Predicting the Singularity of Market Explosion: User-Generated Markets Introduce Creator Economy

- 核心观点:用户生成市场是预测市场未来方向。

- 关键要素:

- 传统预测市场收费致负和博弈。

- 用户生成市场引入创作者收益分成。

- 主播可创建实时互动预测市场。

- 市场影响:推动预测市场向创作者经济转型。

- 时效性标注:中期影响

Originally Posted by Jarrod Watts

Compiled by Odaily Planet Daily Golem ( @web3_golem )

Prediction markets could have ended the era of “bankers always making money,” but unfortunately, most prediction markets are still profiting for themselves.

In this article, I will explain why prediction markets currently fail to serve users and why I believe the next phase of prediction markets will be to enable a creator economy through user-generated markets.

The key points I will cover include:

- Explore the transition from negative-sum games to near-zero-sum prediction markets;

- How the introduction of the creator economy and revenue sharing will drive explosive growth in prediction markets;

- Live streaming opportunities in the prediction market.

The banker is dead

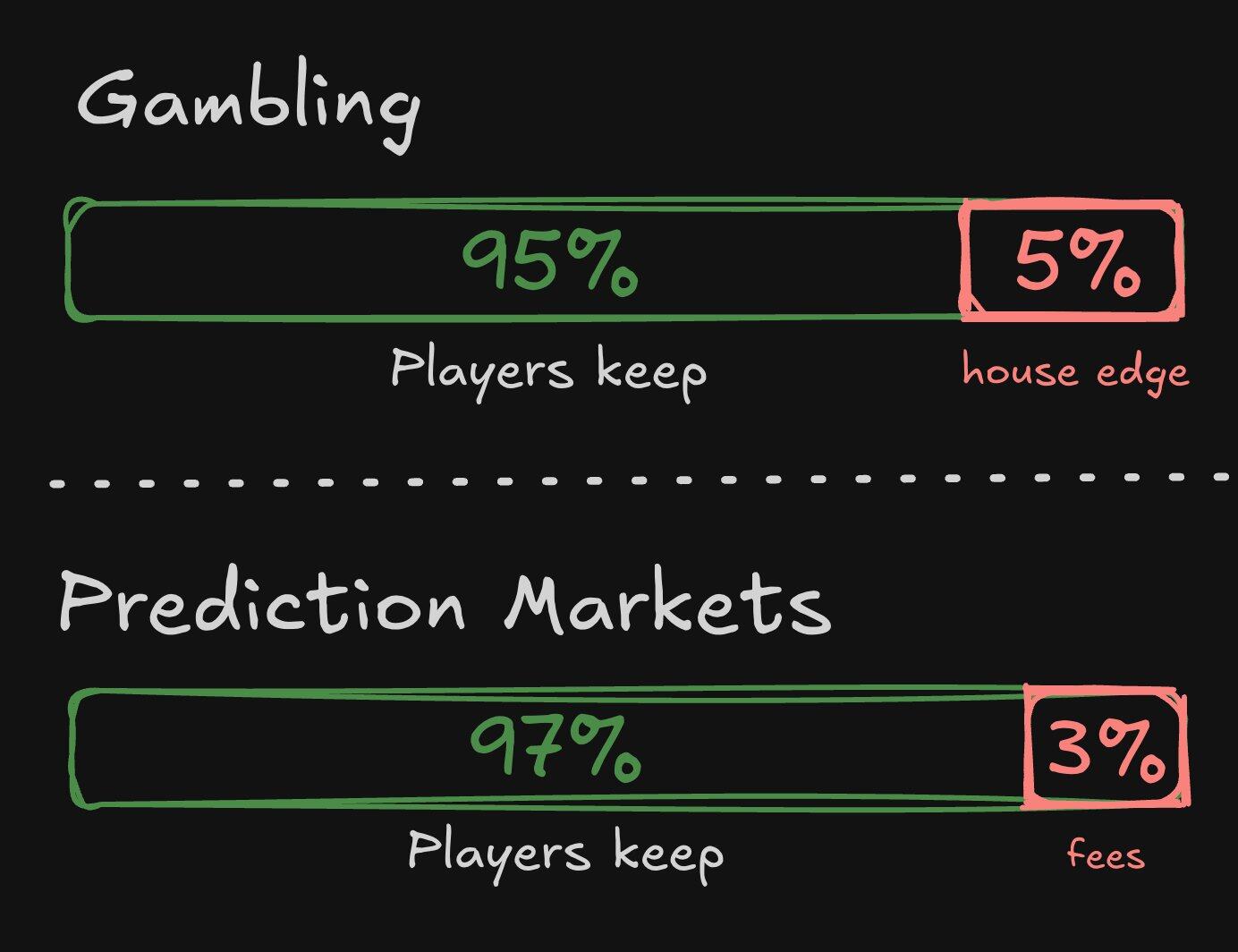

Most forms of gambling, including sports betting, are negative-sum games, where players lose money to the house. The sum of expected return to player (RTP) rates is set at varying levels below 100% to systematically extract funds from players. Most people understand this, yet are willing to gamble anyway, exchanging money for the dopamine rush we get from anticipation.

Prediction markets can change this by eliminating the dealer and allowing players to PvP with each other in an open market. Prediction markets are zero-sum games where the winners take money from the losers, similar to trading.

This is objectively better than traditional gambling/sports betting, and while your moral compass might disagree, there’s clearly a huge market demand for these products – and fairness is always better than milking the market for profit.

But this argument breaks down when prediction markets start charging fees. Most platforms (with the exception of Polymarket) typically take around 2-3% of a player’s entry amount or expected profit.

Prediction market fees turn it from a zero-sum game to a negative-sum game

The consequence of prediction markets charging fees is that they reintroduce the negative-sum nature of gambling, meaning players lose money to the casino/platform over time.

