From Trump's rise to fame to the market manipulation scandal, can Meteora be reborn through TGE?

- 核心观点:Meteora即将发币但深陷市场操纵丑闻。

- 关键要素:

- 联创Ben因操纵Meme币价格丑闻辞职。

- MET代币48%在TGE时直接解锁分配。

- 项目从Mercurial转型后TVL曾达16亿美元。

- 市场影响:引发对Solana生态Meme币监管担忧。

- 时效性标注:短期影响

Original title: Lianchuang is accused of market manipulation, and the most controversial DEX on Solana is about to hold a TGE.

Original author: Eric, Foresight News

Solana DEX Meteora, which plans to officially launch the MET token on the 23rd of this month, announced its token economics during the National Day holiday and named the plan "Phoenix Nirvana."

According to the MET token economics, 20% will be distributed to Mercurial stakeholders; 15% will be distributed to Meteora users through the LP incentive program; 2% will be distributed to off-chain contributors, those who contribute to Meteora's development; 3% will be distributed to the Launchpad and Launchpool ecosystems; 3% will be distributed to the Jupiter staking incentive program; 3% will be distributed to centralized exchanges, market makers, etc.; and 2% will be distributed to M3M3 stakeholders. In addition, 18% of MET will be allocated to the team, and 34% will be held as Meteora reserves, both of which will be vested linearly over 6 years.

Overall, 48% of the tokens will be distributed and unlocked directly during the TGE. However, MET will not be distributed through a conventional airdrop. Instead, 10% of the tokens will be distributed to users as liquidity positions. According to Meteora, this mechanism eliminates the need for project owners to provide additional tokens for initial liquidity, while still allowing users to earn transaction fees.

What many people don't know is that Meteora's development has been incredibly eventful, and it's fair to say the project itself has experienced a resurgence. To understand the story behind this and understand the meaning of Mercurial and M3 in the token distribution plan, we need to start from the beginning.

From "Princelings" to "Prisoners"

Meteora's predecessor, Mercurial Finance, was founded in 2021 as a stablecoin asset management protocol for the Solana ecosystem. It's worth noting that the Mercurial founding team also developed Jupiter, the current dominant protocol in the Solana DEX space. Ben Zhow, one of the co-founders of both, is a product designer by training. He previously led user experience and product development at design consultancies IDEO and AKQA, and later co-founded social apps Friended and WishWell. The other anonymous founder, known as meow, has served as an advisor to numerous DeFi/wallet projects, including Instadapp, Fluid, Kyber, and Blockfolio, and was an early contributor to the decentralized domain name protocol Handshake.

Mercurial's core mission is to build a platform focused on providing low slippage for on-chain stablecoin transactions and high returns for liquidity providers (LPs). To reduce slippage, Mercurial doesn't require LPs to maintain a 1:1 token ratio when providing liquidity. This flexible configuration allows LPs to arbitrage by adding unilateral liquidity after large trades, thereby reducing slippage on subsequent trades. Furthermore, Mercurial utilizes a specialized price curve to concentrate liquidity within a desired range. If a user's trade falls outside this range, they will receive less liquidity.

To increase returns, Mercurial employs a dynamic fee mechanism. Simply put, when trading is active, Mercurial increases transaction fees to reduce LPs' impermanent loss; when trading is slow, Mercurial reduces transaction fees to stimulate trading. Furthermore, with DAO approval, Mercurial deploys assets within the pool to external protocols, such as lending, to further increase LP returns.

In the DeFi boom of 2021, protocols like Mercurial, aiming to become the Curve on Solana, were highly sought after. They secured early investments from Alameda Research, Solana Ecosystem Fund, OKEx (now OKX), and Huobi, and also conducted an Initial Exchange Offering (IEO) on FTX. At the time, FTX founder Sam Bankman-Fried personally endorsed the project, stating, "The team's strong technical, research, and operational capabilities demonstrate Solana's appeal. We look forward to working with them to enhance the liquidity and usability of the Solana platform."

