When banks join the stablecoin war: The twilight of the duopoly era and the reshuffle of the $100 billion market

- 核心观点:稳定币市场双寡头垄断格局正被打破。

- 关键要素:

- 中介机构自主发行稳定币成本降低。

- 新兴稳定币普遍聚焦收益分成机制。

- 银行获准入场将改变竞争格局。

- 市场影响:推动稳定币多元化,挤压现有巨头份额。

- 时效性标注:中期影响。

Original author: Nic Carter

Original translation: Saoirse, Foresight News

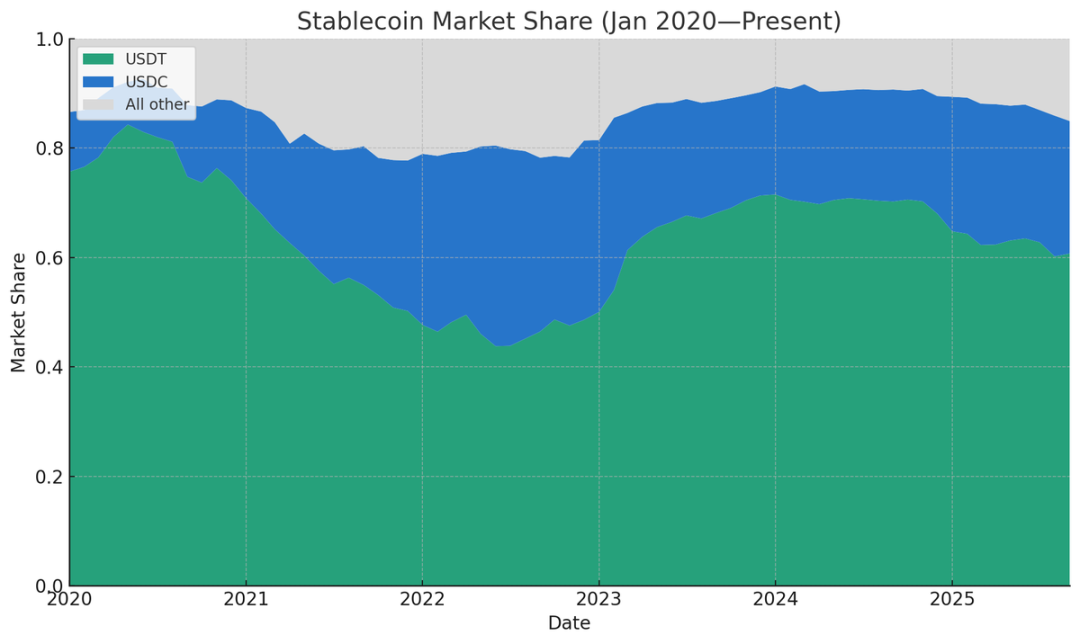

Circle's equity valuation stands at $30.5 billion. Tether's parent company (issuer of USDT) is reportedly seeking funding at a $500 billion valuation. Currently, the combined supply of these two major stablecoins stands at $245 billion, representing approximately 85% of the entire stablecoin market. Since the inception of the stablecoin industry, only Tether and Circle have consistently maintained a significant market share, leaving other competitors struggling to match their position.

- Dai’s market capitalization peaked at just $10 billion in early 2022;

- Terra's UST soared to $18 billion in May 2022, but its market share was only about 10%, and it was only a flash in the pan and eventually collapsed;

- The most ambitious challenger is BUSD issued by Binance, which reached a peak market capitalization of US$23 billion (15% of the market) at the end of 2022, but was subsequently forced to shut down by the New York Department of Financial Services (NYDFS).

Stablecoin relative supply share (data source: Artemis)

The lowest record of Tether and Circle's market share I could find was 77.71% in December 2021—at that time, Binance USD, DAI, FRAX, and PAX had a considerable combined market share. (If we trace back to before Tether's creation, its market share naturally did not exist, but Bitshares, Nubits, and other mainstream stablecoins that preceded Tether have not survived to this day.)

