Original author: Aylo

Original translation: Saoirse, Foresight News

Consider this question: Do you think you can sell at the exact market peak? The answer is clear—almost no one can, including me, and there's no need to force it. A characteristic of cycle tops is that they appear quickly on short-term time frames, but they're difficult to accurately identify until higher time frames (HTFs) become visible.

Day traders who focus on short-term trading may be able to catch some signals, but they have already shouted "the top has arrived" many times. After so many times, these judgments are naturally meaningless - after all, they don't pay attention to the macro market background.

Therefore, regarding market cycles, it's up to you to make informed financial decisions based on your own observations. Markets are constantly changing, and my perspectives will adjust based on new data. These are for reference only.

Arguments for a Four-Year Cycle Top

Pattern Recognition Argument:

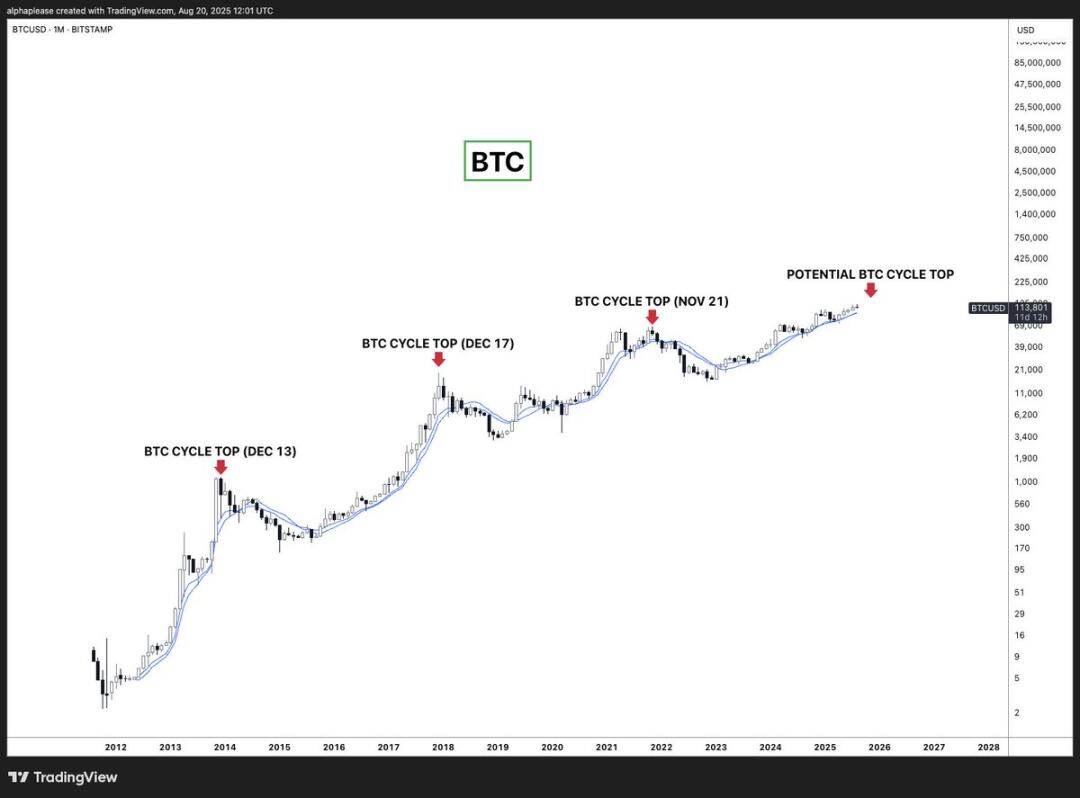

Looking back at historical charts, a clear pattern is hard to miss: December 2013, December 2017, and November 2021 (all cycle tops). The consistency of the four-year cycle is remarkable, and market patterns tend to persist until disrupted by fundamental changes.

Reasons this pattern may continue:

- Deeply ingrained psychology: The four-year cycle is deeply embedded in the minds of cryptocurrency market participants;

- Self-fulfilling prophecy: Broad perception of the cycle could trigger coordinated selling pressure, compounded by hidden leverage in the system (e.g., DATs);

- Halving correlation: Bitcoin halving triggers a supply shock, with historical peaks typically occurring 12-18 months after the halving (although this cycle is more of a market narrative);

- Occam's razor principle: The simplest explanation is often closest to the truth - why complicate the pattern of three fulfillments?

