OpenAI angrily denounced Robinhood for unauthorized use. Whose interests were affected by stock tokenization?

Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

Thanks to its series of operations to enter the "stock tokenization" market, Robinhood has dominated the headlines of major financial media in the past few days, and its stock price has exceeded US$100, setting a record high.

Odaily Note: Please refer to " Robinhood rewrites the global trading landscape, and stock tokens enter the era of dimensionality reduction ."

In addition to introducing listed stocks into the on-chain market through tokenization, Robinhood has also expanded the scope of stock tokenization to unlisted private companies, and will give EU users unlisted OpenAI and SpaceX stock tokens. This move is widely interpreted by the market as Robinhood's attempt to seize pricing power in the Pre-IPO market.

OpenAI accuses Robinhood of unauthorized use

However, in the early morning of July 3, OpenAI officially issued a statement on X to clarify: " These so-called OpenAI tokens are not OpenAI equity. We have no cooperation with Robinhood, are not involved in this matter, and do not endorse it. Any transfer of OpenAI equity must be approved by us - we have not approved any transfer. Please be careful. "

In response to OpenAI’s rebuke, Robinhood co-founder and CEO Vlad Tenev responded on X: “ In our recent cryptocurrency event, we announced that we would give away a limited number of OpenAI and SpaceX stock tokens to eligible European customers. While these tokens are not strictly “equity” (interested friends can check our terms for details) , they actually provide retail investors with access to these private assets. Our giveaways set the stage for a bigger plan. Since our announcement, we have heard from many private companies eager to join us in this tokenized revolution.”

