The Way of Value Circulation: On the Destruction and Redistribution Strategies in Cryptocurrency

- 核心观点:资产再分配优于销毁以增强系统安全。

- 关键要素:

- 再分配补偿受害者并保留系统价值。

- 销毁削减资产会降低系统安全性。

- 再分配激励诚实行为并解锁新场景。

- 市场影响:推动协议设计优化激励机制。

- 时效性标注:中期影响。

Original author: Pavel

Original translation: TechFlow

summary

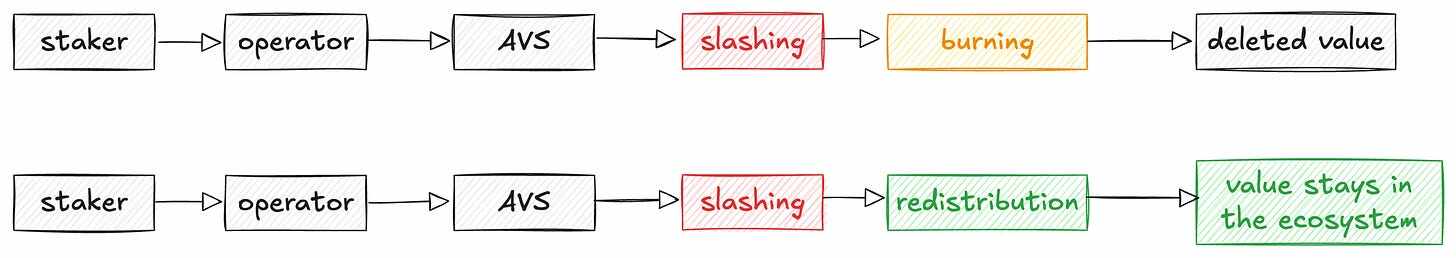

We are exploring whether it is better to destroy or redistribute assets in order to maintain system health and rational incentive mechanisms.

- When slashing is the initial stage of punishing malicious behavior , reallocating assets is often more efficient than simple destruction.

- When destruction is a core feature of the design and does not involve slashing (such as in a deflationary economic model) , there is no reason to implement redistribution.

- When reallocation is a core feature of the design but behaves like a bug , destruction should not be used as a replacement; the design needs to be fundamentally improved.

definition

Many people seem confused and think that when a token is slashed, the stake that was slashed is automatically destroyed, resulting in a decrease in supply. This is not the case.

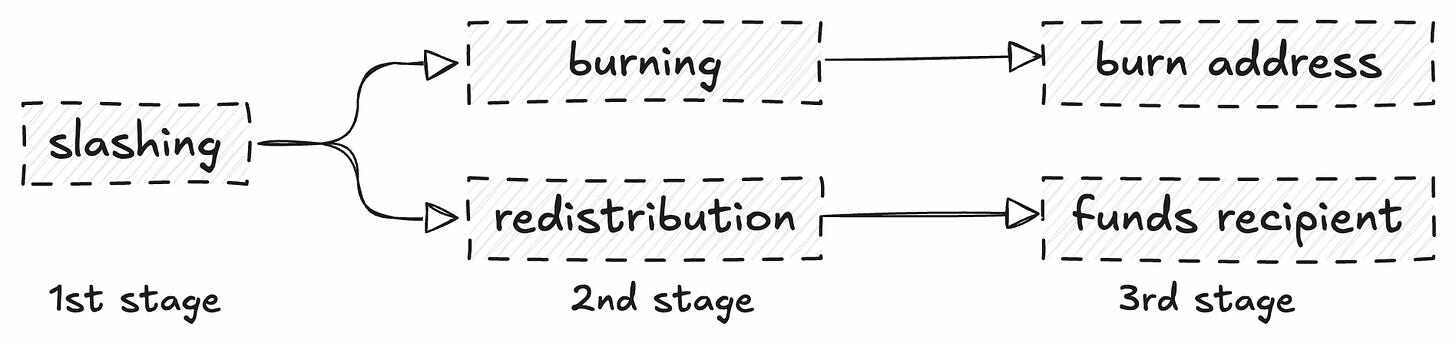

- Slashing : Refers to “taking back” assets from malicious actors.

- Destruction and redistribution : Describes what happens next with these reclaimed assets.