The market dominance of these two giants peaked in March 2024, with a combined 91.6% of the total stablecoin supply, but has since declined steadily. (Note: Market share is calculated based on supply because it is easier to measure; if calculated based on transaction value, number of trading pairs, real-world payment volume, number of active addresses, etc., the share would undoubtedly be higher.) As of now, the market share of the two giants has fallen to 86% from its peak last year, and I believe this trend will continue. The reasons behind this include the increased willingness of intermediaries to issue their own stablecoins, the intensified "race to the bottom" in stablecoin returns, and the new regulatory environment following the introduction of the GENIUS Act.

Intermediaries have independently issued stablecoins

In the past, issuing a "white-label stablecoin" (a customized stablecoin based on an existing technical framework) not only required high fixed costs but also reliance on Paxos (a regulated fintech company). This has completely changed: Available issuing partners include Anchorage, Brale, M0, Agora, and Stripe's Bridge. Several small, seed-stage startups in our portfolio have successfully launched their own stablecoins through Bridge—you don't need to be a giant to enter the stablecoin issuance market.

In his article on “Open Issuance,” Bridge co-founder Zach Abrams explained the rationale for self-issuing stablecoins:

For example, if you were to build a new type of bank using an existing stablecoin, you would face three major problems:

a) Failure to earn sufficient returns to build a quality savings account;

b) The reserve asset portfolio cannot be customized, making it difficult to balance liquidity improvement with income growth;

c) When withdrawing your own funds, you will also need to pay a redemption fee of 10 basis points (0.1%)!

His point is quite pertinent. Using Tether creates little to no returns that can be passed on to customers (while customers generally expect a certain return when depositing funds). Using USDC, while returns are possible, these must be negotiated with Circle, which takes a percentage of the profits. Furthermore, using third-party stablecoins comes with numerous limitations: You can't independently determine freezing/seizure policies, you can't choose the blockchain network on which the stablecoin is deployed, and redemption fees can rise at any time.

I once believed that network effects would dominate the stablecoin industry, ultimately leaving only one or two major stablecoins. However, my view has changed: cross-chain swaps are becoming increasingly efficient, and swapping between different stablecoins within the same blockchain is becoming increasingly convenient. Within the next year or two, many cryptocurrency intermediaries may display user deposits as generic "dollars" or "dollar tokens" (rather than explicitly labeling them as USDC or USDT), guaranteeing redemption into any stablecoin of their choice.

Currently, many fintech companies and new banks have adopted this model - they prioritize product experience rather than adhering to the traditions of the cryptocurrency industry, so they directly display user balances in "US dollars" and manage reserve assets themselves on the back end.

For intermediaries (whether exchanges, fintech companies, wallet providers, or DeFi protocols), there's a strong incentive to shift user funds from mainstream stablecoins to their own stablecoins. The reason is simple: if a cryptocurrency exchange holds $500 million in USDT deposits, Tether can earn approximately $35 million annually from this "float," while the exchange receives nothing. There are three ways to convert this "idle capital" into revenue:

- Requesting stablecoin issuers to share some of their revenue (e.g. Circle shares revenue with partners through a rewards program, but as far as I know, Tether does not distribute revenue to intermediaries);

- Collaborate with emerging stablecoins (such as USDG, AUSD, and USDe issued by Ethena), which have their own revenue sharing mechanisms;

- Independently issue stablecoins and internalize all profits.

For example, if an exchange wants to persuade users to switch from USDT to its own stablecoin, the most direct strategy is to launch a "yield plan"—for example, paying users a profit based on the US Treasury bond rate and retaining 50 basis points (0.5%) of the profit. For fintech products serving non-cryptocurrency native users, a yield plan isn't even necessary: users can simply display their balances in US dollars, automatically convert funds to their own stablecoin, and then withdraw them to Tether or USDC as needed.

At present, such trends have gradually emerged:

- Fintech startups generally adopt the "universal dollar display + back-end reserve management" model;

- Exchanges actively enter into revenue-sharing agreements with stablecoin issuers (e.g., Ethena successfully promoted its USDe on multiple exchanges through this strategy);

- Some exchanges have joined forces to form stablecoin alliances, such as the Global Dollar Alliance, whose members include Paxos, Robinhood, Kraken, Anchorage, etc.

