A 200% first-day surge, a 50% drop in a week: The ice and fire of the Bullish IPO

- 核心观点:加密企业借政策东风登陆美股。

- 关键要素:

- Bullish IPO融资11亿美元。

- 持有2.4万枚比特币储备。

- Ark Invest大额增持推动股价。

- 市场影响:加速加密与传统金融融合。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

In 2025, US crypto stocks ushered in a veritable bull market . With the Trump administration's push for a "Crypto Capital of America" strategy and the signing of stablecoin legislation, crypto companies' standing on Wall Street rapidly rose. Clear policy signals, coupled with huge investor expectations, made crypto-related stocks the star assets of the capital market. Sensing this signal, crypto companies flocked to list on the Nasdaq or NYSE, attempting to leverage Wall Street's power to accelerate their growth.

On August 13th, digital asset trading platform Bullish successfully completed its initial public offering, raising $1.1 billion at a price of $37 per share, exceeding the market's previous estimate of $32 to $33. The IPO was oversubscribed by more than 20 times , bringing its market capitalization to $5.4 billion. Its stock ticker is BLSH.

On its first day of trading, Bullish's stock price soared to $118 per share, a surge of over 200%, triggering multiple circuit breakers due to excessive volatility. Although the stock price has retreated since the initial surge, currently trading at $62.89, it remains nearly 70% above its IPO price.

On Bullish's first day of trading, Ark Invest purchased over 2.5 million shares through its ARKK, ARKW, and ARKF ETFs , with a market capitalization exceeding $170 million. This drove the stock price up by over 22% that day, pushing its market capitalization to over $12 billion. On August 20th, amidst a general decline in crypto stocks, Ark Invest added another 356,346 Bullish shares (approximately $21.2 million) and 150,908 Robinhood shares (approximately $16.2 million).

Feedback from the capital market clearly shows that the imagination of the crypto narrative remains strong.

Assets and Reserves: Block.one's "Transfusion" and Bitcoin's Trump Card

Bullish not only boasts a spectacular debut but also boasts a solid capital and asset base. Its CEO is former NYSE President Tom Farley, and its largest shareholder is Block.one CEO Brendan Blumer, who holds a 30.1% stake. Leveraging Block.one's financial and technological support, Bullish has been targeting the institutional client market since its inception, emphasizing trading security and liquidity.

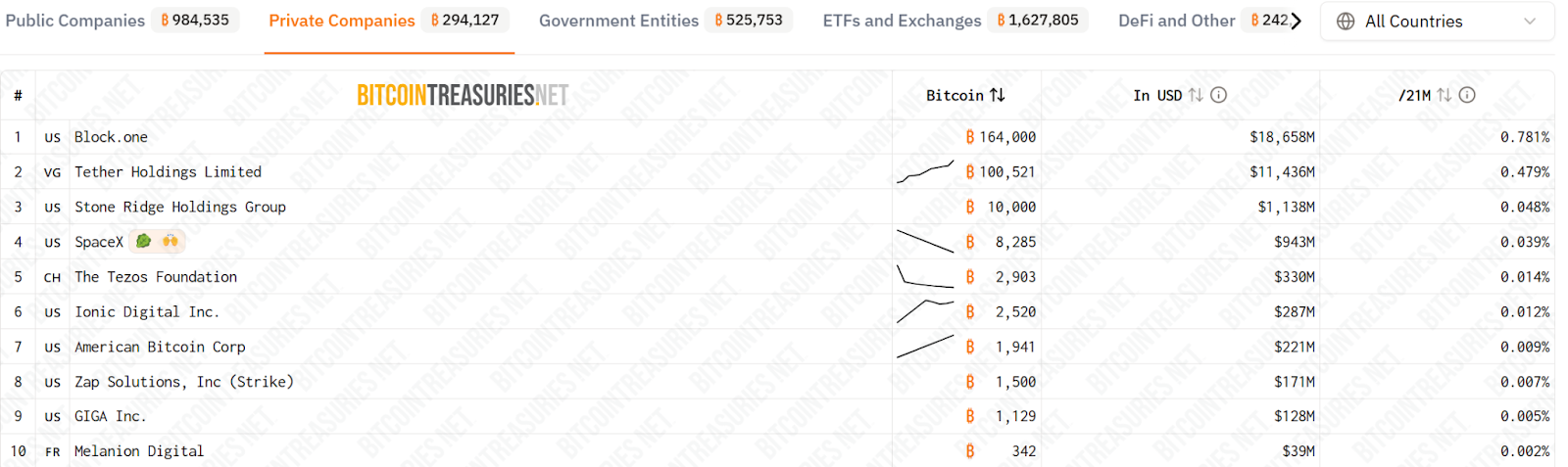

According to BitcoinTreasuries.net , Bullish's 24,000 BTC holdings after its IPO put it among the top five publicly traded companies by Bitcoin reserves, surpassing leading players like Metaplante and Coinbase. Tesla, by contrast, has fallen out of the top ten.

