ArkStream Capital: The crypto market will usher in a structural turning point of "compliance narrative + real returns" in Q2 2025

In the second quarter of 2025, the crypto market showed an overall recovery trend, and multiple favorable factors formed a combined force to accelerate the pace of the industry. On the one hand, the global macro environment has stabilized and tariff policies have eased, providing a more friendly background for capital flow and asset layout. On the other hand, many countries and regions around the world have introduced a number of friendly policies for the development of the cryptocurrency industry. Traditional financial markets have begun to actively embrace cryptocurrencies, linking token structures with traditional financial assets to achieve the "financialization" of capital structure.

The stablecoin track was particularly active this quarter. From the expansion of USDT/USDC to the implementation of compliance frameworks in multiple countries, as well as Circle's IPO , all of these have pushed the cryptocurrency narrative closer to the mainstream capital market, sending a strong positive signal. At the same time, the narrative of on-chain derivatives continues to heat up, with Hyperliquid becoming a phenomenal leader, with daily trading volumes repeatedly approaching or surpassing some centralized exchanges, and native tokens continuing to outperform the market, becoming one of the strongest performing assets. With the continuous optimization of on-chain matching systems and user experience, the derivatives market is accelerating the structural transition from "off-chain replication" to "on-chain native", which has further promoted the development of DeFi.

Global Stablecoin Regulation and Potential Opportunities

Genius Act promotes the acceleration of global stablecoin regulation

In the second quarter of 2025, the global stablecoin market showed the dual characteristics of sustained growth and accelerated implementation of the regulatory framework. As of June 24, the total market value of global stablecoins reached US$240 billion, an increase of about 20% from the beginning of the year. Among them, the US dollar stablecoin occupies an absolute dominant position, with a market share of more than 95%. The scale of the two major stablecoins, USDT and USDC, is US$153 billion and US$61.5 billion respectively, accounting for a total of 89.4% of the market share, and the market concentration has further intensified. In terms of transaction volume, the transaction volume on the stablecoin chain has exceeded US$10 trillion in the past three months, of which the adjusted effective transaction volume is US$2.2 trillion, the number of transactions is 2.6 billion, and the number of transactions is 519 million after adjustment. Stablecoins are gradually evolving from crypto trading tools to mainstream payment media, and are expected to drive the expansion of the US dollar stablecoin market to US$2 trillion in the next three years, further strengthening the dominant position of the US dollar in the global digital economy.

Note: The “adjusted” data in transaction volume and number of transactions refers to Visa’s filtering of non-organic activities such as programmatic trading and robot behavior, which aims to more accurately reflect the actual usage of stablecoins.

Stablecoins overall data

Stablecoin transaction volume

Number of stablecoin transactions

In this environment, the regulation of stablecoins is imminent. To this end, the U.S. Congress has taken key actions, including the GENIUS Act, S.1582, which was passed by the Senate on June 17, 2025 with an overwhelming bipartisan majority of 68 votes in favor and 30 votes against. This landmark legislation marks the first time that the United States has formally established a comprehensive federal regulatory framework for payment stablecoins backed by fiat currency. The bill complements broader digital asset market structure legislation such as the Digital Asset Market CLARITY Act of 2025, and together they have built a new landscape for digital asset regulation in the United States.

ArkStream interprets the strategic intent and industry impact of the Genius Act from two perspectives. On the one hand, the Act carries the United States' grand strategy of promoting the modernization of the payment and financial systems and consolidating the global dominance of the US dollar; on the other hand, it also marks a critical turning point for the crypto industry to enter compliance and institutionalization.

From a strategic perspective, the Genius Act is not just a simple regulation of stablecoins, but also a systematic financial layout by the US government to maintain the core position of the US dollar in the global financial system. The bill stipulates that all compliant stablecoins must achieve a full reserve of 1:1 US dollars. These reserves must be strictly deposited in the form of cash, demand bank deposits or short-term US Treasury bonds in regulated qualified custodians, and implement a high-frequency audit and information disclosure system to ensure the transparency and security of assets. This move not only greatly reduces the market's concerns about the transparency of stablecoin assets and the misappropriation of reserves, but also establishes a "US debt absorption pool" that is deeply bound to the on-chain payment system. Against the background of the rapid growth of the issuance of stablecoins, it is expected to drive trillions of dollars in new US Treasury demand in the next few years, thereby effectively supporting the long-term sustainable development of US finances.

