Original link: "Bitwise Chief Investment Officer: Get ready for the crypto ETF feast"

Matt Hougan, Chief Investment Officer, Bitwise

Original translation: Luffy, Foresight News

In my usual CIO memo, I try to offer my thoughts on market dynamics. For example, last week I wrote about why it's "Solana Season" and predicted that Ethereum's main competitor would surge towards the end of the year. Since then, Solana is up 7.72%, which is pretty good.

But watching the cryptocurrency market these days is like watching the Super Bowl pre-game show. Thanks to interest rate cuts, surging inflows into exchange-traded funds (ETPs), growing concerns about the US dollar, and strong momentum in tokenization and stablecoins, the market is poised for a significant year-end rally. Yet, as investors, we're mostly on the sidelines. Why?

For one thing, August and September are historically the two worst performing months of the year for cryptocurrencies. But a more important reason is that major developments — like the recent approval of a Bitcoin ETP by a major brokerage firm, or the progress of new legislation in Congress — often take time to bear fruit.

So, while we wait, I wanted to give you a glimpse into what’s happening with the SEC regarding cryptocurrency ETP approvals. It seems to me that the SEC is poised to completely liberalize this market.

Common Listing Standards

Spot cryptocurrency ETPs are currently approved by the SEC on a case-by-case basis. If you want to launch a spot cryptocurrency ETP based on a new asset in the US (such as the Solana ETP or Chainlink ETP), you must submit a special application to the SEC requesting the right to do so.

In your application, you have to prove certain things about the market: that the market has enough liquidity to support the ETP, that the market is not manipulated, etc.

It's no exaggeration to say that this takes time. The SEC's review process for each application can take up to 240 days, and even then, approval isn't guaranteed. The first application for a spot Bitcoin ETP was filed in 2013, but the SEC didn't approve the product until 2024. Applications have always been a costly and risky endeavor.

But as we speak, the SEC is working to develop a "universal listing standard" for cryptocurrency ETPs. The idea is that under the universal listing standard, as long as an application meets certain clearly articulated requirements, the SEC will almost certainly approve it. And it will be fast: applications will be approved in 75 days or less.

What are the requirements?

The SEC is still studying the issue and listening to input from the crypto industry. Currently, most proposals suggest that issuers should be able to launch spot cryptocurrency ETPs as long as the underlying asset has a futures contract traded on a regulated US futures exchange. Eligible futures exchanges include giants like the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (Cboe), but may also include lesser-known derivatives platforms like Coinbase Derivatives Exchange and Bitnomial. Assuming the broader list is approved, crypto assets that may soon be approved for ETPs include Solana, XRP, Chainlink, Cardano, Avalanche, Polkadot, Hedera, Dogecoin, Shiba Inucoin, Litecoin, and Bitcoin Cash. This list will likely grow as more futures contracts are launched.

What history tells us

The adoption of universal listing standards, which could come as early as October, could lead to a flood of new cryptocurrency ETPs. This is intuitively conceivable, and the history of ETFs supports this.

