A true “alt season” is unfolding in the crypto stock market

- 核心观点:山寨币季已在加密股票市场展开。

- 关键要素:

- 机构资本涌入加密股票。

- 加密股票涨幅远超主流代币。

- 股票市场对机构更熟悉合规。

- 市场影响:推动加密股票轮动上涨。

- 时效性标注:中期影响

Originally Posted by Alana Levin

Original translation: TechFlow

Many people have raised questions about whether this crypto cycle will usher in an "Alt Season." Some are looking to January 2024 or 2025, expecting non-Bitcoin crypto assets (altcoins) to appreciate significantly, perhaps even reaching new all-time highs.

In past cycles, significant Bitcoin price increases often triggered similar performance in many long-tail crypto assets, sometimes even outperforming Bitcoin. However, this pattern does not appear to have repeated itself in the past few years. Currently, Bitcoin's market share has reached 58%, and has been steadily rising since November 2022.

So, will this cycle skip the “altcoin season”? Or has the “altcoin season” not yet arrived? Or…or…is the “altcoin season” already quietly unfolding in a completely different market, and we haven’t noticed it?

My hunch is that the latter scenario is the case. A true “altcoin season” is underway in the crypto stock market.

What are the typical characteristics of an “altcoin season”?

- Rising prices attract new capital → the question is, where does this new capital come from?

- Rising prices lead to profit rotation → the question is, who is profiting and where are the profits being redeployed?

While new capital is certainly looking to enter the crypto space, it's coming more from institutional investors than retail investors. While retail investors tend to be quick early adopters, institutional investors are more cautious and often require external validation of legitimacy as a catalyst. And this validation is already happening: in 2024, the US Securities and Exchange Commission (SEC) approved Bitcoin and Ethereum spot exchange-traded funds (Spot ETFs); SEC Chairman Atkin recently announced "Project Crypto"; and Nasdaq CEO Adena Friedman has publicly endorsed the tokenization of equities. The list goes on.

Institutional investors are pouring in with fresh capital, and I suspect much of this capital is being channeled into crypto stocks rather than crypto assets. The stock market is more familiar and accessible to institutions. Institutional investors already have well-established operational systems (including custody, compliance processes, dealer relationships, etc.), while directly purchasing crypto assets may require entirely new capabilities. Furthermore, while purchasing stocks falls within their remit, directly purchasing crypto tokens (especially long-tail assets) may be beyond their scope.

As a result, institutions are pouring money into crypto stocks or crypto-related stocks. For example:

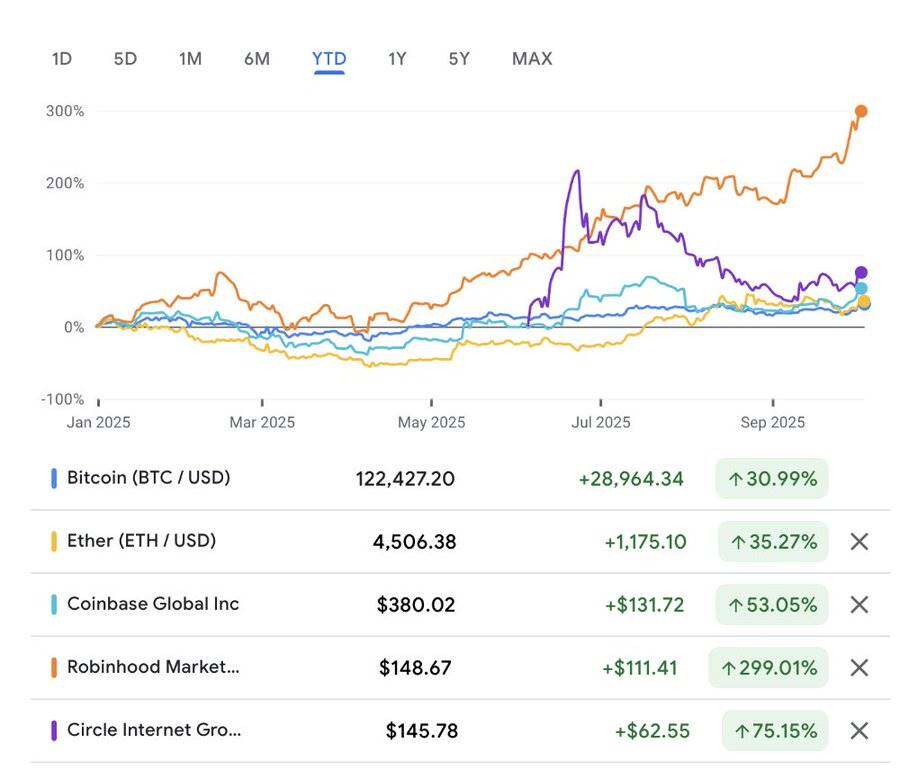

- Coinbase is up 53% year-to-date;

- Robinhood rose 299%;

- Galaxy rose 100%;

- Circle is up 368% since its June IPO (or 75% based on its first day of trading close).

In comparison, Bitcoin rose 31%, Ethereum rose 35%, and Solana rose 21%. Crypto stocks have clearly outperformed.

If we look at Bitcoin’s performance since its bottom on December 17, 2022, the situation is similar.

There is reason to believe this trend will continue. A flurry of crypto-stock IPOs are planned, and more late-stage companies may file to go public in the coming years.

As is typical with altcoin seasons, not all assets will perform well. I expect some rotation, as traders take profits from overvalued assets (such as CRCL, which currently trades at 26x P/S) and redeploy capital into other assets.

In the crypto market, we often see a rotation of different hot spots. For example, the market may shift from DeFi assets to gaming tokens and then to AI-related tokens. The crypto stock market may also experience a similar trend. An "altcoin season" may see funds shift from stablecoin-related stocks to exchange stocks and then to digital asset reserve companies (or other trends).

I believe the crypto stock altcoin season may end up looking more like a historic altcoin season than any future altcoin season in the crypto-native markets for a number of reasons:

- Asset concentration. Currently, only a handful of stocks offer cryptocurrency investments. This is similar to past cryptocurrency cycles, when buyers likely found fewer than 100 tokens attractive. It's worth noting that this is in stark contrast to today's native cryptocurrency market, which boasts millions of tokens and, therefore, a more dispersed distribution of assets.

- Leverage. Many crypto-native lending platforms collapsed in the last cycle, and we haven't seen them rebuild. However, stock investors can use leverage, which means market booms can be more significant (but crashes can also be more severe).

We may see an "altcoin season" for crypto-native assets in the future. However, this will take time, as new marginal capital sources will need to gradually build up the operational capabilities to support their investment in crypto assets.

So, for now, this may not be the altcoin season many were expecting — but we are in it nonetheless.