More importantly, the Genius Act clearly defines compliant stablecoins as payment tools, excluding them from becoming securities, which fundamentally solves the long-standing problems of unclear regulatory ownership, overlapping regulation, and legal uncertainty in the United States for crypto assets. By drawing a clear line between stablecoins and securities, the bill removes important obstacles for traditional financial institutions and large companies to enter the crypto market, significantly reduces compliance risks, and promotes the active involvement of institutional funds. At the same time, the bill adopts a "federal + state" dual-track regulatory authorization model, which not only recognizes the reality of the existing dual banking system, but also achieves a seamless connection between traditional financial supervision and the emerging stablecoin ecosystem, enabling stablecoin issuers to obtain compliance licenses and financial institutions to legally participate in the issuance and operation of stablecoins.

Against the backdrop of intensified global digital currency competition, the United States has actively built a global "token payment network" centered on the U.S. dollar by promoting a compliant stablecoin system led by the private sector. This open, standardized, and auditable stablecoin architecture not only enhances the digital liquidity of U.S. dollar assets, but also provides an efficient and low-cost solution for cross-border payments and settlements. Especially in emerging markets and the digital economy, stablecoins can break through the limitations of traditional bank accounts, achieve point-to-point dollar settlement, improve transaction convenience and speed, and become a new digital engine for the internationalization of the U.S. dollar. This move reflects the United States' realistic strategy in digital currency governance. Different from the closed central bank digital currency (CBDC) system led by other countries, it pays more attention to market-driven and regulatory coordination to seize the commanding heights of global digital financial infrastructure.

For the crypto industry, the Genius Act is equally significant. In the past few years, as the core infrastructure of on-chain transactions and the DeFi ecosystem, stablecoins have always faced the dual challenges of insufficient asset transparency and regulatory gray areas, which has led to institutional investors' cautious participation in crypto assets. The 1:1 full reserve system enforced by the bill, combined with strict custody, auditing and high-frequency information disclosure mechanisms, blocks the risks of "black box operations" and reserve misappropriation from an institutional level, greatly enhancing the market's trust and acceptance of stablecoins. In addition, the bill also innovatively constructs a multi-level compliance authorization system, providing a clear and operational legal framework for the issuance and application of stablecoins, significantly reducing the compliance threshold for financial institutions, payment service providers and cross-border trade platforms to access the stablecoin system.

This means that stablecoins and their derivative on-chain financial activities will move from the previous "regulatory gray area" to the mainstream compliance track and become an important part of the digital asset ecosystem. For innovative scenarios such as DeFi, digital asset issuance, and on-chain credit, the compliance guarantee of stablecoins can not only reduce systemic risks, but also attract more traditional capital and institutional participation, and promote the maturity and scale of the entire industry.

In general, the Genius Act is not only a key node in the US financial strategy, but also a major milestone in the institutional evolution of the crypto industry. Through the dual clarification of laws and regulations, stablecoins will become the core driving force for promoting payment modernization and enhancing the global influence of the US dollar, and pave a solid compliance path for on-chain financial innovation and mainstreaming of digital assets. ArkStream will continue to pay attention to the implementation progress of the bill and its far-reaching impact on the global digital financial ecosystem.

