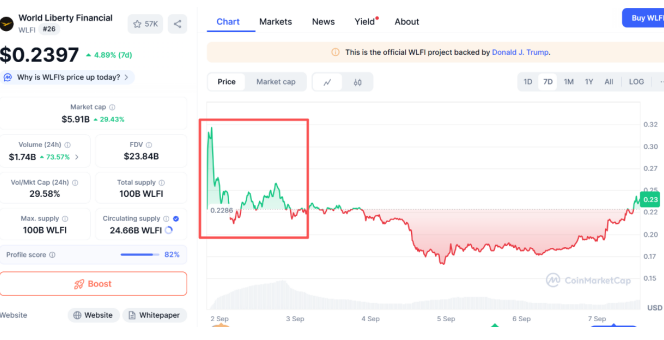

Since its launch, the price of World Liberty Financial (WLFI), a token in which the US presidential family has a deep involvement, has experienced dramatic price fluctuations. Following a sharp drop on its launch day, WLFI experienced another surge, reaching a peak of 0.25 USDT on September 7th, with a 24-hour peak gain of 33%. Given the cryptocurrency industry's tradition of winning over investors with rising prices and investors' faith in the Trump family, WLFI's initial post-launch crisis is expected to have been successfully weathered.

The market value soared, and Sun Yuchen, who owned more than 3 billion WLFI, undoubtedly won again, with a floating profit of over 100 million US dollars overnight.

Just a day ago, he was attacked by many people as the biggest reason for the sharp drop in the price after the issuance.

At that time, the market was full of short-selling on Sun Yuchen, saying that he was selling coins and that his address was frozen. As a result, many people shorted heavily, and suffered heavy losses.

You can question Brother Sun, but you cannot question his ability to make money and his good luck. This sentence has come true again.

Mechanism defects lead to stampede shipments

When we review this incident, the data shows that Sun Yuchen’s operation was obviously not the main reason for the sharp drop after the issuance of W. The main reasons were the defects of the token project model and the realization of the previous gains.

WLFI, a DeFi project supported by the Trump family, has attracted much attention since its launch, but its token price quickly fell below its issue price, rising from $0.20 at the opening to around $0.5, and then quickly falling to around $0.15, which is similar to the trajectory of the TRUMP coin issuance.

Why are there similar trends? The gap between previous expectations and reality is too large.

The total supply of WLFI is 100 billion, but the project unlocked approximately 24.67 billion to 27.15 billion tokens into circulation at launch, accounting for 24%-27% of the total supply. This is far higher than the market's expectations of an initial circulation of 5 billion and a gradual release. Therefore, around September 1st, there was already a lot of criticism of WLFI in the market, and many KOLs advised retail investors to stay away from WLFI, otherwise they would be unlucky.

According to CoinMarketCap data, after WLFI was listed on multiple DEXs, including Ethereum, Solana, and BNB Chain, the initial circulation directly increased the likelihood of a sell-off. Meanwhile, WLFI did not explain the reason for the one-time release of such a huge amount of circulation.

WLFI's token economics design has significant shortcomings, particularly an imperfect lockup mechanism and relatively weak market maker support. While the project has a pre-set unlocking schedule (e.g., unlocking 5% of the total supply in September), the early unlocking was excessively large, and no corresponding lockup incentives were announced, significantly increasing the motivation of early subscribers to cash out in the short term.

Furthermore, during initial IPOs, projects typically utilize market makers to provide a floor for market fluctuations. This time, the apparent absence of market makers has led to insufficient liquidity, and with such a large-scale sell-off of unlocked shares, market makers may find themselves unable to provide a floor.

WLFI's understanding of market operations is as immature as if it had just entered the industry, which directly magnified the extent of the break-even.

Since its peak in January of this year, TRUMP coin has been in a continuous slump, with its market capitalization evaporating significantly, leaving many retail investors with a heavy price to pay. Unlike TRUMP coin's meme-like nature, WLFI, which aims to build decentralized finance, should have driven up market prices through slow construction. However, its initial market capitalization reached $30 billion, placing it directly among the top ten crypto assets, significantly weakening subsequent valuation growth.