At Mercurial's peak in early August 2021, its TVL accounted for nearly 10% of Solana's overall TVL. Even at the end of 2021, when Solana's TVL almost exceeded 10 billion US dollars, Mercurial's TVL still accounted for more than 2%. Although it may not be called a mainstay, it is also one of the important DeFi infrastructures on Solana.

The rest of the story is well known. The Solana ecosystem was completely slammed by the 2022 bear market, and its performance plummeted with the collapse of FTX. Mercurial, also severely damaged by its close relationship with FTX, saw its TVL plummet and remain sluggish. In October 2023, its TVL briefly dipped below $10 million, less than 5% of its peak. Similar stories have occurred with many now-defunct DeFi projects, but Mercurial's story doesn't end there.

Transformed to focus on DEX and became famous due to Trump

On December 27, 2022, Mercurial published an article on Medium announcing the Meteora plan, including launching Dynamic Vaults and AMM under the Meteora platform, launching new tokens to replace the original MER, completing brand transformation and transitioning to Meteora.org.

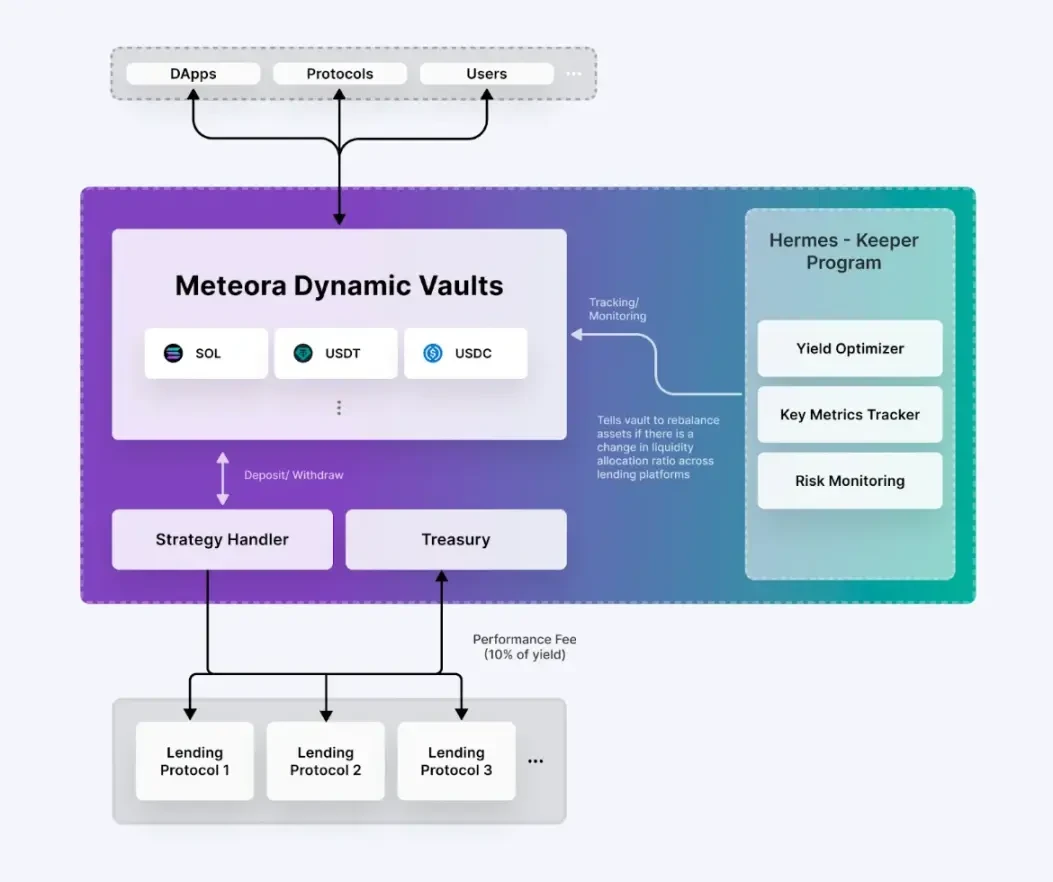

At the time, Mercurial was focused on Dynamic Vaults, hoping to establish Meteora as a yield layer on Solana. The team envisioned Meteora as a new platform comprised of Dynamic Vaults, AMM pools, and Guardians, who would monitor and rebalance vault assets across various lending protocols every few minutes to maximize returns for limited partners.

