How to use Grok to capture crypto market sentiment and trading signals in real time

Original title: How to use Grok for real-time crypto trading signals

Compiled by: Asher ( @Asher_0210 )

Editor's Note: This article focuses on the application value of Grok in crypto trading, especially its ability to capture early trading signals and macro event reactions by real-time scanning of sentiment dynamics on X. In addition, it also states that Grok and ChatGPT have their own focuses, the former is good at real-time sentiment monitoring, and the latter is suitable for strategy design and logical reasoning.

However, Grok is not a universal tool. It cannot execute transactions, interpret charts or perform risk management, and is easily affected by social noise. Only by combining Grok with other analysis tools can the efficiency and accuracy of trading decisions be improved.

How to use Grok to get market sentiment, trading signals and macro event views

Anyone who has ever traded crypto during a meme cycle knows how quickly sentiment can change, and how much most tools lag. Grok changes that. With its direct integration with X, Grok is able to scan thousands of posts, tags, and comment threads in real time. Used wisely, Grok is more than just a “sentiment reader”; it’s a tool that can be used to “trade sentiment.” Here are some real-world ways crypto traders are using Grok:

Real-time emotion monitoring

Grok can dynamically scan crypto posts on X, capturing keywords and sentiment changes that may affect the market, such as "bottom has appeared", "huge unlocking", "whale sell-off" or "rate cut confirmed". It is not just a surface scan, but analyzes the context, emotional tone and posting intention of each post. By accessing X's API, some traders began to try to use Grok to:

1. Track early sentiment signals for unpopular coins

In April 2024, discussion around TURBO increased on X, mainly triggered by developers’ previews of new features. This change preceded the chart signal by about 36 hours, and TURBO subsequently ushered in a 22% price increase, showing that sentiment tools can capture momentum in advance.

2. Perceive the emotional fluctuations caused by macro events

During the Fed’s FOMC update in March 2024, Grok monitored rising anxiety in BTC-related discussions. Before the actual price drop, market sentiment had turned negative, helping some traders adjust their positions early.

3. Identify Sentiment-Price Divergence

In February 2024, community discussion around FET increased significantly, but the price remained stable. Some traders saw this as a signal to enter the market, and the price broke through two days later.