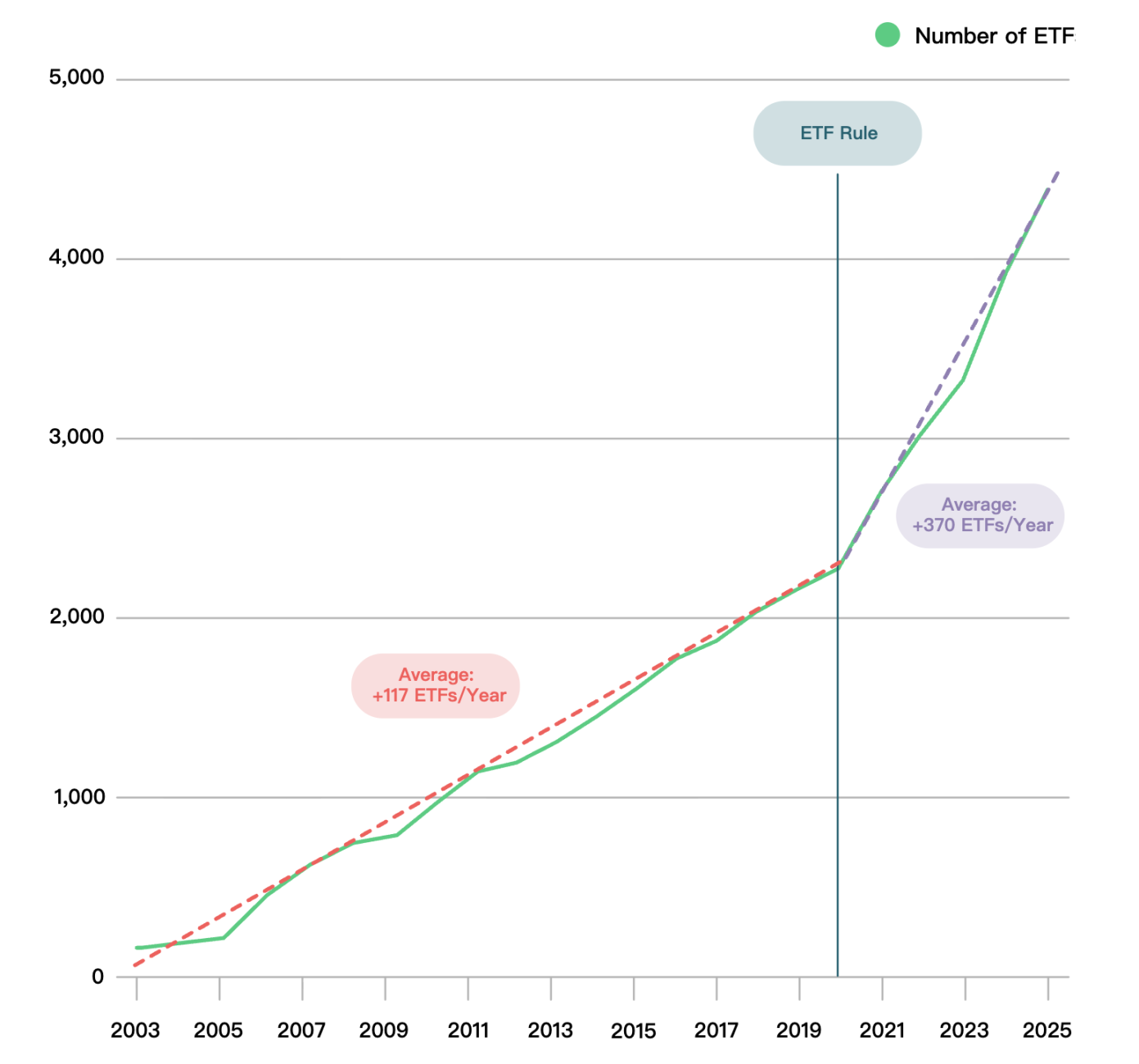

Until the end of 2019, all ETFs followed the same case-by-case regulatory approach currently applied to cryptocurrency ETPs. However, in 2019, the SEC adopted the "ETF Rule," which established common listing standards for stock and bond ETPs. Subsequently, the number of ETF issuances surged significantly.

The chart below from ETFGI shows the number of ETFs listed annually in the U.S. Before the passage of the ETF Rule, an average of 117 new ETFs entered the market each year. Since the ETF Rule took effect, this number has more than tripled to 370 per year.

Source: Bitwise, ETFGI

As the number of ETFs has grown, the number of ETF issuers has also increased significantly because it has become very easy for companies to launch ETFs.

I expect the same thing to happen in crypto. We should see the rise of dozens of single-asset crypto ETPs and index-based crypto ETPs, and we should see many traditional asset managers launch spot crypto ETPs as well.

What this means for crypto asset prices

Investors could easily misunderstand the impact this has on the market. The mere existence of a cryptocurrency ETP doesn’t guarantee significant inflows. You need a fundamental interest in the underlying asset.

For example, the spot Ethereum ETP launched in June 2024 but didn’t really start attracting capital until April 2025, when interest in stablecoins began to rise. Similarly, I suspect that ETPs based on assets like Bitcoin Cash will struggle to attract inflows unless the asset itself shows renewed interest.

However, the point of ETPs is that if fundamentals start to improve, the asset is more likely to rise significantly. Most of the world's capital is controlled by traditional investors, and it is much easier for these investors to allocate funds to the cryptocurrency space when ETPs exist.

There's another, perhaps more difficult to quantify, point: ETPs demystify cryptocurrencies. They make them less intimidating, more visible, and more accessible to the average investor. To crypto natives with a dozen wallet addresses, Chainlink, Avalanche, and Polkadot are no longer exotic-sounding tokens; they're ticker symbols anyone can access in their brokerage account. This allows people to pay more attention to cryptocurrencies and their many use cases in real life. They're more likely to notice articles about Chainlink partnering with Mastercard for payments, Wyoming using Avalanche to issue a stablecoin, or Standard Chartered exploring the use of Ripple technology for cross-border payments.

The SEC’s adoption of a universal listing standard was a “coming of age” moment for cryptocurrency, a signal that we had entered the mainstream, but it was only the beginning.

- 核心观点:SEC将推出加密货币ETP通用上市标准。

- 关键要素:

- 通用标准将简化ETP审批流程。

- 审批时间将从240天缩短至75天。

- 多资产ETP将加速进入市场。

- 市场影响:推动更多传统资金流入加密市场。

- 时效性标注:中期影响。