BitMart recently released its August coin listing data: over half of the new projects launched that month were first-time tokens. For a leading global trading platform, this ratio has undoubtedly attracted attention within the industry.

Some believe this high proportion of initial public offerings reflects the "extreme involution" among exchanges—platforms scrambling to seize the window of opportunity for high-quality projects in an effort to stand out from the competition. Meanwhile, others point out that for ordinary users, this means earlier access to potential assets and even excess returns.

From various perspectives, this data reflects both shifts in the industry landscape and BitMart's long-established strategic DNA. This article will analyze BitMart's August listings, comparing them with data from the first half of the year and July, and explore the significance of this trend for the industry and users.

August data: continuation of high initial launch rate

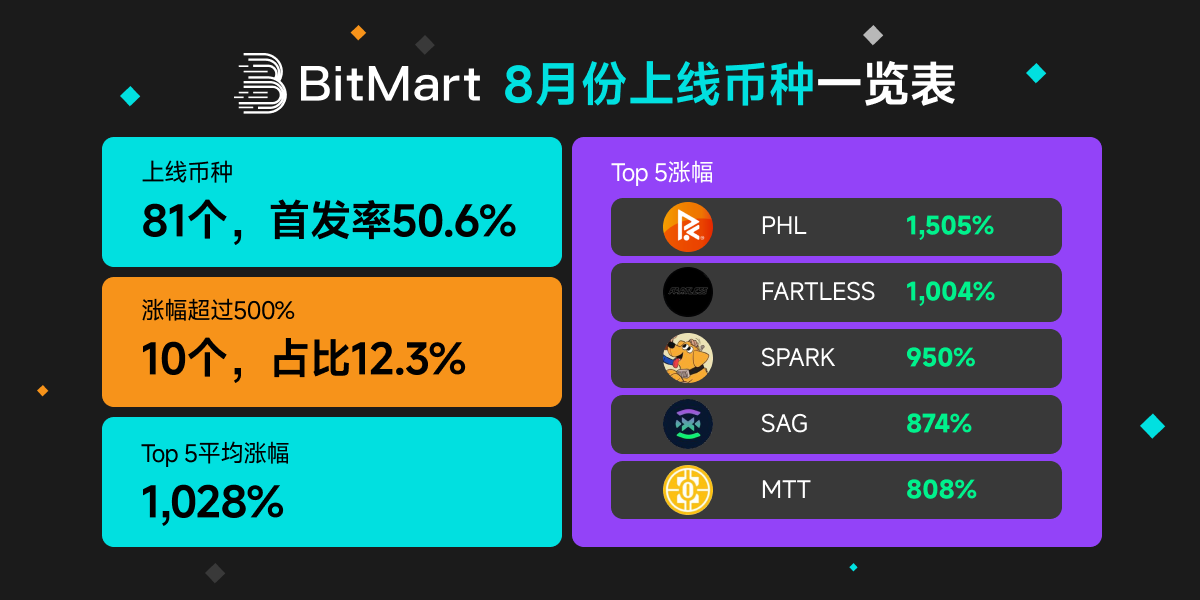

According to public information, BitMart launched a total of 81 new assets in August 2025, with an initial launch rate exceeding 50%. This means that more than half of all assets launched that month were listed on global exchanges for the first time.

Looking at the distribution of sectors, August's initial coin offerings spanned a range of hot sectors, including MEME, AI, RWA, DePIN, and GameFi. As industry trends shift, BitMart's listing selection maintains a relatively balanced coverage of these sectors. For example, AI-related projects, due to their close integration with real-world industries, continue to attract investment and community attention; while GameFi and MEME coins, while still possessing traffic-generating properties, have attracted a large number of users' short-term participation.

Opinions within the community are divided. Some users prioritize the potential growth and scarcity of initial offerings, believing that being on board early offers the potential for excess returns. Others worry about the uncertainty and risk of early-stage assets. However, the results show that 12.3% of assets have seen growth exceeding 500%, with the average increase for the top five assets reaching 1,028%. This data not only alleviates market concerns but also demonstrates the platform's foresight and ability in project selection and pacing.

Overall, BitMart's August listing strategy not only maintained its distinctive "early-stage project window" approach, but also further solidified market recognition through a high initial public offering ratio and impressive performance. This result demonstrates that, far from weakening user confidence, the high initial public offering ratio has actually garnered increased attention and discussion for the platform, shifting the focus from "involutionary listing" to affirmation of the platform's foresight and project judgment.

Historical comparison: from accidental to normal

To better understand the August data, we need to compare it over a longer time period.

Overall situation in the first half of the year

According to official data, in the first half of 2025, BitMart launched a total of 538 high-quality assets across multiple sectors. Of these, 341 were first-time projects, representing 63%. This percentage is not only significantly higher than the industry average, but also solidifies BitMart's market position as a "first-time launch hub."

The market performance of listed assets is also remarkable. Within six months, 24 tokens saw increases exceeding 1,000%, 46 tokens saw increases exceeding 500%, and 154 currencies saw increases exceeding 100%. More notably, 19 of the top 20 highest-performing assets were BitMart's first launches. This data demonstrates BitMart's accuracy in project selection and market pacing, providing positive feedback for its launch strategy.

