Original author: Nancy, PANews

As the prices of Bitcoin and Ethereum continue to climb, Wall Street is accelerating its control over crypto asset pricing through crypto ETFs, which have become a key indicator of price trends and market sentiment. Just-concluded second-quarter financial reports from institutional investors show that while the strong influx of institutional funds has driven the expansion of crypto ETFs, it has also exacerbated the market's fragmentation. BlackRock's products, in particular, have become the preferred choice for new funds, while ETFs from other institutions have performed relatively poorly.

Spot ETF fund flows diverged significantly, with BlackRock alone receiving the largest inflows.

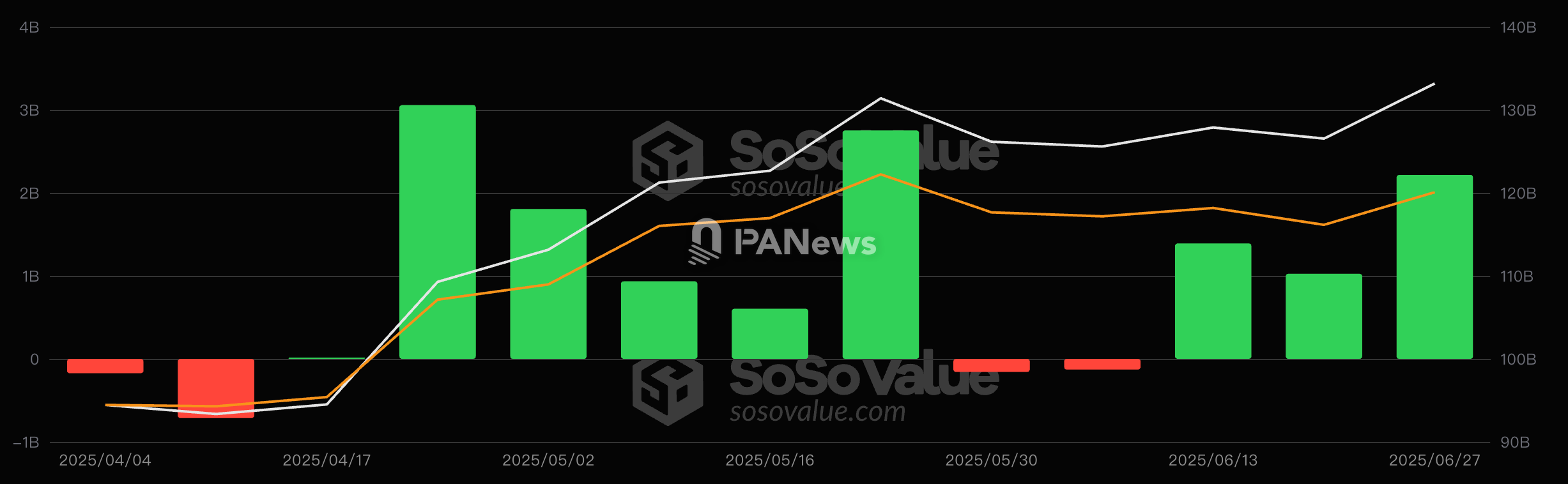

In the second quarter of this year, the overall performance of US Bitcoin and Ethereum spot ETFs was strong, but capital inflows were highly concentrated and long-tail ETFs performed relatively poorly.

According to SoSoValue data, 12 related ETFs recorded a total net inflow of US$12.8 billion in the quarter, with an average monthly inflow of approximately US$4.267 billion, but the inflow of funds was almost monopolized by one company.

BlackRock's IBIT attracted $12.45 billion in a single quarter, accounting for nearly 96.8% of the market's net inflows, while its stock price rose 23.1% during the same period. In contrast, the performance of other institutional investors was lackluster. Fidelity's FBTC saw approximately $490 million in net inflows, with its stock price rising approximately 23.15%; Grayscale's Mini BTC saw inflows exceeding $330 million, with its stock price rising 22.9% during the period; Bitwise's BITB saw inflows exceeding $160 million, with its stock price rising 23% during the period; VanEck's HODL saw net inflows of less than $150 million, with its stock price rising approximately 23.1%; and the remaining seven products (such as Grayscale's GBTC and Ark Investments' ARKB) generally experienced net outflows.

