Rebuilding Ten Airlinks: The Future of Stablecoin Crypto Payments

Original author: Frank @IOSG

Key Points TL;DR

- Stablecoins are crypto's killer app : not NFTs, not meme coins. They're already the "everyday currency" of the Global South. The market isn't focused on creating new currencies, but on how to truly integrate existing stablecoins into everyday payments.

- Consumer value is driven by B2B transactions : While peer-to-peer remittances and crypto cards are certainly important, I believe the largest TAM will occur in cross-border payments between businesses. Cryptographic orchestration layers and PSPs that abstract stablecoins and embed them directly into large corporate transfer systems can capture the additional benefits of massive capital flows and capital accumulation.

- Licenses + Corridors = Moat : Just as infrastructure has shifted from a technological competition to a distribution one, the true barriers in B2B payments lie in regulatory licenses (MSB/EMI/SVF, etc.), banking partnerships, and first-mover advantage in cross-border corridors (e.g., Bridge holds US MSB/MTL licenses, and RD Tech holds Hong Kong SVF licenses).

- Orchestration > Aggregation : Aggregators are merely market matching platforms, with thin profit margins; orchestrators control compliance and settlement. True defensive power comes from directly holding licenses and being able to independently manage capital flows.

- Competition is intensifying , shifting from an emphasis on "underlying technology" to a competition for "actual usage." Similar to consumer applications, the market rewards genuine adoption and user scale. TRON's rising transaction fees have already demonstrated robust demand for stablecoin transactions. The next phase will see stablecoin native chains (stablecoin issuers with established issuance and distribution channels, such as Plasma and Arc) actively encouraging users to trade and settle directly on their own stablecoin blockchains, similar to application-specific chains like Hyperliquid. This will prevent the majority of transaction fees from being siphoned off by general-purpose public chains. At the same time, users can also pay transaction fees directly with transferred stablecoins, aligning payment media with network incentives.

introduction

Stablecoins and the blockchains built around them are becoming a hot topic and making headlines almost daily. Tether.io's Plasma and Stable, Circle's Arc, Stripe's Tempo, Codex PBC, 1 Money, Google's next-generation L1 blockchain under development, and many more projects are accelerating this trend. Meanwhile, Metamask, one of the world's most widely used self-custodial wallets, has officially announced the launch of its native stablecoin, marking the further expansion of its wallet product into payment and value-carrying capabilities. Meanwhile, Remitly, the cross-border remittance giant, has announced the launch of Remitly Wallet, a multi-currency fiat and stablecoin wallet currently in beta testing with plans for a September official launch in partnership with Circle.

These moves collectively demonstrate that a growing number of large payment companies and Web 2 and Web 3 tech giants are accelerating vertical integration, entering the stablecoin and blockchain payment markets directly. Instead of relying solely on third-party infrastructure, they are choosing to issue their own stablecoins, build their own wallets, and even launch dedicated payment blockchains. Stablecoins are rapidly expanding beyond crypto-native use cases into broader payment, remittance, and financial services sectors, becoming one of blockchain's most practical applications.

Therefore, this article provides us with a good opportunity to discuss:

- Current Stablecoin Payment Technology Stack

- Tracks with PMF

- Propose an investment framework for each payment track

Stablecoin payment infrastructure

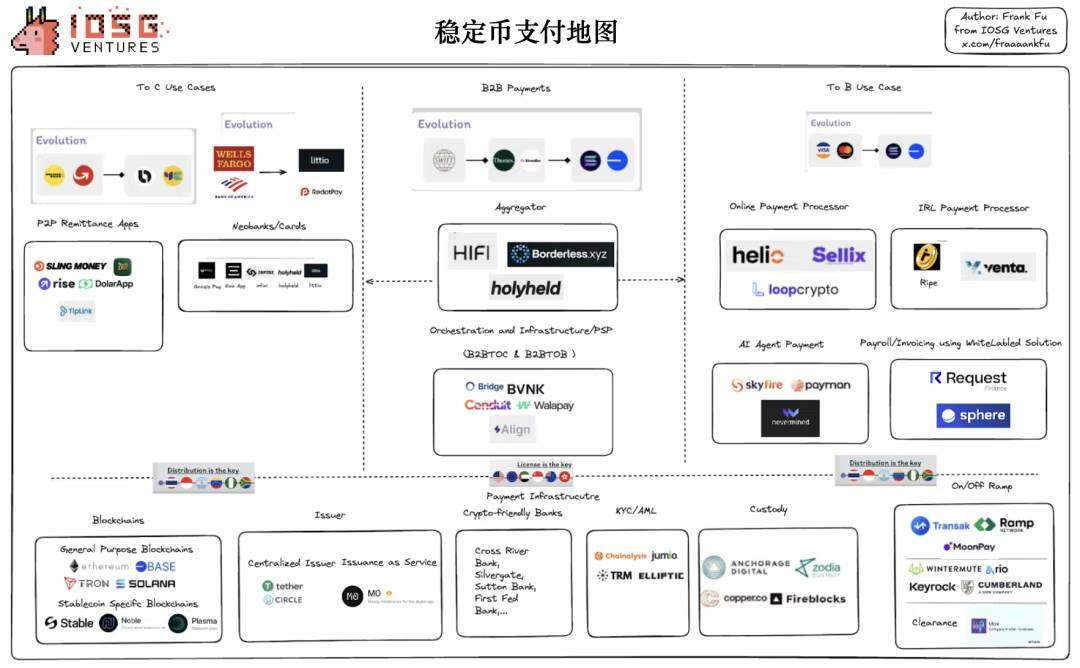

Although there are various definitions in the market, I believe that the technology stack of stablecoin payments can be broken down from the following perspectives:

* The mapping used in this article is from the author’s compilation in July. For the latest market map, please refer to the ASXN dashboard (https://stablecoins.asxn.xyz/payments-market-map).