In February 2023, the new platform Meteora officially launched. However, as mentioned above, the TVL hit its lowest point in October of that year. Meteora's "change of identity" didn't help it escape the shadows. After 10 months of uncertainty, a turnaround occurred at the end of 2023.

In early December of that year, Meteora announced that it would implement a liquidity incentive plan starting on January 1, 2024, allocating 10% of new tokens to users who provide liquidity. The incentives would not only include stablecoin liquidity pools, but also liquidity pools for non-stablecoin assets. It was precisely from this moment that Meteora's strategic focus shifted to DEX, and its TVL rose from less than US$20 million before December to more than US$50 million.

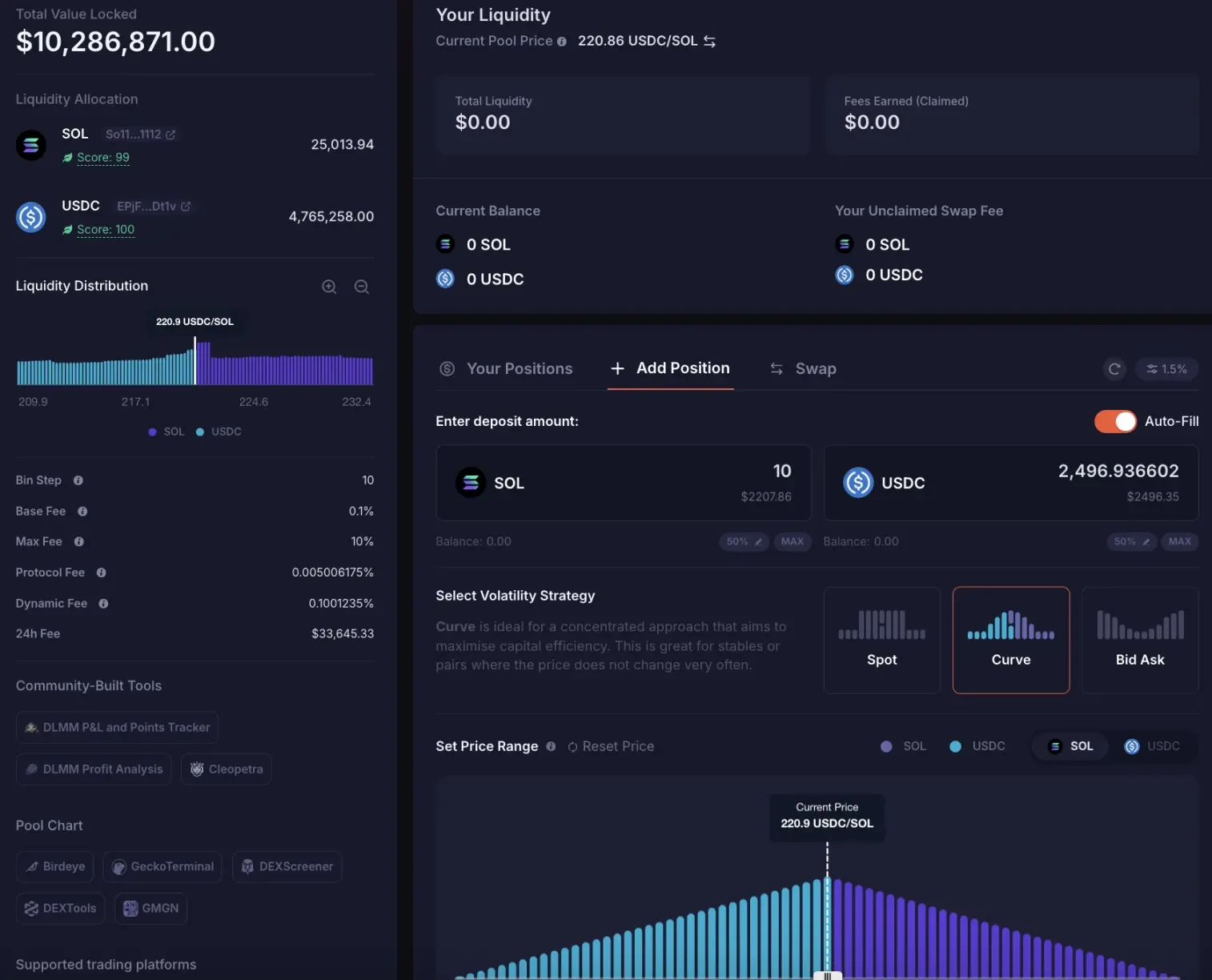

Launched alongside the incentive program is a new AMM model, DLMM (Dynamic Liquidity Market Maker), inspired by Trader Joe's. Simply put, in this new AMM model, liquidity is not continuous but instead segmented into "bins." Each bin represents a fixed price. Until the liquidity in that bin is exhausted, the price of the asset traded through Meteora remains constant with zero slippage.

For example, suppose the current price of SOL is $200 and there are two SOL/USDC liquidity bins on Meteora, with prices of 200 USDC and 201 USDC respectively. Suppose at a certain moment, the market price of SOL rises from $200 to $201, but there are still 10 SOLs remaining in the SOL liquidity at 200 USDC on Meteora that have not been traded. At this time, the execution price for buying 10 or less SOLs through Meteora will still be 200 USDC. Only when the total purchase volume exceeds 10 SOLs will the liquidity move to the liquidity bin at 201 USDC.

For users, there are three ways to add liquidity: Spot, Curve, and Bid Ask. Both Spot and Curve distribute added liquidity evenly, but the former uses a linear average, while the latter uses a curve average. Bid Ask mode allows for unilateral addition of liquidity, for example, adding only SOL or USDC liquidity to the SOL/USDC pool.