July situation

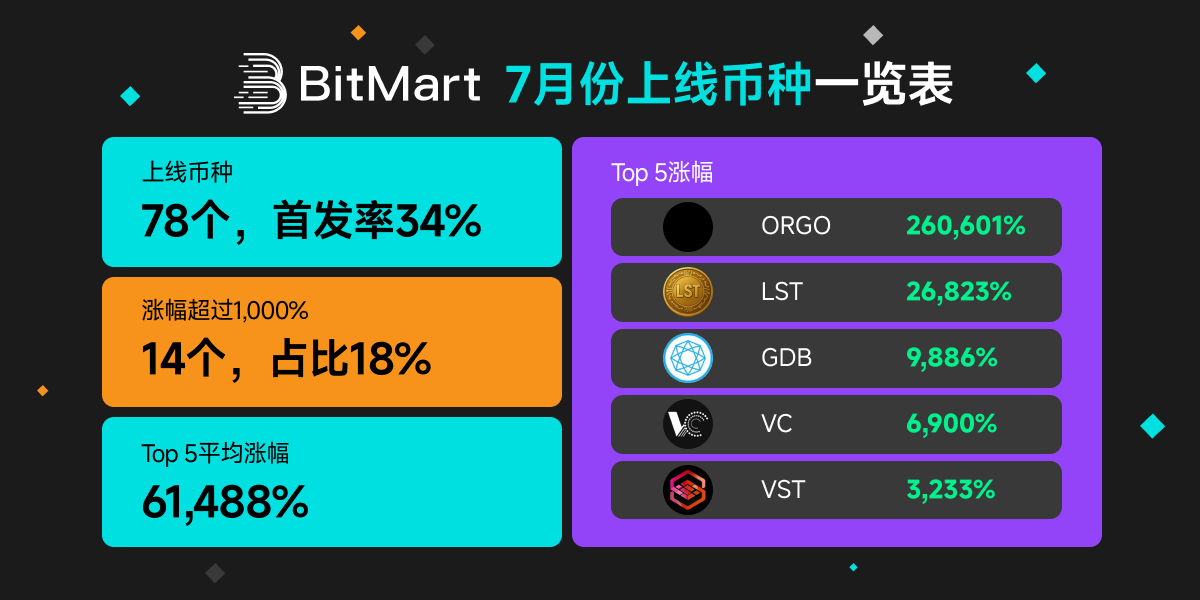

If we narrow the time window to July 2025, BitMart launched a total of 78 cryptocurrencies that month, 26 of which were first launches, accounting for 34%. Although this proportion is lower than the overall level in the first half of the year, it is still significantly higher than the industry average.

Even more striking is the market performance of new tokens: 14 tokens saw increases exceeding 1,000%, representing 18% of the total. Among these, ORGO, LST, GDB, VC, and VST saw increases of 260,601%, 26,823%, 9,886%, 6,900%, and 3,233%, respectively, for an average increase of 614 times. While such extreme growth cannot be replicated, the data does demonstrate BitMart's strong execution capabilities in project discovery and community engagement.

Trend Comparison

Combining the data from July and August shows a significant rebound in the proportion of first-time projects. In July, the percentage was 34%, while in August it exceeded 50%, more in line with the overall level in the first half of the year. This suggests that BitMart may have strategically increased its investment in first-time projects, especially as the popularity of these sectors continues to heat up.

Competitive landscape: How to survive in the face of internal competition

In the exchange industry, the question of who gets to list high-quality projects first largely determines a platform's influence and user retention. As industry competition intensifies, the initial public offering ratio is becoming a new metric for evaluating an exchange's competitiveness.

As is common industry practice, most leading platforms are accelerating their coin listing pace and expanding their reach to avoid user outcry due to a lack of popular assets. However, BitMart's initial offering ratio is significantly higher, a strategy that has established a relatively distinct advantage in the face of homogenous competition.

It's worth noting that peers have differing views on this trend. Some platforms are choosing to quickly follow suit, striving to capture a share of the initial launch window; others are more cautious, emphasizing the importance of asset quality and regulatory compliance. This divergence suggests that the future exchange landscape may further diverge: some platforms will be seen as "launch platforms" for early-stage projects, while others may attract specific user groups by positioning themselves as "robust and secure."

BitMart itself is well-known in the community for its "early and accurate coin listings." Data from the first half of the year through August demonstrates that this strategy has become a core part of the platform's DNA. For BitMart, this differentiated positioning not only continuously attracts traffic and users but also gradually develops into a globally competitive advantage, ensuring its unique position in the fiercely competitive industry.

Genetic Analysis of BitMart's Strategy

BitMart's initial public offering ratio in August 2025 once again exceeded 50%. While continuing the strategy in the first half of the year, it also pushed the industry's discussion on "involution" to a new climax.

For users, this trend means more early opportunities, but also greater uncertainty; for platforms, it is a means to strengthen their own characteristics in the competition, but it also requires more risk control and resource costs.

There are two key points to observe in the future:

The long-term performance of the first-launch project - only the continued quality of the project and the realization of its value can prove the sustainability of the strategy.

The evolution of competition in the industry - whether more exchanges will join the "IPO race" or gradually return to rationality - still needs to be answered by the market.

Against this backdrop, BitMart's choice has undoubtedly become a focus of industry attention. Regardless, its high initial public offering ratio has become a defining characteristic of BitMart. Whether this can ultimately translate into long-term advantages requires more time and data to verify.

- 核心观点:BitMart高首发率策略巩固竞争优势。

- 关键要素:

- 8月首发比例超50%,延续高位。

- 涨幅超500%资产占比12.3%。

- 覆盖AI、GameFi等多热门赛道。

- 市场影响:推动交易所竞争加剧,用户获早期机会。

- 时效性标注:中期影响。