Original author: Tiger Research

Original translation: AididiaoJP, Foresight News

TL;DR

- Bitcoin L1 as a Trust Anchor: The BTCFi infrastructure is securely built around Bitcoin, using it for final settlement and verification while keeping complex logic off-chain. Concepts like BitVM can extend Bitcoin’s smart contract functionality without changing the consensus mechanism.

- A multi-layered execution ecosystem: From Bitcoin-anchored blockchains like Stacks, to BTC staking chains like Botanix and BounceBit, to Rollup-inspired systems like Merlin and Bitlayer, each approach balances scalability, programmability, and trust in different ways while maintaining Bitcoin as the core of security and value.

- Complementary systems like the Lightning Network: While the Lightning Network excels at fast, low-cost payments rather than DeFi, its liquidity and routing revenue potential can connect Bitcoin’s transaction layer with BTCFi’s capital markets, unlocking hybrid use cases as the bridge technology matures.

As mentioned in Part 1, BTCFi’s goal is to unlock idle Bitcoin capital and transform it into a productive asset. However, to achieve this, infrastructure is crucial.

In this section, we explore the infrastructure layers that underpin Bitcoin DeFi: from Bitcoin’s base layer to emerging Layer 2, sidechains, and novel execution environments. These infrastructure components enable DeFi applications to be built around Bitcoin without compromising its core principles.

Bitcoin L1: Settlement, Finality, and Trust

The Bitcoin blockchain is the most secure, decentralized financial ledger in existence. With over a decade of near-zero downtime and a history of deliberately conservative upgrades, Bitcoin L1 is widely regarded as the final settlement layer for cryptocurrencies.

This fundamental advantage gives Bitcoin a unique role: it serves as the cornerstone of trust in the multi-layered DeFi system. The BTCFi protocol anchors Bitcoin L1 not for computation but for settlement, using it as the "final court" for verifying transaction results.

Crucially, BTCFi generally avoids modifying Bitcoin’s base layer to implement DeFi logic. The prevailing design philosophy is to build around Bitcoin’s simplicity and durability, placing execution logic off-chain or on Layer-2 and sidechains, while always returning to Bitcoin’s Layer 1 for settlement and security.

That said, some experimental designs, particularly certain zk-rollup implementations, could benefit from new opcodes (such as OP_CAT), which would require a soft fork. These proposals remain speculative, and most BTCFi infrastructure is focused on extending its utility without changing Bitcoin’s core consensus rules.

Looking ahead, proposals like BitVM take this concept a step further. BitVM is an early concept that allows complex programs to run off-chain while still allowing Bitcoin to verify the results. Think of it like completing a complex math problem on paper and publishing the answer; the answer is considered valid unless challenged. If challenged, proof must be put on-chain within a set time window, with Bitcoin enforcing the result.

This could potentially enable fully functional smart contracts on Bitcoin without modifying the core system. While still experimental, it reflects a broader trend: using Bitcoin as the foundation of trust while moving advanced functionality and logic to external layers.

Overall, Bitcoin L1 remains simple and conservative, which is precisely why it succeeds. It serves as a settlement layer and value anchor for a growing modular ecosystem. BTCFi's goal is not to turn Bitcoin into Ethereum, but to expand its utility while maintaining its integrity.

The following sections will explore the structure of the execution layer, design differences, and how they enable Bitcoin to support a wider range of financial applications.

Anchored to Bitcoin's blockchain

Bitcoin-anchored blockchains are independent execution environments that derive some of their legitimacy or security from Bitcoin's hashing power or on-chain transactions. These chains run their own consensus mechanisms, but by "anchoring" to Bitcoin, they benefit from its security without directly executing logic on Bitcoin L1.

Think of it like building a gated community next to a heavily protected national reserve. The gated community (sidechain) has its own roads and houses (smart contracts and consensus mechanism), but it is protected from tampering by its proximity to Bitcoin’s infrastructure (leveraging the reserve’s monitoring system, namely Bitcoin miners or block hashing).

Anchoring methods include:

- Merge mining: Bitcoin miners simultaneously verify blocks on the sidechain

- Proof of Transfer (PoX): Bitcoin transactions are used as input to elect block producers

- Timestamps or checkpoints: The state of the chain is periodically recorded on Bitcoin

These chains aren’t completely trustless by default. Some require a custodian to manage BTC deposits or withdrawals, while others rely on indirect economic or timestamping links to Bitcoin.

