Layer 1 camouflage: When more crypto applications start to "touch porcelain" the public chain

- 核心观点:DeFi和RWA协议伪装Layer1难获高估值。

- 关键要素:

- Layer1享有更高估值因其生态扩展性。

- 多数协议缺乏可持续经济模型支撑。

- 应用链需先验证产品再转型基础设施。

- 市场影响:投资者将更关注实际产品力。

- 时效性标注:中期影响。

Original author: Alexandra Levis

Original translation: TechFlow

DeFi and RWA protocols are repositioning themselves as Layer 1 to gain infrastructure-like valuations. However, Avtar Sehra said that most DeFi and RWA protocols are still limited to narrow application areas and lack sustainable economic benefits - and the market is beginning to see through this.

In financial markets, startups have long tried to brand themselves as “tech companies,” hoping investors would value them at tech-specific multiples. And the strategy often works—at least in the short term.

Traditional institutions paid the price. Throughout the 2010s, many companies scrambled to reposition themselves as tech companies. Banks, payment processors, and retailers began calling themselves fintechs or data companies. But few commanded the valuation multiples of true tech companies—because their fundamentals often didn't match their narratives.

WeWork is one of the most iconic examples: a real estate company disguised as a tech platform ultimately collapsed under the weight of its own illusion. In financial services, Goldman Sachs launched Marcus in 2016, a digital-first platform designed to compete with consumer fintechs. Despite some early progress, the project was scaled back in 2023 due to chronic profitability issues.

JPMorgan Chase once boasted about being a "tech company with a banking license," while BBVA and Wells Fargo invested heavily in digital transformation. However, these efforts rarely achieved platform-level economic benefits. Today, these corporate tech fantasies lie in ruins—a stark reminder that no matter how you package your brand, you can't transcend the structural limitations of capital-intensive or regulated business models.

The crypto industry is currently facing a similar identity crisis. DeFi protocols are hoping to achieve valuations similar to those of Layer 1. RWA decentralized applications are attempting to establish themselves as sovereign networks. Everyone is chasing the "tech premium" of Layer 1.

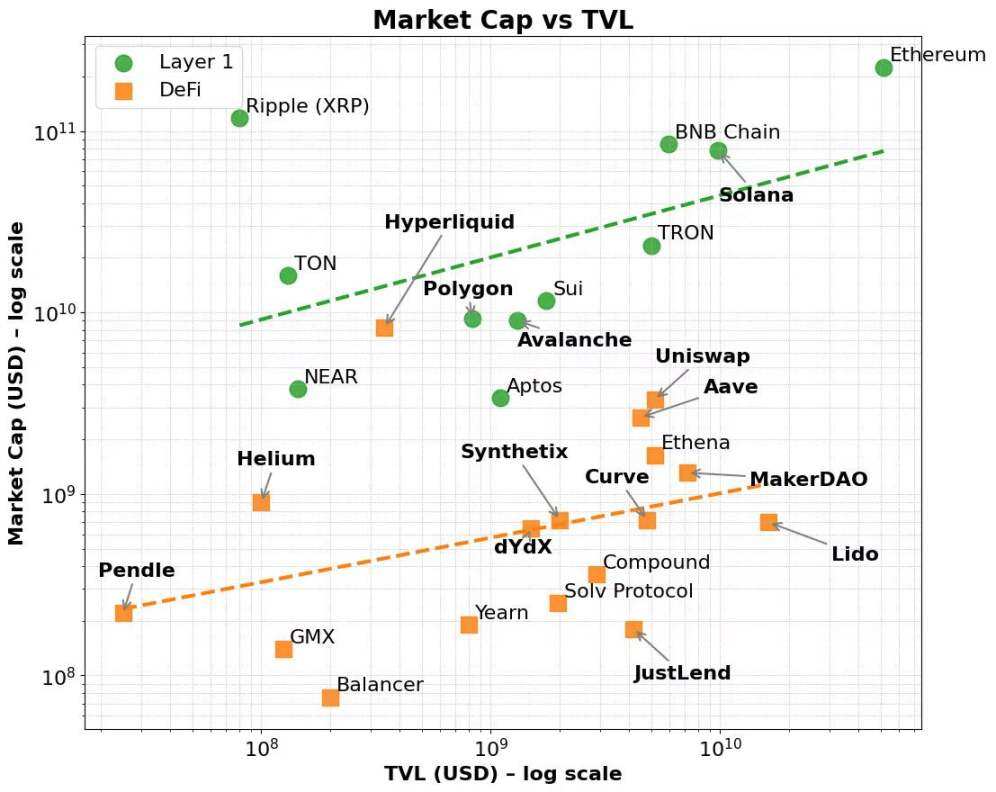

To be fair, this premium does exist. Layer 1 networks like Ethereum, Solana, and BNB have consistently enjoyed higher valuation multiples relative to metrics like total value locked (TVL) and fee generation. These networks benefit from a broader market narrative—one that favors infrastructure over applications, and platforms over products.