At the bottom of the entire payment map is the blockchain itself, which is both the infrastructure and the foundation.

Recently, when Paradigm's Matt Huang explained why Stripe chose to build on the new L1 Tempo rather than on Ethereum's L2, he offered a long list of reasons. While many of these reasons were criticized by the Ethereum community and various venture capitalists, one of them, regarding Fast Finality, clearly exposed the real problems currently facing Ethereum.

▲ Source: Matt Huang from Paradigm

"Finality" in blockchain means that once a transaction is confirmed, it cannot be reversed or altered, nor can it be revoked due to network fluctuations or chain reorganizations. "Fast finality" provides this guarantee in seconds or even sub-seconds, rather than forcing users to wait for more than ten minutes. Furthermore, because L2 finality relies on L1, no matter how fast or powerful L2 is, its security and finality speed still rely on L1.

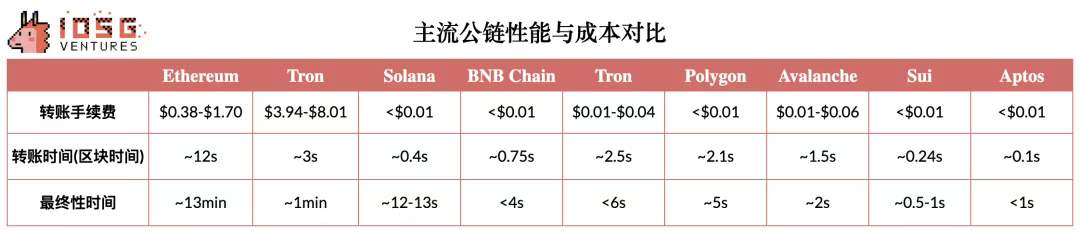

Ethereum's current mechanism is robust, but somewhat slow. Blocks are generated every 12 seconds. Transactions are included quickly, but final economic confirmation takes approximately 12–15 minutes, or two PoS epochs. During this time, validators continuously vote and stamp the results, locking in the results. While sufficient so far, the market is increasingly demanding final confirmation times of less than 2 seconds to meet the needs of commercial payments and institutional high-frequency settlement. If the underlying chain is slow, it cannot support high-speed payments; if network transfer costs are high, the promise of "low fees" cannot be fulfilled; even the best user experience can be hindered by poor infrastructure.

▲ Source: OKX Gas Tracker (July 23, 2025), Block Time & Finality Time: Token Terminal

Putting aside the perspective of vertical integration, this is why we're seeing more and more stablecoin issuers and traditional payment giants building their own blockchains. Beyond profit-sharing considerations, the core reason is this: all upper-layer applications and user experiences ultimately rely on the underlying infrastructure. Only by achieving transaction fees as low as a fraction of a cent, near-instant finality, and a token design that eliminates the need for users to worry about gas can a truly smooth and seamless user experience be achieved.

Common core foundational features include:

- Stable and low transaction fees, and can be paid directly in stablecoins

- Permissioned validator node set

- High throughput (TPS)

- Compatibility with other blockchains and payment systems

- Optional privacy features

What really determines success or failure often goes beyond technology, including:

