If you’ve been following the Sui Blockchain or the broader DeFi world lately, you’ve likely heard a lot of buzz about Momentum (MMT) . It’s one of the most anticipated new projects in the Move ecosystem.

But the question is: What exactly is Momentum? And how does its token, MMT, work?

This article will give you a comprehensive understanding. We'll break down Momentum's core mechanisms, the problems it aims to solve, why the veMMT model is key to the entire system, and its fundamental differences from traditional DEXs. After reading this, you'll not only understand its technical logic but also how, as an average user or investor, you can truly participate in and benefit from the Momentum ecosystem.

Quick Look|TD;DR

– Momentum (MMT) is a next-generation DeFi protocol based on the Sui blockchain , aiming to provide core liquidity, trading, and governance infrastructure for the Move ecosystem.

– It combines the ve(3,3) token economic model, the CLMM decentralized exchange (DEX) mechanism, and a community-first design philosophy to align the profit goals of traders, liquidity providers, and token holders.

– Momentum recently announced that it will launch a $4.5 million community subscription campaign through Buildpad , allowing real users to have priority access to unlocked, instantly tradable MMT tokens .

– The project is invested by top institutions such as OKX Ventures, Coinbase Ventures, and Circle . The core person in charge, ChefWEN, previously worked in the Meta Libra engineering team and has strong technical capabilities.

– As of now, Momentum has completed a cumulative trading volume of US$3.4 billion , with a total locked value (TVL) of approximately US$95 million . It is accelerating to become the core liquidity hub of the Sui ecosystem and plans to expand to the multi-chain market through Wormhole .

Table of contents

How Momentum Works: An Analysis of Its Core Principles

Token Economics Analysis | In-depth understanding of the MMT ecosystem

Momentum's application scenarios and ecological layout

How to get MMT: A complete guide to participating

Competitive Advantage: What Makes Momentum Different

Potential risks and challenges

Looking Ahead: Where Momentum is Heading

What is Momentum (MMT)?

Momentum (MMT) is a new generation decentralized finance (DeFi) protocol based on the Sui blockchain ( SUI ) , aiming to provide the core driving force for liquidity, transactions and governance for the Move ecosystem .

The project, originally named MSafe , was a multi-signature wallet and fund management tool renowned for its security. As the team delved deeper into the Sui ecosystem, they realized they could do more—build a liquidity engine that could connect all corners of the DeFi world. Thus, Momentum Finance was born.

Momentum's vision is clear:

Momentum builds the core liquidity infrastructure for the Sui ecosystem and will gradually expand to other chains. By combining a decentralized exchange (DEX) , a revenue mechanism , and the veMMT voting lock-up model , Momentum truly aligns the interests of traders, liquidity providers, and token holders.

Relying on Sui's high-performance Move architecture , Momentum has lightning-fast transaction speeds, extremely low fees and a scalable foundation, providing solid support for the entire DeFi ecosystem.

Simply put, Momentum is not just a DEX, it is building the underlying infrastructure for Sui's DeFi - allowing transactions, liquidity, project issuance and on-chain governance to be seamlessly connected and operate in coordination.

Team, investment and strategic support

– Financing Background: Momentum completed financing with a valuation of US$100 million , led by OKX Ventures , with participation from well-known institutions such as Coinbase Ventures and Circle .

– Ecological Cooperation: Deep cooperation with Sui’s official ecosystem , and integration of mainstream stablecoins such as FDUSD and USDY .

– Core Team: Project leader ChefWEN was a former Meta Libra engineer and has extensive experience in blockchain architecture and security.

$MMT Community Subscription Event

Momentum is about to launch the $MMT Community Offering . The event will be conducted on the Buildingpad platform, providing real users with priority participation opportunities rather than traditional institutional private placements.

The event aims to raise $4.5 million USD , with all tokens fully unlocked at TGE (when the token goes live), with no lock-up period or vesting period . Users can obtain priority access through Buildpad's HODL or WAGMI events , or participate through the general channel after completing KYC verification .

Learn more: Momentum MMT Community Subscription Event (Source: Building)

How Momentum Works: An Analysis of Its Core Principles

To truly understand how Momentum (MMT) works, we must start with its three core components: the ve(3,3) model, the CLMM liquidity mechanism, and the reward and token release cycle.

A. ve(3,3) model

"ve(3,3)" stands for "vote-escrowed (3,3)." Originally developed by Curve and Solidly , it's a model that combines governance and incentives. Its core logic is simple— it encourages users to lock in their stake rather than sell , aligning participants' long-term interests with the protocol's growth.

