Original author: Pine Analytics

Original translation: TechFlow

summary

Eclipse Labs has raised $65 million from top investors to build a second layer (Layer-2) based on the Solana Virtual Machine (SVM) on Ethereum. Eclipse has received support from companies such as Polychain, Placeholder, and Hack VC, positioning itself as a high-performance, cross-chain Rollup platform with ambitious architectural plans.

However, despite the strong funding and good reputation, the on-chain reality is quite different. Activity is shallow and short-lived, driven mainly by airdrop mining rather than organic demand. Gas fees, deposit amounts, and total locked value (TVL) have been declining. The current application ecosystem lacks a unique and valuable product - most products are just weak copies of other products.

Eclipse entered the token launch cycle with an overvalued valuation due to a lack of compelling applications and declining usage, and its fully diluted valuation is expected to be over $300 million, even though its network fundamentals do not support this valuation.

The likely outcome: A brief short squeeze will be followed by sustained selling pressure as insiders and market makers take advantage of retail interest and then exit.

Unless Eclipse offers a product that can only exist within its stack, the token will temporarily inflate the ecosystem — and then gravity will pull it back to the ground.

Raising funds

Since its inception, Eclipse Labs has raised $65 million through multiple rounds of financing, becoming one of the best-funded Ethereum Layer-2 projects.

Financing round breakdown

Pre-Seed ($6 million) – August 2022

This round of financing was led by Polychain Capital, with participation from Tribe Capital, Tabiya, Accel, Polygon Ventures, etc. This early round of financing positioned Eclipse as an ambitious attempt to bring Solana's high-performance virtual machine (SVM) to Ethereum. It is estimated that the valuation of this financing is $30 million to $40 million, which is more common in strong infrastructure development projects at the time (such as pre-product).

Seed round ($9 million) — September 2022

The round was led by Tribe Capital and Tabiya, with participation from CoinList, Infinity Ventures Crypto, Soma Capital, and Struck Crypto. Although Eclipse has not yet achieved a formal network or protocol landing, this round of financing has pushed Eclipse's valuation to nine figures (a post-financing valuation of $100 million to $120 million). The funds will be used to expand the engineering team and accelerate infrastructure construction.

Series A ($50 million) — March 2024

Led by Hack VC and Placeholder, Delphi Digital, Polychain (returning investor), OKX Ventures, GSR, Flow Traders, Distributed Capital, Maven 11 and DBA participated in the round. This round of financing aims to launch the Eclipse mainnet and build the Eclipse ecosystem. Although Eclipse's valuation has not been officially disclosed, industry insiders estimate that its valuation is between $300 million and $500 million, which means that Eclipse will become a top competitor for Ethereum Layer-2.

Strategic Positioning

Eclipse’s financing is unique not only in its size, but also in the strategic crossover appeal of its promise:

Gain support from Ethereum and Solana investors (e.g. Anatoly Yakovenko, Solana Foundation, Ethereum Foundation researchers).

An architecture that merges the security of Ethereum with the execution layer of Solana and the modular data availability of Celestia.

This allows Eclipse to present itself as the future of cross-chain performance — a “world’s best” rollup stack.

Polychain’s Reputation

Polychain Capital led Eclipse’s pre-seed round and participated in subsequent rounds — but their recent behavior in other investments raises serious red flags. In projects like Celestia, they sold off heavily after the token launch, reportedly selling over $240 million of $TIA, causing its price to plummet by 90%. The same pattern has been seen in other Polychain-backed tokens, such as Manta, Scroll, and Solayer, which are all down 80% to 95% from their peak prices.

There is no reason to expect Eclipse to be any different. Polychain has consistently demonstrated a willingness to maximize returns, regardless of the impact on the ecosystem. Their early position in Eclipse suggests that they are prepared to rotate out when liquidity emerges — rather than enter into a long-term partnership.

On-chain activity and usage

Although Eclipse has raised $65 million and positioned itself as Ethereum's fastest L2 platform using Solana's virtual machine, its on-chain activity still shows a short-lived, airdrop-driven usage pattern with little sustained demand. The following data visualization shows the rise and rapid decline of activity in key indicators such as Gas payments, user deposits, TVL (Deep Tide Note: Full name Total Value Locked, locked total value. Used to measure the total value of assets locked in a DeFi protocol or blockchain ecosystem.) and application appeal.