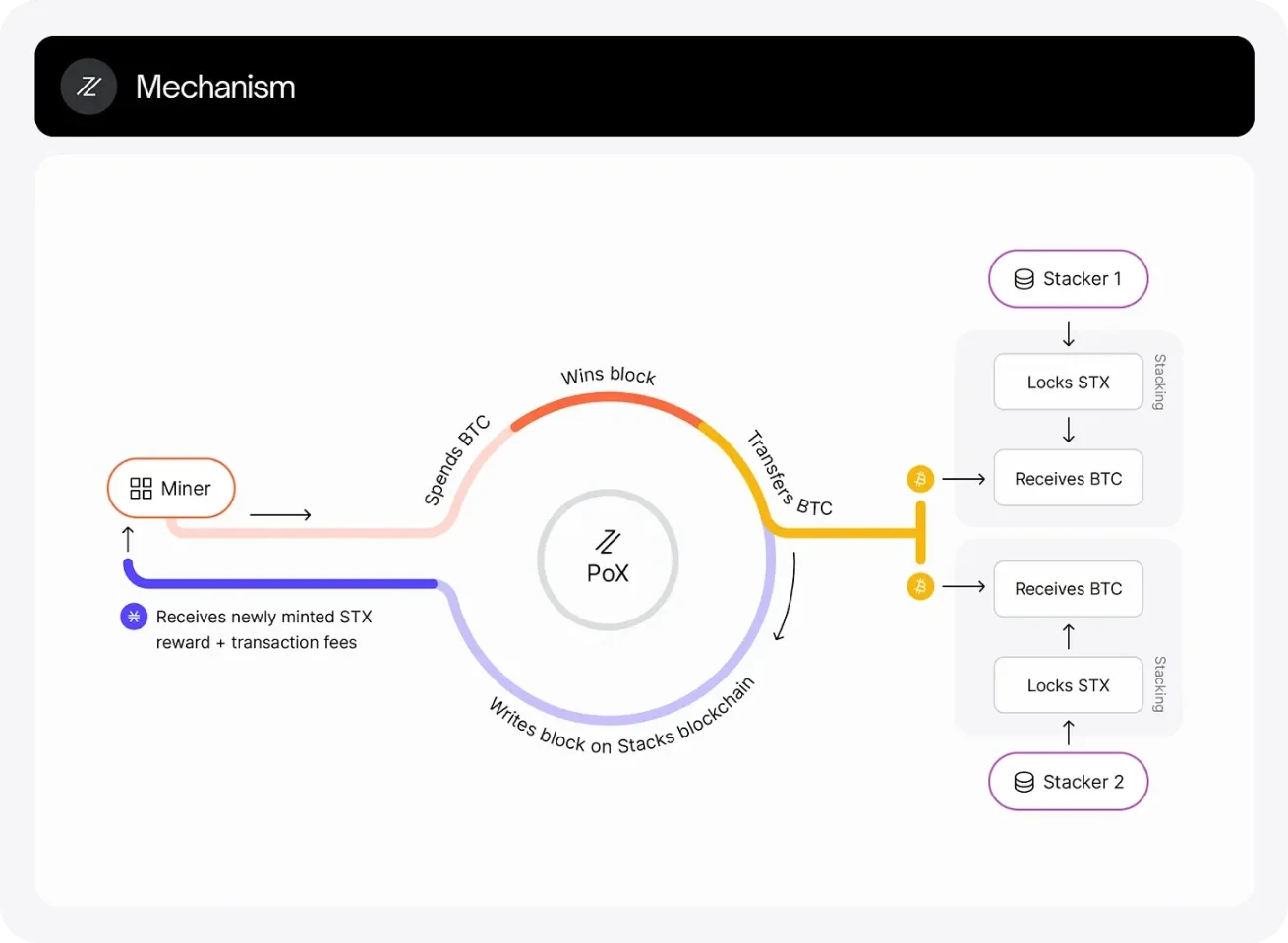

Stacks: A PoX sidechain with Bitcoin finality

Stacks is the most famous example of a blockchain anchored to the Bitcoin blockchain, using its own consensus mechanism, Proof of Transfer (PoX), to connect to Bitcoin. In PoX, Stacks miners submit Bitcoin transactions and "bid" for BTC for the right to produce blocks on the Stacks chain.

