Originally Posted by Ethan Chan & Hannah Zhang

Original translation: TechFlow

The Federal Reserve cut interest rates this week and hinted at further easing in the future. Almost every major crypto headline is delivering the same message:

Lower capital cost → Increased liquidity → Bullish for cryptocurrencies.

But the reality is more complicated. The market has already priced in the expectation of a rate cut, and there has been no immediate surge in the scale of capital inflows into BTC and ETH.

So, let’s not stay at the surface level and examine how interest rate cuts affect one part of DeFi: lending.

On-chain lending markets like Aave and Morpho dynamically price risk rather than relying on regulatory mandates. However, the Fed’s policies provide important context for this.

When the Fed cuts interest rates, two opposing forces are at play:

1) Reverse effect: Fed rates fall → on-chain yields rise as people seek non-correlated assets

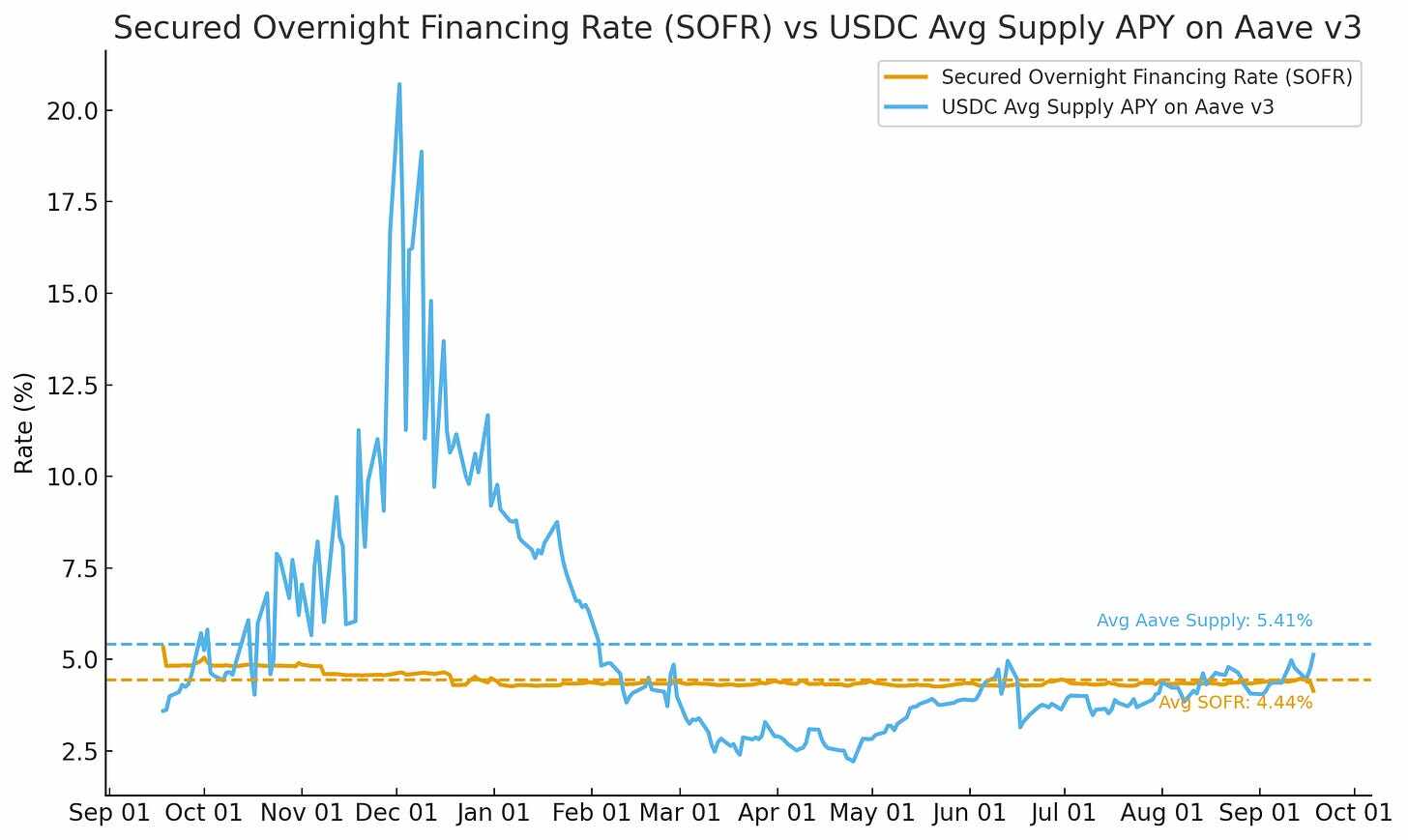

As capital seeks returns beyond traditional Treasury bonds and money market funds, it may flow into DeFi, driving up utilization and increasing on-chain interest rates. If we compare USDC's annualized supply yield (Supply APY) on Aave with SOFR (Secured Overnight Financing Rate), we can see this trend gradually emerging before the Federal Reserve's September rate cut.