Despite introducing a new mechanism, Meteora didn't abandon its existing AMM+ yield aggregator product, instead renaming it DAMM v1 and retaining it within the protocol. Vault, which once had a meager value of only a few million dollars at its low point, now boasts over $90 million in TVL at the time of writing. Meteora subsequently launched DAMM v2, independent of v1. This AMM mechanism is characterized by its high degree of customization, providing new token projects with various tools, such as native liquidity mining and one-sided liquidity, for early value discovery. Meteora's diverse liquidity options have made it a popular choice for many new projects establishing initial liquidity, and the Launchpad and Launchpool ecosystems, which have been allocated 3% of Meteora's tokens, represent this area of activity.

This combination of measures, while not a complete turnaround, stabilized Meteora's position. Meteora began to gain ground in the Solana DEX competition. While its TVL continued to fluctuate between $200 million and $300 million, its trading volume and share of the total DEX trading volume on Solana gradually increased. A year after the transition, in January 2025, the introduction of the Trump token further propelled Meteora's development.

At the time, the Trump team selected Jupiter, Meteora, and Moonshot as partners. On the evening of January 17th and the morning of the 18th, the Trump token issuance team established initial liquidity for Trump on Meteora, sparking a multi-day frenzy. According to DefiLlama data, Meteora's trading volume reached $7.6 billion on the 18th, while Solana's total DEX trading volume that day was $37.945 billion. Meteora, thanks to Trump, accounted for 20% of that total trading volume. By the 20th, Meteora's TVL reached $1.688 billion, accounting for 14.7% of Solana's TVL that day. Three days earlier, this figure had been less than $470 million.

