Tether, the "Federal Reserve on the Chain," launches $20 billion in private fundraising to raise funds for its global payment empire.

- 核心观点:Tether启动巨额融资,加速战略转型应对监管。

- 关键要素:

- 融资150-200亿美元,估值或达5000亿。

- 利润率99%,但合规布局落后于对手。

- 通过投资、政治游说和资产储备强化护城河。

- 市场影响:推动稳定币竞争格局重塑与合规化进程。

- 时效性标注:中期影响

Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

Today's latest news : Tether, the leading stablecoin company, has launched a private fundraising round of $15 billion to $20 billion, selling approximately 3% of its shares. If the deal goes through, its valuation is expected to reach $500 billion, making it one of the world's most valuable private companies after SpaceX and OpenAI. As we head into 2025, with Circle's US listing as the "first stablecoin stock" and the impending introduction of the US GENIUS Act, Tether, as a cornerstone of the industry, is actively promoting the resource-based transformation of USDT. Odaily Planet Daily will explore Tether's strategic considerations and future plans based on this fundraising round.

Stablecoin market capitalization exceeds $170 billion, with a profit margin of 99%, but Tether still cannot hide its anxiety

Just as traditional internet giants at home and abroad have faced bottlenecks in their businesses, Tether is now also struggling to conceal its anxiety. However, unlike traditional internet tech giants, Tether's anxiety stems not from sluggish business growth but from being "too rich."

Yes, you read that right. The biggest problem for Tether today is that its profits are too high and its cash flow is too much. Excessive assets and profits are difficult to efficiently convert into more stable businesses, resources, and moats.

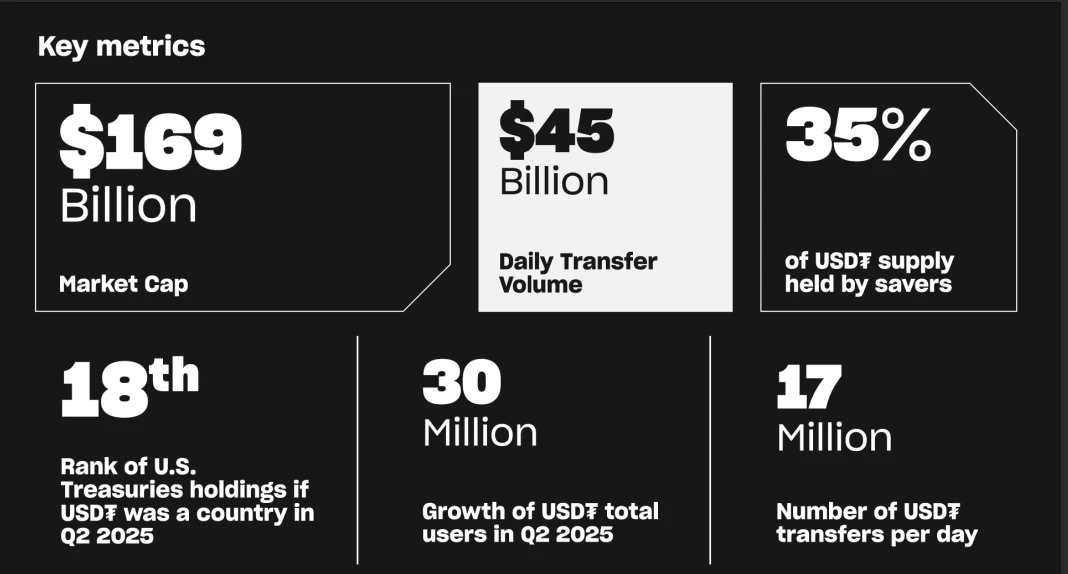

Previously, Tether CEO Paolo Ardoino disclosed USDT-related data at a USAT presentation: USDT has nearly 500 million users worldwide, with a 10% growth rate in Q4 2024; USDT's market capitalization is nearly $170 billion, with an average daily trading volume of approximately $45 billion, and 35% of the USDT supply controlled by depositors; if Tether were a country, based on its US Treasury holdings as of Q2 2025, Tether would rank 18th among US Treasury holders; Tether added 30 million users in the second quarter; and the average number of USDT daily traders reached 17 million. 63% of USDT traders trade exclusively in USDT, while approximately 78% of other stablecoin traders also trade other tokens (Odaily Planet Daily Note: This data may indicate a larger number of users who exclusively use USDT for payments and transfers).