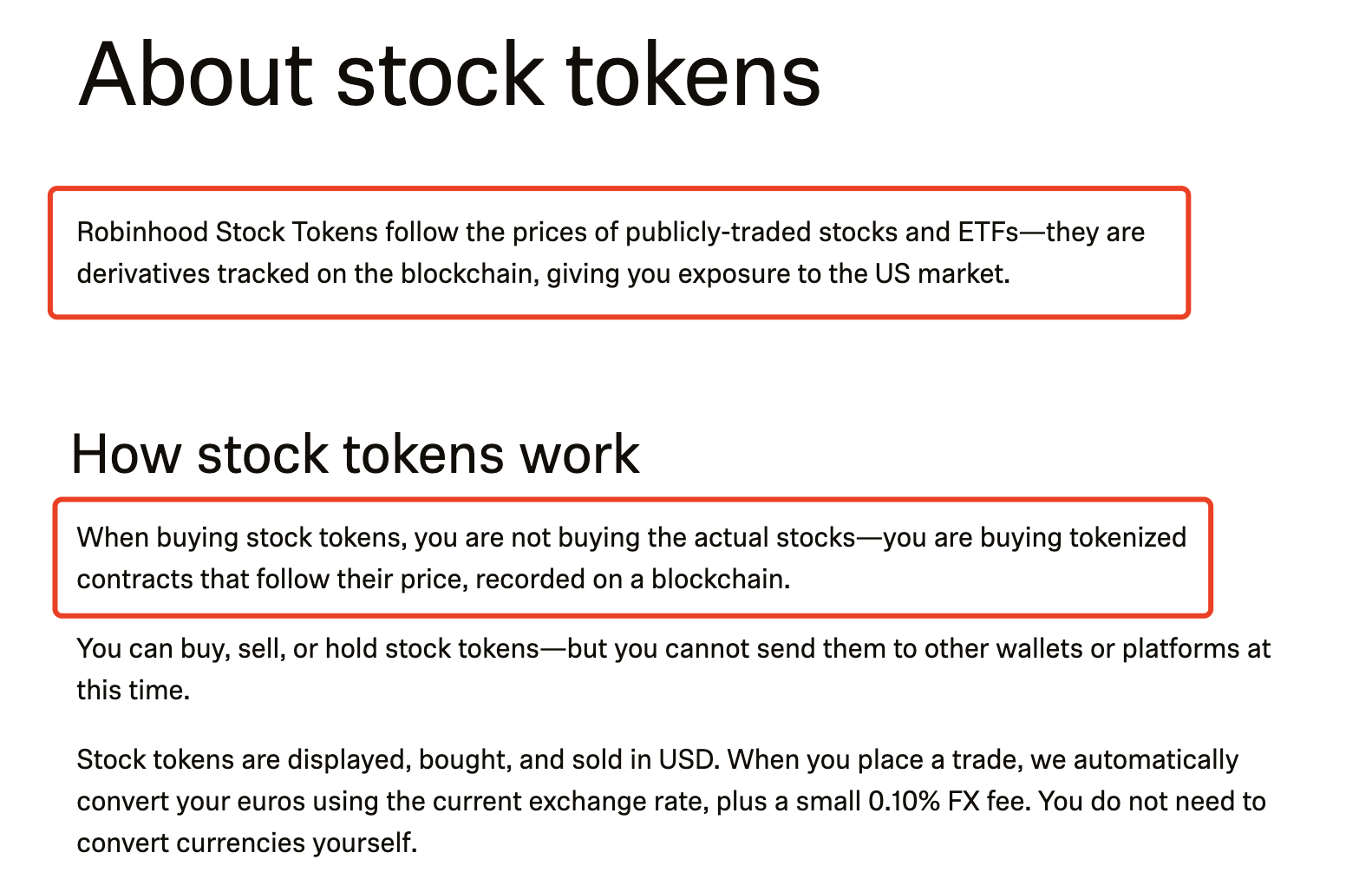

Regarding Vlad Tenev’s description of “tokens are not equity”, we found a more detailed explanation in Robinhood’s product documentation: “ Robinhood Equity Tokens track the prices of publicly traded stocks and ETFs. They are derivatives that track prices on the blockchain… When you buy an equity token, you are not buying the actual stock, but a tokenized contract that follows its price and is recorded on the blockchain. ”

Core controversy: Can unlisted stocks be tokenized?

As two hot companies in the current financial market, OpenAI 's rebuke of Robinhood quickly triggered heated discussions in the market. The focus of the discussion was on whether the shares of unlisted private companies such as OpenAI and SpaceX could be tokenized? Do platforms such as Robinhood (or derivatives issuers) need authorization from the other party? Can private companies restrict the circulation of such stock tokens?

Odaily Note: It is worth mentioning that Elon Musk, who has a deep grudge against OpenAI, jumped out today to mock OpenAI for "only having fake stocks" ... The grudge between Elon Musk and OpenAI is related to OpenAI's transformation from a non-profit organization to a for-profit entity. This is also a public case that has attracted much attention in the Internet industry. Interested readers can search and inquire on their own.

Bankless founder David Hoffman speculated that Robinhood may have reached an agreement with someone who holds OpenAI/SpaceX shares - "Vlad Tenev specifically mentioned during his speech that he was associated with a wealthy investor who owns OpenAI/SpaceX shares. These shares are likely still owned by the original investor (individual or entity), and OpenAI may have approved the original investor to sell the equity. In this case, a private agreement can be signed between Robinhood and the investor without the approval of OpenAI. Nevertheless, private companies such as OpenAI can still refuse to trade their shares in accessible venues, which will be a real friction for Robinhood."

