Crypto investment, betting on fundamentals or capital flow?

- 核心观点:加密投资分基本面与资金流驱动。

- 关键要素:

- 基本面投资依赖可量化收益。

- 资金流投资依赖市场情绪。

- 比特币介于两者之间。

- 市场影响:引导投资策略向基本面倾斜。

- 时效性标注:长期影响。

Original Article by Jon Charbonneau

Original translation: Chopper, Foresight News

The latest popular narratives in the crypto space are “yield” and “DAT (cryptocurrency treasury)”, which highlight two diametrically opposed investment approaches:

- Fundamental investing: buying an asset because you expect to receive quantifiable economic benefits (such as cash returns) under a set of clear assumptions. These returns create intrinsic value for the asset.

- Greater Fool Investing: Buying an asset simply because you believe someone will buy it from you in the future at a higher price (even if the market price is already above intrinsic value).

In other words, are you primarily betting on fundamentals or on capital flows? This short article will provide a simple framework to help you understand the value of both.

Fundamentals and capital flows

The core lies in the future

Fundamental investing is generally considered to be less risky and less volatile than pure betting on fund flows:

- Lower downside risk: Fundamental investors tend to be more protected from large losses. Because the asset has intrinsic value, you gain some downside protection. This can be reflected in the asset's market price or its ability to generate cash flow for you.

- Smaller upside: Fundamental investors often miss out on the biggest winners. You’ll completely miss out on purely speculative investments (like Meme Coin’s 1,000x increase) and often sell out of your positions prematurely (e.g., before reaching peak valuations).

While these are often marginal gains, both approaches ultimately rely on predictions about the future—and your predictions can be right or wrong. You're betting on future fundamentals (e.g., you believe protocol X will generate $Y in revenue next year) or future capital flows (e.g., you believe token X will have $Y in net buying inflows next year).

Therefore, the core of both approaches is: how confident are you in these predictions. In fact, fundamental investing is often easier to make confident predictions. For example:

- Fundamentals: You see businesses like Tether or protocols like Hyperliquid consistently generating high revenue. Combined with an understanding of the core business, you can reasonably forecast future cash flows. A high-quality project won't lose all its customers or revenue overnight; ideally, it will grow.

- Money Flow: I don’t see much advantage in betting on how long the DAT mania can last (except for insider trading). It could cool down tomorrow, or it could last a year, I really don’t know.

Growth and value

Fundamentals don't equate to boring or low returns. Even pure fundamental betting can yield outsized winners. In this scenario, you're typically betting on future improvements in fundamentals (i.e., growth investing) rather than maintaining current fundamentals (i.e., value investing). Betting on high growth often carries higher risk, so you expect higher returns to compensate.

This is also a gradual process, and growth-oriented and value-oriented investments are not mutually exclusive. Given that the crypto space is primarily an early-stage investment, most fundamental investments here are more growth-oriented than value-oriented.

An asset that's currently losing money but has high growth potential may be a better fundamental investment than one that's currently profitable but has low growth potential (or even shrinking profitability). Would you rather hold OpenAI or Ethereum? This confuses many crypto investors, as investments with high price-to-earnings ratios can actually be fundamental investments. The key difference is:

- Fundamental investing: You believe the protocol has the potential for extremely high future growth, which can translate into high future returns.

- Greater Fool Investing: You don't expect growth or returns, you just hope someone will buy it from you at a higher valuation.

Fundamentals-driven vs. DAT-driven

Based on all of the above, I still prefer to hold underlying assets with solid fundamentals. This includes mature projects with strong current fundamentals that I expect to continue, as well as early-stage projects with fundamentals that have high future growth potential.

Conversely, we haven't invested in any DATs to date (though I'm open to their value proposition under specific circumstances). I'm also cautious about assets whose investment rationale relies almost entirely on DAT fund flows rather than strong underlying fundamentals. Once the DAT frenzy subsides, the price support for these assets could quickly collapse. I believe this is primarily a speculative trend driven by fund flows, and I personally don't see much room for excess returns. Invest where you have an advantage, and DATs can also buy into assets with strong fundamentals.

Reduce reliance on human psychology

Buffett and Bitcoin

Confidence in a forecast is often inversely proportional to the extent to which the outcome depends on assumptions about unpredictable human psychology and behavior.

The key to fundamental investing is this: You don't need others to agree with you. A simple test is: "Would you hold onto this asset even if you could never sell it?" Warren Buffett doesn't need the market to agree with him. He buys stocks that generate sufficient cash flow to not only recoup his investment but also provide a reasonable rate of return.

- Bitcoin: Buffett once said that he would not buy all the Bitcoin in the world even for $25, because Bitcoin cannot generate any income for the holder and is only valuable when it can be sold to others.

- Apple stock: On the contrary, anyone would be happy to buy all the Apple stock for $25, even if they could never sell it, because Apple can generate $25 in revenue in an instant.