By recycling Bitcoin's proof-of-work as a resource, Stacks is connected to Bitcoin's economic layer. Similar to hybrid PoS chains, Stacks also anchors its state to Bitcoin by including the hash of the Stacks block in Bitcoin's PoX block submission transaction, ensuring its chain history is timestamped and tamper-proof on the Bitcoin layer.

Source: Stacks

Stacks uses the Turing-incomplete Clarity smart contract language, designed with predictability and security in mind. Developers can read Bitcoin state and trigger contract logic based on Bitcoin transactions, making it one of the earliest and most mature Bitcoin-adjacent DeFi platforms.

Source: Stacks

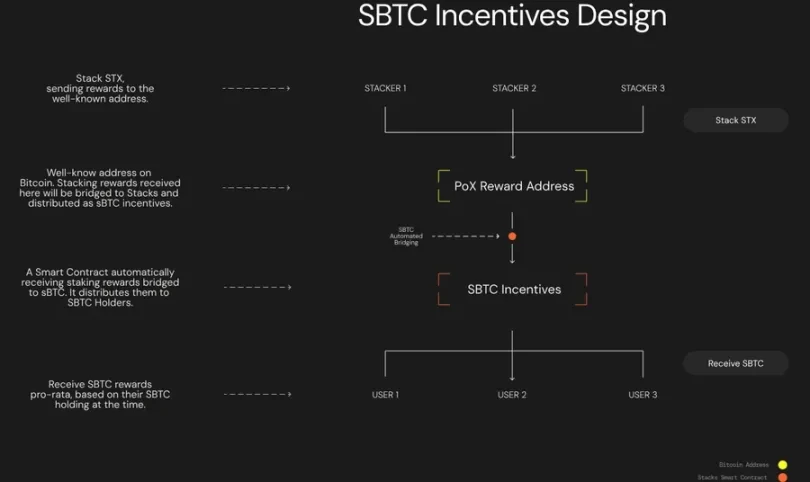

The BTC asset bridge on Stacks is implemented using sBTC, an asset pegged 1:1 to BTC maintained by threshold signers. These signers are also validators who secure the Stacks network by staking STX, reducing the potential for malicious behavior, as any attack could affect their staked assets. While the bridge design still involves some trust assumptions, exits are permissionless as long as a majority of signers behave honestly.

Stacks inherits Bitcoin's settlement security, anchoring its state to Bitcoin and using Bitcoin transactions as proof. However, execution and bridge escrow are secured by the Stacks network itself, offering greater flexibility than a strict Bitcoin Layer 2. While the network has its own native token (STX) and consensus rules, it's not strictly a Layer 2, but its entire ecosystem revolves around the value of Bitcoin.

BTC staking or hybrid PoS chains

BTC-staking or hybrid PoS (Proof-of-Stake) chains are execution environments that incorporate Bitcoin directly into their security model, either requiring users to stake actual BTC or pegging their state back to Bitcoin. These chains typically offer high throughput, fast finality, or EVM compatibility, while still relying on Bitcoin as a trusted backing in some form.

Unlike traditional sidechains that rely on a fixed mechanism, the BTC staking chain pursues higher decentralization and transparency through the following means:

- Require validators to stake BTC as collateral on L1

- Leveraging Bitcoin block entropy (the randomness of block hashes) to fairly select node operators

- Anchoring checkpoints back to Bitcoin to create a tamper-proof audit trail

Think of it like renting a safe deposit box in a secure, state-owned bank, but operating your business elsewhere. The bank (Bitcoin) doesn't oversee your business, but it holds your collateral publicly, and you must follow the rules or risk losing your deposit. Customers (users) trust you not only for your service, but also because their funds are ultimately backed by the security of Bitcoin.

This design balances performance and decentralization. It avoids the drawbacks of static multi-signatures without reaching the level of complete trustlessness of Rollup-style chains. These chains are particularly attractive to institutional users because they combine:

- Familiar smart contract interface

- Direct BTC staking mechanism

- An exit path to Bitcoin L1 without federal permission

Each implementation differs in staking mechanisms, governance, and token design, but the common thread is the desire to transform BTC into a productive, security-laden asset rather than just an idle reserve.