In addition to the US "Genius Act", many countries and regions around the world are also actively promoting the compliance framework of stablecoins. South Korea is actively building a regulatory framework for stablecoins. In June 2025, the ruling party proposed the "Basic Act on Digital Assets", which allows qualified local companies to issue stablecoins, strengthens reserve and capital requirements, and promotes the legalization of the industry. The regulatory power is handed over to the Financial Services Commission (FSC), and a digital asset committee is established to unify supervision. The Bank of Korea (BOK) has turned from initial opposition to support, provided that it obtains supervision over the Korean won stablecoin. This "central bank co-management" model reflects the pragmatic regulatory evolution in the context of stablecoins impacting the traditional banking system and monetary policy. At the same time, South Korea is also promoting broader market liberalization reforms, such as postponing crypto taxes until 2027, opening corporate crypto accounts, and planning spot crypto ETFs, supplemented by crackdowns on market manipulation and illegal trading platforms, forming a regulatory combination of "guiding compliance + cracking down on violations", intended to consolidate its position in the Asian crypto hub.

Hong Kong will officially implement the Stablecoin Ordinance in 2025 , becoming one of the first jurisdictions in the world to establish a stablecoin licensing system. The ordinance is expected to take effect in August, requiring stablecoin issuers to register in Hong Kong, hold 1:1 reserve assets, be audited, and be included in the regulatory sandbox testing mechanism. Hong Kong's system design is both benchmarked against international standards (such as MiCA) and provides Chinese companies with a compliant channel to go overseas, consolidating its position as a financial bridgehead for "controlled innovation."

In this context, Chinese companies such as JD.com and Ant, as well as many Chinese securities firms and financial institutions, are trying to enter the stablecoin industry. For example, JD.com piloted the Hong Kong dollar stablecoin in the Hong Kong regulatory sandbox through its subsidiary JD Coin Chain Technology, emphasizing compliance, transparency and efficiency, with the goal of reducing cross-border payment costs by 90% and shortening settlement time to 10 seconds. Its strategy adopts the path of "B2B first, C2C follow-up", and plans to obtain licenses from major countries around the world to serve global e-commerce and supply chain settlement. This layout complements the domestic positioning of China's digital RMB, and together constitutes the "dual-track system" of the national digital currency strategy-the central bank controls the internal circulation, and leading enterprises explore the external circulation, taking the initiative in the global digital asset landscape.

Stablecoin compliance brings huge opportunities to the crypto market

For the two leading stablecoins in the current market, USDC (issued by Circle) and USDT (issued by Tether), the passage of the Genius Act has far-reaching implications. The bill explicitly defines payment stablecoins that meet its strict standards as non-securities, which provides a clear legal status and regulatory "entry" for issuers such as USDC that have actively sought compliance. This means that these stablecoins will no longer be subject to the onerous provisions of securities laws, but will follow a framework designed specifically for payment instruments. The bill requires a full 1:1 reserve of US dollars, independent audits, monthly disclosures, and formal licensing, which will further enhance the legitimacy and market trust of highly transparent stablecoins such as USDC. For USDT, the bill expands the scope of regulation to include foreign stablecoin issuers that serve US users, which means that Tether will be subject to US jurisdiction and must comply with anti-money laundering (AML) compliance requirements regardless of where it is headquartered. While this may increase its compliance burden, in the long run, this regulatory clarity is also seen as a benefit to Tether as it helps to enhance its legitimacy in the US market. In addition, the bill explicitly prohibits stablecoins with accompanying returns, which may limit the issuer's revenue model but is intended to strengthen the nature of stablecoins as a payment tool rather than an investment product.

Taken together, these regulations not only pave a clear compliance path for leading stablecoins, but also lay a solid foundation for the healthy development of the entire industry. The passage of the Genius Act has opened up unprecedented development opportunities for the cryptocurrency industry, mainly in the following three key areas.

First, the deep integration of compliant stablecoins and the DeFi ecosystem will release huge financial potential. The bill clarifies the legal identity and regulatory framework of stablecoins, opening a green channel for institutional funds to enter the DeFi ecosystem. Taking WLFI and the industry's leading DeFi projects as examples, more and more teams are committed to building transparent, secure liquidity pools and credit protocols that comply with regulations. Improved compliance not only lowers the investment threshold, but also drives DeFi from "experimental" to mainstream, releasing hundreds of billions of dollars in potential incremental growth.