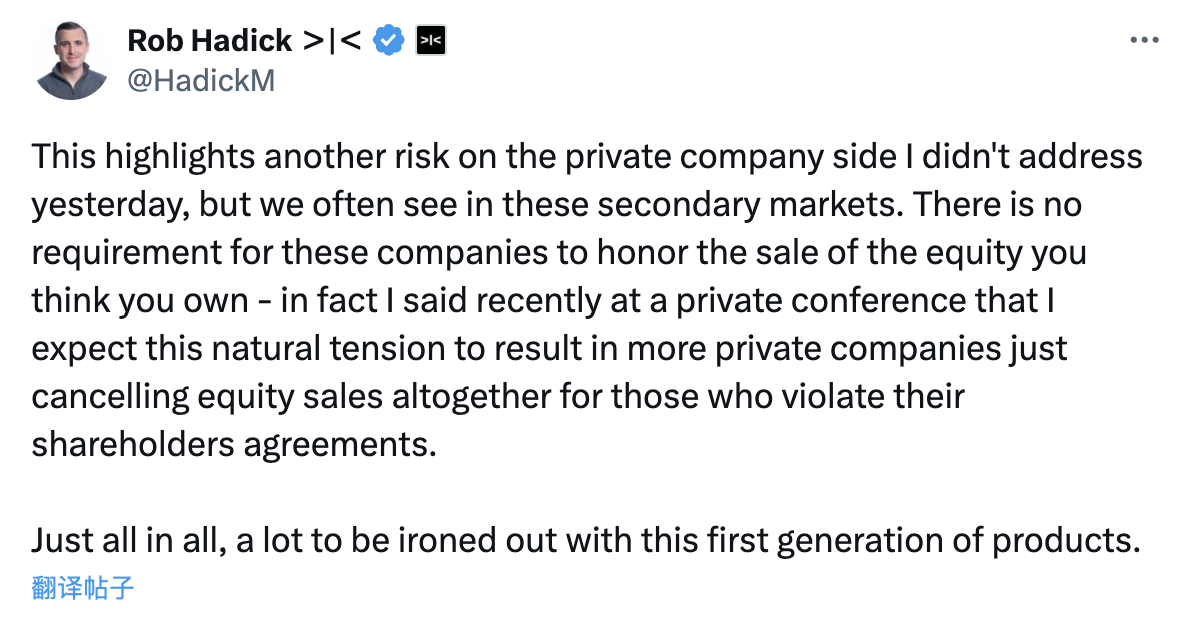

However, Dragonfly partner Rob Hadick believes that there is another potential risk in this model, that is, private companies such as OpenAI may not recognize the completed equity sales agreement in the name of breach of contract: "OpenAI's clarification highlights another risk on the private company side that I did not mention yesterday, but these issues often appear in the secondary market. Private companies are not obliged to recognize the equity transfer rights you believe you own - in fact, I recently said in a closed-door meeting that I expect this natural contradiction to lead more private companies to directly cancel equity sales that violate shareholder agreements. Overall, many problems of this generation of products remain to be solved."

Collins Belton, a venture capital lawyer, gave a more detailed explanation. Collins said that many non-venture capital lawyers believe that it is mainly securities laws and other laws that restrict the operation of private and public stocks. This is correct to a certain extent, but additional contractual obligations between shareholders and between shareholders and companies may also apply. For example, a company can agree with shareholders in the articles of association, memorandum or articles that some or all company shares cannot be "transferred" without the company's consent - "transfer" not only refers to the actual transfer, but is usually defined broadly, covering everything from pledges to the creation of derivatives.

Collins added that hot Silicon Valley startups often impose secondary market restrictions through contracts in later stages, and that in early-stage companies, these restrictions may only apply to common stockholders, especially when venture capitalists have influence. However, as companies become very hot and mature, they often impose such restrictions on all shareholders, including well-known venture capitalists.

Collins also mentioned: "I initially wondered whether emerging stock tokenization issuances like Robinhood and xStocks solved this problem. I thought that with Robinhood's influence, they might have solved this potential problem, but based on OpenAI's statement, I doubt they have done so. They may be playing dumb, or they may really not know there is this limitation."

According to Collins's explanation at the legal level, if OpenAI did sign an additional agreement with investors to restrict the "transfer" of shares, then Robinhood's stock tokenization operations on OpenAI (even in the form of derivatives as Robinhood said) should be restricted. Combined with OpenAI's description that "any equity transfer must be approved by us", it is very likely that OpenAI does have such a restrictive agreement - but because Robinhood did not disclose the specific source of these shares, the market is temporarily unable to determine the specific details of the agreement between OpenAI and the unknown investor.

The game behind the scenes: the battle for pricing power

OpenAI and Robinhood are openly competing against each other, and neither side seems to be willing to back down. This is because behind the simple question of “whether stocks can be tokenized” lies the “competition for IPO pricing power.”