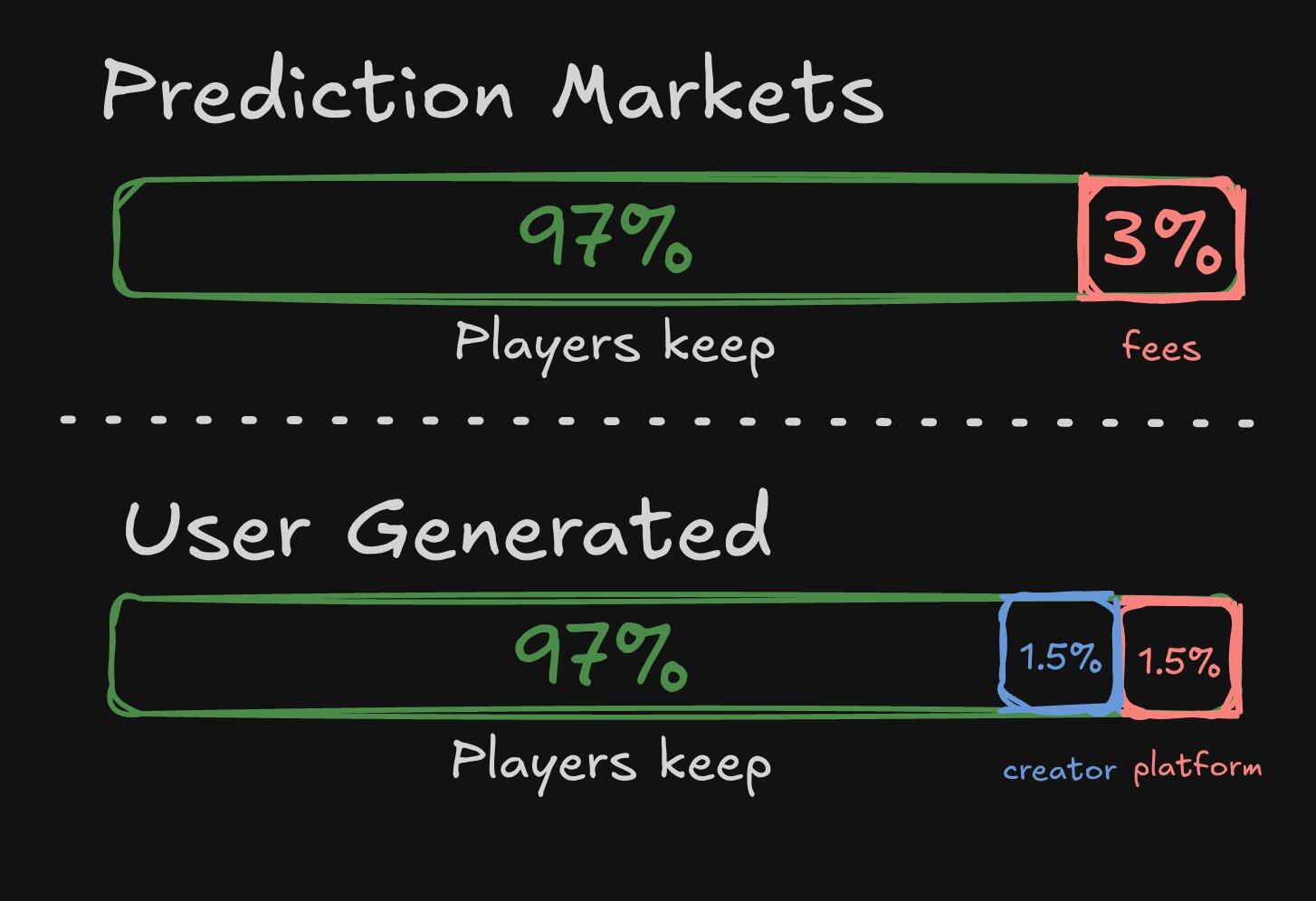

However, I believe there is a powerful alternative way to leverage these fees and thereby increase user engagement: by creating user-generated marketplaces .

Prediction Market as a Creator Economy

I believe prediction markets should:

- Allow users to create marketplaces without permission;

- Introducing a revenue sharing mechanism that allows marketplace creators to earn a certain percentage of commission.

Introducing a revenue sharing mechanism for market creators

Doing so can transform users into co-creators who can create new marketplaces (and user-generated content around them) that drive growth for the platform without the team having to directly bear the production costs. Roblox and