As we said before, slashed assets can be destroyed or redistributed:

- Destruction reduces the total supply;

- Redistribution transfers value to another party (not necessarily the victim). In addition, destruction can also occur independently through the protocol's built-in mechanisms without the need for slashing.

How redistribution can enhance economic security

Let's take EigenCloud, one of the most prominent protocols in the cryptocurrency space today, as an example . Its operators were slashed for failing to meet their obligations, which is a good thing: malicious actors are punished. However, before slashing funds were redistributed, these funds were typically destroyed (and can still be destroyed).

We believe that burning slashing funds in such a system is tantamount to cutting off one’s own legs. Because when the operator’s stake is slashed: the operator is penalized (for good reason), but:

- The injured party does not receive any compensation (imagine a victim is hit by a car, the driver is sentenced, but the victim does not receive any help).

- The security of the system decreases (because there are fewer assets to secure the system).

Why destroy it when you can preserve and transfer that value to the victim? By redistributing it, reliable participants can earn more rewards, victimized users can receive compensation, and the value remains in the ecosystem, simply being redistributed. This also unlocks more use cases for applications, such as:

- A new on-chain insurance protocol that operates in a permissionless manner ;

- Faster and guaranteed decentralized exchange (DEX) transactions , such as compensating traders when requests fail, expire, or are not completed in a timely manner;

- Provide more incentives for operators to operate honestly and transparently;

- Protect borrowers with a guaranteed APR, greater transparency, and the potential for native fixed rates.

Economic security not only directly protects users before an incident occurs (e.g., through burn mechanisms), but also directly protects users after an incident. Protocols like Cap already implement redistribution functionality, whereby the funds of slashed operators are redistributed to affected cUSD holders.

The challenge of redistribution

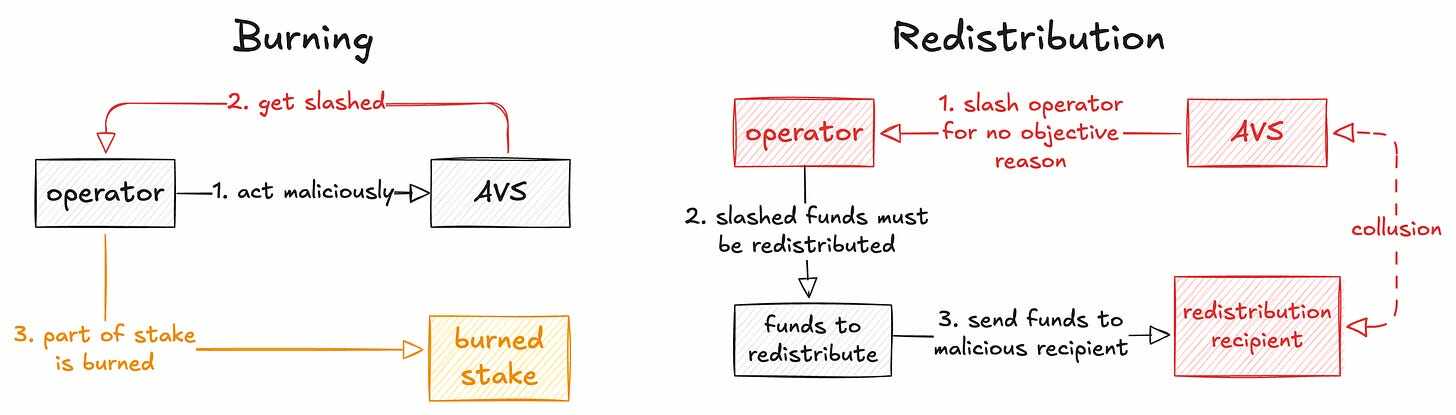

Destroying assets is easier than redistributing them. There's no need to worry about the subsequent handling of these assets; simply destroying them directly offers no benefits and no risks. The benefits of destroying assets are fewer, and the risks are significantly reduced. However, redistributing assets significantly changes the rules of the game, making the transfer of value from malicious actors to victims more complex than one might imagine.

Malicious operators could now potentially collaborate with a malicious validator service (AVS). Currently, AVS can implement any custom slashing logic, even if it's unfair or biased. Within the slashing mechanism, AVS has little incentive to act maliciously, as operators won't commit stake knowing they could be slashed for non-objective reasons.