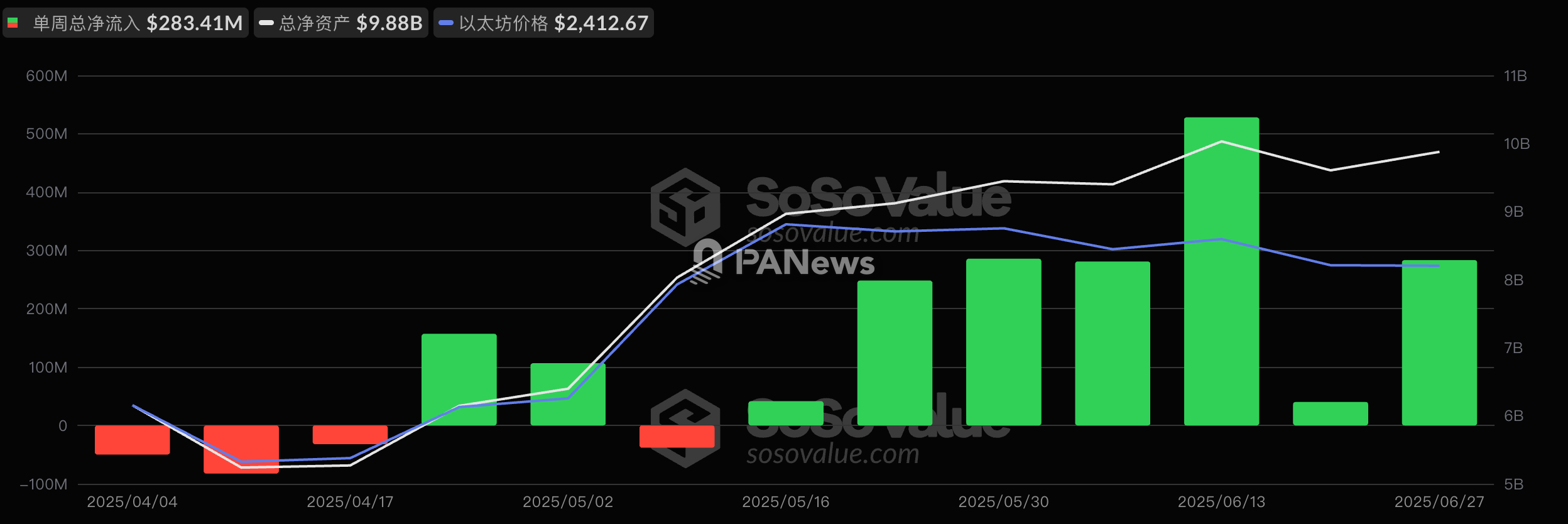

Ethereum spot ETFs also performed well. SoSoValue data shows that nine Ethereum spot ETFs saw cumulative net inflows of over $1.79 billion during the quarter, with an average monthly inflow of over $590 million.

Among them, BlackRock's ETHA remained the main recipient of funds, with a net inflow of nearly US$1.45 billion and a share price increase of 11.5% during the period; Fidelity's FETH attracted a net inflow of more than US$250 million and a share price increase of 34.6%; Grayscale's mini ETH had a net inflow of more than US$160 million and a share price increase of 34.7%; Bitwise's ETHW had a net inflow of approximately US$33.27 million and a share price increase of 36.37% during the period; VanEck's ETHV received an inflow of US$5.81 million and a share price increase of 34.76%; Grayscale ETHE had a net outflow of more than US$130 million and a share price increase of 34.26% in a single quarter; Franklin's EZET received a net inflow of approximately US$6.32 million and a share price increase of approximately 34.61%; 21 Shares' CETH had an inflow of US$8.14 million and a share price increase of 34.63%; Invesco's QETH had a net inflow of US$3.37 million and a share price increase of approximately 33.6%.

12 companies hold a total of US$15.8 billion, with BlackRock products becoming the preferred choice for heavy holdings

PANews sorted out the Bitcoin/Ethereum spot ETF holdings of 12 listed companies in Q2. These institutions generally increased their allocation to Bitcoin and Ethereum ETFs in the quarter, with cumulative holdings of approximately US$15.8 billion, accounting for about one-tenth of the market value of all Bitcoin ETFs. At the same time, they strengthened risk management and return optimization through call/put options.

Among Bitcoin spot ETFs, IBIT and FBTC are key institutional holdings, with most institutions, such as Goldman Sachs, Jane Street, Susquehanna International, and Millennium Management, significantly increasing their holdings. ARKB, meanwhile, saw explosive increases among some institutions, such as Susquehanna International and Schonfeld Strategic Advisors. Regarding Ethereum ETFs, ETHA became the preferred choice, with Goldman Sachs, Millennium Management, and Capula Management all significantly increasing their holdings in the second quarter. FETH also saw increased holdings by several institutions, but the scale and increase were smaller than those of ETHA. Most other Ethereum ETFs fell behind.

Goldman Sachs: Spot holdings exceed $2.7 billion, ETHA increases 283%

As of the second quarter of 2025, Goldman Sachs has increased its investment in crypto ETFs, with its spot holdings exceeding $2.7 billion, particularly in Ethereum-related products. Specifically, Goldman Sachs slightly increased its IBIT holdings during the quarter, bringing its holdings to over $1.568 billion, and held over $1.25 billion worth of IBIT call and put options. The firm also increased its FBTC holdings to over $430 million and reduced its corresponding put options.