Fortnite are great examples of this model in action – both use a portion of their revenue to pay community map creators.

In the prediction market, creators can create markets related to their community/niche, provide users with new ways to participate, and earn revenue from it. Because the application scenarios of the prediction market are almost unlimited, it means that it can be applied to countless creators.

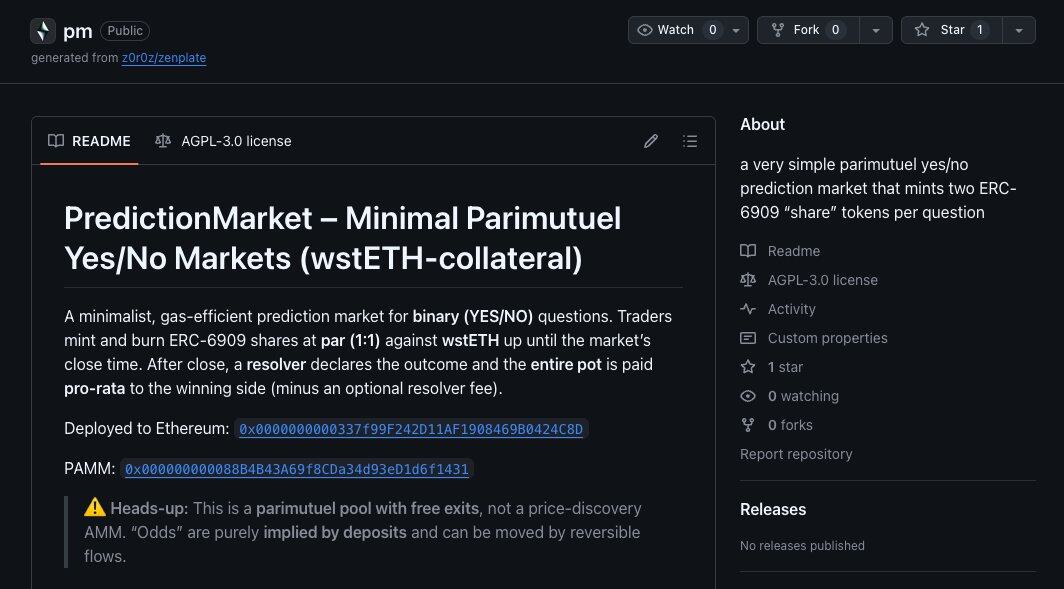

While technical limitations exist, during my research for this article, I discovered a GitHub repository that contains smart contracts for creating user-generated prediction markets. It also contains an AMM variant to address some of the liquidity issues posed by user-generated markets.