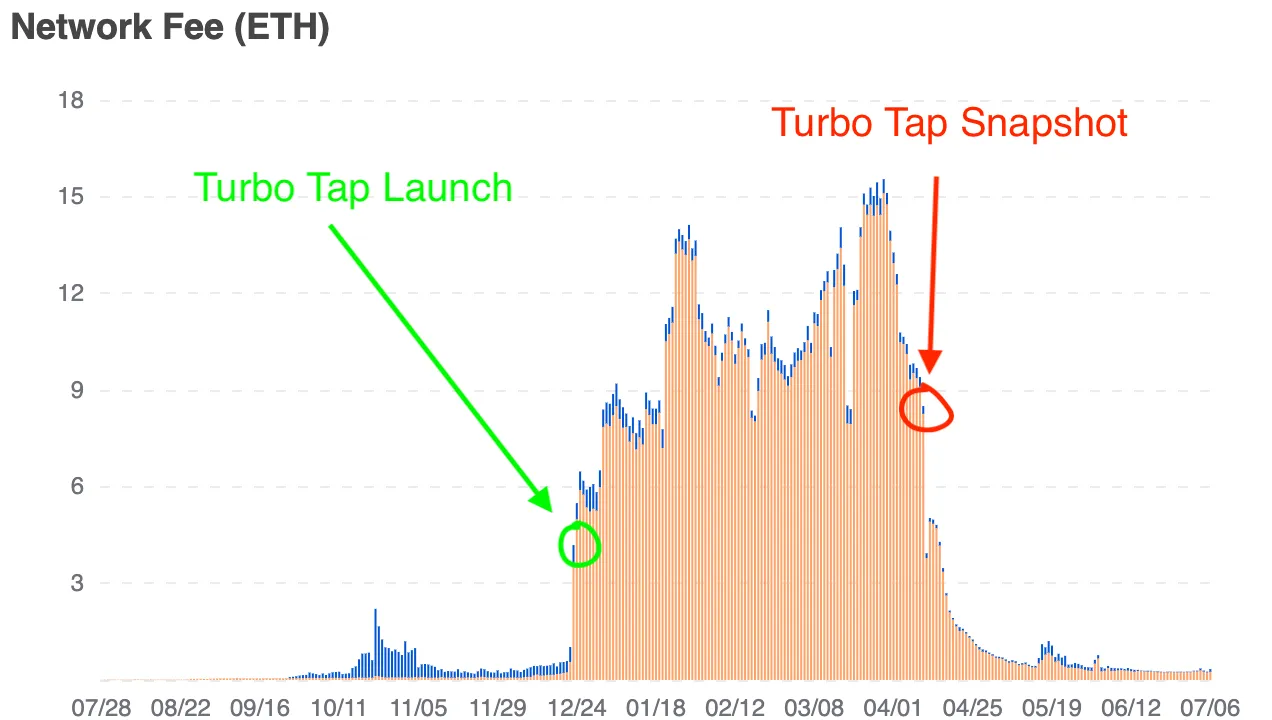

Network fees reveal airdrop-driven speculation

This chart shows the total daily network fees paid on the Eclipse Platform in ETH. Turbo Tap (an application specifically for airdrop mining) saw an immediate spike in activity after its launch. The sharp drop after the Turbo Tap snapshot was released further confirms the correlation between usage and reward expectations.

By June 2025, network fees had fallen below 1 ETH per day (~$750), reflecting both a decline in user transactions and the disappearance of incentive-driven behavior. This trend supports the view that there is no natural demand for transactions on the network other than airdrop mining.

Chain deposits steadily decline

The curves for ETH and Hyperlane deposits into Eclipse track closely with the surge in Gas usage — both saw rapid growth between December 2024 and March 2025, driven by incentive-driven activity. Starting in Q2 2025, deposits began to steadily decline as users withdrew funds and potentially reallocated them to more liquid or active ecosystems.

Hyperlane-based deposits peaked at $25 million to $27 million in the first quarter of 2025, but have since fallen below $17 million. This downward trend is also relatively consistent in bridge assets such as USDC, SOL, and WIF. Importantly, this is not a realignment of asset composition, but an outflow of funds from the entire ecosystem. As the reward incentive mechanism gradually weakens, user participation also declines, exposing the fragility and temporary nature of Eclipse's liquidity foundation.