- A clear go-to-market (GTM) strategy

- Effective business development execution

- Sound partner ecosystem

- Efficient introduction and support of developers

- Marketing and external communication

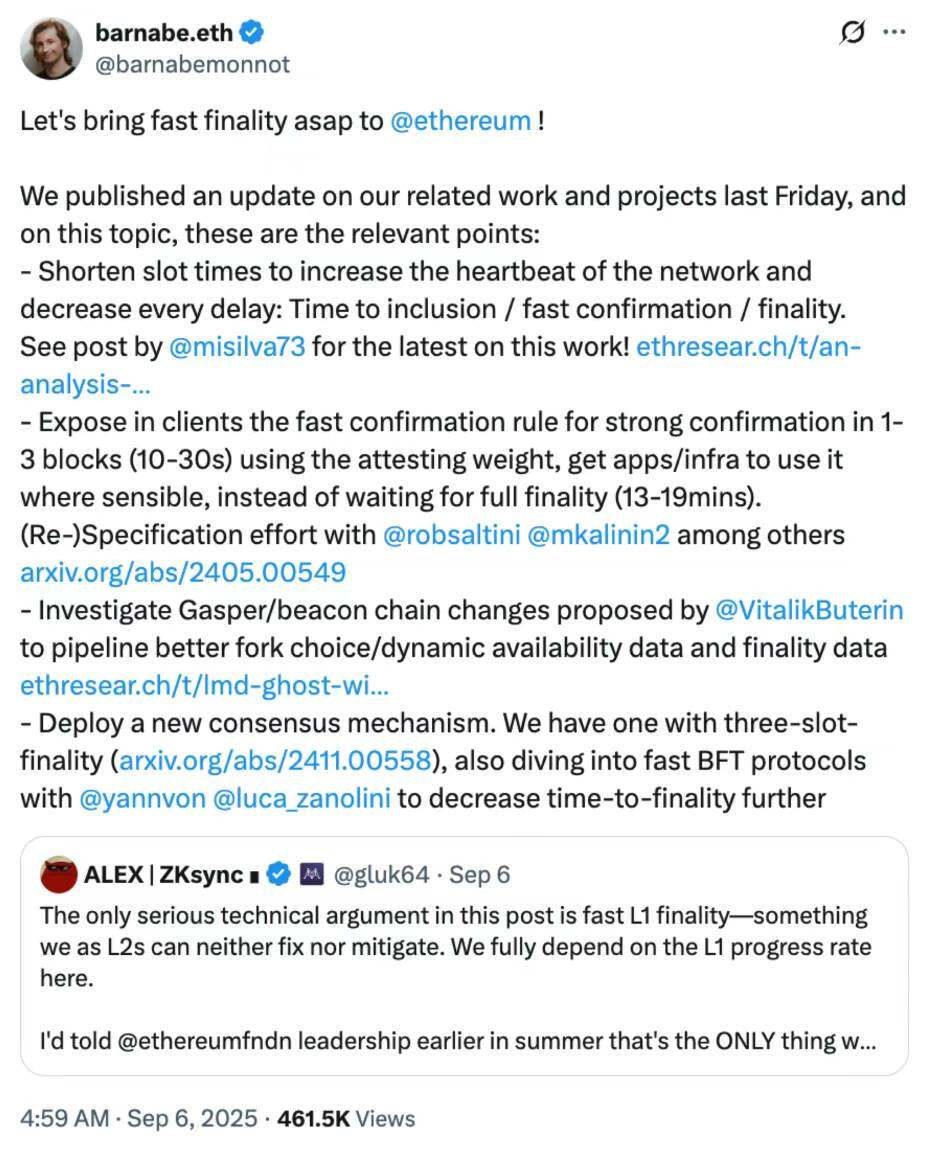

We'll delve into the specific comparisons between different blockchains in a subsequent article, so I won't go into detail here. Of course, Ethereum has long recognized the importance of Fast Finality without compromising decentralization. Community members are pushing the Ethereum Foundation (EF) to accelerate this process, and EF's Barnabé Monnot shared the ongoing plans:

- The block generation time will be shortened from 12 seconds to 6 seconds, and relevant tests have been completed.

- After the new "quick confirmation rule" is launched, transactions can be strongly confirmed after waiting for 1-3 blocks (about 10-30 seconds), without having to wait for complete final confirmation.

- We are also trying to optimize the core protocol based on the solution proposed by Vitalik and explore the next generation of consensus mechanisms, such as "three-slot final confirmation".

▲ Source: Barnabé Monnot from EF

In addition to the rapid development of stablecoin networks, the issuance of stablecoins themselves is also experiencing explosive growth. Stablecoin issuance platform M0 recently completed a $40 million Series B funding round led by Polychain Capital, Ribbit Capital, and Endeavor Catalyst Fund. M0's Stablecoin-as-a-Service platform enables institutions and developers to issue highly customized stablecoins with full control over branding, functionality, and returns. All stablecoins built on M0 are inherently interoperable and share unified liquidity. With its open multi-issuer framework and fully transparent on-chain architecture, M0 is pushing the boundaries of traditional stablecoin issuance.

Since its inception, M0 has been adopted by projects such as MetaMask, Noble, KAST, PLAYTRON, Usual, USD.AI, and USDhl to issue stablecoins for various purposes. Recently, the total issuance of stablecoins based on M0 exceeded $300 million, a 215% increase since the beginning of 2025.

Similar to the trend of stablecoin issuers vertically integrating into the underlying blockchain infrastructure, application chains with creativity in demand scenarios are now also beginning to vertically integrate at the stablecoin issuance level in order to establish a deeper binding relationship at the ecological level.