In addition, he said: "Tether's profit margin is 99%." Considering that the Tether team only has about 150 people, it is no wonder that some people say "the most profitable business is still 'printing money'"!

Tether's core business - USDT issuance

Such lucrative profit margins naturally spark envy, and are a key reason why stablecoin issuance has become a hot topic in the industry in recent years. After all, simply relying on the interest earned on reserve assets like US Treasury bonds, stablecoin issuers can pocket profits exceeding 4%. This is also the key to Circle's ability to generate hundreds of millions of dollars in net profit despite annually providing nearly $1 billion to Coinbase and Binance.

Now, the main source of anxiety facing Tether is regulatory compliance.

Compared with the stablecoin Paxos, which has obtained compliance licenses globally, and Circle, which has obtained compliance licenses in important markets such as the United States, Tether's current compliance layout in the United States and Europe is slightly unsatisfactory.

For Tether CEO Paolo Ardoino and the Tether team, opening up in the US and European markets, where US dollar funds mainly flow, as soon as possible is crucial for its development in the next 10 years.

In order to resolve its various "anxieties", Tether's layout in the past two years has been astonishingly complex.

Tether's anxiety-relieving "combination" of donations, investments, and asset allocation

In response to the close pursuit of Circle and competitors including Paxos and Ethena, Tether is also making efforts in various aspects to maintain its "stablecoin dominance".

Preemptive "business donations": wooing the US Secretary of Commerce and former Executive Director of the White House Encryption Council as allies

Back in November of last year, Cantor Fitzgerald, a long-established financial services firm founded in 1945 and one of the 25 primary dealers in the United States able to trade U.S. Treasury bonds directly with the Federal Reserve, acquired approximately 5% of Tether for $600 million. At the time, Tether was valued at just $12 billion. Cantor Fitzgerald is backed by current U.S. Secretary of Commerce Howard Lutnick.

This transaction was viewed as evidence of a conflict of interest between key Trump administration officials and Tether. In January of this year, prior to her nomination as U.S. Secretary of Commerce, Senator Elizabeth Warren, a senior member of the Senate Banking Committee, raised questions about this matter. Howard Lutnick responded by resigning from Cantor Fitzgerald, with his son taking over the helm.

Building on this network, Tether will also launch its US-based stablecoin, USAT , by the end of the year. The company claims the stablecoin will strictly adhere to the regulatory standards of the US GENIUS Act, be backed by transparent reserves, utilize Tether's Hadron technology platform, be issued by federally regulated crypto bank Anchorage Digital, and have Cantor Fitzgerald serve as the designated reserve custodian. Furthermore, the CEO of USAT is Bo Hines, former executive director of the White House Cryptocurrency Council.

"Diversified Investment" across crypto, media, AI, sports, technology and other industries

Another way Tether is coping with external competition is through its diversified investment strategy. Tether CEO Paolo stated in a post today that the company is evaluating financing from a group of well-known core investors to maximize its strategic expansion across all existing and new business lines. These include stablecoins, distribution channels, artificial intelligence, commodity trading, energy, communications, and media.

Plasma, a popular project in the recent crypto market, is one of the projects in which Tether has invested. In addition, in order to recover part of the profits from the issuance of stablecoins from major cooperative ecosystems such as Ethereum, TRON, and BNB Chain, Tether has also proactively launched the stablecoin L1 public chain Stable.