Anchor generates prediction market

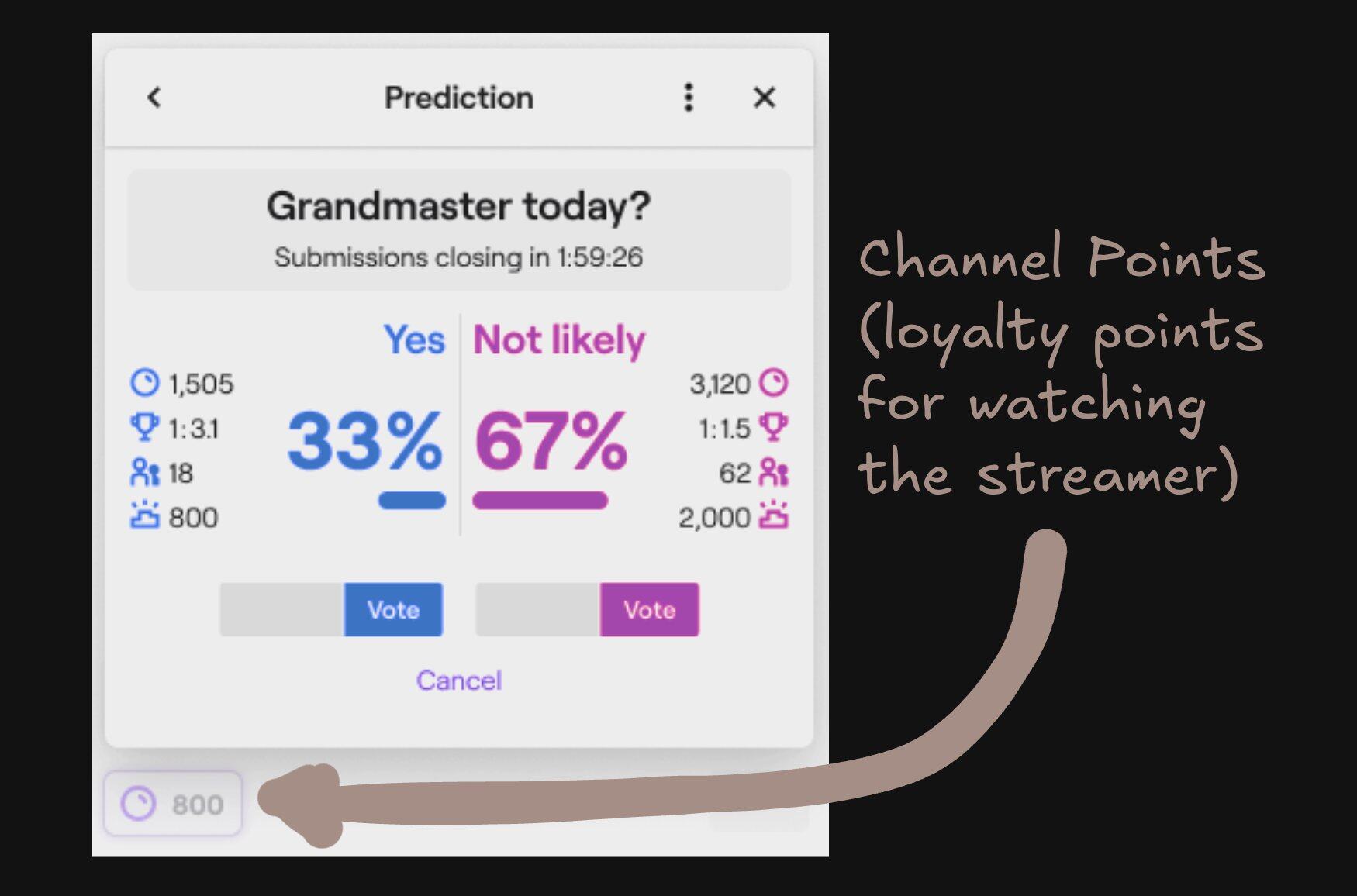

User-generated prediction markets naturally evolve into real-time, fast markets created by streamers for their viewers. In these prediction markets, streamers can initiate votes, and viewers can participate and watch the results in real time.

This allows creators to create short-term prediction markets where viewers can vote on questions like “Will I win this game?” Twitch already implements this feature, but it uses its native channel points instead of USDC.

Twitch live prediction market example

This type of activation is a win-win for everyone – streamers get compensated through revenue sharing, and viewers become more engaged with their streams. I see this as a huge opportunity for both streamers and content creators going forward.

Conclusion

Prediction markets have been incredibly successful, but scaling user-generated prediction markets remains a huge opportunity (and likely technically challenging). The potential for users to become ambassadors and create content directly promoting the prediction market platform is clear, and we look forward to seeing the products that embrace this concept become reality.