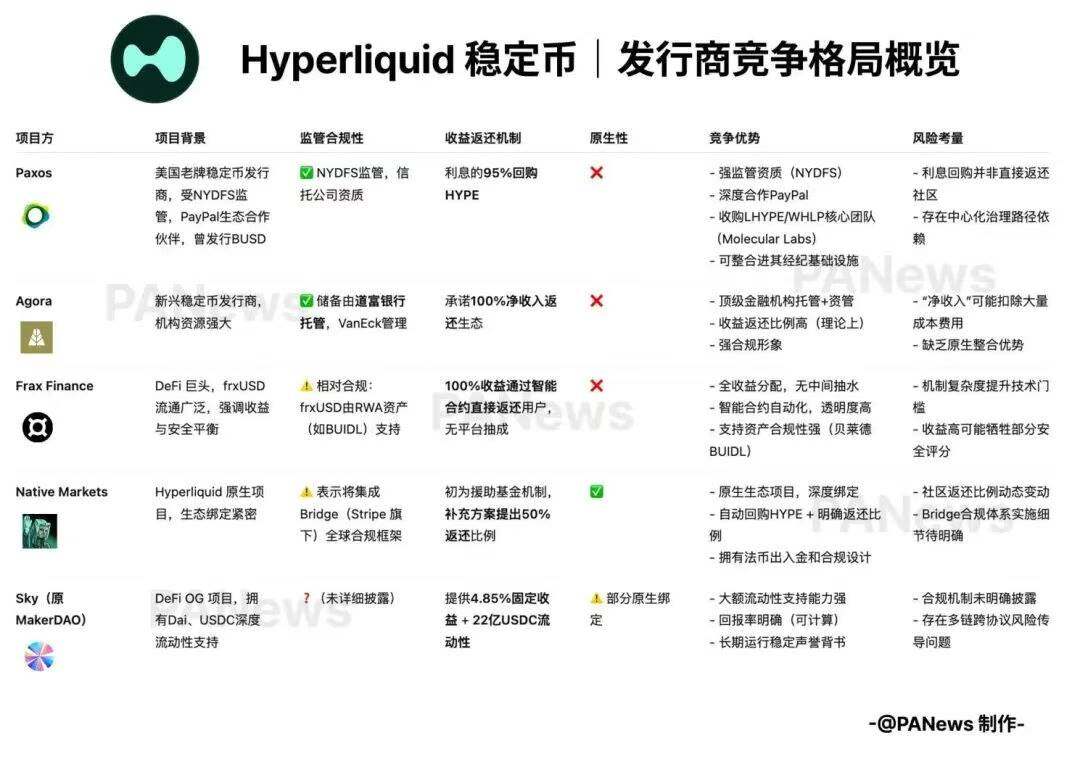

Last Friday, Hyperliquid announced its plans to launch its native stablecoin, USDH, within its HyperEVM ecosystem. The issuer would be selected through an on-chain voting and public tender. Over the following week, various stablecoin issuers submitted bids, with the winning bidder ultimately determined by a majority vote of $HYPE stakers. To emphasize decentralized governance, the Hyperliquid Foundation, despite holding a significant amount of $HYPE stake, abstained from voting, leaving decision-making entirely to the community.

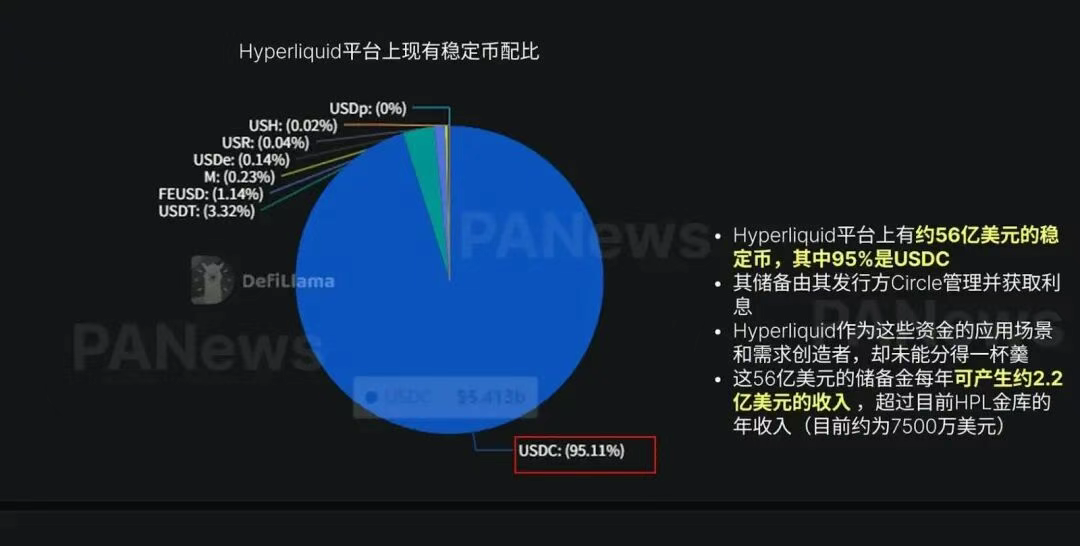

Hyperliquid's motivation for launching USDH is straightforward: the platform currently holds approximately $5.6 billion in stablecoin assets , 95% of which is USDC . This reserve is held in custody by Circle, the issuer, and earns interest, but Hyperliquid, as the creator of both use cases and demand, receives no share of these profits. If this $5.6 billion in USDH were replaced with USDH, calculated based on Treasury bond rates, it would generate over $220 million in annual interest income, far exceeding the platform's current annual HLP revenue (approximately $75 million). This additional revenue will be used to repurchase and distribute $HYPE, thereby benefiting the ecosystem.

