Global financial markets are experiencing a period of dramatic change. Geopolitical frictions are escalating, technological advancements are accelerating, and social and cultural shifts are constantly reshaping people's values. Against this backdrop, investing has long ceased to be a simple game of financial calculation and has gradually taken on more ideological and social dimensions.

For nearly a century, the "value investing" theories of Benjamin Graham and Warren Buffett have been considered the gold standard in investment. However, with the gradual weakening of the US dollar's hegemony, frequent monetary policy fluctuations, and accelerating shifts in global capital flows, this traditional framework faces unprecedented challenges. At the same time, crypto assets, such as Bitcoin, have emerged on the scene, attracting a large number of investors driven by conviction and ideology. This trend has sparked a new discussion: What is a truly effective investment philosophy today?

This article will explore the two ideas of "smart investors" and "ideological investors", combining financial innovation with the role of crypto trading platforms to explore the choices and balances of investors in the new environment.

The value logic of traditional "smart investors"

The concept of the "intelligent investor," first coined by Ben Graham, centers on investing based on a company's intrinsic value and determining whether it's undervalued through rigorous financial analysis. Buffett took this concept to its extreme, developing a value investing system that prioritizes long-term holdings and a margin of safety.

This logic has endured for decades because it relies on a relatively stable macroeconomic environment: the global dominance of the US dollar, the expansion of the free trade system, and relatively predictable monetary policy. In such a world, tools like discounted cash flow models and risk-free interest rate assumptions can play a significant role in helping investors accurately value assets.

However, recent realities have challenged this logic. Whether it's the post-pandemic restructuring of global supply chains, the frequent policy interventions by various countries, or the industry reshuffles brought about by technological change, traditional models appear unable to keep up. For example, the US government's direct ownership of corporate equity has shattered the myth of a "perfectly free market." For savvy investors accustomed to relying on historical data and predictable trends, this drastic shift in the environment requires a re-examination of their methodologies.

The rise of “ideological investors”

Unlike intellectual investors who emphasize rationality and numbers, ideological investors prioritize conviction and cultural identity. They believe that asset value stems not only from cash flow and financial statements but can also be deeply embedded in technological concepts, geopolitics, and even community consensus.

Cryptocurrency exemplifies this mindset. Bitcoin's rise isn't due to its superior performance within traditional financial models, but rather its embodied values of decentralization, censorship resistance, and monetary sovereignty. For many investors, buying Bitcoin isn't simply a financial decision; it's a way of expressing their opinions.

This investment logic is also reflected in the selection of companies. Companies like Tesla and Palantir have attracted significant retail investor support due to their founders' strong personal convictions and distinct values. The rise of social media has further amplified this power. Communities on Reddit, Twitter, and Telegram can quickly reach consensus, significantly impacting market prices.

The advantage of ideological investing is that it finds new value amidst volatility and uncertainty. For investors who value conviction, short-term price fluctuations are unimportant; long-term consensus is their safety margin. However, this approach also carries risks—if consensus collapses, prices often fall more drastically than under traditional investment logic.

Financial Innovation and the Role of Platforms: The Case of BitMart

In today's world where value investing and ideological investing coexist, crypto trading platforms play a unique role. They are not only the infrastructure for technology and finance, but also a place where different investment philosophies converge.

Take BitMart, for example, a global cryptocurrency trading platform. For users inclined toward value investing, BitMart offers stable trading depth and transparent market mechanisms, enabling them to find fair valuations among relatively mature assets. For those more ideologically inclined, BitMart provides opportunities to participate in emerging projects, allowing them to invest in potential future trends based on conviction and community consensus.

This means that on exchanges like BitMart, two investment philosophies coexist. Value investors can pursue steady returns, while ideological investors can express their ideals by selecting assets with cultural and technological significance. In other words, the platform is not just a tool for matching buyers and sellers; it serves as a bridge for investors to realize their ideals.

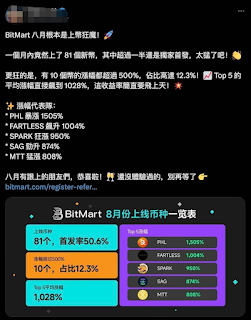

BitMart's recent market activity provides a vivid illustration of this dual role. Over the past few days, a chart showing its initial public offering ratio exceeding 50% has been widely circulated in the crypto community, sparking in-depth discussion among numerous prominent influencers (KOLs). This phenomenon has garnered significant attention because it captures the current market dynamics: while investors seek a balance between traditional values and emerging ideologies, they are also closely monitoring how platforms are guiding capital flows and promoting value discovery through their listing strategies. BitMart's high initial public offering ratio not only reflects its keen awareness and support for emerging, ideologically driven projects, but also demonstrates market recognition of its ability to screen and discover potentially valuable assets.

Furthermore, BitMart is also experimenting with integrating the community and the market. By supporting the launch of community-driven projects, BitMart not only provides investors with diverse options but also aligns the market more closely with their values and needs. This model aligns closely with the crypto industry's philosophy of "users are both participants and builders."

Conclusion: Two-track investment philosophy

The complexity of today's markets has surpassed the scope of a single theory. The value logic of intelligent investors remains the cornerstone of market understanding, particularly when evaluating mature assets. However, the thinking of ideological investors opens up a new dimension to investment, making beliefs and community consensus an integral part of price.

The two logics are not contradictory but complementary. The real challenge for modern investors is how to find a balance between them: neither ignoring the rationality of traditional valuation nor underestimating the market power brought by beliefs and communities.

The role of crypto trading platforms in this process cannot be ignored. Platforms like BitMart enable investors with diverse perspectives to find their niche in the same market. This not only broadens investment options but also provides a more open platform for global investors.

Future investment may no longer be a choice between "value" and "belief," but rather a complex interweaving of rationality and emotion, models and consensus, tradition and innovation. Understanding and accepting this complexity may be the key to truly intelligent investing.

- 核心观点:价值投资与意识形态投资互补并存。

- 关键要素:

- 传统价值投资模型面临宏观环境挑战。

- 意识形态投资看重信念与社群共识价值。

- BitMart平台同时服务两种投资逻辑需求。

- 市场影响:推动投资理念多元化与平台创新。

- 时效性标注:中期影响。