Obviously, fundamental investors are usually free to sell assets, but at least they buy with the understanding that the market value of an asset may deviate from its intrinsic value for a long time, and they are willing to wait it out. In extreme cases, they will say, "If you wouldn't hold a stock for 10 years, don't even think about holding it for 10 minutes."

Fundamental investors still consider human behavior, as it influences their predictions of an asset's future returns (for example, whether people will continue to pay for the protocol's products). However, they don't have to take the extra, more difficult step of trusting others will agree with their logic and buy the asset. Even when an asset clearly can create value through product sales, predicting market reactions is often difficult (i.e., the market can be chronically irrational, undervaluing fundamentally strong assets). Predicting market reactions is even more challenging when it's clear that an asset can't create value through product sales (e.g., Meme Coin).

Even when investing based on fund flows, you can increase your forecast confidence by reducing your reliance on human psychology. For example, rather than relying solely on narrative-driven sentiment, you can predict sell flows by quantifying token issuance, investor vesting schedules, and unrealized profits held by investors.

Furthermore, identifying certain long-term behavioral patterns can reduce uncertainty. For example, humans have used gold as a store of value for thousands of years. While it's theoretically possible that everyone would suddenly believe tomorrow that gold is worth only its practical value, this is highly unlikely. If you hold gold, this isn't typically your biggest risk.

Bitcoin, Ethereum, and Meme Coin

Similarly, Bitcoin's rise over the past 16 years has given us increasing clarity about when and why people buy Bitcoin. This helps us rely less on human psychology (e.g., will people buy Bitcoin when global liquidity increases?) and more on other underlying investment rationales we actually want to bet on (e.g., will global liquidity continue to increase?). Therefore, even though Bitcoin is largely a flow-driven investment, it may still be the most confident investment for most crypto investors.

This also helps us understand why the investment case for Ethereum is inherently more complex. It requires making more uncertain assumptions about human behavior and market psychology. Most investors generally believe that Ethereum's cash flow generation alone is insufficient to justify its valuation based on fundamentals. Its continued success is more likely to stem from its becoming a durable store of value (much like Bitcoin), which requires some or all of the following assumptions:

- Multiple crypto stores of value: You might predict that people would start assigning relatively higher value storage premiums to assets other than Bitcoin (such as Ethereum), and that Bitcoin would no longer be special. However, we haven't seen this happen, and historically, people have tended to favor one asset over another for this function (for example, gold is primarily priced for monetary value, while silver is primarily priced for use value).

- Replacing Bitcoin as a store of value: You might predict that Bitcoin will eventually fail (e.g., due to security budget issues or quantum computing) and that Ethereum will become the natural successor to "digital gold." However, it's likely that all crypto assets will fall if confidence collapses.

- Store of value tied to a specific utility: Ethereum's logic is often tied to its additional utility relative to Bitcoin, measured through various metrics such as "value secured," EVM activity, Layer 2 activity, or DeFi usage. However, unlike the cash flows (i.e., revenue) generated by Ethereum, these metrics do not provide intrinsic value—they simply represent a story about the store of value. Therefore, Ethereum is far from a pure expression of the underlying logic that "network-level metrics will grow." Betting on these trends also involves betting on how the market will price Ethereum accordingly.

To be clear, there's nothing inherently wrong with making these bets. Buying Bitcoin in 2009 required making similarly uncertain assumptions about human behavior, and the results were quite positive. Investors simply need to understand what they're betting on and how their views differ from the market consensus. To achieve sustainable outperformance, you need to understand where the market is wrong.

At the other extreme, there are pure meme coins. These are destined to have no lasting monetary premium; you're completely betting on human psychology and the market's short-term reaction to new narratives. Is the meme exciting enough? Interesting enough? Or just too boring? It's like a game of chicken.

in conclusion

There's nothing inherently right or wrong about the two investment approaches we've discussed. The key for investors is whether you can systematically use them to make confident forecasts. More confident forecasts reduce volatility and downside risk; forecasts with greater confidence than the market consensus can help you achieve excess returns.

In most cases, especially for long-term investing, I find I'm better able to replicate alpha using strategies that rely more on fundamentals. However, as mentioned earlier, this isn't always the case. An investment like Bitcoin can fall somewhere between "fundamental investing" and "greater fool investing," depending on how you quantify the currency's utility. You might have high confidence in a Bitcoin bet (based primarily on fund flows) but less confidence in a DeFi project (based primarily on fundamentals).

Finally, these two approaches are not mutually exclusive. You can invest based on both fundamentals and fund flows. In fact, the investments that offer the best risk-adjusted returns often combine both.

Historically, as a crypto investor, it's been worthwhile to be primarily guided by capital flows. This makes sense: tokens used to surge inexplicably every four years, interest rates were zero, investors raised too much capital, and few projects generated sufficient cash flow to justify high valuations. But looking ahead, as the industry matures, I believe focusing on fundamentals may ultimately yield more excess returns.