In Momentum, this is how it works:

1. You hold MMT tokens;

2. You can choose to lock up your MMT for a certain period of time to earn veMMT (Vote to Lock MMT) ;

3. The longer the lock-up period, the higher your voting weight;

4. Using veMMT, you can vote on which liquidity pools receive token rewards;

5. In return, veMMT holders receive transaction fees, as well as “bribes” from other projects (extra incentives provided to secure votes).

This mechanism closely aligns the interests of liquidity providers (LPs) and token holders :

All token release rewards are distributed to LPs, while all transaction fees are returned to veMMT holders. This creates a self-reinforcing cycle — encouraging users to continue staking, voting, and participating, thereby driving positive growth for the entire ecosystem.

It is worth mentioning that Momentum promises to return 100% of transaction fees to users and does not charge any protocol fees at all.

B. CLMM (Centralized Liquidity Market Making Model)

Momentum's DEX adopts the CLMM (Concentrated Liquidity Market Maker) model, a mechanism first popularized by Uniswap v 3 .

Its advantage is that liquidity providers (LPs) no longer need to distribute funds evenly across the entire price curve, but can concentrate them in a certain price range, greatly improving the efficiency of fund use.

For traders, this means deeper liquidity and lower slippage , especially in popular trading pairs.

The parallel execution architecture of the Sui blockchain allows Momentum to process multiple transaction pool updates simultaneously, maintaining smoothness even in high-frequency trading situations.

Image source: Momentum MMT documentation

C. Rewards and Token Release Cycle

Momentum's token incentive mechanism follows a dynamic emission cycle:

– The system will periodically release new MMT tokens to reward liquidity providers;

– veMMT holders vote to determine which trading pools receive a higher proportion of token rewards;

–At the same time, veMMT holders can also obtain transaction fees from the corresponding pool, as well as “bribe” rewards from other projects.

This mechanism creates a powerful "flywheel effect":

LPs receive token rewards → veMMT holders receive transaction fees and voting incentives → More users participate in staking and voting → Protocol liquidity continues to increase.

For ordinary users, the strategy is very clear:

Provide liquidity → Earn MMT → Lock up as veMMT → Accumulate rewards and voting rights at the same time, forming a long-term profit cycle.

Token Economics Analysis | In-depth understanding of the MMT ecosystem

Next, let’s take a look at how MMT’s token economics model works — including token supply, release mechanisms, incentive allocation, and the role of users in the system. While some details are still being refined, the overall architecture is already quite clear.

Supply, Release, and Lockup Mechanism

The total supply of MMT has not yet been fully disclosed , but it is certain that a considerable portion of it will be used for liquidity incentives .

These token emission mechanisms are designed to attract early liquidity providers, thereby helping the protocol quickly build deeper market liquidity and higher trading volume.

When users lock MMT, they will receive veMMT (voting locked MMT) .

veMMT represents both governance rights and revenue rights . The longer the lock-up period, the higher the voting rights. This design encourages users to participate in the ecosystem long-term rather than short-term speculation.

The main uses of MMT and veMMT

In the Momentum ecosystem, MMT is the core token for governance and incentives , while veMMT is the governance certificate after lock-up. Their main functions include:

– Lock MMT into veMMT to participate in voting and governance ;

- Earn transaction fee dividends through veMMT;

- Accepting “bribes” (i.e., incentives offered to attract votes) from other projects;

– Used for staking, participating in project issuance, or obtaining priority access in Launchpad or ecosystem activities .

According to official information , 100% of transaction fees will be returned to veMMT holders , and the protocol itself will not withdraw any part into the treasury.

Momentum's application scenarios and ecological layout

Momentum's capabilities extend far beyond token swaps. It's designed to become the core hub of the Sui DeFi ecosystem , supporting a variety of financial and governance use cases.

DEX and liquidity provision

At its core, Momentum is a decentralized exchange (DEX) where users can freely trade tokens on the platform and earn rewards by providing liquidity.

Try it now: Momentum Dex (Source: Momentum dApp)

Try it now: Momentum Liquidity (Source: Momentum dApp)

Launchpad and token issuance (to be launched)

Momentum's Launchpad module provides a channel for new projects to issue tokens on Sui. Projects can directly complete token distribution, obtain initial liquidity, and access the platform's trading pool through Momentum.

Vault and Multi-Signature Services

Continuing its security genes from the MSafe stage, Momentum also provides secure vault management, multi-signature wallets, token custody and unlocking services to help teams and DAOs safely manage funds and assets.

Bribery and Governance Market (to be launched)

Other projects can strive for more token release weight by providing incentives to veMMT holders, thereby forming an active market around governance voting.

Cross-chain integration

Momentum has partnered with Wormhole and OKX Wallet to expand support for EVM and Solana assets . This will open up trading and liquidity between different chains, allowing users to experience a wider range of cross-chain DeFi activities on Sui.