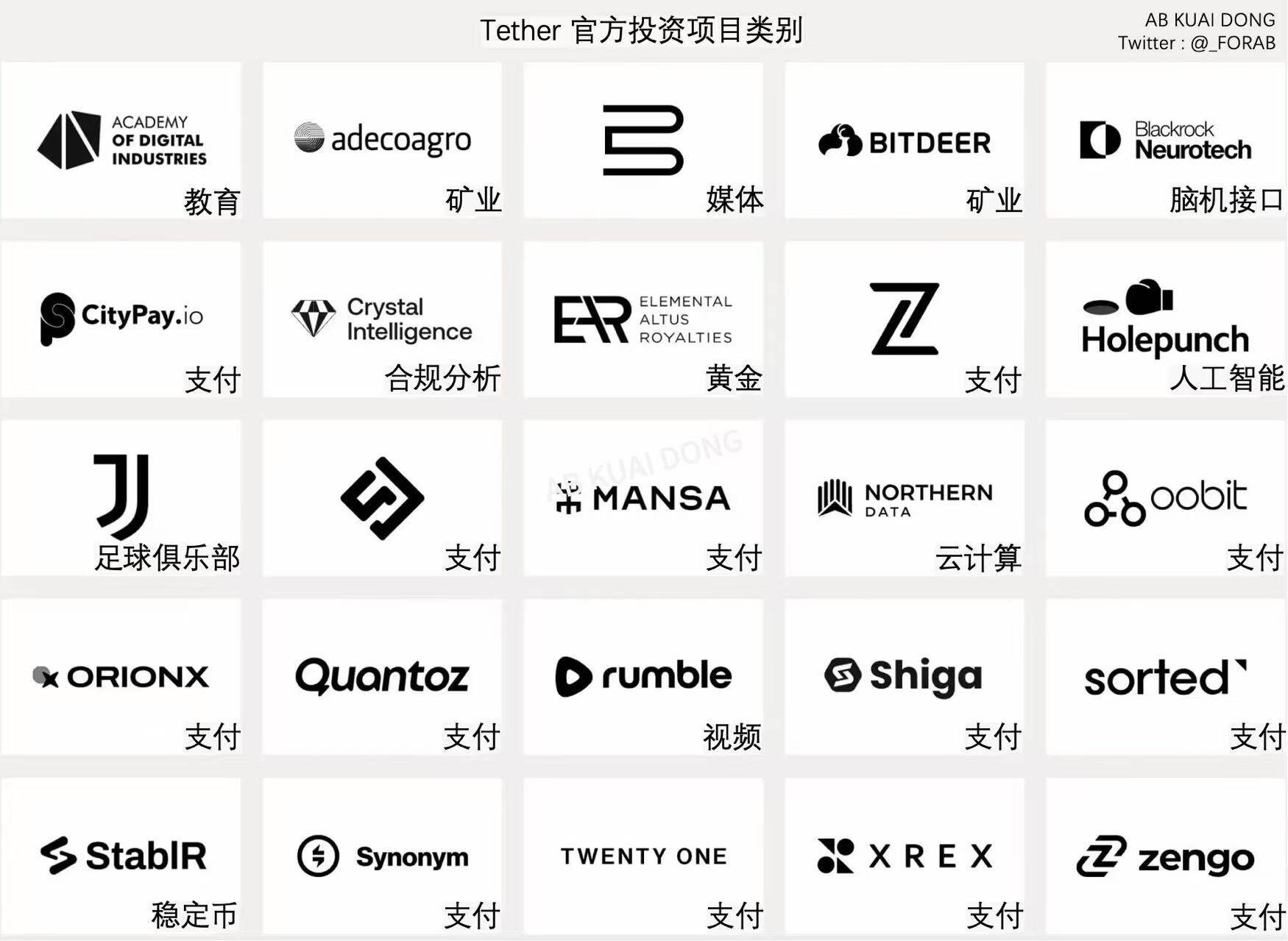

According to crypto KOL @_FORAB, Tether has invested in 10 projects this year, mostly focusing on cryptocurrency payments and asset management.

Part of Tether's investment portfolio

For more information about Tether’s investment layout and business model, please see the detailed analysis in the previous article "The “First Stablecoin” USDT’s Market Value Has Hit a New High, Revealing the Hundred-Billion-Dollar Business Empire Behind Tether" .

The "hoarding strategy" of Guanggu Grain: BTC, gold, and US bonds are the basis

Apart from external political resources and investment layout, Tether's main development confidence still comes from its own deep reserve assets.

