The five major rising logics are becoming clearer, and ETH may usher in a structural reversal

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

In December 2024, ETH fell from $4,000 to $1,400, with almost no decent rebound, a drop of more than 65%. The plunge was accompanied by a full-scale capitulation sell-off by traders and early whales, and the market chips were drastically reshuffled in panic. The ETH/BTC exchange rate simultaneously fell back to a low of 0.018, almost returning to the starting point of the bull market in 2019.

With the same starting point, can ETH replicate the same trend this time?

Just when most people have lost confidence in Ethereum, a structural change is quietly brewing. Policy boundaries are becoming clearer, institutional capital is flowing back, EF is self-correcting, on-chain data is diverging, and industry narratives are refocusing. ETH may be brewing a structural revaluation.

Policy tailwind: Crypto regulatory framework emerging from uncertainty

At the macro level, crypto assets are gradually moving out of the gray area. Key legislative processes such as the GENIUS Act and the CLARITY Act have made breakthroughs, and the SEC is also discussing the establishment of an exemption framework for DeFi. The regulatory thinking of the crypto industry is moving from exclusion to acceptance, and from suppression to "limited encouragement."

As the foundation of DeFi, the core settlement layer of stablecoins and NFTs, Ethereum may become the most direct beneficiary of this round of policy support, and its compliance process is naturally embedded in the entire industry framework. When the regulatory environment becomes clearer, the first to be re-evaluated by institutions must be Ethereum, which is born as an "orthodox infrastructure."

Capital Returns: ETH’s New Narrative Has Been Ignited

Since SharpLink, a US-listed company, announced the establishment of a strategic reserve of ETH, Siebert Financial, Treasure Glabal, Bit Digital and other listed companies have successively announced that they will include it in their corporate balance sheets. A new narrative of ETH as a strategic reserve of assets has begun to be written.

SharpLink, known as the "ETH version of MicroStrategy", has now announced that it has increased its holdings by another 7,689 ETH, bringing its total holdings to 205,634 ETH. Based on the current price of $2,600, the total holdings are worth approximately $530 million. Behind this round of capital reallocation is the revaluation of ETH's asset attributes.

Capital always has a keen sense of smell, and many institutions are ready to move. On July 3, Abraxas Capital withdrew 48,823 ETH (worth $126 million) from Binance and Kraken. A wallet suspected to be associated with Matrixport withdrew 40,734 ETH (worth $104 million) from Binance and OKX.

Nick Tomaino, founder of 1confirmation , wrote that Coinbase has been hoarding ETH and currently holds more than $335 million worth of ETH on its balance sheet. Robinhood will follow Coinbase, and other companies will follow suit. Although it is still in the early stages, the competition for L2 ownership of ETH has begun.

Foundation self-correction: governance shifts to transparency

The Ethereum Foundation, a power center that was once questioned for its "lack of transparency", has also begun to make in-depth adjustments to its governance structure. Faced with the centralization dilemma and transparency crisis, the Foundation has drastically reorganized its research and development team and laid off employees. At the same time, the Foundation released the latest version of its fiscal policy document, clarifying its asset management strategy, ETH sales mechanism, and long-term commitment to the DeFi ecosystem.

This is not only an attempt at self-correction, but also a signal to the market: Ethereum will continue to defend its credible neutrality and institutional legitimacy.

Additional reading: " Reorganizing the R&D team, can EF's organizational change become a booster for ETH prices? "

Data support: on-chain indicators speak for themselves

On-chain data is telling the foundation of Ethereum's rise. As of now, the number of weekly active independent users of Ethereum-based stablecoins has exceeded 750,000, setting a record high. Among them, USDT and USDC still dominate, with circulation on Ethereum of US$73 billion and US$41 billion respectively, accounting for about 85% of the current total market value of stablecoins.

CryptoQuant data shows that since June 2025, more than 500,000 ETH have been newly pledged, making the total amount of Ethereum pledged on the entire network exceed 35 million for the first time, setting a record high. At the same time, the total holdings of "accumulation addresses" that have never sold ETH also rose to a record high of 22.8 million. During the consolidation phase in June, the purchases of long-term Ethereum holders increased significantly, and the accumulation volume and price trend formed a clear deviation, and long-term holders showed a strong tendency to hoard.