Learn more: Momentum × Wormhole cross-chain integration (Source: Momentum dApp)

How to get MMT: A complete guide to participating

If you want to participate in the Momentum (MMT) ecosystem, there are several easy ways to start earning or acquiring tokens.

Earn MMT by providing liquidity and mining

When the token emission mechanism is launched, providing liquidity to Momentum's trading pool will become the main way to obtain MMT.

You can focus on trading pools that have gained higher weight through veMMT voting to maximize your gains.

Lock up MMT and earn veMMT income

After obtaining MMT, you can lock it up and convert it into veMMT .

veMMT gives you governance voting rights, while also providing you with incentives such as transaction fees and “bribes” from other projects.

Locking up also means that your long-term stake in the protocol is more secure.

Participate in the $MMT community subscription event

Momentum is launching the MMT Community Offering on the Buildpad platform , providing real users with the opportunity to obtain fully unlocked tokens in advance.

The goal of this event is to raise US$4.5 million , and all tokens will have no lock-up period and no vesting period .

Users can participate through Buidlpad's HODL activities , WAGMI activities or the normal channel after completing KYC certification .

See more: MMT Community Subscription Event Official Tweet (Source: X)

Buy on DEX or CEX

You can trade or exchange MMT directly on Momentum DEX , or purchase it through mainstream exchanges in the future, such as XT.COM . At the same time, other platforms within the OKX and Coinbase Ventures ecosystems are also expected to be launched simultaneously, providing users with diversified trading portals.

Participate in Launchpad and community activities

Actively participating in Momentum’s Launchpad, governance voting, and community activities will not only earn you additional MMT rewards, but also provide early access to new projects being built on Sui.

Competitive Advantage: What Makes Momentum Different

Momentum stands out in the DeFi space because it combines the innovative features of the Sui blockchain with a proven foundation. It's not just another fork of the ve(3,3) model, but an evolving liquidity ecosystem centered around scalability, fairness, and long-term user benefits.

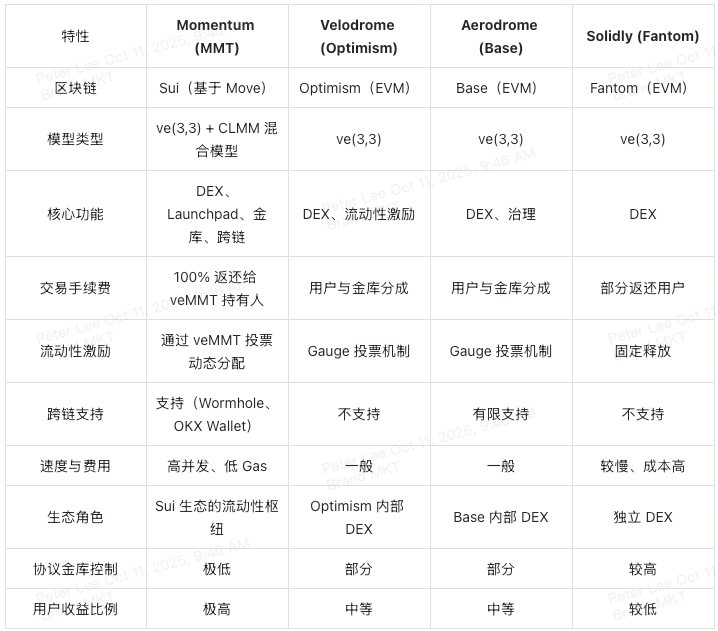

Comparative Analysis: Momentum vs. Other ve(3,3) DEX Protocols

Core conclusions

– Breaking through traditional forks : Momentum not only continues the ve(3,3) model, but also integrates cross-chain functions, vault services and Launchpad modules to form a complete ecological closed loop.

– Speed and cost advantages : Based on Sui’s high-performance architecture, Momentum’s transactions are faster and gas fees are lower, far superior to most EVM protocols.

- User-first token economy : All transaction fees are distributed to veMMT holders, and liquidity rewards are fully owned by LPs, truly maximizing benefits.

– Integrated Ecosystem Positioning : Momentum serves as both a trading and revenue center, as well as a project launch and governance center, providing liquidity infrastructure for the entire Sui DeFi ecosystem.

Overall, Momentum's competitiveness lies in its execution and sustainability . If the ecosystem continues to expand, it has the potential to become a core pillar of DeFi liquidity within the Move ecosystem .

Potential risks and challenges

While Momentum demonstrates strong growth potential, it faces several risks that could impact its long-term development.