- DeFi protocols are also exploring their own stablecoins. The most typical example is Hyperliquid (a decentralized exchange): it selects stablecoin issuance partners through public bidding, with the clear goal of reducing dependence on USDC and obtaining reserve asset returns. Hyperliquid received bids from multiple institutions including Native Markets, Paxos, and Frax, and ultimately chose Native Markets (a decision that is controversial). Currently, the USDC balance on Hyperliquid is approximately US$5.5 billion, accounting for 7.8% of the total USDC supply. Although the USDH issued by Hyperliquid cannot replace USDC in the short term, this public bidding process has damaged USDC's market image, and more DeFi protocols may follow suit in the future.

- Wallet providers are also jumping on the bandwagon. For example, Phantom (the leading wallet in the Solana ecosystem) recently announced the launch of Phantom Cash, a Bridge-issued stablecoin with built-in earning and debit card payment capabilities. While Phantom cannot force users to use the stablecoin, it can offer various incentives to encourage migration.

In summary, with the decline in fixed costs of stablecoin issuance and the widespread adoption of revenue-sharing partnerships, intermediaries no longer need to cede float profits to third-party stablecoin issuers. As long as the scale and reputation of the issuer are large enough to gain user trust in their white-label stablecoins, self-issuance becomes the optimal option.

The “race to the bottom” for stablecoin returns intensifies

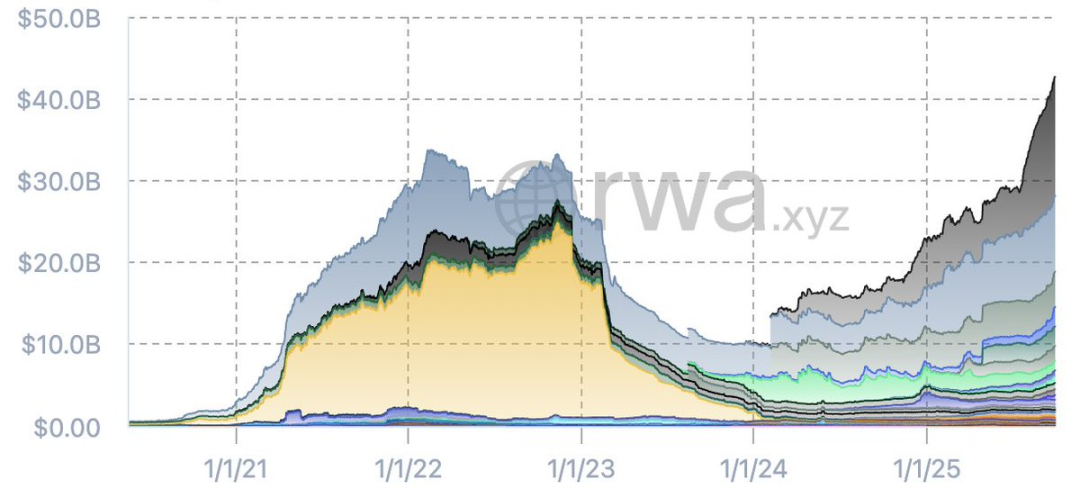

If we look at the stablecoin supply chart excluding Tether and USDC, we'll see that the market landscape for "other stablecoins" has shifted significantly in recent months. 2022 saw the emergence of a number of short-lived popular stablecoins (such as Binance BUSD and Terra UST). However, with the collapse of Terra and the outbreak of the credit crisis, the industry underwent a shakeout, and a new wave of stablecoins emerged from the ashes.

Stablecoin supply excluding USDT and USDC (Source: RWA.xyz)

Currently, the total supply of non-Tether/Circle stablecoins has reached a record high, and issuers are more dispersed. The mainstream emerging stablecoins in the market include:

- Sky (MakerDAO’s upgraded version of Dai);

- USDe issued by Ethena;

- PYUSD issued by Paypal;

- USD 1 issued by World Liberty.