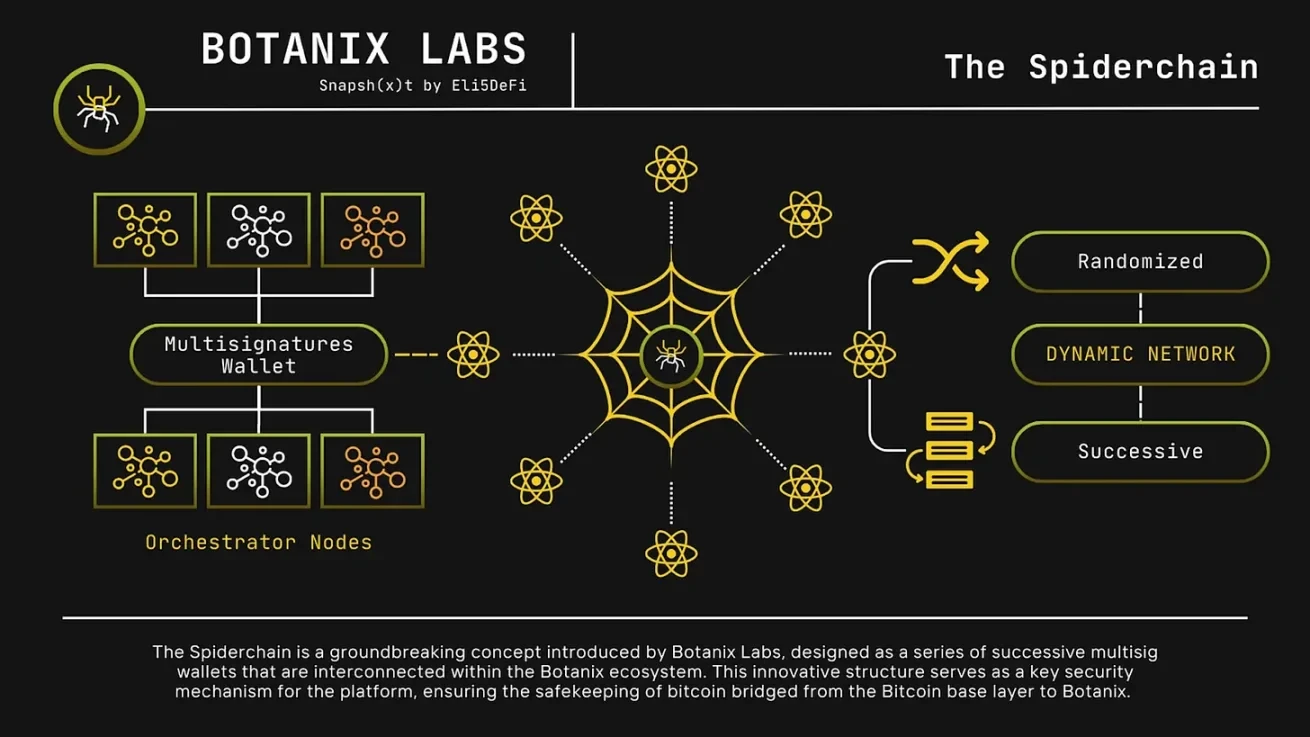

Botanix: Spiderchain and PoS Anchoring

Source: Botanix

Botanix is a newly launched Bitcoin L2 that combines proof-of-stake validation with Bitcoin pegs through a novel architecture called Spiderchain.

At its core, a rotating set of coordinator nodes manages a multi-signature BTC bridge. These nodes are selected using Bitcoin block hashes as random entropy and require actual BTC to be staked on Bitcoin L1. The network periodically submits state hashes to Bitcoin, making Bitcoin the final checkpoint of the Botanix chain.

This architecture eliminates the need for a fixed federation and allows users to withdraw BTC at any time, creating a permissionless exit path. On-chain activities are EVM-compatible, and all gas fees are paid in BTC, not wrapped tokens or separate gas assets.

Botanix also supports native DeFi applications such as Rover (a liquidity staking protocol that distributes revenue from network fees). Its security assumptions rely on a majority of honest PoS coordinators and fraud visibility on Bitcoin L1, striking a balance between performance and decentralization.

With updates and future developments, Botanix is positioning itself as a reliable infrastructure layer for Bitcoin-native finance.