▲ Source: PA News

Among the many bidding proposals, the proposal of Hyperliquid's native project Native Markets won. The relevant details can be found here: https://www.theblock.co/post/370570/native-markets-team-wins-hyperliquid-usdh-stablecoin-bid-eyes-test-phase-within-days

▲ Source: PA News

Beyond the importance of blockchain and stablecoins, we can also clearly see the crucial role of the on/off ramp (the on/off channel between fiat currency and crypto assets) in user experience. Whether users can smoothly and cost-effectively convert fiat currency into stablecoins or other crypto assets often directly determines whether the entire application can achieve true mass adoption.

Five years ago, IOSG proactively invested in Transak , a leading global on/off ramp service provider. Transak provides seamless fiat on/off ramps for wallets, exchanges, and payment applications, supporting users in over 150 countries and regions. Recently, Transak secured $16 million in its latest round of funding, led by Tether (USDT's parent company) and IDG. In addition to Transak, IOSG has also invested in Kravata, a Latin American-based project focused on fiat and cryptocurrency on/off ramps. Kravata offers a business-to-business (B2B) API for enterprise clients and a B2B API for integration with third-party applications. As of Q2 2025, Kravata has over 90 clients worldwide, operating in three countries. This initiative not only demonstrates the market's long-term optimism about the on/off ramp sector, but also reaffirms IOSG's accurate assessment of the value of industry infrastructure during its early investment phase.

It is foreseeable that as stablecoins and blockchain payments gradually become mainstream, on/off ramp infrastructure like Transak will become a key hub connecting the past and the future: it is both the entrance for users to enter the crypto world and the bridge for stablecoins to integrate into the global payment system.

Tracks with PMF

Once payment infrastructure is fully developed, cross-border payments will become the most direct and obvious breakthrough. Global cross-border capital flows reach $150 trillion annually, yet the current system often takes three days, incurs approximately 3% in fees, and involves multiple layers of intermediaries. If a stablecoin based on an efficient "rail" were used, the entire process would take just three seconds, with fees as low as 0.01%, and enable direct point-to-point settlement. Given such a significant efficiency gap, adoption is almost inevitable.

B2B cross-border payments represent a perfect product-market fit (PMF) in the cryptocurrency space. Today, 40% of blockchain fees come from transferring USDT, and hundreds of millions of users in emerging markets use it daily to hedge against currency devaluation and inflation. Putting aside infrastructure and speculative spending cycles, payments (particularly B2B cross-border payments) are the area in crypto with the greatest potential to complement SWIFT. The true winners may not be new chains or universal stablecoin issuers, but orchestrators with licenses and distribution capabilities in key cross-border corridors .

This is also why we saw earlier that Airwallex, the Web 2 enterprise cross-border transfer giant, felt the threat of stablecoin cross-border payment companies and made defensive remarks on Twitter, but did publicly recruit stablecoin developers on its recruitment website.

The Payment Orchestration Layer integrates fiat currencies and stablecoins, multiple payment methods, channels, and processing services to provide an end-to-end payment and settlement solution. This layer emphasizes stablecoin compatibility, supporting not only fiat currency receipts and payments, but also stablecoin receipts, cross-border transfers, and stablecoin redemptions back to fiat.

Cross-border payments often follow a "fiat currency → stablecoin → fiat currency" path: exchanging local fiat currency for stablecoin, using the stablecoin for international transfers/settlement, and then converting it back to local fiat currency at the receiving end. The role of the payment orchestration layer is to optimize this path, reducing friction, saving time, and improving efficiency.

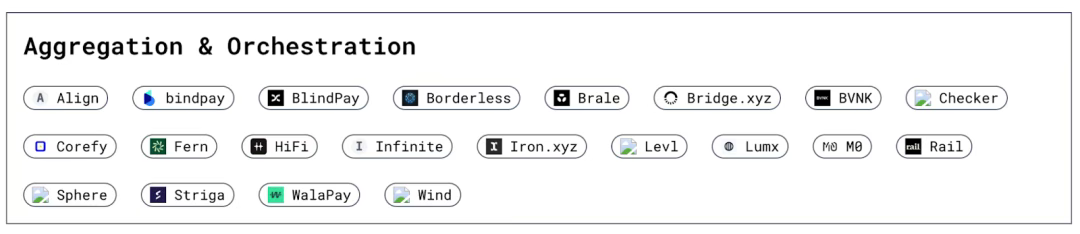

While established companies like Airwallex and Stripe are also actively developing stablecoin payments, startups often have advantages in innovation and execution speed. For example, Align focuses on the cross-border remittance needs of large multinational corporations, while ArrivalX focuses on overseas payments for Chinese merchants. I believe that the future is more likely to see regionally centered solutions, rather than a single, unified global model, similar to the competitive landscape on the on/off ramp.

Because each region is significantly influenced by local regulations, laws, and banking/financial infrastructure, against the backdrop of the rapid development of stablecoin payments, small and medium-sized startups that can effectively position themselves as a "local + regional + orchestration layer" company will have ample room to capitalize on specific payment corridors. Beyond licenses, providing stablecoin-fiat currency bidirectional circulation and highly compatible payment/settlement services is a key differentiator. Compliance and risk management will be crucial to long-term success.