However, in a redistribution mechanism, AVS can transfer the stake of one operator to another malicious operator (who collaborates), essentially extracting value from the system. A similar situation can occur if the AVS key is compromised, which may also affect the overall "attractiveness" of the operator or AVS.

Here, additional evaluation of the mechanism design is required:

- There should not be an option to "switch type" after the operator is created;

- A method should be provided to identify compromised (malicious) operators and redistribute value (if value ultimately flows to malicious parties), while also providing continuous monitoring, etc.

While destroying funds is simpler and redistributing them is fairer, it does require additional complexity.

Fix incorrect reallocation

The Maximum Extractable Value (MEV) scenario can be viewed from the following perspective: innocent users and liquidity providers (LPs) can be slashed for no apparent reason. For example, when a user wishes to swap assets, they may be subject to front-running or pinning attacks, resulting in a worse output (price).

We can confidently say that they were slashed because they submitted collateral (assets to exchange) to the system (DEX), held those assets for a certain period of time (exchange time), and ultimately received far less than expected.

There are two core issues here:

- LPs were cut for no reason (they acted with no ill intent).

- Users are being slashed for no reason; they are not acting maliciously or trying to profit from or contribute to the system, they simply want their actions to be executed.

Here, value is extracted and redistributed, with the exploiters rewarded and the parties who have done nothing wrong taking a cut.

- By formulating certain collation rules, such as Arbitrum Boost, users can more easily solve this problem.

- The issue is further complicated for LPs, as they are often victims of LVR (loss and rebalance).

Can destruction solve these problems?

Burning can provide decentralized benefits to all token holders, but it cannot specifically compensate LPs who directly lose money due to arbitrage activities. In theory, this problem can be solved by burning because once the profits are destroyed, there is no incentive to arbitrage.

However, once arbitrage profits are extracted, identifying such arbitrage becomes more difficult: while on-chain transactions are visible, CEX data does not reveal the exact addresses of traders.

In this case, poor redistribution design can be addressed with application-specific ordering rules, such as Angstrom ’s solution, which lets LPs capture value that would otherwise be lost to exploiters. This approach works quite well.

In this particular case of MEV, reallocation and destruction are not really viable options; they only address the symptoms, not the root cause. The problem requires a fundamental change in design.

Destruction is better than reallocation

To be clear, reallocation is not a panacea. Burning is more appropriate in the following situations: When slashing is not involved, burning is often a core feature in the mechanism design.

Taking BNB as an example, BNB’s quarterly destruction is a core feature of its deflationary token economic model and cannot be replaced by redistribution because this process involves neither exploiters nor victimized users.

A similar process occurs in Ethereum (ETH) (EIP-1559), where the base fee is destroyed, creating a deflationary effect. Given Ethereum's mechanism design, fees can become very high during periods of network congestion. Some might argue that instead of destroying the base fee, it could be transferred to a treasury fund to partially offset fees during periods of network congestion. However, the potential drawbacks of this approach far outweigh the potential advantages:

- Redistributing fees could dilute the deflationary effect, leading to higher inflation and potentially depressing token value over time;

- Improper allocation of funds and reduced revenue (e.g., which transactions should the fund prioritize? Is it reasonable for users to pay priority fees, if the fees can be compensated by the fund? etc.);

- Knowing that fees will be reimbursed may make it easier to generate junk transactions, exacerbating congestion;

- Assuming Ethereum’s base fees were redistributed to stakers, this could incentivize validators to prioritize high-fee transactions and ignore those that were not sponsored or paid for in advance.

There are many other similar cases, but the point is that reallocation is not a panacea. If destruction occurs independently (without slashing), there is little reason to use reallocation instead of destruction.

Summarize

Finally, we would like to point out that in scenarios not involving slashing, reallocation generally performs worse than destruction, while in scenarios involving slashing, reallocation generally performs better than destruction.

The incentive alignment problem is a long-standing issue in crypto and often varies from protocol to protocol. If economic value directly impacts the security or other critical aspects of the system, it is best not to destroy that value, but to find a way to correctly redistribute it to those who act honestly, thereby incentivizing fair and honest behavior.