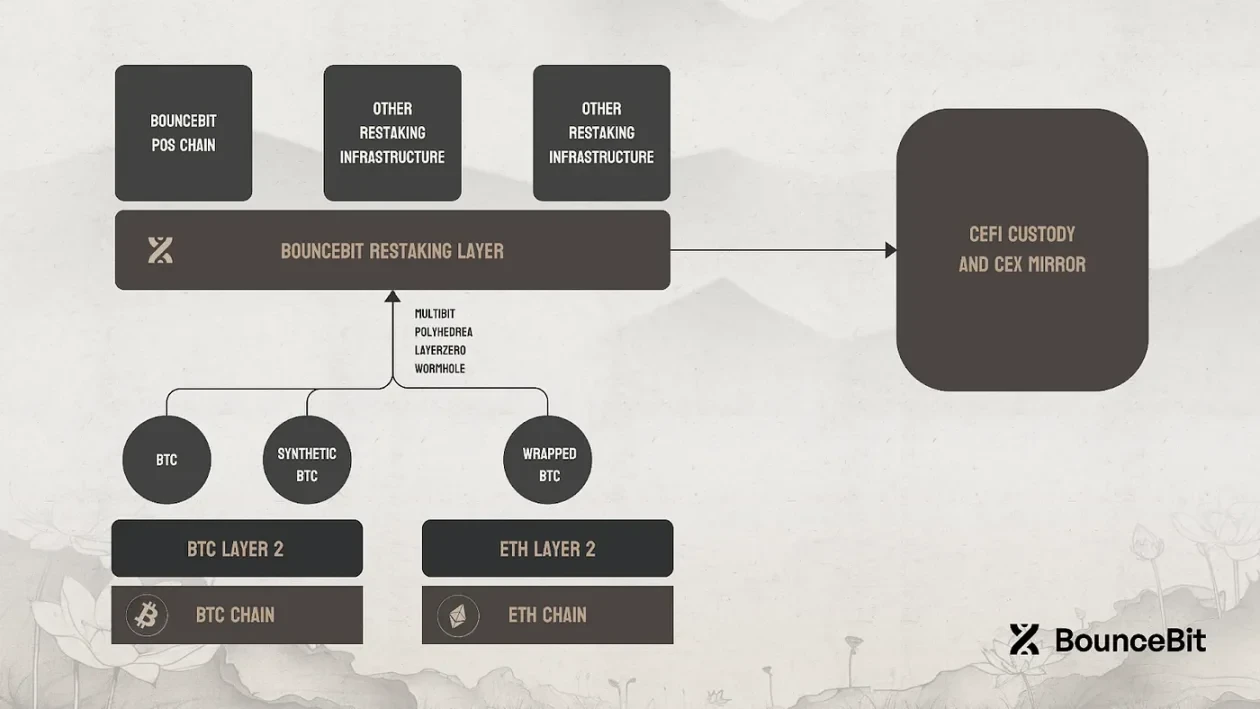

BounceBit: CeDeFi and the Institutional Yield Layer

BounceBit takes a different approach, targeting institutional users by fusing CeFi infrastructure with DeFi access and using Bitcoin as the primary source of liquidity and trust.

Source: BounceBit

Its consensus model is a dual-token PoS, combining the native BB token and BBTC (a tokenized representation pegged 1:1 to BTC). Validators are selected based on their combined stake of the two assets. Users deposit real BTC with a regulated custodian and receive BBTC on-chain. This is a centralized bridge, but one designed with auditability and legal compliance in mind.

Source: BounceBit

Once on-chain, BounceBit users will have access to a range of one-click yield strategies through the automated CeDeFi infrastructure. These strategies include arbitrage, basis trading, and, potentially in the future, tokenized RWA yields (e.g., Treasury bonds). The ecosystem is modular, with oracles, liquidity strategies, and validator sets all centered around Bitcoin as productive capital.

While the trade-offs are obvious (custodial risk and a permissioned component), BounceBit’s focus on ease of use, compliance, and stable returns makes it attractive to institutions looking to invest BTC in an income strategy without directly managing complex DeFi instruments.

BounceBit embodies one of BTCFi’s paths: prioritizing real-world integration over strict decentralization, providing infrastructure to connect traditional finance and Bitcoin’s native capital markets.

Rollup-inspired protocols

Rollup-inspired protocols aim to bring Ethereum-style scalability and programmability to Bitcoin without changing Bitcoin itself. These systems execute transactions off-chain and submit proofs back to Bitcoin, enabling high throughput and smart contract support while still relying on Bitcoin as the ultimate arbiter of trust.