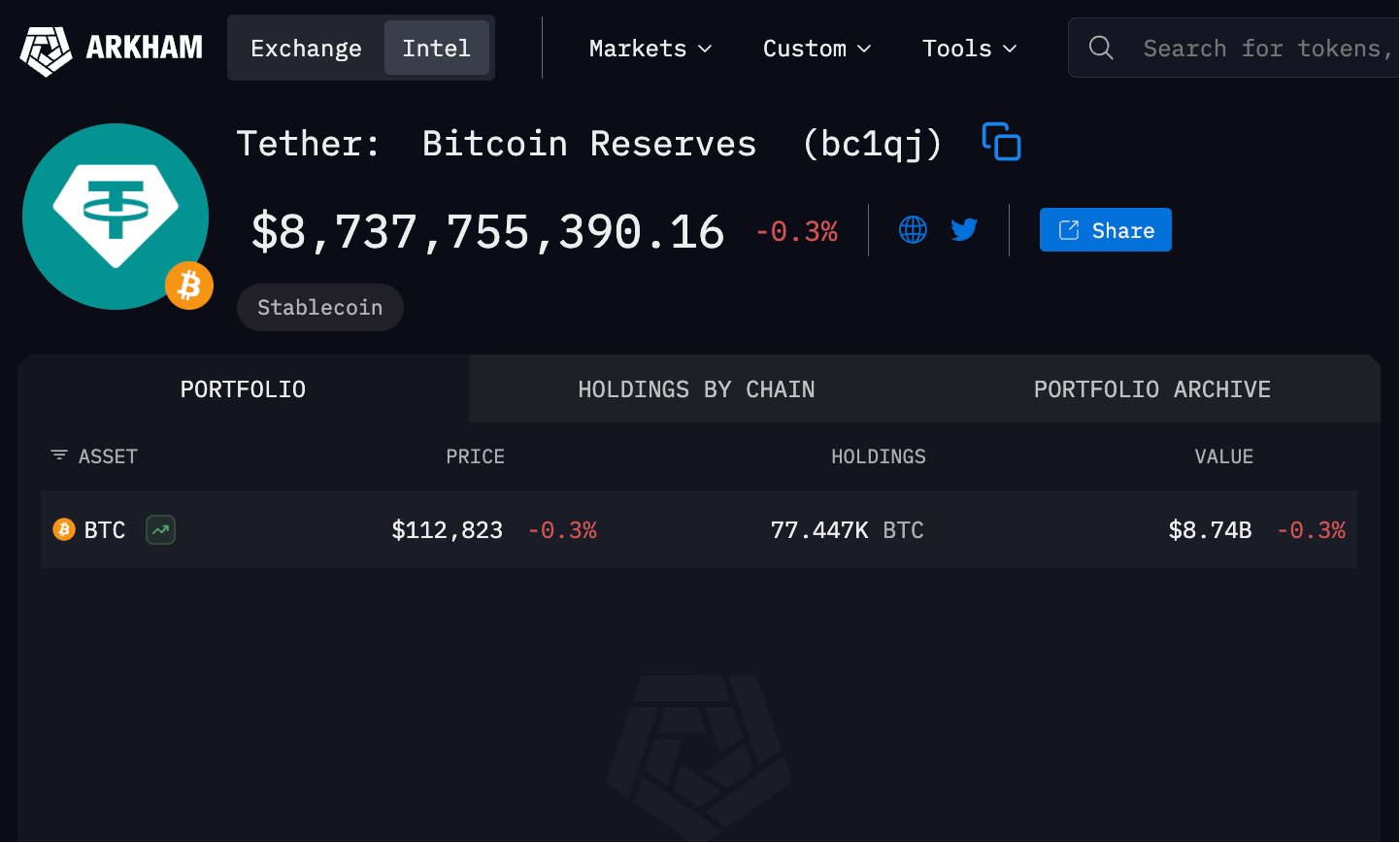

In early September, Tether CEO Paolo Ardoino announced the company's primary Bitcoin holdings, stating , "The vast majority of our Bitcoin is held directly." According to the Arkham website , this address holds over 77,000 BTC, valued at $8.74 billion.

Tether's gold reserves are also substantial. Earlier this month, Tether revealed plans to invest in various links in the gold supply chain, including mining, refining, trading, and royalty companies. It currently holds $8.7 billion worth of gold reserves in a Zurich, Switzerland, vault, which serves as collateral for its stablecoin. In June of this year, Tether Investments acquired a minority stake in Elemental Altus, a Toronto-listed gold royalty company, for $105 million. Furthermore, Tether's gold token, XAUT, currently has a market capitalization exceeding $1.4 billion , ranking it first among gold tokens.