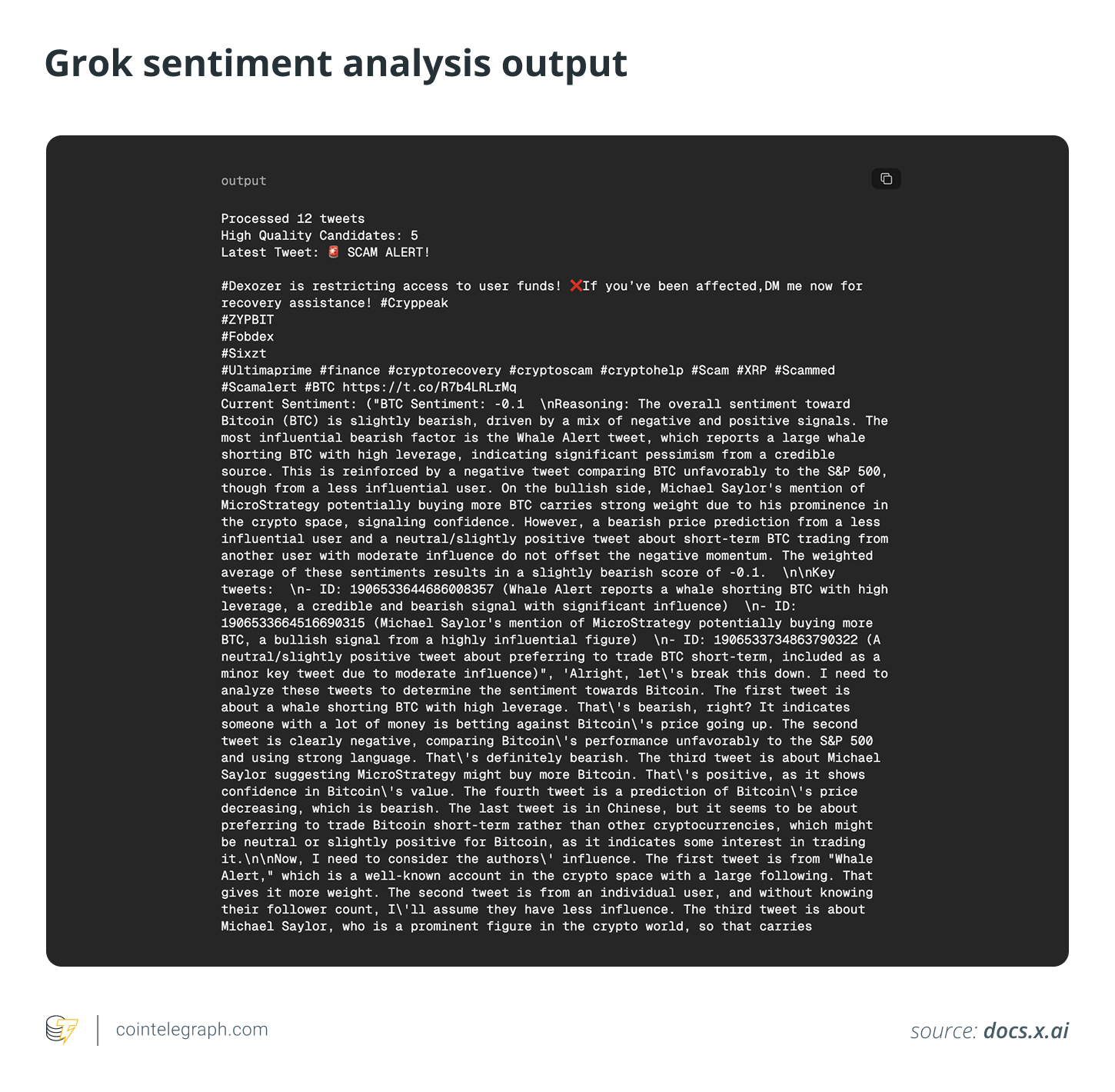

Unlike traditional keyword scanners, Grok uses deep sentiment analysis and real-time data integration from X to more accurately capture details in high-impact events such as CPI announcements, ETF rumors, and KOL attitude shifts. The following figure is an example of the output of Grok's custom sentiment analyzer connected to X, which analyzed 12 posts about Bitcoin in six hours (the data set includes posts from well-known accounts such as Whale Alert and Michael Saylor, as well as comments from some less influential bloggers on BTC leverage, short-term trading, and macro comparisons), with the goal of evaluating the real-time sentiment trends and tendencies of the crypto market during volatile trading hours.

X Dynamic Signal Analysis

Thanks to its integration with X, Grok can capture momentum signals as soon as a certain type of content starts to gain momentum. Traders who use Grok often use it to:

Tracking token mention spikes: When a token ticker (like “FET” or “TURBO”) is mentioned frequently by multiple verified or active accounts in a short period of time, it could mean that the topic is rapidly gaining momentum.

Monitor KOL movements and token-related behaviors: especially when an account with a large number of followers hints at an upcoming listing, a partnership, or a price expectation, accompanied by an unusually high volume of interactions (such as a surge in reposts or an explosion of comments).

For example, in a 24-hour period in February 2024, the number of posts about “ORDI” surged from less than 50 to over 400, driven primarily by some top traders discussing its potential listing, and Grok marked this surge in narrative velocity before prices reflected the heat.

By analyzing these real-time social signals, Grok can help users identify momentum shifts in the crypto community earlier, allowing traders to evaluate and position before the narrative is formed and appears on aggregator sites or news feeds, rather than chasing the rally after the fact.

Macro Awareness in High Time Frame Trading

Grok helps traders track market sentiment around macroeconomic events (such as CPI announcements, interest rate decisions, crypto regulation, etc.) in real time. For example, after the release of the US Consumer Price Index (CPI) in December 2024, the data showed an annual inflation rate of 2.9%, and Bitcoin briefly broke through $98,500. This trend was in line with market expectations, and some analysts interpreted it as a positive signal for risky assets, reflecting the market's optimism about the Federal Reserve's possible rate cuts.

