Data Revealed: How Much Money Can MEV Bot Make from CEX-DEX Arbitrage?

This article comes from: Flashbots data analyst danning

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

How much profit can the MEV arbitrage robot make from CEX-DEX arbitrage?

No one has been able to answer this question before, but we are excited to announce that a new paper has finally been published that uses a formal method to measure it (paper link: https://arxiv.org/abs/2507.13023 ), and I will summarize all the core findings of the paper for you in a series of pictures and explanations below.

Super Concentrated

Profits? Pretty good, but not as much as you might think ;

Bot strategies vary, but the excess returns of top traders mostly decay within 0.5 to 2 seconds ;

Market concentration is increasing, including in the field of block builders ;

However, as competition among blockchain builders intensifies, the profit margins of CEX-DEX arbitrage are shrinking year by year ;

Bots are becoming deeply integrated into the blockchain construction process in various ways;

The deeper the bond with the block builder, the thinner the “surface” profit (which is actually transferred to related parties);

The smaller the market share of a block builder, the higher the actual profit margin retained by its associated arbitrageurs;

Even though it ranks among the top two in the industry, blockchain construction is still a tough business (profits are thin as paper).

Relatively detailed version

In the 1 year and 7 months of data we collected, the data performance of 19 leading CEX-DEX arbitrage robots is as follows:

Total transaction volume reached $241 billion;

extracted $233.8 million in profits;

Only $90.1 million in net proceeds were retained ($143.7 million in shares paid to block builders) ;

Overall, the average profit margin of CEX-DEX arbitrage is 38.5%.

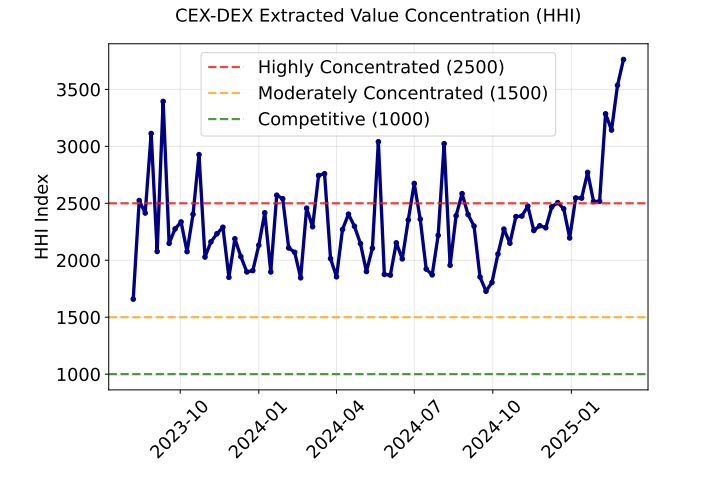

Based on the market share analysis of arbitrageurs, we confirm that the MEV market concentration trend of CEX-DEX has reached a “highly monopolistic” level.