In addition, Block.one itself holds 164,000 Bitcoins (with a market capitalization of over $18.6 billion), making it the largest private company holding Bitcoin. An SEC financial report published on its official website shows that as of 2021, Bullish had total assets of approximately $5.85 billion, with a net worth of $4.69 billion.

Overall, Bullish not only obtained sufficient funds through the IPO, but its Bitcoin reserves and net asset size also provided strong guarantees for the company's long-term competitiveness in the crypto financial market.

From EOS to Bullish: A History of Betrayal

Bullish's rapid rise is inseparable from the deep financial backing of Block.one. However, looking back at history, the love-hate relationship between Bullish and EOS remains a cause for regret.

In 2017, Block.one launched EOS with the ambitious vision of "millions of TPS and zero transaction fees." The initial coin offering (ICO) raised $4.2 billion, setting a record for funding in the crypto industry and earning it the nickname "Ethereum's killer." However, the gap between ideals and reality quickly widened: cumbersome CPU and RAM staking mechanisms hindered user experience; node elections were dominated by large investors and exchanges, devolving into a voting system, far from the fair ecosystem the community had hoped for.

A deeper rift stems from the unfair distribution of resources. Block.one pledged $1 billion to support the EOS ecosystem, but $2.2 billion of the $4.2 billion raised was used to purchase U.S. Treasury bonds, invest in Bitcoin, speculate in stocks, and acquire Silvergate Bank (which went bankrupt in 2023). The amount of funds actually flowing to EOS developers was disastrously low.

In 2021, Block.one turned around and launched Bullish in a high-profile manner, investing US$100 million in cash and attracting top capital such as Peter Thiel, Alan Howard, SoftBank, and Galaxy Digital to join, with a financing scale of up to US$1 billion.

However, this new platform neither uses the EOS chain nor supports EOS tokens, nor does it leave any resources for the EOS community. For EOS supporters, this is a blatant betrayal: Block.one leveraged EOS to generate revenue, only to pivot and launch a new venture, leaving EOS on the sidelines of the public blockchain competition.

The outrage eventually escalated into a "governance uprising." The EOS Network Foundation (ENF) joined forces with node operators to push an on-chain proposal to remove Block.one's governance authority. Although EOS has formally "de-Block.oneed," control of the funds remains with Block.one, and the legal dispute between the two parties remains unresolved.

Landing on Wall Street: Knocking on the Door to Traditional Finance

In fact, this isn't Bullish's first attempt at capital markets. As early as 2021, it planned to go public through a SPAC (Special Acquisition Corporate Acquisition) backdoor listing, but the plan ultimately stalled due to multiple factors. It wasn't until June 2025 that the Financial Times revealed that Bullish had secretly submitted an IPO application to the SEC.

This time, with the capital support of Block.one and Tom Farley's Wall Street background, Bullish finally opened its doors to the New York Stock Exchange. A successful IPO not only signifies increased funding but also symbolizes the legitimate reputation of crypto companies in the US capital market.

More notably, Bullish received $1.15 billion in IPO proceeds in the form of stablecoins, marking a milestone in the US capital market as the first IPO settled in stablecoins. These stablecoins, minted primarily on the Solana network, include US dollar-denominated USDC, USDCV, USDG, PYUSD, RLUSD, USD 1, and AUSD, as well as euro-denominated EURC and EURAU, all exclusively custodied by Coinbase. This innovation opens a new path for the application of crypto assets in traditional finance and heralds the further integration of crypto assets with traditional finance.

Conclusion

Bullish's listing is the product of both policy and market forces. On the one hand, there's a loosening of the institutional environment, and on the other, there's a swift response from capital. Its value lies not only in its $5.4 billion market capitalization or its 24,000 bitcoins, but in its symbolic significance: crypto finance is moving from fringe experimentation to institutionalized status.

Whether the US crypto stock craze can continue and drive a new round of industry prosperity remains to be seen, both under market and policy scrutiny. However, Bullish has undoubtedly sounded the opening bell for this new chapter.