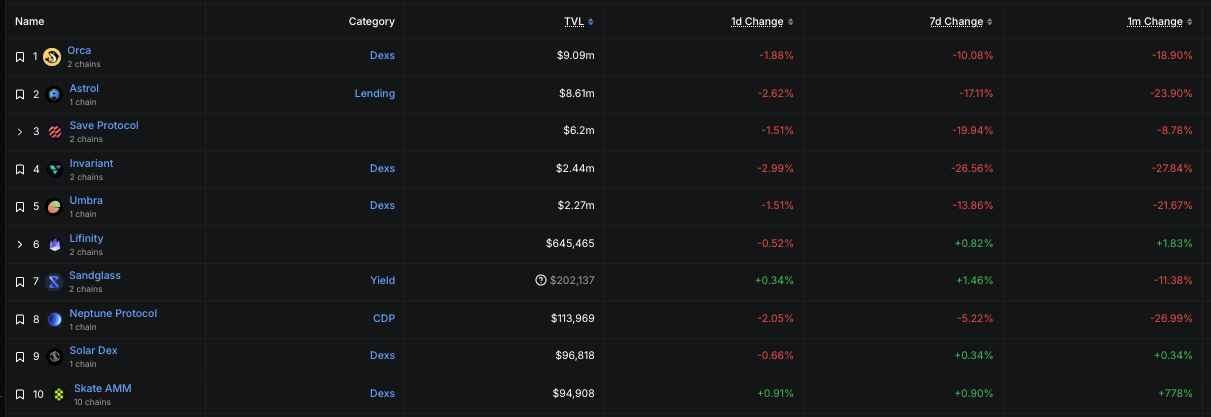

The DeFi application ecosystem is small, illiquid, and highly loss-making

Among the top 10 Eclipse apps, TVL is still low:

Only 3 apps have a TVL of more than $2 million (Orca, Astrol, Save).

Most others make less than $500,000, and some make less than $100,000.

The 1-month change column shows a massive double-digit decline in almost all major protocols (Astrol -24% , Invariant -28% , Neptune -27% ).

This situation suggests that developers haven’t found sticky traction, and users haven’t found a useful or profitable reason to stay.

Loss of focus

As it stands, the Eclipse application ecosystem lacks any unique and valuable products. The existing application portfolio - DEX, lending market, stablecoin, NFT market - is structurally no different from existing applications on Solana, Ethereum or other Layer-2. In most cases, they provide fewer features, poorer liquidity, and lack competitive advantages.

For a blockchain to sustain long-term use and justify its block space, it needs a clear point of origin — an application or experience that users can’t get elsewhere. So far, Eclipse has not achieved this.

Instead, the network's short-term activity is driven almost entirely by airdrop mining. While the upcoming token launch may spark user interest temporarily, it is unlikely to retain user attention without a core reason to stay. Token incentives can spark user momentum, but they cannot replace true product-market fit.

Without great Eclipse-native applications, the ecosystem could quickly disintegrate after the TGE. Builders would leave for platforms with greater liquidity. Users would move to chains where their tokens have an exit opportunity. And the network — despite its deep pockets and engineering prowess — could become irrelevant, not because the technology failed, but because nothing truly matters in it.

If Eclipse wants to have a future, it needs to incubate or attract an application that can only be implemented on its architecture - one that can leverage the SVM in a way that no EVM chain can replicate. Otherwise, the token will only briefly inflate the ecosystem before gravity pulls it back to earth.

Expected Token Issuance Updates

Based on similar projects and the current state of the Eclipse ecosystem, the most likely outcome is a valuation mismatch for TGE. Despite the chain’s declining usage and lack of sticky applications, Eclipse is expected to have a higher valuation at its initial public offering (FDV) than its most recent private round of funding — likely over $300 million. This would immediately rank it among the highest valued L2 platforms, despite its lack of corresponding fundamentals.

The perpetual contract market will likely go live soon after launch, and traders will begin shorting the token in an attempt to drive its price down to where it should be. In response, market makers and early backers will short squeeze these shorts, temporarily driving up the price until short positions are reduced to manageable levels. Once liquidity dries up, stakeholders holding unlocked or liquid tokens will begin to gradually sell, creating sustained selling pressure and triggering what is usually a persistent, violent downtrend.

This pattern — an overpriced launch, an initial market squeeze, followed by a long launch — is common in overhyped, underutilized ecosystems. Without a natural demand catalyst or unique application to attract attention, Eclipse’s token is likely to follow the same trajectory.

Final Thoughts

Eclipse has raised significant funding, built an impressive technology stack, and attracted the attention of top investors. But none of this has translated into sustained user demand, product-market fit, or a raison d’être for the blockchain beyond short-term speculation.

The reality is clear: Eclipse has no killer app, no sticky user base, and no unique reason for developers or capital to stay after the token launch. The token launch will likely be like many token launches in the past - a short-lived hype wave followed by sustained selling pressure due to insider rotation and lack of organic demand.

Eclipse may yet find its footing, but that path will require more than just funding and clever architecture. It will need to deliver what only Eclipse can deliver — not just technically, but economically and experientially. Until then, the project’s valuation will be out of sync with its utility, and its tokens will be priced more based on narrative than actual usage.

In a market like this, the downward gravitational pull will eventually prevail.