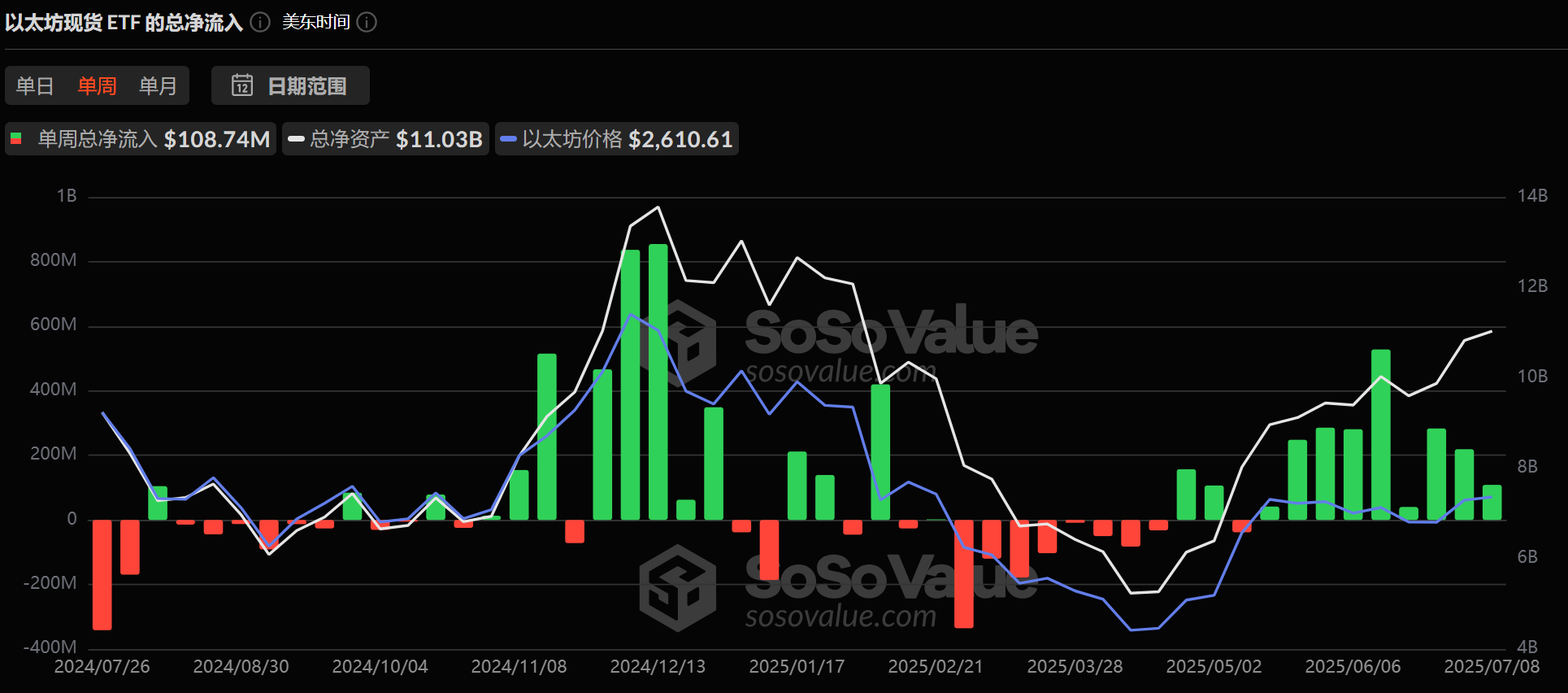

Ethereum spot ETFs have recorded net inflows for nine consecutive weeks . Bitwise Chief Investment Officer Matt Hougan said in a post that the inflows into Ethereum exchange-traded funds will accelerate significantly in the second half of the year, as more and more stablecoins and stocks will begin to be traded on the Ethereum chain, which is a phenomenon that is easy to understand for traditional investors. In June this year, the inflow of funds into Ethereum ETFs has reached US$1.17 billion. If this trend continues, the inflow of funds into Ethereum ETFs in the second half of the year may reach US$10 billion.

Industry perspective: Believers return

Driven by multiple factors, the market seems to have found sufficient reasons for Ethereum's rise. Industry leaders are also cheering for Ethereum's next round of rise to re-anchor market confidence.

1confirmation founder: Firmly support Ethereum, which is the cornerstone of the industry's continued development

Nick Tomaino, founder of 1confirmation , firmly stated that Ethereum is the cornerstone for the continued development of the entire industry. He emphasized that the values of trusted neutrality, open source and permissionless innovation must be continuously inherited and spread.

Tomaino pointed out that some current trends, such as venture capital chains and companies adopting Ethereum vault strategies, are not directly related to the above values, but that does not mean they are bad. He quoted Hal Finney’s view 33 years ago: “Computers can be used to liberate and protect people, not control them.”

Bankless Co-founder: Ethereum MEV minimizes investment or helps traditional finance adopt

David Hoffman, co-founder of Bankless, said that Ethereum's continued investment in credible neutrality and minimization of MEV (miner extractable value) may bring additional advantages to its adoption in the traditional financial (TradFi) sector. He pointed out that blockchains like Robinhood that use a single sorter do not have the problem of illegal MEV, but Ethereum's investment in fair MEV infrastructure is equivalent to "compliance" efforts in traditional finance. This investment may become an important driving factor for traditional financial institutions to choose Ethereum instead of other blockchains, further enhancing Ethereum's competitiveness in compliance and technical credibility.

ZKsync founder: Solana simply cannot compete with Ethereum in terms of decentralization and censorship resistance

Previously, Solana co-founder Toly wrote that Solana is not going to "go to war" with Ethereum, but is going to fight against Layer 2, a centralized sorter based on Ethereum.

In response to Solana co-founder Toly, ZKsync founder and Matter Labs CEO Alex Gluchowski said that Solana simply cannot compete with Ethereum in terms of decentralization and censorship resistance, nor can it compete with single-orderer Layer 2 networks in terms of latency and performance.

Consensys CEO: Ethereum Layer 1 will become the world’s main ledger

Joseph Lubin, CEO of Consensys and co-founder of Ethereum, wrote: "Ethereum Layer 1 will become the world's main ledger. It allows anyone to view, use, and add data or functions without permission, with credible neutrality and censorship resistance. It is tamper-proof and verifiable (through penalty mechanisms and transparency), and continues to advance its decentralization process. It has a top-notch large community that is always highly vigilant because there will always be patient and well-resourced participants trying to disrupt the system. Fortunately, as Ethereum develops and matures, it will become increasingly difficult to disrupt the system."

Conclusion: ETH, this time is really different

Every round of faith reconstruction always starts at the coldest moment of the market. After the baptism of the plunge, its chip structure has become sparse, and any entry of marginal funds may trigger a price rebound. At present, its price may still fluctuate, but its value has quietly changed.

ETH may really be back.