Second, stablecoins bring revolutionary opportunities to the payment field. With the rapid growth of digital payment demand, Stripe has accelerated the layout of stablecoin payment card business by acquiring exchanges such as Bridge, Binance and Coinbase, and promoted the transformation of payment infrastructure to stablecoins. The low-cost and high-efficiency settlement advantages of stablecoins are particularly suitable for cross-border payments, instant settlements and micropayments in emerging markets, helping them become a key bridge connecting traditional finance and the digital economy.

Third, RWA combines stablecoin anchoring with blockchain technology to promote asset digitization and liquidity innovation. With the help of compliant contracts and on-chain issuance, real estate, bonds and other physical assets are converted into tradable digital assets, expanding the liquidity of traditional assets and providing investors with diversified configuration options. The characteristics of blockchain reduce intermediary costs and improve transparency. With the solidification of the compliance foundation of stablecoins, the issuance and circulation of RWA on the chain are expected to develop rapidly, promoting the deep integration of the encryption ecology and the real economy.

Of course, in addition to opportunities, the Genius Act also brings challenges. It expands the definition of digital asset service providers and requires developers, validators, etc. to comply with anti-money laundering regulations. Although the blockchain protocol itself is not regulated, decentralized projects face greater compliance pressure. The bill is more suitable for centralized institutions, and decentralized projects may be forced to move out of US supervision, leading to market differentiation.

Circle's IPO ushered in a new paradigm: corporate balance sheets move on-chain

At the beginning of the second quarter of 2025, the crypto market entered a period of consolidation under the uncertainty of the global macro environment and high interest rates brought about by the tariff storm. Investors' risk appetite declined, the differences within the industry became more obvious, funds were obviously concentrated in Bitcoin, and Bitcoin Dominance continued to rise, reaching the highest value in four years, while the copycat market was generally under pressure. Despite this, institutional participation enthusiasm remains strong, especially through the continuous inflow of compliant channels such as spot ETFs and stablecoins, and the status of crypto assets in the global asset allocation system has been further enhanced.

Bitcoin Dominance

Circle is the biggest beneficiary of this institutional carnival, and its IPO is undoubtedly the biggest highlight of this quarter. As the issuer of USDC, Circle was successfully listed on the New York Stock Exchange with an issue price of US$31 per share, higher than the expected range, raising a total of US$1.1 billion. The IPO pricing market value reached US$6.9 billion, and in less than a month, the market value once reached 68 billion. Circle's strong performance represents the official entry of regulatory compliance crypto companies into the mainstream capital market. Its path of MiCA compliance and long-term SEC filing has become an important model for the stablecoin industry and has also opened a window for other crypto companies to go public.

In addition to Circle, many listed companies have taken substantial steps in digital asset allocation strategies. The most representative one is SharpLink Gaming (SBET). As of June 20, 2025, it has accumulated 188,478 ETH and deployed all of its holdings to the staking agreement. The annualized rate of return has brought staking rewards of 120 ETH. The company raised funds through PIPE financing and "on-market" issuance mechanisms, and received support from institutions such as Consensys and Pantera. In addition, SharpLink also actively uses the ATM (At-The-Market) financing mechanism to flexibly issue shares according to market conditions and quickly raise operating funds, further strengthening its asset allocation and business expansion capabilities. With diversified financing channels, the ETH strategy has become SharpLink's core asset management path.

DeFi Development Corp (formerly Janover Inc.) reshaped its business structure with Solana as its core asset. In April 2025, it purchased a total of 251,842 SOLs, equivalent to approximately $36.5 million, through two rounds of transactions. On June 12, it announced that it had obtained a $500 million equity credit line for further positions. DFDV plans to tokenize the company's shares on the Solana chain through cooperation with Kraken to create a "native listed company on the chain." This is not only a shift in asset allocation mode, but also an innovation in financing and liquidity mechanisms.

In addition to Ethereum and Solana, Bitcoin remains the preferred reserve asset for institutions. Strategy (formerly MicroStrategy) holds 592,345 Bitcoins as of June 2025, with a market value of more than $63 billion, making it the world's largest public BTC holder. Metaplanet is rapidly advancing its Bitcoin reserve strategy in the Japanese market, increasing its holdings by 1,111 BTC in the second quarter of 2025, bringing its total holdings to 11,111, and plans to achieve its goal of 210,000 BTC by 2027.