In addition, emerging stablecoins such as Ondo's USDY, USDG issued by Paxos (as a member of the alliance), and Agora's AUSD are also worth keeping an eye on. In the future, bank-issued stablecoins will also enter the market. Existing data already illustrates the trend: compared to the previous stablecoin boom, there are more trusted stablecoins in the market today, and the total supply has also exceeded that of the previous bull market—even though Tether and Circle still dominate market share and liquidity.

These new stablecoins share a common characteristic: a widespread focus on "revenue transmission." For example, Ethena's USDe generates returns through cryptocurrency basis trading and passes a portion of these returns on to users. Its supply has soared to $14.7 billion, making it the most successful emerging stablecoin this year. Additionally, Ondo's USDY, Maker's SUSD, Paxos' USDG, and Agora's AUSD all incorporated revenue-sharing mechanisms from the outset.

Some may question whether the GENIUS Act prohibits stablecoins from offering yields. While this is true to some extent, recent exaggerated statements from banking lobbyists indicate that the issue remains unresolved. In fact, the GENIUS Act does not prohibit third-party platforms or intermediaries from paying rewards to stablecoin holders—and these rewards are funded by the yields paid by issuers to intermediaries. From a mechanistic perspective, this loophole cannot be closed through policy text, nor should it be.

With the advancement and implementation of the GENIUS Act, I've noticed a trend: the stablecoin industry is shifting from "paying returns directly to holders" to "passing returns through intermediaries." For example, Circle's partnership with Coinbase is a prime example—Circle pays returns to Coinbase, which in turn passes a portion of these returns on to users holding USDC. This model shows no signs of stopping. Almost all new stablecoins have built-in return strategies, and the logic behind this is easy to understand: if you want to convince users to switch from the highly liquid and market-recognized Tether to a new stablecoin, you must provide a compelling reason (returns being the core attraction).

I predicted this trend at the TOKEN 2049 Global Cryptocurrency Summit in 2023. Although the introduction of the GENIUS Act has delayed the timetable, this trend is now clearly evident.

For the less flexible incumbents (Tether and Circle), this "yield-driven" competitive landscape is undoubtedly disadvantageous: Tether offers no yield at all, and Circle only has revenue-sharing partnerships with a few institutions like Coinbase, with unclear partnerships with other institutions. In the future, emerging startups may squeeze the market share of mainstream stablecoins by offering higher revenue shares, creating a "race to the bottom" (essentially a "race to the ceiling"). This landscape may favor institutions with scale advantages—just as the ETF industry experienced a "race to zero" in fees, ultimately creating a duopoly between Vanguard and BlackRock. But the question is: if banks eventually enter the game, can Tether and Circle still emerge victorious?

Banks can now officially participate in stablecoin business

Following the passage of the GENIUS Act, the Federal Reserve and other major financial regulators adjusted relevant rules. Banks can now issue stablecoins and conduct related business without applying for new licenses. However, under the GENIUS Act, bank-issued stablecoins must comply with the following rules:

- 100% collateralized by Highly Liquid High-Quality Assets (HQLA);

- Support 1:1 on-demand conversion to fiat currency;

- Fulfilling information disclosure and audit obligations;

- Accept supervision from relevant regulatory authorities.

At the same time, stablecoins issued by banks are not considered "deposits protected by federal deposit insurance", and banks are not allowed to use the collateral assets of stablecoins for lending.

When banks ask me whether they should issue a stablecoin, my advice is usually “don’t bother”—just integrate existing stablecoins into core banking infrastructure, without issuing them directly. Even so, there are still banks or banking consortiums that might consider issuing stablecoins, and I believe such cases will emerge in the coming years. Here’s why:

- Although stablecoins are essentially “narrow banking” (only accepting deposits, not lending), which may reduce bank leverage, the stablecoin ecosystem can bring multiple revenue opportunities, such as custody fees, transaction fees, redemption fees, API integration service fees, etc.

- If banks find themselves losing deposits to stablecoins (especially those that offer returns through intermediaries), they may issue their own stablecoins to stem the tide;

- For banks, issuing stablecoins is relatively inexpensive: they don't need to hold regulatory capital for stablecoins, and they are considered "fully-funded, off-balance-sheet liabilities," making them less capital-intensive than ordinary deposits. Some banks may consider entering the tokenized money market fund sector, especially given Tether's continued profitability.