Retail investors have learned from Trump's mistakes to "cash out quickly," and a sell-off initiated by WLFI is inevitable. Even if Sun Ge has the potential to dump the market, that's perfectly normal. The question is: does Sun Ge actually have the chips to do so?

600 million VS 27.2 billion, I am afraid Sun Ge can't beat it

WLFI broke the issue price and fell rapidly, which intensified the criticism against the project party before and after the opening. At this time, rumors of Brother Sun "dumping" WLFI appeared, but the person who raised the question only made a promise without providing any evidence.

Based on the principle of presenting facts and reasoning, as well as the traceability of blockchain, from the analysis of on-chain data and timeline, it can be seen that this accusation was just a joke. As for whether it was later used maliciously, everyone has their own opinions.

As an early investor, Sun purchased $75 million worth of WLFI tokens. On September 1st, Sun's unlocked share was only approximately 600 million WLFI (20% of the unlocked amount), which was a drop in the bucket compared to the approximately 27.2 billion unlocked in the first phase of the project.

There is also an episode here. The unlocking of WLFI was completed by returning all tokens through early subscribers, and then the project party returned the unlocked tokens of the first phase. It can be seen that they did not design the lock-up and unlocking mechanism at the beginning. It was more like a temporary solution. Moreover, according to the analysis of Nansen, a well-known institution in the industry, the price drop occurred a few hours before Sun Ge transferred the money to Binance. It was mainly due to institutional selling pressure and large orders from DEX, rather than his personal behavior. Compared with Sun Ge’s transfer of about 55 million tokens, 8 other top holders cashed out on the first day of listing. And this is the main source of pressure.

On-chain tracking shows that most of Sun Ge’s WLFI holdings have not moved. Although the WLFI team froze his wallet (claiming to prevent phishing), they also admitted that this was more of an internal decision of the project rather than a conclusive evidence of a market crash.

Opinions within the industry are divided as to whether Sun was behind a massive market dump. On-chain data clearly doesn't support the conclusion. However, as a prominent figure in the industry, and with his canary-like nature, some of his actions are often exaggerated and interpreted, making it difficult to say they didn't significantly impact the market.

However, the industry generally believes that freezing Sun's account severely undermines the project's "decentralized philosophy." For a project claiming to be decentralized finance to be able to so easily freeze the vast assets of an early investor through centralized means is completely contrary to its stated decentralized philosophy. This demonstrates that WLFI's decentralized governance may have significant flaws.

He posted on social media that he supports Justin Sun's sale of unlocked tokens and believes there is nothing wrong with it. He said that the people who should be held accountable are CryptoQuant CEO Ki Young JuWLFI Foundation, because its "de-banking" treatment of users violates its own purpose.

The fog is deep and the short position has suffered heavy losses

In this WLFI IPO debacle, Sun "passively" won, while others like Maji, who seized the opportunity to go long, profited greatly. The project passed its first post-launch test. So who are the losers?

The short sellers were clearly misled by market sentiment. Many people, influenced by market sentiment, shorted W after the price fell, suffering heavy losses. Data shows that recently, LFI 24-hour WLFI short positions were 10.41 million.

Don't underestimate the dark side of trading. It's hard to say there aren't profit motives behind all the gossip. Those who criticize Sun Ge and bearish WLFI may simply dislike him, but they could also be long positions hoping to pick up shares at a low price and liquidate short positions. Every additional pessimistic atmosphere they create increases their profits.

Data shows that as of September 7, W and USD's steady progress, as well as the Trump family's actual global influence, these important conditions and facts have been intentionally or unintentionally ignored. The RSI indicator of WLFI is close to the oversold area, and the short-term selling pressure is close to the limit. There is a strong demand for a rebound. LFIALT 5 Sigma strategic cooperation 1

It's hard to argue that there isn't a larger game at play here. Those who lack independent judgment and are easily swayed by market sentiment are easily fooled.

To borrow Zhao Benshan’s classic quote, “Haiyan, please be more careful!”

- 核心观点:WLFI价格波动源于机制缺陷而非个人行为。

- 关键要素:

- 初始解锁量过大,占总量24%-27%。

- 做市商缺位导致流动性不足。

- 孙宇晨仅解锁6亿枚,占比极小。

- 市场影响:暴露项目治理缺陷,引发信任危机。

- 时效性标注:短期影响。