From the perspective of geographical distribution, corporate crypto asset strategies are no longer limited to the US market. There are active explorations in the Asian, Canadian and Middle Eastern markets, showing global and multi-chain characteristics. Matching this is the attempt to use assets in more complex forms such as staking, DeFi protocol integration, and on-chain governance participation. Companies are no longer just passive holders of coins, but are building balance sheets and income models with crypto assets at the core, pushing the financial model from "reserve" to "interest-bearing" and from "risk aversion" to "production."

At the regulatory level, the regulatory compliance represented by Circle's IPO, as well as the SEC's abolition of SAB 121 and the establishment of the "Crypto Task Force", indicate that the US policy stance is moving in a clearer direction. At the same time, although Kraken is still facing SEC litigation, its active promotion of early IPO financing also shows that the leading platforms still have expectations for the capital market. Animoca Brands plans to list in Hong Kong or the Middle East, and Telegram explores the use of TON to drive revenue sharing mechanisms, which also reflects that the choice of regulatory location is becoming an important part of the strategy of crypto companies.

The market trends and corporate behaviors this quarter indicate that the crypto industry is entering a new stage of "institutional structural reallocation" and "on-chaining of corporate balance sheets". The "MicroStrategy-like" strategy has provided new capital increments for several altcoins with the highest market capitalization. ArkStream believes that native crypto VCs should follow the trend at this time and focus on the following directions in the future: first, projects with stablecoin, pledge, and DeFi profitability capabilities; second, service providers that can assist companies in executing complex asset allocations (such as institutional-level pledge platforms and crypto financial accounting systems); and third, leading companies that embrace compliance and are willing to enter the public capital market. In the future, the depth of corporate configuration and model innovation for specific altcoin ecosystems will become the core variables for a new round of industry valuation reconstruction.

Hyperliquid, On-Chain Derivatives, and the Rise of Real Yield DeFi

In the second quarter of 2025, the decentralized derivatives protocol Hyperliquid achieved a key breakthrough, further consolidating its dominant position in the on-chain derivatives market. As the derivatives platform with the smoothest on-chain trading experience and the product design closest to the centralized exchange standards, Hyperliquid not only continues to attract top traders and liquidity, but also effectively drives the growth and user migration trend of the entire derivatives track. At the same time, its native token HYPE also performed well during the quarter, rising more than 400% from the low point in April and hitting a record high of about $45 in mid-June, further verifying the market's consensus on its long-term potential.

The core driving force behind the rise of HYPE tokens comes from the explosive growth of platform trading volume. In April 2025, Hyperliquid's monthly trading volume was about $187.5 billion. In May, this figure soared 51.5% to a record $248 billion. During this period, the trading boom set off by well-known trader James Wynn significantly increased the platform's attention and became an important catalyst for this round of growth. As of June 25, Hyperliquid's monthly trading volume still reached $186 billion, and the cumulative trading volume in the second quarter was as high as $621.5 billion. At the same time, Hyperliquid's market share in the decentralized perpetual contract market is as high as 80%, far exceeding 30% in November 2024; its monthly perpetual contract trading volume in May reached 10.54% of the total $2.3 trillion derivatives volume of the centralized exchange Binance during the same period, setting a new record. These data fully demonstrate Hyperliquid's trading appeal and user stickiness as the leader in the on-chain derivatives market, as well as its rapid rise and leading position in the industry.