Source: Allium

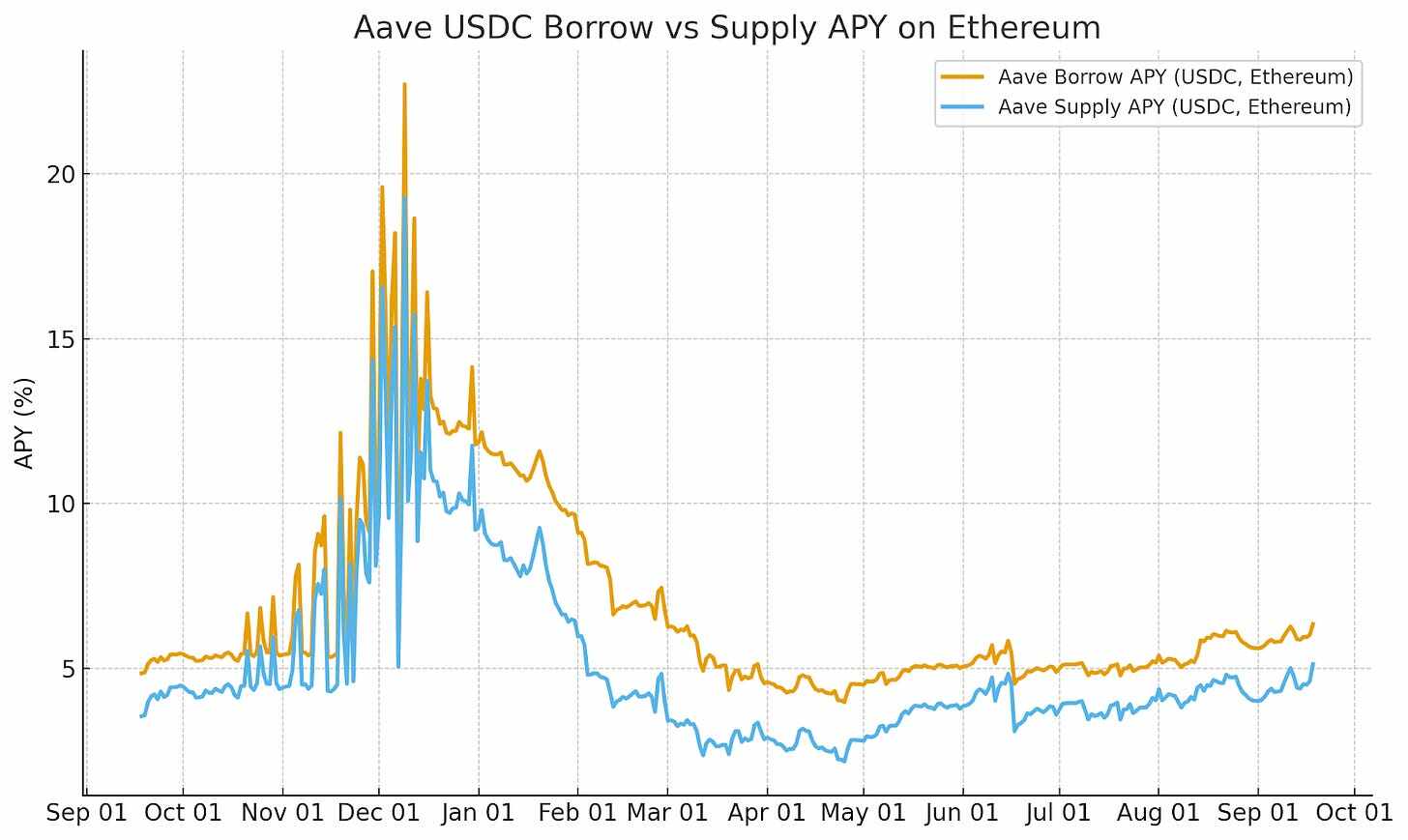

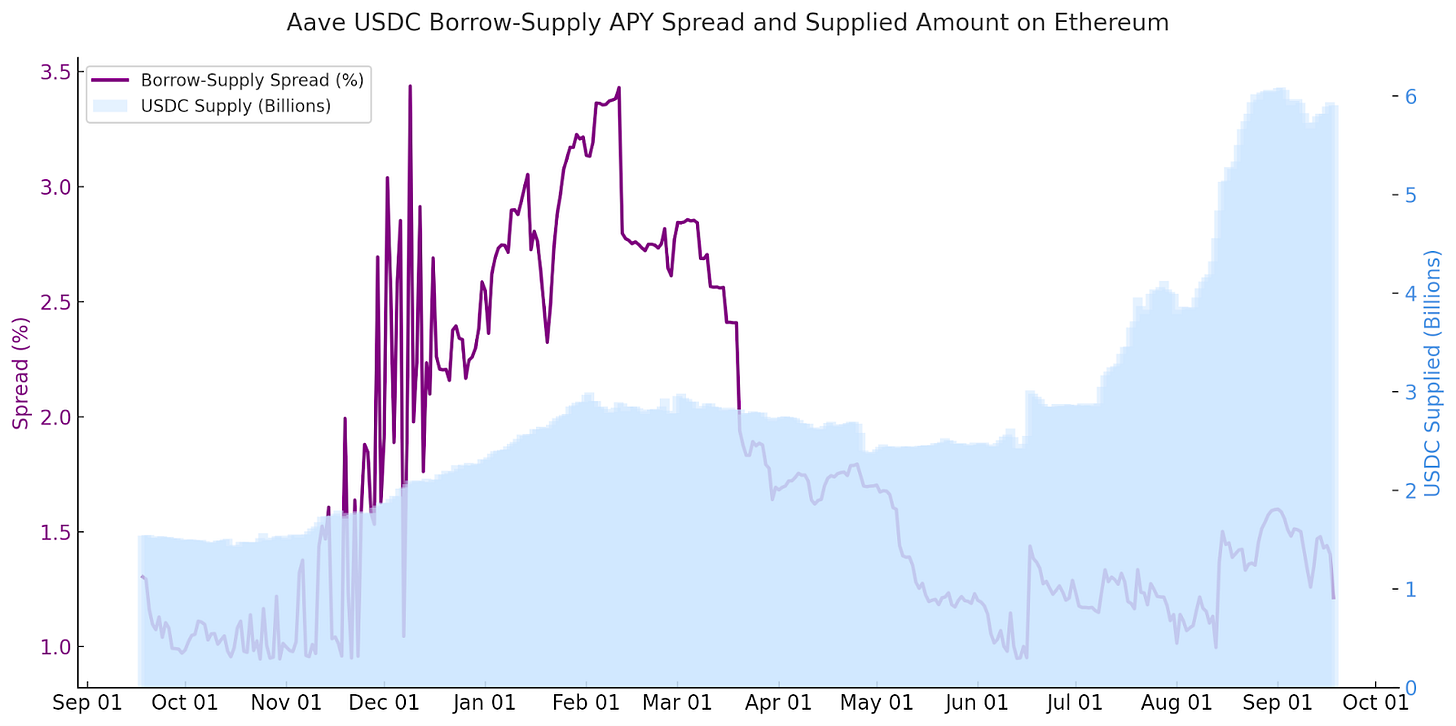

We also see this happening as DeFi borrow-supply yield spreads decline.

Taking Aave’s USDC lending on Ethereum as an example, the lending-supply yield gap gradually narrowed in the days leading up to the Fed’s rate cut announcement. This was mainly due to more funds chasing yield, supporting a short-term reverse effect.

Source: Allium

2) Direct correlation: Fed rates fall → on-chain yields also fall as alternative sources of liquidity become cheaper

As risk-free rates fall, the cost of alternative sources of liquidity, such as cryptocurrencies, also decreases. Borrowers can refinance or add leverage at lower costs, driving down both on-chain and off-chain lending rates. This dynamic typically persists over the medium to long term.