▲ Source: ASXN

https://stablecoins.asxn.xyz/payments-market-map

Furthermore, in many articles on payments, aggregation and orchestration are lumped together in the same quadrant. However, we believe that the aggregation and orchestration layers differ in how they capture value in B2B transactions. The aggregation layer, unlicensed, can be considered a wrapper around the orchestration layer. While it can connect to more regional platforms, it's constrained by its profit-sharing structure when it comes to price negotiation. This can be seen as a business model similar to Circle's—the larger the scale, the harder it is to achieve high profits.

In addition to serving as the underlying service of the B2B aggregation layer, these orchestrators are also further supporting the application side of the entire payment network, which can be specifically divided into To C applications and To B applications.

To C applications currently focus mainly on P2P payment applications, such as Sling, as well as neobanks that provide more stablecoin interest-earning scenarios for consumers, such as infini and Yuzu.Money, and stablecoin cards that solve the difficulties faced by stablecoin consumers in using them in the real world.

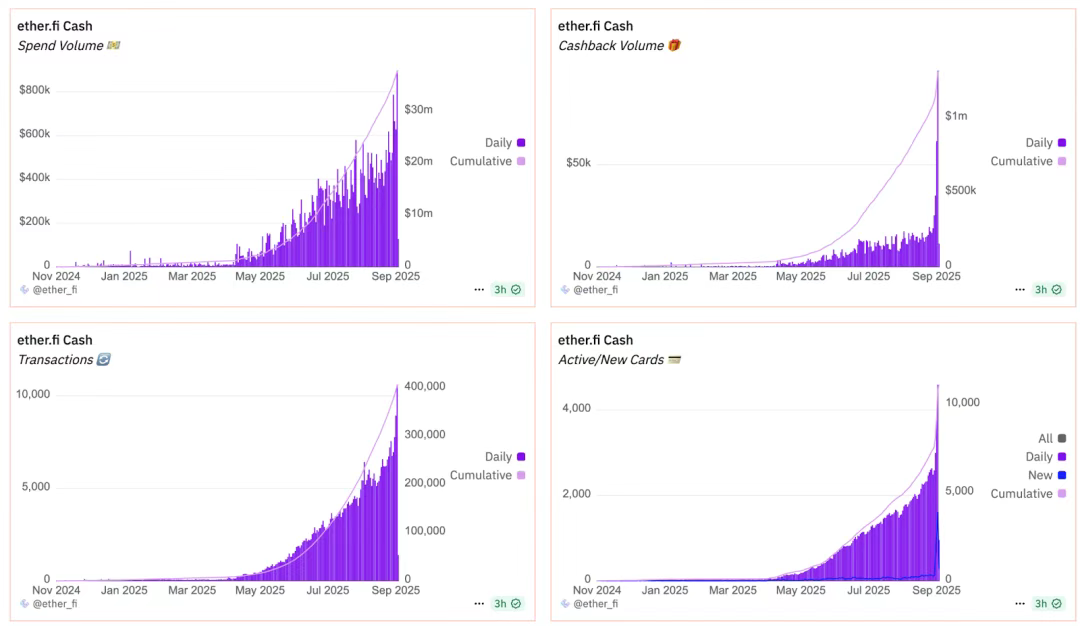

IOSG has long been involved in consumer applications, having invested in Ether.fi, an interest-bearing payment super app. Its card transaction volume, cashback volume, number of transactions, and number of cards issued all reached record highs in September.

▲ Source: Ether.fi Dune Dashboard

On-chain funds are clearly chasing yield: approximately 45% of DeFi's total value (TVL) (approximately $56 billion) is driven by yield, primarily in protocols like Aave, Morpho, and Spark. The market capitalization of yield-focused stablecoins is rapidly growing, soaring from $1.5 billion to $11 billion, representing 4–4.5% of the total stablecoin market ($255 billion). DeFi yield-focused projects, including Ethena, Pendle, Aave, Spark, and Syrup, continue to garner attention.