Hyperliquid Trading Volume

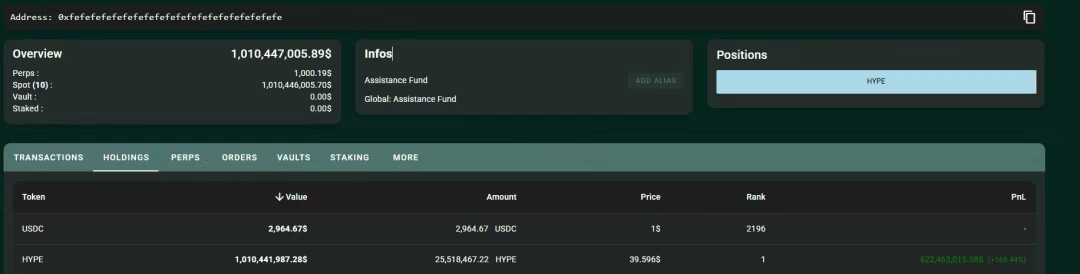

Hyperliquid's core profit source is entirely dependent on the transaction volume generated by its platform. The protocol accumulates revenue by charging fees for each transaction, building a highly sustainable profit model. With the increase in user activity and transaction depth, the platform's fee income continues to grow and becomes the basic driving force for the value of tokens and ecological expansion. 97% of this income is targeted to repurchase HYPE tokens through the aid fund, forming a strong value return mechanism. Over the past seven months, Hyperliquid's total expenses have reached $450 million, and the aid fund has held more than 25.5 million HYPEs. Based on the current market price of about $39.5, the market value of holdings exceeds $1 billion. This repurchase not only continues to reduce the market's circulating supply, but also directly ties platform growth to token performance, significantly improving HYPE's price elasticity and long-term growth potential.

Hyperliquid Aid Fund Address

To strengthen this economic model, Hyperliquid has designed a fee structure centered on user incentives and community orientation. The platform sets tiered fees based on the weighted trading volume of users in the past 14 days. Spot trading volume is doubled, high-frequency users can get lower fees, and market makers even enjoy negative fee rebates in high levels, encouraging them to continue to provide liquidity for the order book. By staking HYPE, users can also get up to 40% additional fee discounts and referral rewards, further enhancing the practicality and willingness to hold tokens. It is worth noting that all protocol revenues belong to the community, not to the team or privileged accounts, and the aid fund is fully managed on the chain. All operations require the authorization of a quorum of validators to ensure transparent governance. In terms of the liquidation mechanism, the platform does not charge direct fees, and the profits and losses of backdated liquidations also belong to the community, further avoiding the "profiting from user losses" model common in centralized exchanges, and enhancing user trust and platform credibility.

In addition to its innovative token economic model, Hyperliquid's unique technical architecture is responsible for its record-breaking performance and significant market position. Hyperliquid runs on a proprietary Layer-1 chain driven by the HyperBFT consensus mechanism. This infrastructure enables ultra-fast transaction finality and processes up to 100,000 orders per second. This architecture provides performance similar to that of centralized exchanges while maintaining non-custodial and crypto-native features, greatly improving the user experience. This shows that the continuous innovation of the underlying blockchain technology is not a castle in the air, but has actually improved productivity and user experience, providing technical support for the exponential growth of on-chain users in the future.

Hyperliquid's success is not just about growth in trading data, but also about the industry's renewed attention to the concept of Real Yield. In the DeFi space, "real yield" refers to income generated from actual economic activities, such as transaction fees, lending interest, or protocol income, rather than through inflationary issuance of more tokens. This is in stark contrast to the early model of DeFi in 2020-2022, when protocols grew rapidly by distributing native tokens as rewards, but these rewards often exceeded the platform's actual income, resulting in long-term dilution and capital flight after a short-term boom. The shift to real yield is critical to the long-term viability and survival of DeFi protocols, as any yield model needs to have a foundation of income support to last. Its key features include income derived from actual protocol activities rather than promises, a focus on long-term capital efficiency and user trust, providing real financial utility that users are willing to use even without incentives, and an emphasis on reliability, usability, and real value rather than pure hype.

To this end, as investment institutions, we should prioritize protocols with real economic activities and defensible business models, strong token economics and revenue sharing models, such as Hyperliquid and AAVE, and focus on their long-term sustainability rather than just TVL or speculative price trends.

