From AMM to CLOB, the past and present of prediction market liquidity

- 核心观点:预测市场流动性决定交易效率。

- 关键要素:

- 流动性不足导致小额交易大幅影响价格。

- Polymarket从AMM亏损模式转向CLOB盈利模式。

- CLOB通过限价单和奖励机制激励流动性供给。

- 市场影响:提升预测市场交易深度与稳定性。

- 时效性标注:中期影响

Original author: Dora Lsk

Original translation: TechFlow

Recently, more and more people have started discussing prediction markets.

Although they are becoming increasingly popular, there are some drawbacks.

One of them is illiquidity, which plays a crucial role in trading.

What is liquidity?

In simple terms:

In a highly liquid market, you can use large amounts of money to buy stocks without causing a significant change in price. For example:

- Highly Liquid Market : You can buy over $3,000 worth of YES stock for 77 cents per share, with the price barely fluctuating.

- Or you could place an order at 75 cents, which would likely be filled quickly because there is sufficient liquidity and active traders in the market.

But in illiquid markets, even small purchases can significantly affect prices.

For example, as I recently wrote about a market example:

Original tweet link: Click here

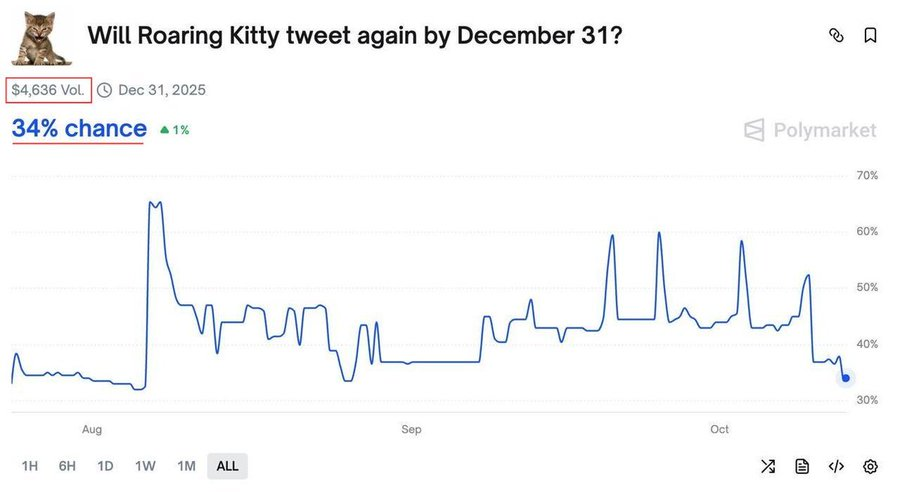

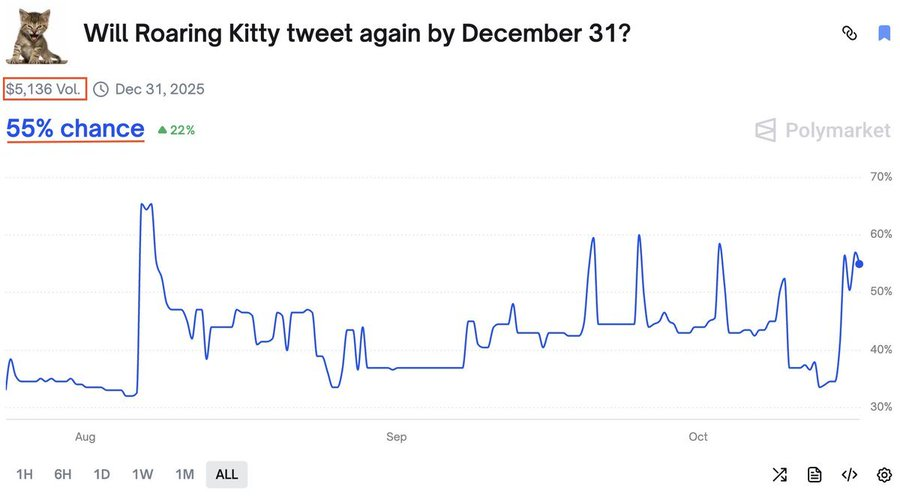

On Polymarket, when I wrote that article, the market was trading at just $4,636 with a probability of 34%.

But then the trading volume increased by only $500, but it significantly affected the price, pushing the probability up to 55%.

Therefore, in prediction markets, liquidity is an important measure of how easily you can buy or sell a position without significantly changing the price.

Liquidity in the Past: The AMM Model

Before 2022, Polymarket used a model based on AMM (Automated Market Maker).

An AMM is an algorithm that allows transactions to take place without traditional buyers or sellers.

- It works through a formula where regular users can deposit funds into the market and earn fees from other people’s trades.

- However, when the market settles, one of the tokens becomes worthless while the liquidity provider still holds it.

- This situation often results in the fee income being unable to offset the losses.

As a result, most people who provided liquidity through the AMM model ended up losing money.

More details can be found in the following tweet:

Original tweet link: Click here

Current Liquidity: CLOB Model

At the end of 2022, Polymarket switched to the CLOB (Central Limit Order Book) model.

CLOB is basically the order book system we are familiar with:

- Here, prices are set by traders themselves rather than being automatically generated.

- This model makes the CLOB market more profitable and allows market makers to profit from the bid-ask spread.