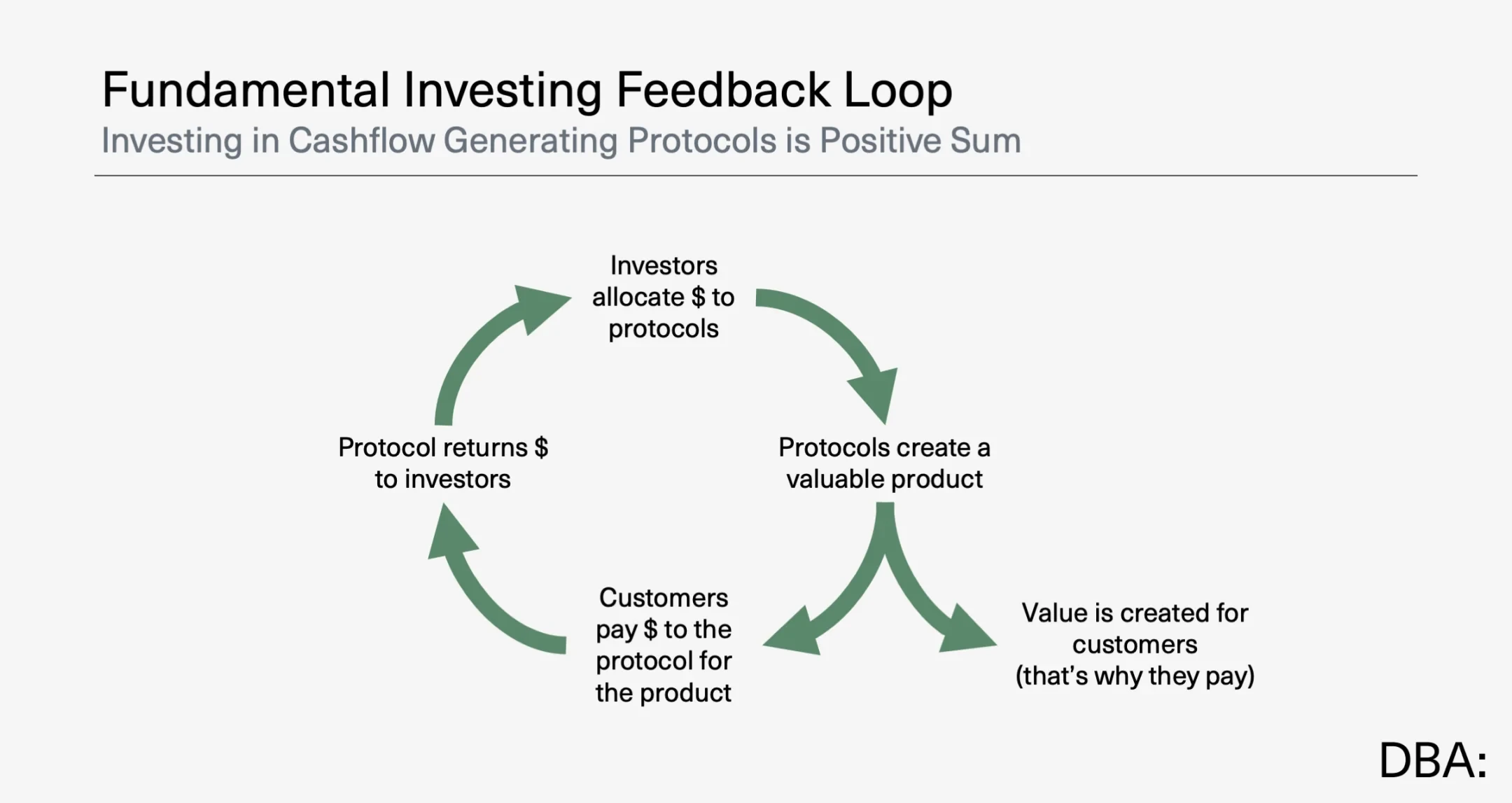

I also hope that fundamentals will become more important, as they are crucial to the long-term health of the industry. I have no problem with meme coins (they're mostly just fun gambles), but trading narratives around assets that don't create value is inherently a zero-sum game. In contrast, allocating capital to cash-flow-generating projects can be a positive-sum game. Building cash-flow-generating projects requires creating products that customers are willing to pay for; issuing tokens purely for narrative purposes doesn't require this; the token itself is the product.

The crypto space needs this feedback loop created by fundamental investing:

Thankfully, the general trend in the crypto space is:

- Cryptocurrency investing is becoming increasingly fundamentals-driven . We finally have more tokens that generate significant cash flows, token transparency frameworks are becoming more widespread, and token valuation frameworks are becoming more and more understood. As a result, the differences in token returns are growing.

- Traditional financial investments are becoming increasingly driven by capital flows . The world is becoming increasingly bizarre and depraved, with meme stocks and wild IPO first-day surges becoming increasingly common. Understanding the next big narrative is crucial.

One day, the two will converge and we will only talk about "investment." But one thing will not change: both fundamentals and capital flows will still be important.