Project Investment

Bio Protocol

Bio Protocol is a decentralized protocol designed for scientific research. It is committed to reconstructing the underlying mechanisms of capital flow, achievement incentives, liquidity management and scientific research automation in the traditional scientific research system through blockchain technology, and creating an open, transparent and market-oriented scientific research financial infrastructure. Its core goal is to support the creation and accelerated development of a new generation of BioDAO, and to achieve a closed loop of the entire chain of scientific research projects from screening, financing, governance to achievement transformation. The protocol is built around five basic scientific research operation modules: decentralized scientific research screening (Curation), scientific research start-up financing (Funding), automated liquidity management (Liquidity), milestone incentives (Incentives) and AI-driven scientific research automation assistants (BioAgents). Bio Protocol ensures the consistency of project quality and interests through on-chain governance and pledge mechanisms, uses Treasury to provide diversified liquidity support, and combines AI agents to improve scientific research efficiency, creating an integrated and sustainable scientific research ecosystem. In addition, Bio Protocol introduces IP-Tokens (intellectual property tokens) to realize the expression of on-chain governance and participation rights of scientific research results, promote the openness and co-governance of the scientific research process to the community, and create a transparent and efficient scientific research asset pool.

IoTeX

IoTeX is a decentralized, modular Web3 infrastructure platform that aims to connect smart devices and real-world data with blockchain to build a decentralized real-world open ecosystem. The core goal is to open up the connection between Web2 and Web3, so that smart devices, real-world data, and various decentralized applications (DApps) can interact safely, reliably, and efficiently, and realize value exchange.

Vaulta

Vaulta is a high-performance Web3 banking operating system built specifically for the next generation of digital finance, positioned as the core infrastructure of RWA and compliant financial markets. Its underlying layer uses the self-developed Savanna consensus mechanism and Vaulta EVM, supporting transaction finality and concurrent processing capabilities in seconds, ensuring stable and low-cost transaction performance even in high-load environments, and meeting the throughput and reliability requirements of institutional-level applications. Unlike general public chains, Vaulta's design natively supports programmable finance and modular banking architecture, allowing developers to build composable account systems, asset management logic with controllable permissions, and nested governance structures.

In the RWA field, Vaulta provides a complete set of end-to-end asset tokenization infrastructure, including natively supported asset custody, compliance whitelists, hierarchical account permissions, and auditable on-chain revenue distribution mechanisms. In terms of compliance, Vaulta does not bypass regulation, but deeply connects to existing regulatory logic. Its built-in permission-based operating environment supports account review and fund path monitoring under multiple regulatory jurisdictions. At the same time, Vaulta has built an audit-friendly ledger structure and programmable compliance rule set, enabling financial institutions to meet financial regulatory requirements in different regions without sacrificing control.

Attend events

Participated as a guest in the "What is the real impact of Singapore's DTSP bill" held by BlockBeats

https://x.com/BlockBeatsAsia/status/1933004478674059458

Participated in the Space【Can True Decentralization Coexist with VC Ownership and Governance Influence?】 hosted by Cryptic

https://x.com/cryptic_web3/status/1937752659110613228?s= 46

Participated in the fourth phase of the Web3 accelerator project held by TDefi as a mentor

https://x.com/tde_fi/status/1933868272925151536?s=46

Participated as a judge in the [ETH Huangshan] event held by KeyMapDAO

https://x.chttps://x.com/keymapdao/status/1931323849347621021?s=46

Participated as a guest on the talk show "The Left Curve" hosted by Radarblock

https://x.com/radarblock/status/1888899390523445605?s=46

Reference Links

Visa stablecoin on-chain data:

https://visaonchainanalytics.com/transactions

Bitcoin Dominance:

https://coinmarketcap.com/charts/bitcoin-dominance/

Sharplink:

https://investors.sharplink.com/sharplink-gaming-expands-eth-treasury-holdings-to-188478

Strategy’s BTC purchase data:

https://www.strategy.com/purchases

Animoca IPO News:

Hyperliquid’s trading volume:

https://defillama.com/perps/hyperliquid

Hyperliquid's assistance fund address:

https://hypurrscan.io/address/0xfefefefefefefefefefefefefefefefefefefefe

Hyperliquid trading fee structure:

https://hyperliquid.gitbook.io/hyperliquid-docs/trading/fees