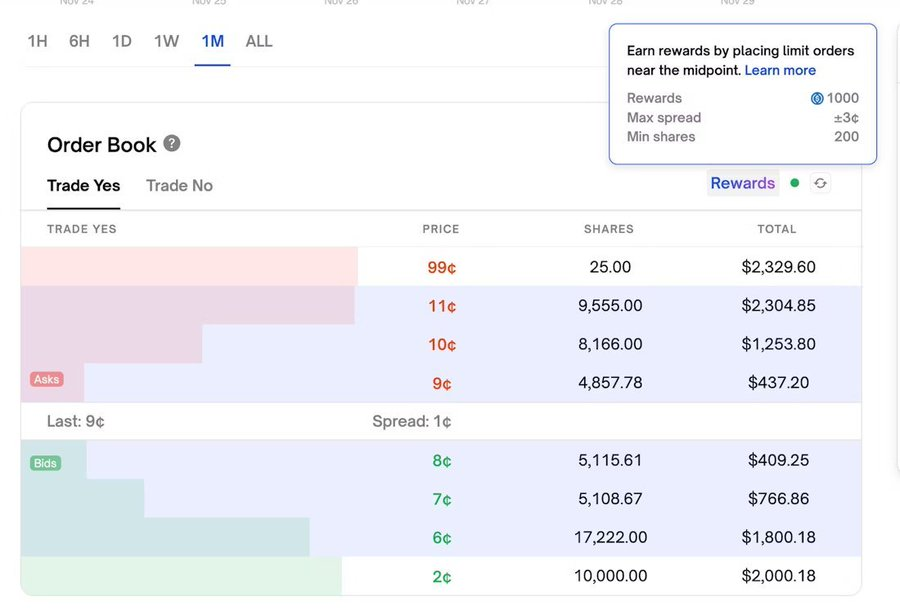

Polymarket also encourages users to provide liquidity through a reward mechanism.

The specific operations are as follows:

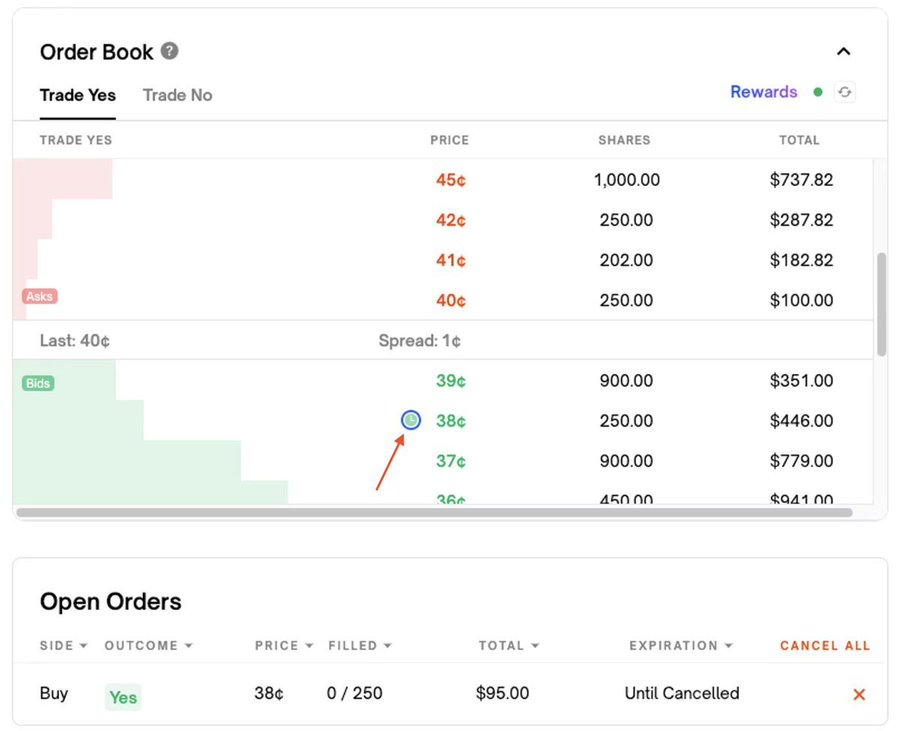

You place a limit order to buy or sell a stock in a market that requires liquidity.

In the top right corner, hover your mouse over "Rewards" and you'll see:

- Rewards available

- Maximum spread (eligible orders will be highlighted in blue)

- The minimum number of shares you need to buy or sell

If you place an order that earns you a reward, you'll see a clock icon highlighted in blue.

You can find all the information about earning liquidity rewards in the official documentation: Polymarket Liquidity Rewards Guide .

Where does liquidity come from in the first place?

Now that we understand what liquidity is and how it works, we have one more question:

Where does liquidity come from in the first place?

When a market is first created, no one holds "YES" or "NO" shares, and no prices are set.

At this point, someone can place an order, for example:

- "I'd buy YES stock for 70 cents."

If another trader places an opposite order, for example:

- "I'd buy NO stock for 30 cents."

Once these orders are matched, the market forms its first price.

The price is then determined by the average price people are willing to buy (bid) and sell (ask):

- Bid : The highest price someone is willing to pay for a stock.

- Ask : The lowest price someone is willing to sell a stock for.

- Spread : The difference between the buy price and the sell price.

If the price difference is less than or equal to 10 cents, the interface will display the midpoint price:

The formula is: Middle Price = (Buy Price + Sell Price) / 2

If the spread is greater than 10 cents, the last traded price is displayed instead of the mid-price.

The most and least liquid markets

The most liquid market category is political markets, partly because the first major boom in prediction markets occurred during the US election.

At the time, political market liquidity and media attention reached record levels.

At the same time, some of the least liquid markets I encounter are mention markets.

Of course, there are exceptions within each category – liquidity depends on the specific market, regardless of its type.