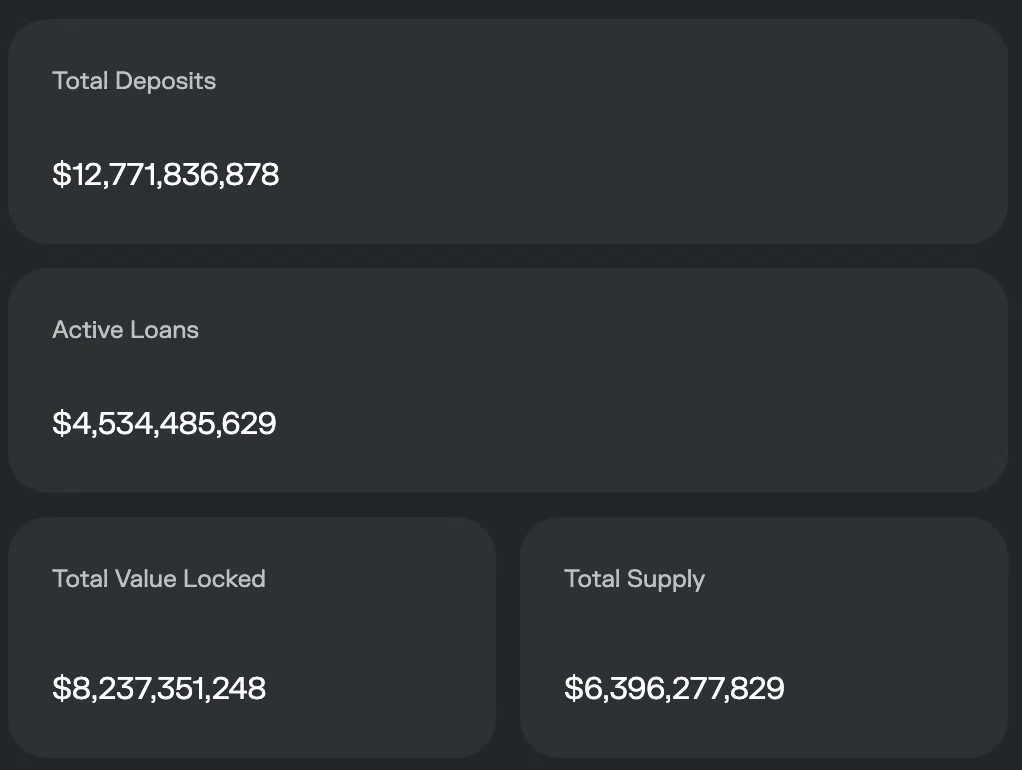

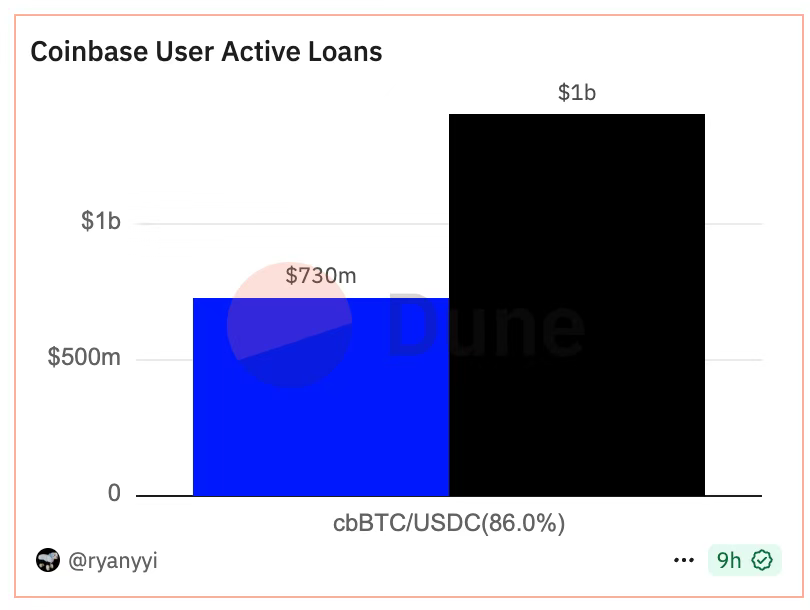

As the number of DeFi protocols continues to grow, operational complexity has also increased, leading to a less user-friendly experience. To alleviate this pain point, Coinbase officially integrated Morpho into its exchange and launched Coinbase Onchain Borrow, a lending product that blends CeFi and DeFi. Users can complete staking and borrowing with a single click on the frontend, while the underlying infrastructure is powered by Coinbase Smart Wallet. This process completely abstracts the steps of creating a wallet and interacting with Morpho, significantly simplifying the user experience. Coinbase Onchain Borrow has provided Morpho with $1.4 billion in deposits and $730 million in active loans, representing 11% and 16% of Morpho's total, respectively. This has helped Morpho reach $12.7 billion in total deposits and $4.5 billion in active loans.

▲ Source: https://app.morpho.org/ethereum/explore https://dune.com/ryanyyi/coinbase-onchain-loans

Following the same investment philosophy of simplifying the on-chain user experience , we chose to invest in Ether.fi early on. Initially focused on ETH staking returns, it has gradually expanded to more complex third-party vault strategies, significantly lowering the barrier to entry for stablecoin users in DeFi operations, allowing them to easily earn returns. They even launched a DeFi credit card, allowing users to repay credit card loans with future interest, truly achieving a "buy now, pay never" model.

The enormous potential of stablecoin digital banks and stablecoin credit cards lies in their ability to move credit issuance directly onto the blockchain, fundamentally weakening and, to some extent, replacing the intermediary role of traditional banks. Under the traditional model, banks' core revenue comes from the interest rate spread between deposits and loans, which is the foundation of the entire system. However, this model also grants banks excessive "selective power": on the one hand, they exclude a large number of unbanked populations who cannot access the deposit system ; on the other hand, they reject businesses and individuals who cannot qualify for loans or credit cards.