Smart contracts and security risks

No protocol is completely immune to attack risks. As Momentum's liquidity and total locked value (TVL) continue to rise, vulnerabilities in its CLMM model, governance mechanism, or fee distribution system may become targets for hacker attacks.

Inflation and Token Supply Pressure

If the token release rate exceeds user demand or the growth of locked-up tokens, the price of MMT may face downward pressure. Finding a balance between incentivizing growth and maintaining value stability is a key challenge facing the protocol.

Concentration of voting rights

If a small number of wallets hold a large amount of veMMT, governance power may be too concentrated, reducing fairness and eroding community trust.

Dependence on Sui Ecosystem

The development of Momentum is closely tied to the growth of the Sui ecosystem. If Sui's user growth or development activity slows, Momentum's user base and transaction volume may also be limited.

Competition and execution risks

Other protocols may copy Momentum's design ideas, and if there are delays in roadmap goals such as cross-chain expansion and RWA (real world asset) integration, it may also affect the market trust of the project.

Looking Ahead: Where Momentum is Heading

Momentum's growth momentum in the DeFi space is already evident. According to DeFiLlama, the protocol's trading volume exceeded $3.4 billion over the past 30 days, generating approximately $24.8 million in annualized fees. Shortly after its beta launch, its total value locked (TVL) exceeded $95 million , a remarkable achievement for a new project entering the Sui ecosystem.

Learn more: Momentum TVL (Source: DeFiLlama)

Looking ahead, the following directions will determine Momentum’s next phase of growth:

– Cross-chain expansion : The team plans to introduce EVM and Solana assets to Sui through Wormhole , allowing mainstream assets such as ETH and SOL to be traded seamlessly on Momentum.

– Real World Asset (RWA) Integration : Momentum intends to introduce tokenized assets such as stocks and commodities, and combine them with compliance and KYC mechanisms to create a more robust asset ecosystem.

– Launchpad Development : By helping new projects raise funds and obtain initial liquidity, Momentum is expected to become the core platform for project issuance on Sui.

– Evolution of the governance mechanism : As more users lock up MMT, governance rights will gradually become decentralized, and veMMT holders will have greater say in parameter adjustments and reward distribution.

If the team can continue to execute efficiently and maintain strong community engagement, Momentum is likely to grow into one of the most critical DeFi infrastructures in the Sui ecosystem , and become an important bridge connecting the broader on-chain ecosystem.

Frequently Asked Questions about Momentum (MMT)

1. What is Momentum (MMT)?

Momentum is a DeFi liquidity engine based on the Sui blockchain , integrating a decentralized exchange (DEX), a yield incentive mechanism, and a voting lock-up governance system based on the ve(3,3) model.

2. What is the difference between Momentum and other DEXs?

Momentum runs on Sui's high-performance architecture and returns 100% of transaction fees to veMMT holders , creating a truly fair, user-driven ecosystem.

3. What is the $MMT community subscription event?

This is a Fair Launch event on the Buidlpad platform , with a goal of raising US$4.5 million . All tokens will be fully unlocked at launch with no lock-up period , allowing real users to participate before institutional investors.

4. How to participate in community subscription?

Users can obtain qualifications through Buidlpad's HODL event or WAGMI event , or participate as an ordinary user after completing KYC real-name authentication between October 22 and 25 .

5. Where can I trade MMT?

You can trade MMT directly on Momentum’s DEX , or purchase it through XT.COM and other major exchanges.

6. What are Momentum’s next plans?

According to the official roadmap, Momentum will promote cross-chain expansion (through Wormhole) , real-world asset (RWA) integration , and further develop the Launchpad platform to attract more projects to settle in the Sui ecosystem.

Quick Links

- XT Labs leads the way: RWA Global Investment Banking Alliance kicks off in Hong Kong, Bitcoin Asia 2025 witnesses XT Smart Chain driving global assets onto the blockchain

- XT.COM Fully Upgraded | Explore Encryption and Reach New Heights of Trusted Trading

- How to invest 100,000 USDT? XT Easy Earn helps you achieve a steady 10%+ passive income.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, over 1 million monthly active users, and over 40 million users within its ecosystem. We are a comprehensive trading platform supporting over 1,000 high-quality cryptocurrencies and over 1,300 trading pairs. The XT.COM cryptocurrency trading platform offers a wide range of trading options, including spot trading , leveraged trading , and futures trading . XT.COM also operates a secure and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

- 核心观点:Momentum是Sui生态核心DeFi流动性协议。

- 关键要素:

- 采用ve(3,3)模型绑定长期利益。

- 基于Sui高性能架构实现低费用。

- 450万美元社区认购无锁仓代币。

- 市场影响:推动Sui生态流动性增长。

- 时效性标注:中期影响