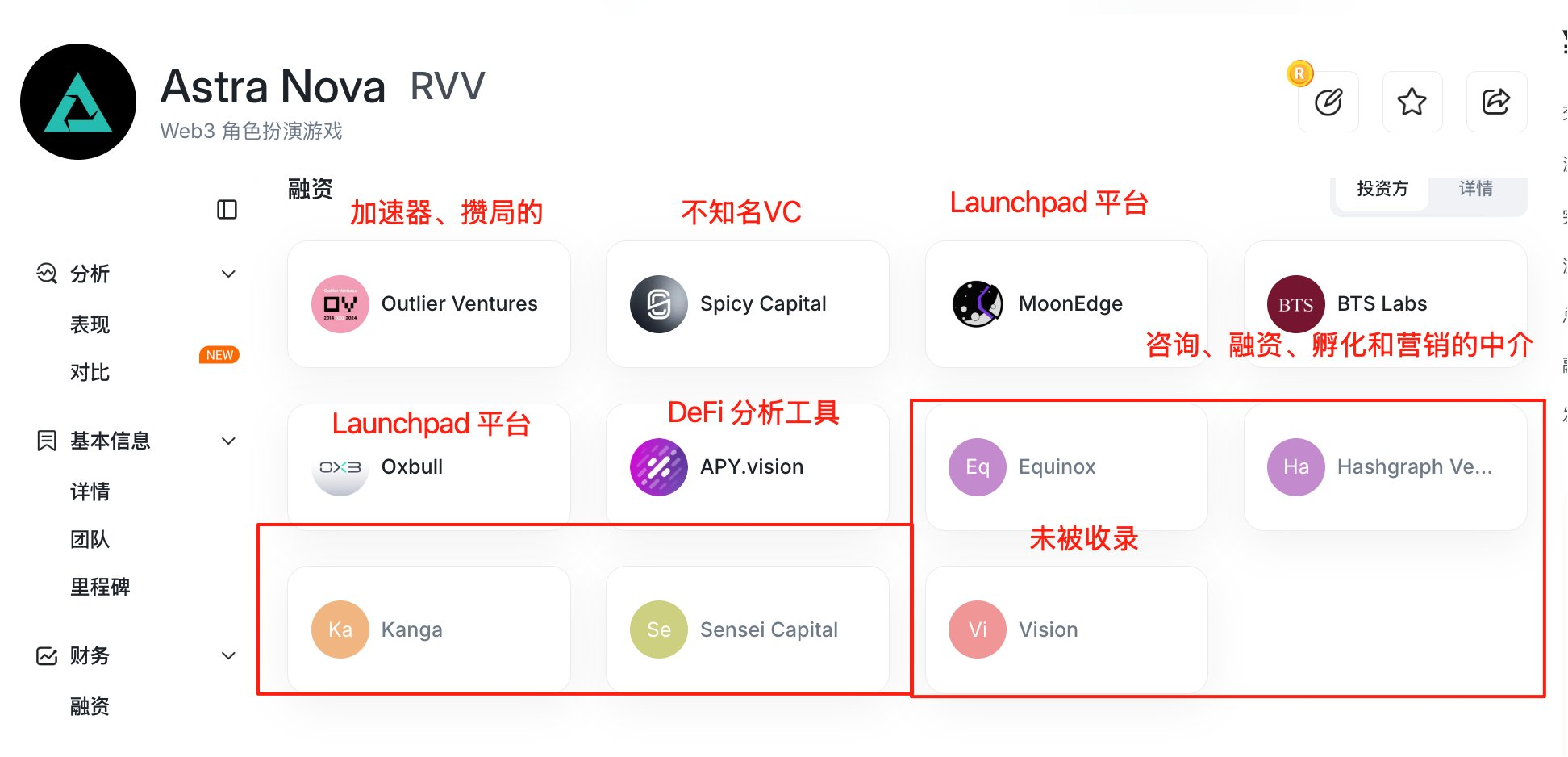

However, crypto KOL @cryptobraveHQ found in the disclosed list of investors that there was no well-known crypto institution participating, and the only well-known one was the crypto incubator Outlier Ventures.