There are two core designs:

- Optimistic rollups: Assume the transaction is valid unless someone disputes it, in which case a fraud proof is required

- ZK-Rollup: Generates zero-knowledge proofs to mathematically confirm the validity of each batch of transactions

Bitcoin presents practical technical challenges to these designs:

- Lack of native support for complex verification logic or recursive proofs

- Limited scripting language makes real-time fraud detection difficult

- No built-in Rollup framework like in the Ethereum roadmap

To overcome these challenges, developers build off-chain execution environments and submit streamlined data (proofs, state roots, or transaction hashes) back to Bitcoin L1. Think of these Rollups as shipping containers passing through a customs checkpoint. Off-chain systems handle all packaging, sorting, and logistics.

Bitcoin acts as a customs official; instead of opening every box, it requires a manifest (certificate) for inspection. If problems arise, the process can be escalated (fraud proof or challenge period). As long as the manifest is trustworthy and the inspection system is effective, the process is fast, efficient, and scalable.

These designs offer strong theoretical guarantees and a high-performance path to Bitcoin-native smart contracts. However, they are also the most complex and relatively new to the Bitcoin ecosystem. Trust assumptions vary depending on the bridge, the proof model, and whether participants actually challenge invalid behavior.

Despite the risks, Rollup-style systems represent the closest thing to trustless scalability for Bitcoin and are rapidly attracting the attention of developers and capital allocators.

Merlin: zkEVM Rollup with BTC Collateral

Merlin Chain is one of the first attempts to build a zkEVM Rollup for Bitcoin, combining zero-knowledge proofs, BitVM-based Bitcoin security, and a decentralized oracle network.

It batches off-chain transactions, generates ZK proofs of state transitions, and submits these proofs to Bitcoin L1 for finality. To address data availability (which Bitcoin cannot natively provide), Merlin uses a Data Availability Committee (DAC), comprised of oracle nodes that store and attest to off-chain data. In its proposed architecture, these DAC nodes must stake BTC and face slashing if they sign invalid state updates that are later disputed.

Merlin provides a smooth EVM experience, supports assets such as Ordinals and BRC-20, and uses MBTC (wrapped Bitcoin on Merlin) as its base currency. It bridges BTC from L1 through Cobo's multi-party computation (MPC) hosting setup and mints MBTC on the network.

The Rollup model here isn't completely trustless; users must assume at least one honest party will challenge the fraudulent state, and the bridge introduces custody risk. However, it offers high performance, Ethereum-level composability, and cryptographic guarantees of correctness.

Merlin has attracted significant attention, with its TVL reaching an all-time peak of over $3 billion, indicating that for many users, the actual benefits of DeFi outweigh the theoretical purity.

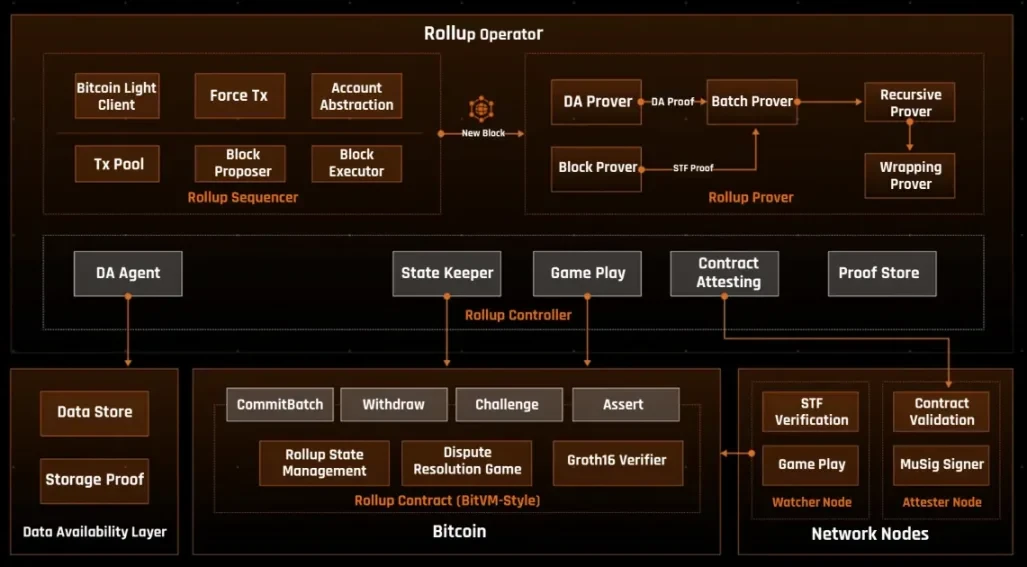

4.2. Bitlayer: BitVM + ZK Rollup Hybrid

Bitlayer addresses the critical gap between Bitcoin's security and the scalability and programmability demands of modern blockchains. By leveraging the strengths of Bitcoin's base layer, Bitlayer inherits the same level of trust, decentralization, and resiliency as Bitcoin.