As for the Ethereum spot ETF, Goldman Sachs significantly increased its holdings in ETHA, with the number of shares held increasing by 283% month-on-month, the market value of holdings exceeding US$474 million, and new call options worth more than US$14.3 million; not only that, it also slightly increased its holdings of approximately 1.95 million shares of FETH, and the value of its holdings reached US$246 million.

Brevan Howard: Spot holdings approach $2.3 billion, with a significant increase in IBIT holdings

Brevan Howard is one of the world's largest macro hedge funds. As of Q2 2025, Brevan Howard held over 3,750 shares of BlackRock's IBIT (valued at approximately $2.296 billion), an increase of over 15.9 million shares, or 74%, compared to the first quarter. Brevan Howard also added $400,000 worth of IBIT put options during the quarter to hedge against potential risks. Furthermore, the firm acquired over 43,000 shares of BlackRock's ETHA (equity trading asset) in the second quarter, valued at approximately $806,000.

Jane Street: Major investors increase their holdings of IBIT and ETHA, with a dual-line layout of spot and options.

In the second quarter of 2025, Jane Street, a world-renowned quantitative trading company, significantly increased its spot allocation to multiple Bitcoin/Ethereum spot ETFs, with an overall holding size of over US$2.2 billion. It also enhanced returns and risk management through volatility trading and hedging, but the size of its holdings was centered on BlackRock's ETF products.

Regarding Bitcoin spot ETFs, Jane Street held 23.967 million shares of IBIT (valued at approximately $1.467 billion) this quarter, a 268% increase from Q1. Jane Street also significantly increased its exposure to IBIT call and put options, bringing the total value of its options holdings to $1.78 billion. It also held 11.43 million shares of ARKB (valued at approximately $409 million), a 128% increase from Q1, and significantly expanded its ARKB call and put options. Jane Street held 1.02 million shares of GBTC (valued at approximately $86.55 million), a 219% increase from Q1, along with approximately $24 million in related call and put options. Jane Street's BITO holdings were valued at over $53.74 million, a 232% increase from Q1. Jane Street also added 190,000 shares of BITB, valued at approximately $11.6 million. In contrast, Jane Street slightly reduced its holdings of Grayscale Mini BTC and significantly reduced its DEFI holdings.

Regarding Ethereum spot ETFs, Jane Street's ETHA holdings in the second quarter exceeded $130 million, an increase of over 3.78 million shares from the first quarter, and added over $42 million worth of related call and put options. FETH holdings reached $47.37 million, a 36% increase from the previous quarter. Furthermore, holdings in ETHE, ETH, EZET, and QETH all hovered in the millions of dollars, while ETHW and CETH saw significant reductions or even liquidations.

Susquehanna International Group: Heavily invested in IBIT and FBTC, and aggressively built up a position in the Ethereum ETF

As of the second quarter of 2025, Susquehanna International Group held Bitcoin/Ethereum spot ETFs worth nearly US$1.5 billion and increased options size to manage volatility risk.

Among them, Haina International holds IBIT worth more than US$680 million, as well as call options of up to US$1.56 billion and put options of US$750 million; FBTC's holdings exceed US$310 million, and it has allocated nearly US$950 million in call and put options; ARKB's holdings increased to US$357 million, and the number of holdings surged by 4565% month-on-month, making it the most significant target for increased holdings; BITB's holdings also increased by 1093% month-on-month, with a holding value of approximately US$100 million; and it also holds thousands of US dollars worth of Grayscale GBTC and BTC, and millions of US dollars of BTCW and HODL.

In terms of Ethereum spot ETFs, Susquehanna International holds $17.9 million worth of ETHA and has added over $84 million worth of call and put options. Grayscale's ETH holdings increased by 588% month-over-month, reaching approximately $23.27 million. Furthermore, the firm expanded and added spot and options positions in products such as FETH, FETH, and ETHW, totaling several million dollars.

Horizon Kinetics Asset Management: Bitcoin ETF is the core configuration, and the position changes are not obvious.

Horizon Kinetics Asset Management's crypto ETF holdings exceed $1.43 billion, with Bitcoin ETFs as its primary allocation. In the second quarter, Horizon Kinetics slightly reduced its GBTC holdings, but its holdings remain over $1.23 billion. It also holds $146 million in Grayscale BTC, the same amount as the previous quarter. Meanwhile, its IBIT holdings increased to $58.88 million, an approximately 11% increase from the previous quarter. Its HODL and FBTC positions remained stable, with assets valued at several hundred thousand dollars. The firm also holds a small amount of Grayscale ETHE and ETH.