After this battle, Meteora's reputation soared. As two projects with the same founding team, Jupiter maintained its position as the Solana aggregator and widened its moat. Meteora also gained the ability to compete with Raydium and Orca. Coupled with the tens of millions of dollars in transaction fees earned by Trump, Meteora and Jupiter have achieved both fame and fortune.

Lianchuang resigns amid market manipulation scandal

The financial impact of Trump's presidency inexplicably sparked a "celebrity meme token craze," including the Melania token issued in Trump's wife's name and the Libra token promoted by Argentinian President Milley through Twitter. However, unlike the wealth effect brought about by Trump, these tokens experienced a brief surge followed by a sustained decline, causing significant losses for many investors. In particular, after the Libra flop, Milley vehemently denied that he had any involvement in the token's issuance, stating that he had merely retweeted relevant information. This led to the emergence of Hayden Davis, the true creator of Libra, and Kelsier Ventures, of which he serves as CEO.

DefiTuna founder Moty later revealed that Meteora and Kelsier Ventures were behind the scheme, with the involvement of far more tokens than just MELANIA and LIBRA. Kelsier profited by manipulating the price of Meme tokens listed on the Meme Token Launchpad M3M3 (Meteora claims it is a community-run platform), including later MELANIA and LIBRA, raking in a total profit of $200 million.

Meteora co-founder Ben clarified his relationship with Kelsier Ventures, stating that he only asked Kelsier if it would issue tokens on the platform to aid in testing when M3 launched. Ben stated that Kelsier Ventures "appeared trustworthy" during this collaboration, leading him to recommend it to the MELANIA team. During the launch of both MELANIA and LIBRA, Meteora and he only provided technical support and did not manipulate prices.

But the day after Ben's clarification, Moty released a video that essentially confirmed Meteora's collusion with Kelsier Ventures to manipulate the price of a large number of Meme tokens. Ben resigned under pressure. Meow, another co-founder of Meteora, also posted on X, expressing confidence that the Meteora team and Ben had not engaged in insider trading or market manipulation, and announced that they would hire the law firm Fenwick & West to investigate the matter and issue a report. However, the market did not buy into this statement, primarily because the lawyer was formerly the general counsel of FTX and was indicted for allegedly assisting FTX in fraud.

In his clarification, Ben also mentioned that Kelsier Ventures independently launched the M3M3 token during the testing of the M3M3 platform. However, Meteora subsequently redesigned the token economics and provided funding to the so-called community to continue operating M3M3. However, the M3M3 token experienced a brief surge followed by a continuous decline. In April, Burwick Law and Hoppin Grinsell LPP assisted investors in filing a class action lawsuit against Meteora and its founders, accusing them of manipulating the issuance and price of the M3M3 token, resulting in a total loss of $69 million.

Burwick Law filed lawsuits in March, alleging that Meteora and Kelsier Ventures participated in the LIBRA issuance, causing investors to suffer substantial losses. No further information has been released on these two lawsuits.

Many believe Trump's launch signaled the death knell for Solana's Meme tokens, but it was actually the Meteora scandals that soothed the market and made investors hesitate. Even now, trading in Solana's Meme tokens isn't exactly quiet, but it's certainly not as frenzied as it was during the initial frenzy.

MET is nearly two years late

The first mention of issuing a new token dates back to December 2023 when Mercurial first announced plans to rebrand as Meteora. In the past two years, Meteora has stated more than once that the token will be launched, but there has been no follow-up. This time, the token of the "difficult birth" project finally has a destination.

This difficult launch is understandable. On the one hand, Meteora was prioritizing growth and expansion during its initial transition, and a hasty token launch could have been counterproductive. On the other hand, Meteora needed to consider the needs of early Mercurial token holders, participants in early liquidity incentives, the large number of new users following the launch of the Trump token, and those who suffered significant losses from holding M3M3 tokens. The decision on how to divide the tokens and the appropriate allocations for each group warranted careful consideration.

It now seems that Meteora has found a solution to the token issue, but the controversy surrounding the project still exists, and issuing tokens may just be the beginning of a new journey for the team.