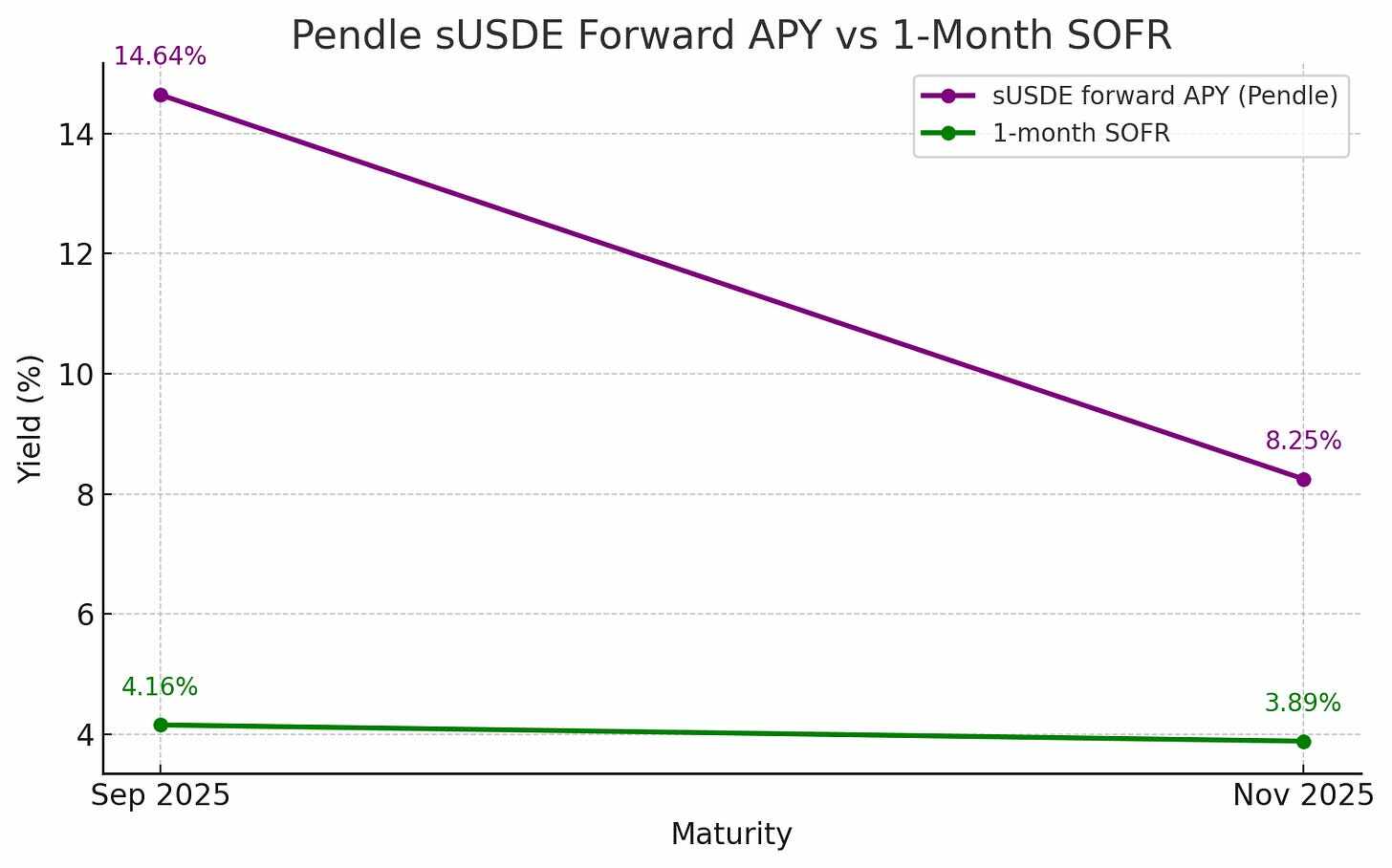

We see evidence of this in the forward rate market data.

Pendle is a DeFi forward yield market where traders can lock in or speculate on future DeFi annualized yields (APYs). While Pendle's maturities don't exactly match traditional benchmarks, they are close enough to SOFR to allow for valuable comparisons—for example, between late September and late November.

On these dates, the one-month SOFR rate was approximately 4.2% (September) and 3.9% (November). Pendle's implied sUSDe yields of similar maturities were much higher in absolute terms (14.6% and 8.3%, respectively). But the shape of the yield curve speaks for itself. Like SOFR, Pendle's forward yields have been trending lower as expectations of further Fed easing become priced in.

Source: Allium

Key Point: Pendle moves in line with traditional interest rate markets, but with a higher benchmark. Traders expect on-chain yields to decline as macroeconomic policies change.

Conclusion: The impact of the Fed’s interest rate cut on the crypto market is not as simple as the title suggests

Interest rate cuts don’t just impact the cryptocurrency market (just as they typically impact the stock market in traditional capital markets). They also have a variety of effects—lower on-chain yields, narrower interest rate differentials, and shifts in the forward yield curve—that ultimately shape liquidity conditions.

Beyond lending, we can also gain further insights into the impact of the Fed’s rate cuts on the cryptocurrency market, such as how the circulating supply of stablecoins will change as issuer yields decline or as realized yields decline, leading to increased ETH staking inflows.

By incorporating real on-chain data, we can look beyond the headlines and truly understand how macroeconomic policies permeate the crypto markets.

- 核心观点:美联储降息对加密市场影响复杂。

- 关键要素:

- 降息或推高链上收益率(反向效应)。

- 降息亦可能拉低链上收益率(直接关联)。

- 远期收益率市场预示链上利率下行。

- 市场影响:重塑DeFi流动性及借贷利率环境。

- 时效性标注:中期影响。