Schonfeld Strategic Advisors: Total holdings valued at over $1.1 billion, with a significant increase in ARKB holdings

Multi-strategy hedge fund management company Schonfeld Strategic Advisors continued to increase its holdings of Bitcoin and Ethereum-related funds in the second quarter, with a total holding value of approximately US$1.12 billion.

In terms of Bitcoin spot ETFs, Schonfeld Strategic Advisors holds FBTC worth over US$437 million, with a slight increase in holdings month-on-month; IBIT's holdings increased to approximately US$347 million, with new call options worth US$1.53 million; ARKB's holdings soared 1228% month-on-month, with a holding value of nearly US$120 million; BITB's holdings expanded to US$113 million, and it held approximately US$530,000 in GBTC.

At the same time, the institution increased its holdings of ETHA by approximately 1.68 million shares this quarter, with a holding value of US$84.45 million; it established a new position of 500,000 shares of ETHW, worth approximately US$9.03 million; and its FETH holdings remained unchanged from the previous quarter, worth approximately US$4.04 million.

Avenir Group: IBIT holdings exceed US$1 billion, ranking first among Asian institutional investors

Avenir Group is the family office founded by Li Lin. As of the second quarter of this year, Avenir Group held over $1.01 billion in IBIT, a 12% increase from the previous quarter, ranking first among Asian institutional investors. The group also added approximately $12.2 million worth of call options. Its FBTC holdings totaled approximately $5.51 million.

Millennium Management: IBIT accounts for more than half, increasing Ethereum ETF allocation

As of the second quarter of 2025, global alternative investment management company Millennium Management held over $940 million worth of crypto ETFs, mainly Bitcoin spot ETFs.

Among them, Millennium Management holds IBiT worth more than US$488 million, with the number of holdings increasing by 22% compared with Q1. It also holds call and put options worth more than US$28 million. The number of FBTC holdings has not changed much from the previous quarter, with the asset value reaching US$160 million. BITB slightly reduced its holdings, with the value of its holdings close to US$45.3 million. ARKB holds a value of approximately US$38 million, with the number of holdings increasing by 207% month-on-month. Grayscale's BTC and GBTC holdings are valued at nearly US$30 million and US$1.96 million, respectively.

In terms of Ethereum spot ETFs, Millennium Management added more than 5.8 million shares of ETHA in Q2, worth more than US$110 million; Grayscale's ETH holdings also increased by 103% month-on-month, with a holding value of US$58.85 million; FETH also saw a significant increase in holdings, with a holding value of approximately US$10.52 million; ETHW's position remained unchanged from the previous quarter, with asset value rising to approximately US$2.6 million.

Capula Management: Total holdings exceed US$800 million, with IBIT accounting for the majority

Capula Management, one of Europe's largest hedge fund managers, held over $868 million worth of Bitcoin/Ethereum spot ETFs in the second quarter. Of this, Capula Management held over 9.48 million shares of IBIT (valued at approximately $580 million), a 23% increase from the previous quarter. Meanwhile, the firm held approximately $140 million worth of FBTC, a significant 65% decrease from Q1.

In terms of Ethereum spot ETF, Capula Management expanded its related allocation scale this quarter, with ETHA holdings surging 196% to 5.35 million shares, worth more than US$100 million; while FETH holdings increased slightly to approximately US$45.21 million.

Symmetry Capital: holds just over $680 million in IBIT, with a slight increase in holdings in the second quarter

Symmetry Investments is a Hong Kong-based hedge fund focused on fixed income arbitrage and global macro strategies. In the second quarter of 2025, Symmetry's holdings in IBIT increased by approximately 4% from the previous quarter, reaching over 11.23 million shares, valued at over US$688 million.

Mubadala Investment: Maintaining IBIT holdings unchanged

Mubadala Investment, a sovereign wealth fund with over $330 billion in global assets under management, held over 8.72 million shares of IBIT in Q2, unchanged from the previous quarter. However, due to a rise in IBIT's share price, the value of its holding increased to approximately $534 million.

Sculptor Capital: Total holdings value exceeds US$500 million, with substantial increase in IBIT holdings

Sculptor Capital, a global alternative asset management firm, held over $500 million worth of Bitcoin spot ETFs in Q2. Specifically, the firm significantly increased its holdings in IBIT this quarter, with its holdings increasing by 60% quarter-over-quarter and valued at over $270 million. Furthermore, the firm held over $200 million and $21.52 million worth of FBTC and BITB, respectively, with holdings remaining unchanged from the first quarter.

- 核心观点:华尔街通过加密ETF加速掌控加密资产定价权。

- 关键要素:

- 贝莱德IBIT独揽96.8%比特币ETF净流入。

- 机构持仓总额达158亿美元,集中配置头部产品。

- 高盛等大幅增持以太坊ETF,ETHA增幅283%。

- 市场影响:加剧市场分化,强化机构主导地位。

- 时效性标注:中期影响。