At the same time, Bitlayer expands Bitcoin’s capabilities by introducing Turing-complete programmability, enabling developers to create complex decentralized applications and smart contracts that were previously impossible within Bitcoin’s native framework.

Source: Bitlayer

Bitlayer introduces smart contract functionality while respecting the fundamental principles of Bitcoin. Its full compatibility with the Ethereum Virtual Machine (EVM) allows Ethereum applications and tools to migrate seamlessly without major modifications. Its development is rapid, with clear milestones:

- Bitlayer PoS (Mainnet-V 1): Launched in April 2024, establishing the network’s initial validators and execution environment

- Bitlayer Rollup (Mainnet-V 2): Currently under development, including the BitVM Bridge mainnet beta for secure BTC asset bridging

- Bitlayer Rollup (Mainnet-V 3): Planned upgrade to achieve lightning-level confirmations and unparalleled execution performance

The core of this architecture is the BitVM Bridge, sometimes referred to as the "third-generation Bitcoin bridge," which replaces traditional multi-signature custodians with a cryptographic challenge-response model. This ensures that even if a majority of participants fail, a single honest validator can protect user funds and ensure correct execution.

In 2025, the ecosystem rapidly expands as partnerships and infrastructure integration accelerate:

- Strategic alliances with Sui, Base, Starknet, Arbitrum, Sonic SVM, Cardano, and Plume Network

- Obtain API support from major Bitcoin mining pools such as Antpool, F2Pool, and SpiderPool, enabling real-time processing of non-standard transactions (NST) by BitVM Bridge

- Deploy YBTC.B (Bitlayer's wrapped BTC) on BSC, Sui, Avalanche, Ethereum, and Plume

This growth has translated into measurable impact:

- Processed over 65 million transactions since March 2024

- Bitlayer's peak TVL reached $850 million

- YBTC.B's TVL exceeds $350 million (according to DeFiLlama)

By combining Bitcoin’s security with next-generation scalability and programmability, Bitlayer promises to fundamentally redefine Bitcoin’s Layer-2 capabilities and shape the future of Bitcoin DeFi.

A hybrid consensus chain aligned with Bitcoin

Hybrid consensus chains aligned with Bitcoin are independent layer-1 blockchains that combine elements of multiple security models, typically Proof-of-Stake (PoS) and Bitcoin’s Proof-of-Work (PoW), to create execution environments that benefit from Bitcoin’s reputation and economic weight but do not rely on it for direct state settlement or consensus.

These chains do not submit data to Bitcoin or settle transactions on it. Instead, they:

- Incentivize Bitcoin miners and holders to participate in network security, not by directly using Bitcoin hash power, but by economically aligning their incentives through staking mechanisms or validator influence

- Allows BTC holders to stake their assets non-custodially through time locks or smart contracts

- Designing validator economics and governance systems to attract Bitcoin ecosystem participants, from miners to long-term holders

Think of them as special economic zones built to attract Bitcoin capital. They have their own laws (governance), infrastructure (consensus), and services (dApps), but offer rewards and influence to Bitcoin-aligned participants. You don't have to give up your Bitcoin; these zones are specifically designed to make your BTC work for you.

What makes them unique is that Bitcoin becomes part of their validator economy, influencing who secures the chain and how rewards are distributed. While Bitcoin is not part of the cryptographic consensus engine, its holders and miners are invited to secure the system through economic mechanisms, creating a powerful combination of autonomy and alignment.

This structure appeals to BTC holders who want to earn yield without giving up custody, as well as miners seeking to maximize capital efficiency without leaving the Bitcoin ecosystem. Hybrid chains don’t compete with Bitcoin; they extend its influence by transforming its stakeholders into active participants in adjacent ecosystems.

This is a looser coupling than a true L2, but more integrated than the general-purpose alternative L1. These chains reflect a broader trend in BTCFi: you don’t have to build on Bitcoin to build for it, as long as the incentives, architecture, and user base align.

