Original article by Seed.eth

SharpLink Gaming Inc. (NASDAQ: SBET) recently announced plans to partner with financial technology company Superstate to tokenize and issue SharpLink’s SEC-registered common stock directly on the Ethereum blockchain through its Opening Bell platform.

According to official documentation, SharpLink’s tokenization path has several key features:

- Compliance Guarantee: Unlike many blockchain projects, SharpLink has chosen a fully compliant approach. Its tokenized shares remain SEC-registered common stock, with the same legal status as traditional bookkeeping shares. This means that shareholder rights remain unaffected by the conversion.

- Self-custody and transparency: Tokenized shares can be stored directly in investors’ digital wallets, achieving “self-custody.” This not only enhances investors’ sense of control but also improves market transparency and efficiency.

- Potential for DeFi Integration: By being on-chain, shares have the potential to be integrated into the decentralized financial ecosystem in the future, for example, as collateral in lending protocols or, subject to regulatory compliance, traded on automated market makers (AMMs). SharpLink has also explicitly stated that this is one of its research priorities.

- Regulatory Support: SharpLink emphasizes that the initiative aligns with the U.S. Securities and Exchange Commission's (SEC) "Project Crypto," which is exploring digital assets and blockchain-driven market infrastructure and provides policy guidance for the implementation of tokenized securities.

Deep integration with the Ethereum ecosystem

SharpLink's choice of Ethereum as the underlying public blockchain for tokenization is no accident. As the world's largest smart contract platform, Ethereum boasts a mature ecosystem and a vast developer community. Furthermore, in June of this year, SharpLink announced it had become the world's first "Ethereum digital asset treasury enterprise" and had significantly increased its ETH holdings.

As of the end of September 2025, the company held a total of 838,000 ETH, with a market value of billions of US dollars.

During the same period, it also received 3,815 ETH rewards through staking, further highlighting its long-term optimistic strategic positioning for Ethereum.

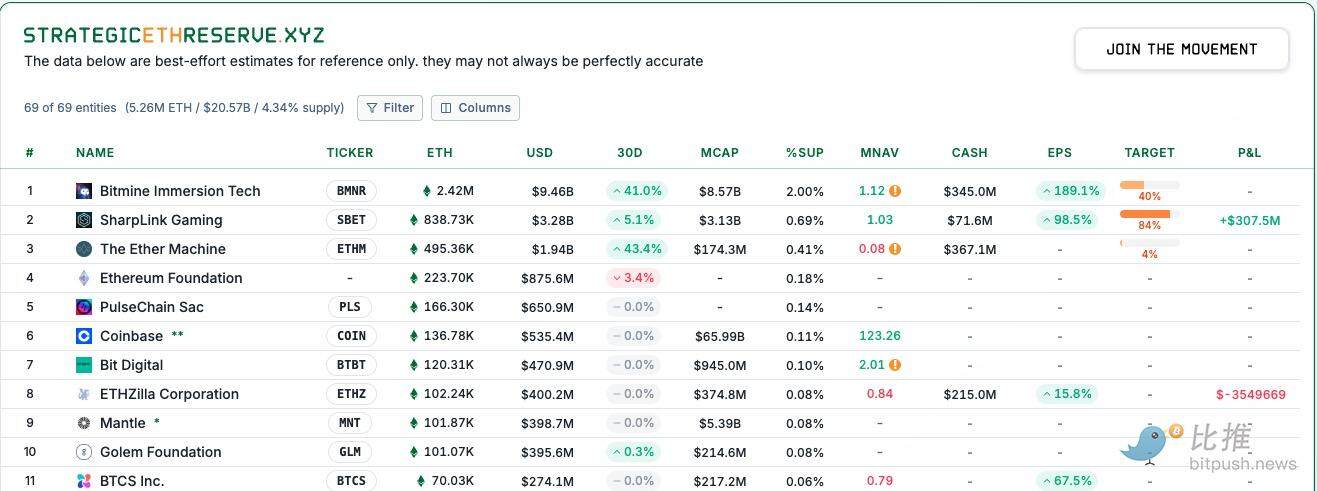

According to StrategicETHReserve.xyz, SharpLink holds over 838,000 ETH, valued at approximately $3.3 billion, making it the second-largest publicly traded Ethereum holder after BitMine Immersion Technologies.

Joseph Lubin, Chairman of SharpLink, co-founder of Ethereum, and CEO of Consensys, said: “Tokenizing SharpLink shares and putting them on-chain is a statement about the future of global capital markets. We are driving the true integration of traditional finance and the composable world of DeFi.”

Stock price performance: Good news cannot hide short-term pressure

Although the tokenization plan has attracted attention at the strategic level, SharpLink's secondary market performance remains sluggish.

- September 19: The stock price hit a high of $17.33;

- September 25: Fell to $16.3, with a daily drop of 9% at one point;

- The cumulative decline in one week exceeded 7.8%, and the trend was extremely unstable.

Investors are wavering between positive news and reality. While tokenization strategies are forward-looking, they are unlikely to improve losses on financial statements in the short term, leading the market to adopt a cautious wait-and-see approach.

Financial report: the contradiction between high investment and losses

SharpLink's latest financial disclosures show that the company is in a typical "asset-heavy expansion + high-risk investment" phase:

- Revenue and profit dilemma

- The limited revenue scale makes it difficult to support market expectations.

- The pre-tax profit margin is negative and the operating losses are widening year by year.

- Earnings per share were dismal, failing to demonstrate sustainable profitability.

- Assets and capital structure

- Total assets are approximately US$454 million, of which shareholders' equity covers almost all of the assets.

- With cash reserves of only US$5 million, it seems insufficient in the turbulent market environment.

- Dividend and expense pressures

- Preferred stock dividend payments amounted to $206.7 million, significantly squeezing profit margins.

- The EBIT (earnings before interest and taxes) loss was several hundred million US dollars, indicating that the main business has not yet emerged from the capital consumption stage.

In other words, although the company has strong on-chain assets (ETH holdings), it still faces heavy pressure in its core business.

From an innovation perspective, SharpLink could become the first company to tokenize its shares in the US capital market, a company with enormous potential. However, from a practical perspective, its financial situation and market performance are not optimistic.

For short-term investors, SharpLink's current trend is weak, and the risks outweigh the opportunities; for long-term investors, if they agree with the future prospects of tokenized securities and the Ethereum ecosystem, they may choose to invest at a low level and bet on a "future narrative."

SharpLink's growth in the coming months will depend on several key factors:

- Whether tokenized shares can be successfully implemented and accepted by investors and regulators;

- Whether the Ethereum asset strategy can unlock value and bring long-term financial benefits to the company;

- Whether the profit model of the main business can be optimized and the situation of continuous losses can be gradually reversed.

If these elements can be gradually fulfilled, SharpLink may be able to get out of its current trough and become a benchmark case for the integration of traditional finance and blockchain; if not, it may continue to linger on the edge of the capital market.

- 核心观点:SharpLink计划合规代币化股票上链以太坊。

- 关键要素:

- 代币化股份保持SEC注册,权益等同传统股票。

- 股份可自我托管,未来可接入DeFi生态。

- 公司持有83.8万ETH,市值约33亿美元。

- 市场影响:推动传统金融与DeFi融合,但短期股价承压。

- 时效性标注:中期影响