We are clearly not in the early stages of this cycle anymore - Bitcoin has risen significantly since the bottom. According to this pattern, we should be approaching peak range.

Arguments Against a "Four-Year Cycle Top" (2026 Cycle Continuation Theory)

Fundamental shift arguments:

I raise a simple question: Will the cycle dominated by institutions really be exactly the same as the previous two cycles dominated by retail investors?

I generally agree that the market is cyclical, so I won’t talk about a “super cycle” in vain, but I think the cycle may be lengthened or shortened due to other factors.

Reasons why this cycle may be different:

1. Differences in behavioral patterns between institutional and retail investors

- The flow of spot ETF funds and traditional exchange flows form a new liquidity model;

- Systematic profit taking by institutions is more stable and is not as prone to panic selling as that by retail investors;

2. Traditional indicators may fail

- We have many cycle analysis tools (such as NVT, MVRV, etc.), but their historical data range is based on the market dominated by retail investors;

- Institutional involvement fundamentally changes the definition of “overreach”;

- When priced in gold, Bitcoin’s current price hasn’t even surpassed the peak of the previous cycle – it’s far from being in a bubble.

3. A radical change in the regulatory environment

- The regulatory environment in this cycle is completely different. The United States and the SEC are more accepting of cryptocurrencies and have formed a clear framework for institutional participation.

- The end of previous cycles was partly due to regulatory shocks (such as the crackdown on ICOs in 2018);

- The risk of this systemic, sudden end to the cycle has now been significantly reduced;

4. Macroeconomic and Federal Reserve Dynamics

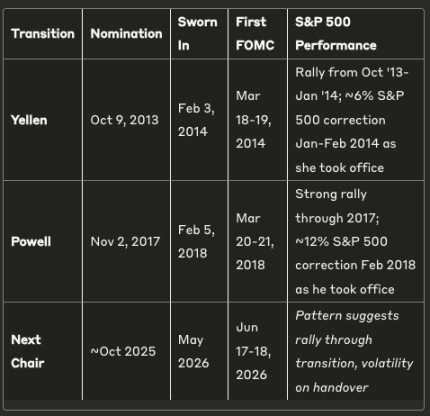

- Federal Reserve Chairman Powell's term ends in May 2026, and Trump may announce his successor in late 2025;

- The dynamics of the "shadow Fed chair" weaken the effectiveness of current policies, and if the market expects Trump to nominate a dovish chair, it may trigger early buying pressure;

- The new Fed Chair's first FOMC meeting is scheduled for June 17-18, 2026 – a potential market catalyst

- A "Goldilocks environment" (an ideal state of lukewarm economic growth) may persist during the transition period

(Note: "Goldilocks environment" is a common expression in financial markets, derived from the concept of "not too hot, not too cold, but just right" in the fairy tale "Goldilocks and the Three Bears." It means that economic and policy conditions may remain stable during the transition period, providing support for the market to continue to rise.)

Historical Patterns of Federal Reserve Chairman Changes: Looking back at past changes, we can find a clear pattern:

Both transitions followed the same sequence – the market would rally upon nomination news, and the rally would continue until the transition was complete, but the S&P 500 would pull back precisely when the new chairman took office.

When Yellen took over, the S&P 500 fell about 6% in January and February 2014; when Powell took over, the index fell about 12% in February 2018. This suggests that after Trump announces his nomination in late 2025, the bull market may continue until the end of the transition, with a high probability of fluctuations around the transition in May and June 2026—possibly coinciding with the peak of the cycle.

5. Changes in market structure

- Concerns about currency devaluation have given rise to new demand drivers that are no longer limited to a shift in risk appetite;

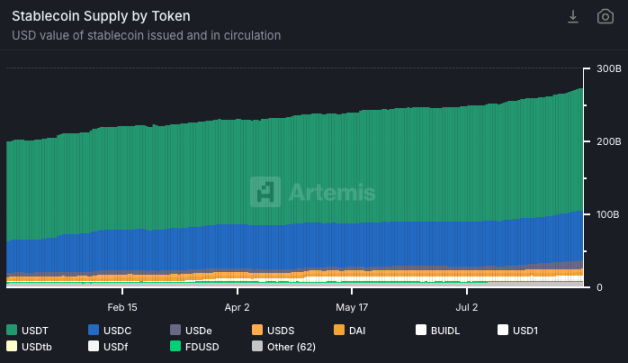

- Stablecoin market capitalization can be used as a leading indicator — and is still growing (this is our “dry powder” indicator);

- The sources of demand for Bitcoin are more diversified than in previous cycles: ETFs, DATs, pension funds, etc.