In an extreme scenario, if the stablecoin industry completely bans revenue sharing and all loopholes are closed, issuers would gain a quasi-money-printing power—for example, collecting a 4% asset yield without paying any returns to users, which could even surpass the net interest margin of a high-yield savings account. However, in reality, I believe these yield loopholes will remain, and issuers' profit margins will gradually decline over time. Even so, for large banks, converting some deposits into stablecoins, even retaining a profit of 50-100 basis points (0.5%-1%), would still generate significant revenue—after all, large banks hold trillions of dollars in deposits.

In summary, I believe banks will eventually join the stablecoin industry as issuers. Earlier this year, the Wall Street Journal reported that JPMorgan Chase (JPM), Bank of America (BOFA), Citigroup (Citi), and Wells Fargo (WFC) had entered preliminary discussions about forming a stablecoin alliance. For banks, the alliance model is undoubtedly the best option—it's difficult for a single bank to build a distribution network capable of competing with Tether, and an alliance can pool resources and enhance market competitiveness.

Conclusion

I once firmly believed that the stablecoin industry would ultimately be reduced to one or two mainstream products, and no more than six at most, repeatedly emphasizing that "network effects and liquidity are king." But now I'm beginning to reflect: Can stablecoins truly benefit from network effects? Unlike businesses like Meta, X (formerly Twitter), and Uber, which rely on user scale, it's the blockchain, not the stablecoin itself, that truly constitutes the "network." If users can transfer in and out of stablecoins frictionlessly, and cross-chain swaps are convenient and low-cost, the importance of network effects will be greatly reduced. When the cost of exit approaches zero, users will not be forced to be tied to a single stablecoin.

It's undeniable that mainstream stablecoins, particularly Tether, still have a core advantage: their incredibly tight spreads (the difference between the bid and ask price) against major foreign exchange pairs across hundreds of exchanges worldwide, a feature that's difficult to surpass. However, a growing number of service providers are now using "wholesale foreign exchange rates" (i.e., inter-institutional exchange rates) to convert stablecoins into local fiat currencies, both on and off exchanges. As long as the stablecoin is trustworthy, these providers don't care which currency is used. The GENIUS Act has played a significant role in regulating stablecoin compliance, and the maturing infrastructure has benefited the entire industry, with the exception of the incumbent giants (Tether and Circle).

The combined effect of multiple factors is gradually breaking the duopoly of Tether and Circle: cross-chain swaps are more convenient, intra-chain stablecoin swaps are almost free, clearing houses support cross-stablecoin/cross-blockchain transactions, and the GENIUS Act promotes the homogenization of US stablecoins - these changes reduce the risk of infrastructure providers holding non-mainstream stablecoins and promote stablecoins towards "substitutability", which is of no benefit to existing giants.

Today, the emergence of a large number of white-label issuers has reduced the cost of issuing stablecoins; non-zero government bond yields have stimulated intermediaries to internalize float returns, squeezing out Tether and Circle; fintech wallets and new banks have taken the lead in implementing this trend, followed by exchanges and DeFi protocols - every intermediary is keeping an eye on user funds, thinking about how to convert them into their own income.

While the GENIUS Act restricts stablecoins from directly providing yield, it doesn't completely block the path for yield transmission, creating room for competition among emerging stablecoins. If this yield loophole persists, a race to the bottom in terms of revenue sharing will be inevitable. If Tether and Circle are slow to respond, their market positions could be weakened.

Furthermore, we must not overlook the "over-the-counter giants"—financial institutions with trillions of dollars in balance sheets. They are closely monitoring whether stablecoins will trigger a run on deposits and how to respond. The GENIUS Act and regulatory adjustments have opened the door for banks to enter the market. Once banks officially participate, the current total stablecoin market capitalization of approximately $300 billion will pale in comparison. The stablecoin industry has only been around for 10 years, and the real competition has only just begun.