The guise of "AI + Middle East + big financing" seems to cover up some empty substance.

Sudden changes in airdrop rules signal a collapse of trust

The Astra Nova project originally promised to fairly distribute 3% of tokens as airdrop rewards through a points system. Users can accumulate points by holding NFTs, staking, or participating in tasks.

The turmoil began just an hour before the launch on October 18th. The project suddenly announced a rule change, limiting airdrop rewards to the top 15,000 users in the leaderboard, a departure from the widely publicized 3% token distribution plan. Thousands of real users saw their rankings collectively "slipped" by approximately 15,000 spots on the leaderboard. Many loyal participants (including NFT holders and long-term stakers) who had previously been in the top 500 were suddenly bumped off the list and denied any rewards.

Community skepticism quickly erupted on the X platform, with suspicions that the project was manipulating the rankings and exploiting airdrop shares through bots. Worse still, the promised seven NFTs and three special edition rewards never materialized. As the skepticism intensified, Astra Nova's Discord and Telegram groups were subsequently locked, virtually terminating communication channels .

Meanwhile, users who participated in the presale were originally scheduled to unlock 50% of their tokens during the TGE, but the project team temporarily changed the rules: a 7-month cliff period followed by a 12-month vesting period . This change meant that users could not sell their tokens in the short term, locking up their funds for an extended period, further sparking community dissatisfaction.

The plunge and the "hacking incident": Who did it?

On October 18th, Binance Alpha launched the RVV token, officially opening trading. The initial supply was 10 billion, with a partial unlock of the circulating supply. The price initially saw a brief surge, but soon turned anomalous. Suspected team addresses began selling heavily, rapidly depleting liquidity.

Binance Alpha subsequently urgently delisted the token, citing "technical incompatibility" and "potential hacking risks," making it the fastest delisting in Binance's history. However, the token's futures contracts continued to trade, leading to retail investors experiencing continuous margin calls due to high leverage. This led to widespread community accusations against Binance for lax auditing.

Under fire from the community, Astra Nova subsequently issued a statement claiming that a third-party market maker account had been hacked. The attackers, after taking control of the account, began dumping assets. The team stated that they immediately notified all exchange partners and confirmed that the project's smart contracts and infrastructure are fully secure and audited. The team is currently working with on-chain security analysis agencies to track the flow of funds and will hand over the case to law enforcement once evidence is collected.

Currently, spot trading is no longer possible, and the contract remains at risk. The Astra Nova project stated that it will repurchase the same number of tokens affected from the market .

Regarding the Astra Nova hacking incident, there are many voices in the community that the team "stole from the inside" and "directed and staged the incident themselves."

Ember: Which hacker would convert the stolen funds into USDT and then transfer it to a centralized exchange?

On-chain analyst Yu Jin reported that approximately 860 million RVV (8.6% of the total supply) was transferred from the project's minting contract and sold on-chain, causing a sharp drop in RVV. These 860 million RVV were sold for 10.288 million USDT, of which 8.226 million USDT were transferred to Gate and Kucoin, while the remaining 2.041 million USDT remained in the on-chain wallet 0x643. The project tweeted that the funds were stolen, but I'm skeptical. Which hacker would convert stolen assets into USDT and hold them directly? And why not transfer them directly to a CEX? USDT can be frozen.

AB Kuai.Dong: Offending exchanges, secondary investors, institutions, and bloggers simultaneously

Crypto influencer@AB Kuai.Dong bluntly stated that Astra Nova had offended exchanges, secondary investors, institutions, and bloggers. The project not only publicly crashed its on-chain trading, but also prompted Binance to issue an emergency pop-up warning about the risks. Furthermore, the project also forcibly changed the unlocking method for all investors, ostensibly under the guise of an exchange requirement.

It's even been revealed that Astra Nova's actions aren't isolated. They learned of a "dump arbitrage" strategy from previous discussions with market makers: if a project could list on Binance Alpha and open futures trading, it would be a significant boost, while listing on other major exchanges would be hopeless. So, rather than being forced to sell off by airdrops, the project would join in the dump. Ultimately, the profits from the combined futures and dumping of the pool would undoubtedly exceed the margin required for listing.