Core: Satoshi Plus and BTC Hash Power Delegation

Core (CoreDAO) is a fully EVM-compatible Layer-1 blockchain launched in 2023 that uses a unique hybrid consensus mechanism, Satoshi Plus. This model combines:

- Delegated Proof of Work (DPoW): Bitcoin miners delegate their hashing power to secure the Core block

- Delegated Proof of Stake (DPoS): CORE token holders stake to select validators

- Non-custodial BTC staking: BTC holders can lock BTC on L1 to support validators without giving up custody

In this model, Bitcoin miners are incentivized to contribute hash power to Core's validator selection process, earning additional rewards without interfering with their normal Bitcoin mining activities. Meanwhile, BTC holders can participate in network consensus through time-locked transactions on Bitcoin L1, achieving what Core calls "trustless Bitcoin staking."

Core offers fast block times, low fees, and full Ethereum compatibility. It provides DeFi, NFT, and dApp infrastructure similar to Ethereum, but its validator set is tied to Bitcoin's economics and mining power, creating an alignment that few chains attempt.

Although Core has its own token (CORE) and governance process and does not directly anchor its state to Bitcoin, it positions itself as a complement to Bitcoin rather than a competitor. Its vision is not to be a narrowly technical Bitcoin L2, but rather to be a Bitcoin-aligned smart contract chain where BTC users and miners can benefit from on-chain activities.

With over 125 dApps deployed and a growing user base, Core demonstrates a BTCFi strategy that blurs the lines between alternative L1 and Bitcoin infrastructure, providing an Ethereum-class ecosystem built on Bitcoin’s credibility and capital.

Lightning Network: Parallel Paths

It's impossible to discuss Bitcoin's scaling architecture without mentioning the Lightning Network, a Layer-2 solution purpose-built for fast and low-cost payments. Unlike protocols like BTCFi, which focus on lending, yield generation, or tokenization, the Lightning Network has taken a different path, brilliantly fulfilling its original mission: enabling Bitcoin to function as peer-to-peer cash.

The Lightning Network works by establishing state channels between users. By locking BTC in the channel, both parties can transact off-chain with near-zero latency and extremely low fees, with the net result settled only on the Bitcoin base layer. This model significantly increases transaction throughput, theoretically enabling the Lightning Network to process millions of transactions per second and reduce transaction costs to fractions of a cent.

By 2025, the Lightning Network secures $400-500 million in BTC liquidity and supports real-world payment applications like Strike, especially in emerging markets where fast remittances and low fees are critical.

However, while the Lightning Network excels at payments, its architecture wasn't designed for DeFi. Its smart contract functionality is extremely limited, optimized for simple channel scripts rather than complex financial logic. You can buy coffee or make micropayments, but you can't launch a lending protocol or deploy a decentralized exchange on the Lightning Network. Liquidity is also fragmented across thousands of channels, making it difficult to aggregate capital for pooled DeFi strategies.

While the Lightning Network remains specialized and its DeFi integration is limited, its strategic importance is clear. It complements the BTCFi protocol by enabling cheap and instant BTC mobility, while the BTCFi platform unlocks value by locking BTC in yield-generating strategies. As bridging technology improves, Lightning Network liquidity is likely to increasingly flow into BTCFi, connecting Bitcoin's payment side with its productive capital layer.

New ideas and infrastructure development

The infrastructure layer is freeing up idle capital in Bitcoin by moving complexity off-chain while anchoring trust back to L1.

New entrants are already furthering these concepts. Plasma, an emerging Bitcoin-pegged sidechain, is purpose-built for fee-free, stablecoin-friendly settlements, combining EVM compatibility with privacy features. Meanwhile, Arch Network is pioneering a bridgeless execution layer on Bitcoin, enabling high-throughput dApps without relying on wrapped assets. While their designs differ, both reflect the same philosophy: innovating around Bitcoin's strengths, not at their expense.

BTCFi’s path forward will be modular and diversified. But infrastructure is only one side of the equation. In Part 3, we’ll turn to the asset and custody layer, focusing on how Bitcoin is moved, held, and represented within the network.

- 核心观点:BTCFi基础设施围绕比特币安全扩展功能。

- 关键要素:

- 比特币L1作为信任锚点。

- 多层执行生态系统平衡性能。

- 闪电网络连接支付与资本层。

- 市场影响:释放比特币资本潜力,推动DeFi创新。

- 时效性标注:中期影响。