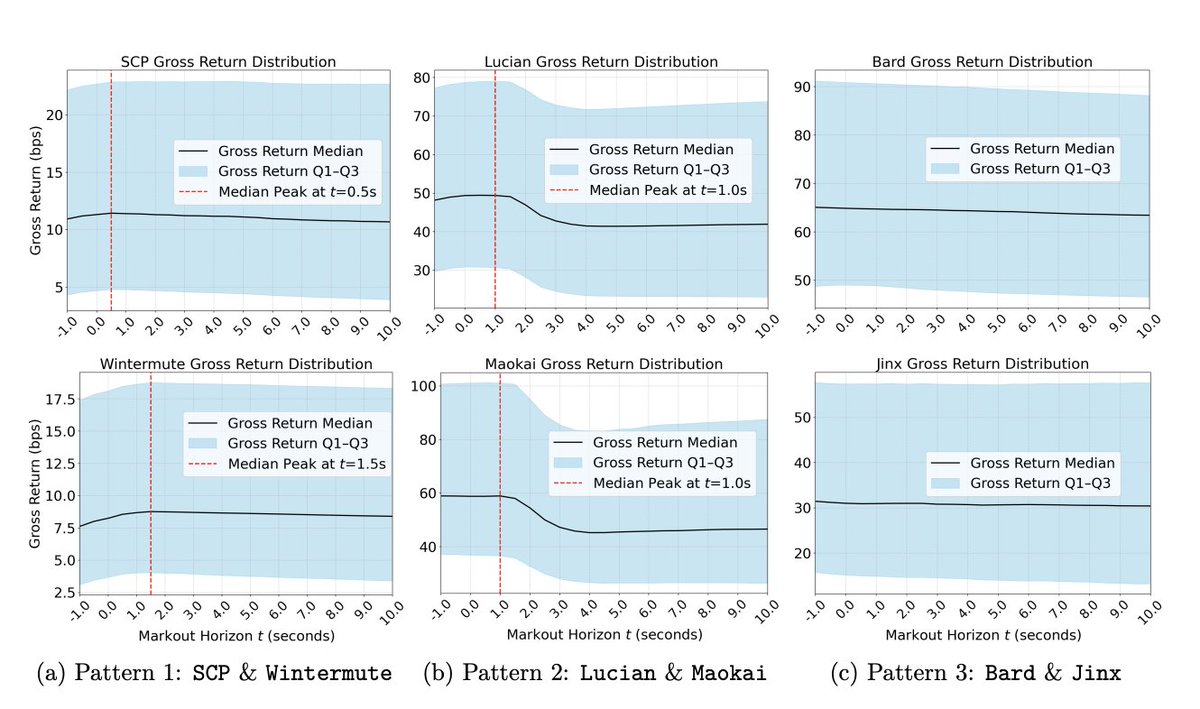

Following the “League of Legends” tier labeling system proposed by @0x Rezin, we calculated the Binance markouts of the arbitrage bot and used a weighted average to define its “gross income” before hedging.

Data shows that most CEX-DEX arbitrage signals disappear rapidly within seconds . The median distribution shows that the revenue peak - that is, the best hedging time occurs in the 0.5-1.5 second range.

After deducting the share paid to block builders, we get an upper limit estimate of the Bot's profits.

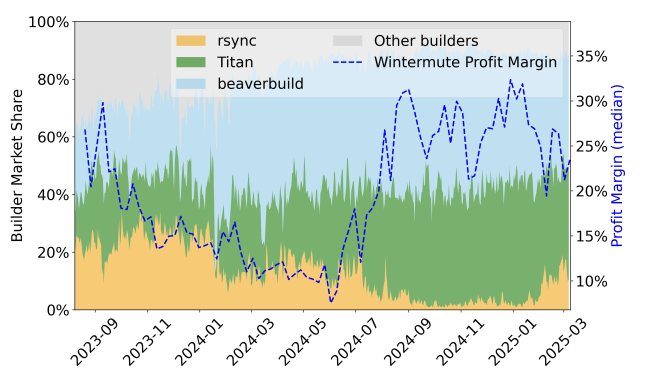

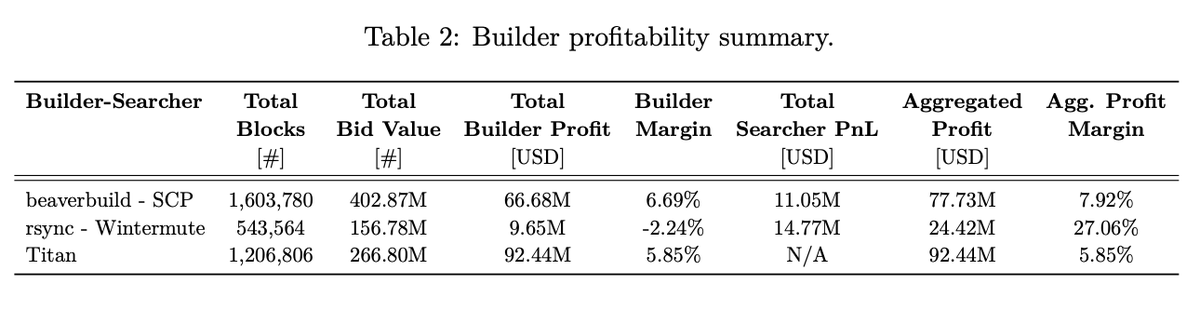

So after taking into account the profit correction of arbitrageurs, what are the current earnings of the top three block builders?

Since rsync (currently ranked third) gave up the "order flow war" in the middle of last year, its market share has obviously plummeted, but what no one noticed is that its profit margin has rapidly rebounded from 5% to 25%+, which brings its combined profit margin (arbitrage + block construction) to about 27%.

However, the top two block builders have limited profits.

During the 18-month data period, beaverbuild (currently ranked first) had a comprehensive profit margin of only 7.92% (including arbitrage income), while Titan (currently ranked second), which has no proprietary arbitrage, had a profit margin of only 5.85%.

Obviously, the opaque nature of “order flow” trading makes this even more difficult to explain.