This premium persists even after controlling for fundamentals. Many DeFi protocols demonstrate strong TVL or fee generation capabilities, yet struggle to achieve comparable market capitalizations to Layer 1 protocols. In contrast, Layer 1 protocols attract early adopters through validator incentives and native token economics, subsequently expanding into developer ecosystems and composable applications.

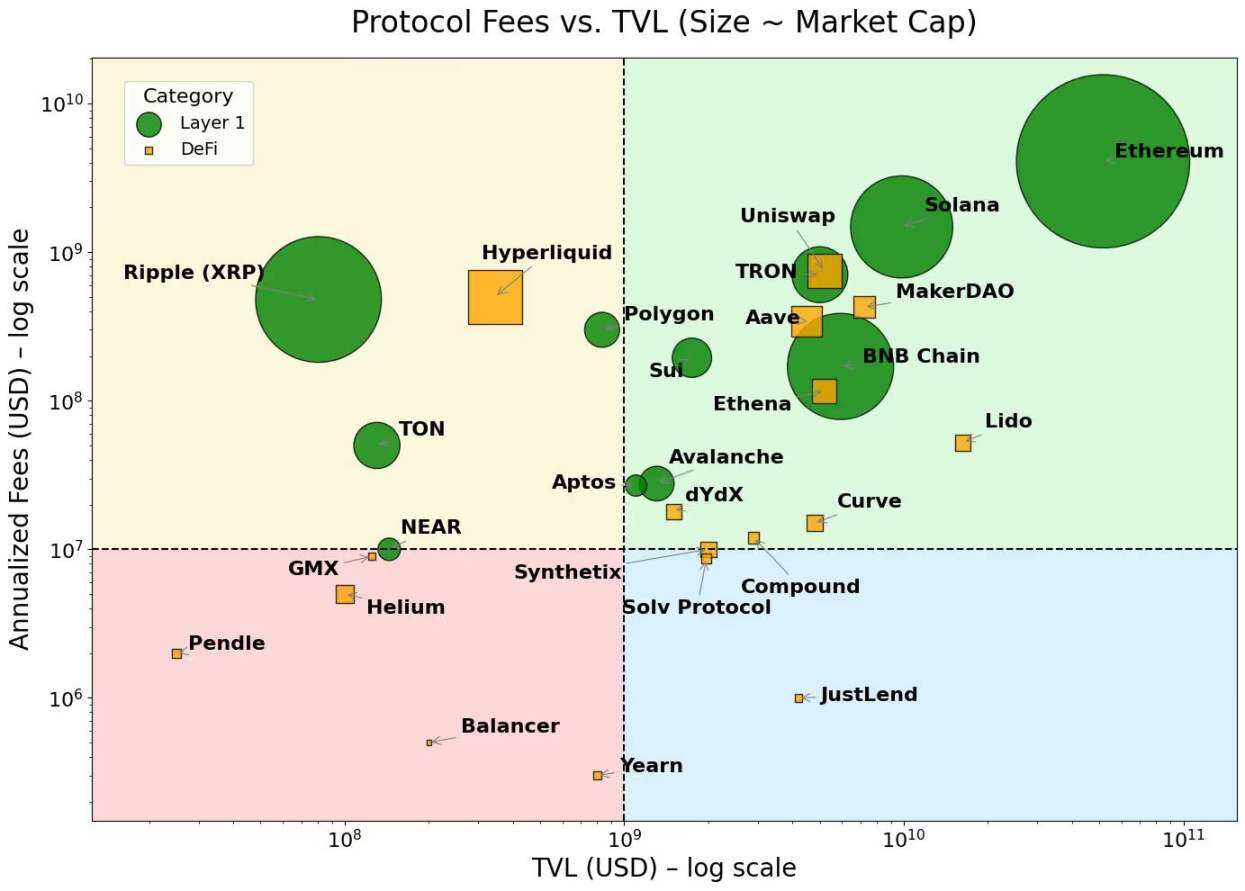

Ultimately, this premium reflects the broad native token utility, ecosystem coordination capabilities, and long-term scalability of Layer 1. Furthermore, these networks often experience disproportionate growth in market capitalization as fee scale grows—suggesting that investors are factoring in not only current usage but also future potential and compounding network effects.

This layered flywheel mechanism — from infrastructure adoption to ecosystem growth — nicely explains why Layer 1 valuations are consistently higher than decentralized applications (dApps), even when their underlying performance metrics appear similar.

This is similar to how the stock market distinguishes between platforms and products. Infrastructure companies like AWS, Microsoft Azure, Apple's App Store, or Meta's developer ecosystem are more than just service providers; they are ecosystems. These platforms enable thousands of developers and businesses to build, scale, and collaborate with each other. Investors assign these companies higher valuation multiples not only for current revenue, but also for the potential to support emerging use cases, network effects, and economies of scale in the future. In contrast, even highly profitable Software as a Service (SaaS) tools or niche services struggle to command the same valuation premium—because their growth is constrained by limited API composability and narrow utility.