What factors may lead to the early end of the cycle and the recurrence of the four-year cycle?

DAT Leverage Risk : I believe the primary bearish factor is the possibility that DAT companies will unwind their positions faster than expected. A massive forced sell-off could overwhelm buyers and alter market structure. However, there's a difference between losing buying demand (mNAVs falling to 1) and becoming the forced seller who triggers a "dip."

Still, losing the purchasing power of a major DAT is clearly significant. Many speculate this is already happening—the mNAVs of Strategy and major ETH DATs have plummeted. I'm not blind to this, and you should be keeping an eye on it.

Macro Risks : A resurgence of inflation is a real macro risk, but there is no sign of it yet. Cryptocurrencies are highly correlated with the macroeconomy, and we are still in a "Goldilocks environment."

The missing element of the cycle top

No market frenzy yet:

- The market is still riding a “wall of worry” – every 5% correction triggers speculation of a cycle top (which has persisted for 18 months);

- There is no sustained enthusiasm yet, nor is there a market consensus for a subsequent rise;

- There is no top feature of "surge followed by collapse" (although it is not a necessary feature).

If cryptocurrencies experience a significant rally later this year and significantly outperform the stock market, this "pump and then crash" signal could mean that the top of cryptocurrencies has arrived well before the business cycle, which could last until 2026.

Stablecoin Leading Indicators

A highly valuable indicator: stablecoin market capitalization growth.

In traditional finance, growth in the M2 money supply often precedes asset bubbles. In the cryptocurrency market, the market capitalization of stablecoins serves a similar purpose—representing the total amount of “dollars” available within the crypto ecosystem.

Major cycle tops often coincide with periods of stagnant stablecoin supply 3-6 months prior. As long as stablecoin supply continues to grow significantly, the market may still have upward momentum.

My current opinion

Frankly speaking, based on current observations, I do not believe that a major cycle top will occur before 2026 (this view may change at any time due to new circumstances).

While there are limited historical data points for the four-year cycle (only three), institutional participation represents a fundamental change in market structure. The Fed chairmanship transition alone could extend the "Goldilocks environment" into 2025—a significant development, especially given the unprecedented correlation between cryptocurrencies and the macroeconomy.

This cycle also sees a greater awareness of the four-year cycle among cryptocurrency market participants, which makes me think the results may be slightly different. When has the public's judgment ever been completely correct?

Will everyone sell out according to the four-year cycle pattern and get out unscathed?

However, I also acknowledge that the consistency of the four-year cycle pattern is remarkable, and market patterns tend to persist until they are broken. The public's perception of the cycle can also become a self-fulfilling prophecy that causes it to end.

As Bitcoin's market share declines, I will continue to gradually take profits on overvalued altcoins; however, I will hold Bitcoin because I believe it will hit new highs in 2026. It is important to note that regardless of the overall market cycle, the altcoins you hold may peak at any time.

Final Thoughts

The four-year cycle pattern is the strongest argument for a 2025 top—it has worked three times, and simplicity often wins. However, changes in market structure dominated by institutions, the dynamics of the Federal Reserve transition, and the absence of a frenzy signal suggest that this cycle could extend into 2026.

Things could change dramatically in the coming months, so don't be too stubborn.

In any case, accept that you won't be able to sell at the exact highest point and develop a systematic exit strategy.

The right position is one that allows you to sleep soundly. If you've already made a lot of money, it's perfectly fine to sell too early.

- 核心观点:比特币四年周期或被打破,顶部或延至2026年。

- 关键要素:

- 机构参与改变市场结构与流动性。

- 美联储主席换届或延长牛市周期。

- 稳定币持续增长预示上涨动力仍存。

- 市场影响:或延长牛市,推迟见顶时间。

- 时效性标注:中期影响。