In contrast, the stablecoin ecosystem completely reshapes this logic. Leveraging the blockchain's programmability, atomic settlement, and immutability, lenders and borrowers can connect directly on-chain, freeing them from the constraints of traditional banking access standards. This revolutionizes payment and credit participation. Based on this, new stablecoin digital banks further encapsulate stablecoins, cryptocurrencies, and DeFi lending protocols, and combine them with the trustless over-collateralization model to create virtually risk-free lending products based on lending pools. This model can manifest as a new lending bank like Coinbase Onchain Borrow or a stablecoin credit card similar to Ether.fi.

We also see new opportunities in B2B commercialization. For example, enabling online and offline merchants to directly access stablecoin payments, thereby avoiding acquiring banks' interchange fees. Furthermore, more convenient invoicing and global payout platforms for corporate clients also have broad development potential. However, these products, particularly those that prioritize enterprise user experience, may face competition as the payment orchestration layer gradually integrates.

A new paradigm for on-chain payments driven by AI

Another interesting area of potential in B2B applications is AI agents acting as clients of payment applications. With the emergence of automated AI agent trading and yield farming applications, such as Theoriq, Giza, and Almanak, we can expect to see the emergence of more fully automated AI agents, constantly searching for new yields 24/7. At the same time, these automated AI agents will require a wallet to purchase the data, computing power, and even human services they need.

The development of AI agents requires new on-chain infrastructure, which may also present a potential investment opportunity. Traditional payment systems, with their slow settlement times, high rejection rates, and frequent reliance on manual labor, are clearly unsuitable for autonomous agents. To this end, Google launched the AP2 protocol and, with Coinbase, released A2A x 402. If MCP is the "tentacle" and A2A is the "language," then AP2 and x 402 represent the "last mile" for AI to achieve full automation: autonomous payment and value exchange.

AP 2's mission is to make AI trustworthy, controllable, and traceable in financial transactions. It doesn't replace Visa or Mastercard, but rather builds a universal trust layer on top of them. Through an authorization mechanism based on verifiable credentials, AI can hold cryptographically signed digital authorizations, ensuring secure and auditable transactions.

Its Mandates mechanism has two modes:

- Real-time authorization: After AI finds the product, the user needs to confirm it on the spot.

- Delegated authorization: Users can set complex conditions in advance (such as "hotels under $200"), and AI will automatically execute only when the conditions are triggered.

All transactions form an immutable chain of evidence, secured and auditable by verifiable credentials, thus preventing "black box" payments. Google's strategy is clear: to unite financial and crypto giants, not directly issuing or clearing coins, but rather defining the rules of "trust."

Most notable among these is A2Ax402, a Google extension specifically designed for crypto payments. Built in close collaboration with Coinbase and the Ethereum Foundation, it enables AI to seamlessly process stablecoins, ETH, and other on-chain assets, supporting Web 3 native payments. In a sense, Google's A2Ax402 aims to integrate AI into the existing financial system, while Coinbase and the Ethereum Foundation's A2Ax402 extension aims to establish a new, crypto-native economic environment for AI.

Google's A2A standard allows AI agents from different projects to communicate with each other, but only under a "mutually trusted environment." To this end, the Ethereum Foundation's ERC-8004 adds a layer of trust, similar to a digital passport system, allowing agents to securely discover, verify, and interact with unknown counterparties on Ethereum or other L2 protocols.

The name x402 comes from the HTTP status code "402 Payment Required." Its concept is to integrate payments into internet communications: when an AI calls an API, the server returns a "402 Bill," and the AI can complete the payment on-chain using a stablecoin and receive the service instantly. This not only enables automated, high-frequency transactions between machines, but also enables granular billing of AI services by request, duration, or computing power, something difficult to achieve with traditional payment methods.

▲ Source: Google

On-chain agentic commerce is rapidly taking shape, driven by the dual innovations of stablecoin payments and AI agents. Emerging companies like Skyfire and Crossmint are already abstracting the AP2 and x402 standards into developer-friendly SDKs and APIs. The ChaosChain team has already completed a prototype integrating AP2 with Ethereum's latest ERC-8004 "trustless agent" standard, and this is just the beginning. The Ethereum dAI team, founded and led by Davide Crapis, is further advancing this process. As the underlying foundation for future AI-agent collaboration, Ethereum has the potential to help us move from today's highly centralized AI system to a censorship-resistant, truly decentralized future. By combining payment chains, stablecoin settlement, and AI-driven value innovation, this ecosystem will foster the emergence of many exciting SuperApps.

References:

- Designing the Ultimate Stablecoin Credit Card - Doğan Alpaslan, Cyber Fund (https://cyber.fund/content/stablecoincreditcard )

- Stablecoin on-chain payments, clearing Web 2 thinking - Zuoye ( https://x.com/zuoyeweb 3/status/1969367029011644804)

- The Final Battle of AI Payments: The Three-Body Game Between Google, Coinbase, and Stripe - Luke, Marsbit ( https://news.marsbit.co/20250919092805091063.html?utm_source=substack&utm_medium=email )

- 核心观点:稳定币是加密领域真正的杀手级应用。

- 关键要素:

- 稳定币已是全球南方日常货币。

- B2B跨境支付是最大市场。

- 牌照与合规是核心壁垒。

- 市场影响:推动支付基础设施竞争与创新。

- 时效性标注:中期影响。