This pattern is now playing out among large language model (LLM) providers. Most are vying to position themselves as the infrastructure for AI applications, rather than simply chatbots. Everyone wants to be AWS, not Mailchimp.

Layer 1s in the crypto space follow a similar logic. They are more than just blockchains; they are coordination layers for decentralized computation and state synchronization. They support a wide range of composable applications and assets, and their native tokens accrue value through underlying activities such as gas fees, staking, and MEV. More importantly, these tokens also serve as an incentivization mechanism for developers and users. Layer 1s benefit from a self-reinforcing cycle—forming an interaction between users, developers, liquidity, and token demand—while supporting both vertical and horizontal scalability across industries.

In contrast, most protocols are not infrastructure, but rather single-function products. Therefore, increasing the validator set does not make them Layer 1—it simply justifies a higher valuation by giving the product the guise of infrastructure.

This is precisely the context for the emergence of the Appchain trend. Appchains combine applications, protocol logic, and settlement layers into a vertically integrated technology stack, promising improved fee capture, user experience, and "sovereignty." In a few cases—such as Hyperliquid—these promises have been fulfilled. By controlling the entire technology stack, Hyperliquid achieves fast execution, an excellent user experience, and significant fee generation—all without relying on token incentives. Developers can even deploy dApps on its underlying Layer 1 layer, leveraging its high-performance decentralized exchange infrastructure. While still relatively narrow in scope, Appchains demonstrate some potential for broader scalability.

However, most application chains are merely attempts to repackage protocols under different identities, lacking both real-world usage and deep ecosystem support. These projects are often caught in a dilemma: attempting to build both infrastructure and products, but often lacking the capital or team to excel in either. The end result is a fuzzy hybrid—neither a high-performance Layer 1 nor a category-defining decentralized application.

This isn't the first time we've seen this. A robo-advisor with a flashy user interface is still essentially a wealth management service; a bank with an open API is still a balance sheet-centric business; and a coworking company with a sophisticated app is still essentially renting office space. Ultimately, as market enthusiasm wanes, investors will reassess the value of these projects.

RWA protocols are currently falling into the same trap. Many attempt to position themselves as the infrastructure for tokenized finance, but lack substantial differentiation from existing Layer 1 platforms and sustained user adoption. At best, they are vertically integrated products lacking a genuine need for an independent settlement layer. Worse still, most protocols have yet to achieve product-market fit in their core use cases. They simply add on infrastructure features and rely on exaggerated narratives to support valuations their economic models cannot support.

So, what is the way out for the future?

The answer isn't to pretend to be infrastructure, but to clearly define your position as a product or service and then nail it. If your protocol can solve real problems and drive significant growth in total locked value, that's a solid foundation. But TVL alone isn't enough to make you a successful application chain.

What really matters is actual economic activity: the total locked value that drives sustainable fee generation, user retention, and clear value accumulation for the native token. Furthermore, if developers choose to build on your protocol because it's truly useful, not because it claims to be infrastructure, the market will reward them. Platform status is earned through merit, not self-proclaimed claims.

Some DeFi protocols, such as Maker/Sky and Uniswap, are moving down this path. They are evolving toward an application-chain model to improve scalability and cross-network access. But they are doing so based on their own strengths: mature ecosystems, clear profit models, and product-market fit.

In contrast, the emerging RWA space has yet to demonstrate sustained traction. Nearly every RWA protocol or centralized service is scrambling to launch appchains—often underpinned by fragile or untested economic models. Similar to the transition of leading DeFi protocols to an appchain model, the optimal path forward for RWA protocols is to first leverage the existing Layer 1 ecosystem, accumulating user and developer traction to drive TVL growth and demonstrate sustainable fee generation capabilities before evolving into an appchain infrastructure model with clear goals and strategies.

Therefore, for application chains, the utility and economic model of the underlying applications must be validated first. Only after these foundations are proven is the transition to an independent Layer 1 feasible. This contrasts sharply with the growth trajectory of general-purpose Layer 1, which can prioritize building a validator and trader ecosystem early on. Initially, fee generation relies primarily on native token transactions. Over time, cross-market expansion will expand the network to developers and end users, ultimately driving TVL growth and diversifying fee sources.

As the crypto industry matures, the narrative fog is dissipating, and investors are becoming more discerning. Buzzwords like "app chain" and "Layer 1" no longer attract attention on their own. Without a clear value proposition, sustainable token economics, and a clear strategic path, protocols lack the necessary foundation to achieve the transformation into true infrastructure.

What the crypto industry, especially the RWA sector, needs is not more Layer 1s, but better products. Projects that focus on building high-quality products will truly win market returns.

Figure 1. Market capitalization and TVL of DeFi and Layer 1

Figure 2. Layer 1 is concentrated in areas with higher fees, while dApps are concentrated in areas with lower fees.