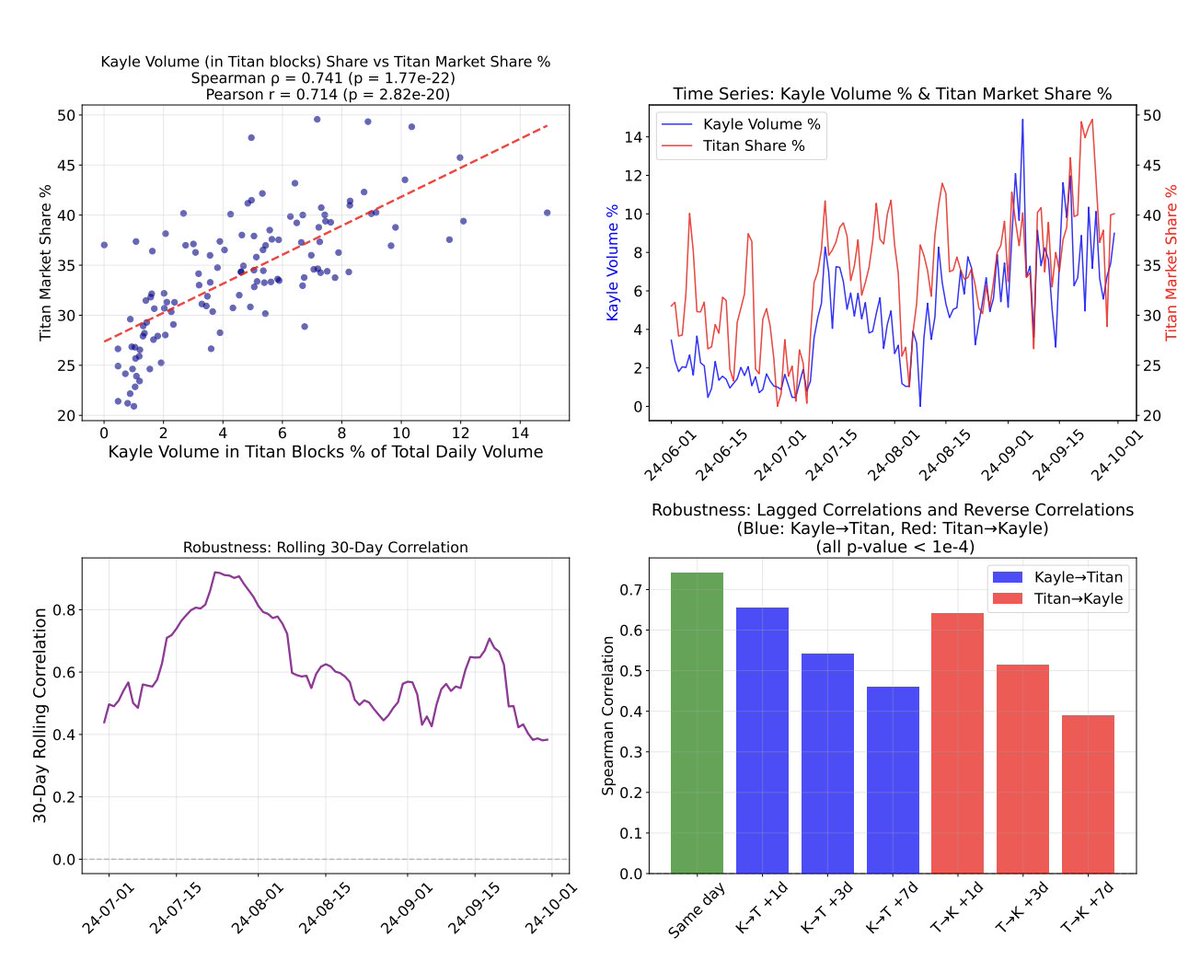

In addition to the known "block builder + arbitrageur" combinations such as beaverbuild + SCP, rsync + Wintermute, the correlation analysis reveals another significant set of exclusive cooperation cases. Observe the 30-day rolling correlation of "Kayle's share of transactions in Titan's built blocks" and "Titan's market share" in the figure below, and you can see the clues.

Our core conclusion is that block construction is a low-profit business, and there is no opportunity to enter the market today without an order flow of ultra-high MEV value.

In addition, the current block auction mechanism has serious inefficiencies. On the one hand, the subsidy mechanism squeezes the profits of block builders; on the other hand, exclusive cooperation splits the order flow and prolongs the waiting time for transactions to be on the chain.

But the current situation is not unchangeable. Flashbots’ newly launched BuilderNet may be able to solve the dilemma and increase the benefits of block builders.