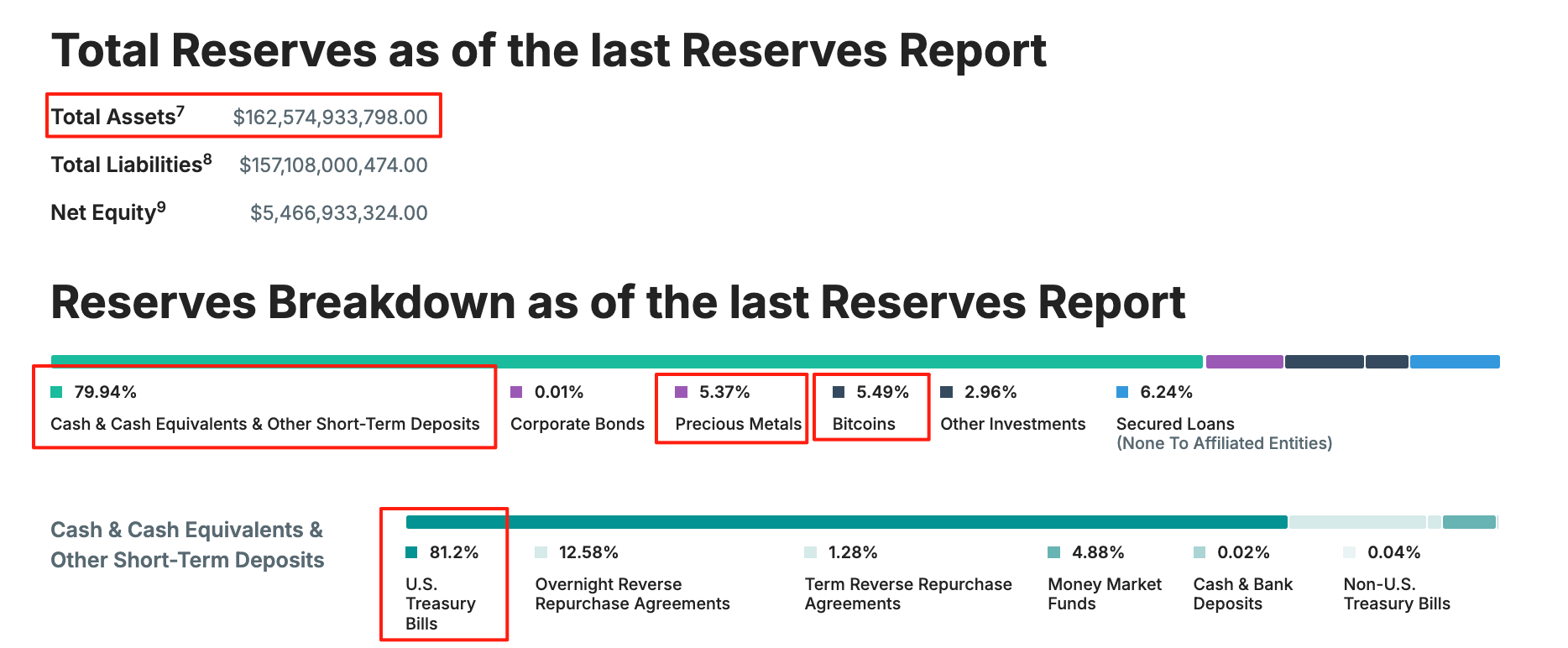

In addition, according to information on Tether's official website, as of the second quarter of this year, its reserve assets reached US$162.57 billion, of which cash and cash equivalents accounted for nearly 80%, and U.S. Treasury bonds accounted for 81.2% of this, making it the "most stable interest-earning machine."

Source: Tether official website

Conclusion: The future of the "Federal Reserve on the Chain" may lie in PayFi

Having said so much, let’s go back to the question in the title of the article: where is the ceiling of the stablecoin track?

Previously, U.S. Treasury Secretary Bensont stated in a post on the X platform that a recent report predicts that the stablecoin market could reach $3.7 trillion by the end of the next decade (2035). Standard Chartered Bank predicted in April that if the US GENIUS Act were passed, the supply of stablecoins could surge to $2 trillion by 2028. JPMorgan Chase released a research report predicting that the global stablecoin market will grow to $500 billion by 2028, far lower than the $1 trillion to $2 trillion forecast by some institutions. It also noted that 88% of current stablecoin demand comes from crypto-native activities (such as trading and DeFi staking), with only 6% used for payments.

Based on the existing information, it is not a problem for the stablecoin sector to grow from the current US$294.5 billion to US$1 trillion in the next decade. As the "on-chain Federal Reserve" that holds an incomplete version of the "coinage right", Tether's future may still have to rely on the "stablecoin global payment + savings boom" driven by Plasma, which is about to issue a coin tomorrow.

Recommended reading:

PayFi is about to launch, XPL is about to go online, but is Plasma One’s genes important?