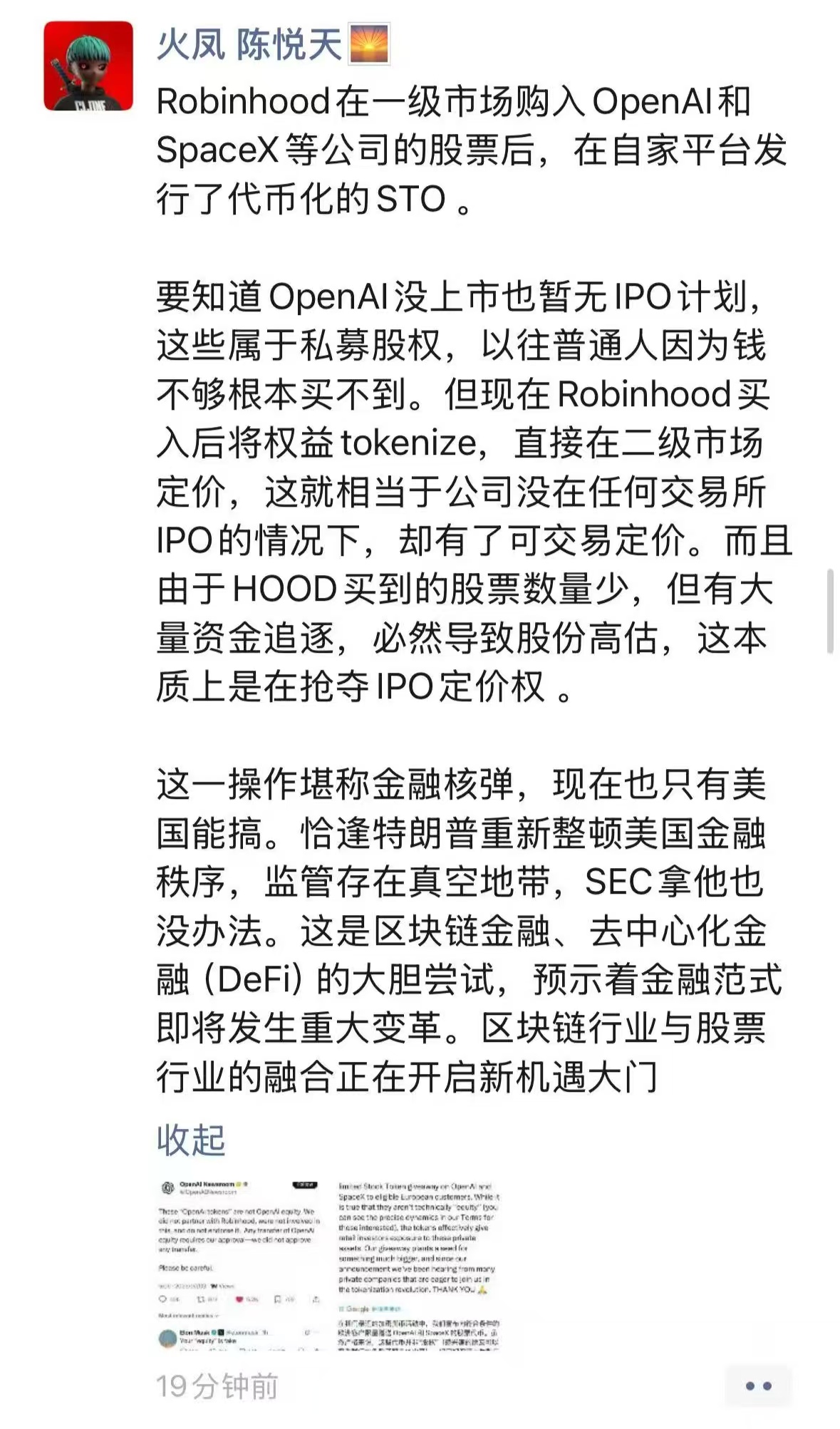

Chen Yuetian, founder of Phoenix Capital, analyzed this in his personal circle of friends and said: " After Robinhood purchased stocks of companies such as OpenAl and SpaceX in the primary market, it issued a tokenized STO on its own platform. It should be noted that OpenAl has not been listed and has no IPO plan. These are private equity. In the past, ordinary people could not buy them because they did not have enough money. But now Robinhood tokenizes the equity after buying it and directly prices it in the secondary market. This is equivalent to the company having a tradable price without an IPO on any exchange. And because Robinhood bought a small number of stocks, but there was a lot of money chasing it, it would inevitably lead to an overvaluation of the shares, which is essentially a grab for the pricing power of the IPO. "

In the traditional financial market, IPO pricing is dominated by the lead underwriters who work with the company to be listed, and both parties will set prices based on different financing needs and development expectations. However, with the entry of Robinhood, a "catfish", private equity that was originally not publicly traded has a secondary market, and anyone can trade freely on the chain regardless of how much money they have, which means that private equity will experience sufficient price discovery before the IPO, and the pricing power will be stripped from the company to be listed and the lead underwriter, which is exactly what OpenAI does not want to see.

Retail investors’ perspective: Can we still push forward?

Considering the current situation, when it comes to tokenizing stocks that are already listed and have clear public prices, platforms such as Robinhood still have some historical experience to draw on, and the implementation path for this part is relatively simple; but tokenizing stocks of private companies such as OpenAl and SpaceX is a path that almost no one has explored, and the current solution provided by Robinhood still has a lot of uncertainty.

Odaily Note: Please refer to " 10 Questions about xStocks: What are we trading when trading US stock tokens? "

Dragonfly partner Rob Hadick said: “Robinhood deliberately remains extremely opaque about the exact nature of the derivatives, how they are hedged, who the counterparties are (where the equity comes from), and what legal recourse you have. The bottom line is that private company equity is an asset derivative with no public price, which contains a large number of securities/profit sharing plans that trade at different prices. Moreover, it is completely opaque how the derivatives are settled based on different underlying company actions.”

From the perspective of retail investors, uncertainty may sometimes represent opportunities, but more often it points to risks.