By analyzing group-level data in real time, Grok often reflects the true market direction better than traditional news headlines. Such signal views help traders rotate funds between BTC, stablecoins and altcoins more efficiently, especially when market sentiment quickly turns after macro events are released.

Comparison between Grok and ChatGPT in crypto trading

Grok and ChatGPT are both widely explored AI tools for crypto analysis, but they focus on different functions. For traders, analysts, or researchers who want to improve decision-making efficiency, understanding the scenarios in which each is applicable can better optimize the workflow.

Grok: Real-time sentiment scanning tool

Platform attributes: Integrated in X, applicable to X Premium+ users.

Core advantage: Real-time analysis of social emotions.

Features:

Track public posts and popular discussions;

Identify early signals in the community about a currency, narrative, or macro event;

Identify potential momentum shifts in advance (such as token mention surges, KOL hints, sentiment changes).

Grok is suitable for capturing trading opportunities “when the trend starts”, especially those based on narrative-driven market conditions.

ChatGPT: Structural analysis and strategy logic construction

Platform attributes: General AI tool, no default access to real-time social media data (unless using API or plugins).

Core advantages: deep understanding and logical reasoning ability.

Features:

Explain trading strategies, indicator principles and risk control ideas;

Summarize structured content such as project research reports and token economic models;

Generate backtesting framework, automatic trading logic, and simulation scenario assumptions;

ChatGPT is more suitable for building medium- to long-term strategies, understanding concepts, and writing automated trading assistance tools.

Data acquisition: real-time information vs. processing

Grok has a significant advantage in "real-time" when it comes to getting information. Since it is directly embedded in X, Grok can instantly scan the latest posts, community reactions, and popular content. This makes it very useful in the following scenarios:

Capture sudden changes in emotions;

Discover viral token mentions before price changes;

Respond quickly to breaking macro or regulatory news.

In contrast, ChatGPT does not provide access to real-time information streams by default unless external tools are connected via browser plugins or APIs. But it excels at structured analysis, such as explaining trading strategies, conceptual backtesting, or summarizing white papers.

Therefore, if you need to quickly obtain the latest feedback from the crypto community, Grok is better; if you need structured insights or technical analysis, ChatGPT is a better choice.

Emotion vs. Strategy

Grok excels at analyzing real-time social narratives in crypto communities, particularly in the following scenarios:

Get crypto market sentiment from X;

Identify early trading signals from popular posts and community discussions;

Identify rotations between meme coins and community-driven pumps;

Sense the market’s reaction to macro events in real time.

ChatGPT is better at the following tasks:

Writing or debugging trading robots;

Explain concepts such as liquidation cascades and funding rates;

Develop AI-driven crypto trading strategies.

For example, in AI4Crypto 's GitHub open source repository, there are some scripts that combine Grok's sentiment data with ChatGPT's backtesting logic. This type of experimental combination is becoming more and more common in the open source quantitative community: Grok is responsible for capturing signals, and ChatGPT is used to write trading logic or simulate trading responses. This "emotion + strategy" collaborative approach is gradually becoming a standard configuration in AI-powered quantitative trading experiments.

Deployment speed

Grok is designed to be a highly "responsive" tool that can capture signals as soon as a topic starts to heat up. Therefore, more and more crypto automation developers are trying to build automatic trading warning systems based on Grok's sentiment mutations. In contrast, ChatGPT deployment is more "set-up". Unless it is connected to a real-time API, it is more suitable for processing historical or static data problems. This is not a disadvantage, but a different positioning:

Grok is a “market monitor” that scans sentiment in real time;

ChatGPT is a "strategy interpreter" that clarifies the logic.

Grok’s Risks, Limitations, and Drawbacks

Although the prospect of Grok is very attractive, it is also necessary to be clear about its boundaries. Many AI trading experiments fail not because the tools are bad, but because they expect it to be a "know-it-all". Grok can enhance the trading process of traders, but it is not a plug-and-play "magic signal source".

Unable to execute transaction

Unlike crypto bots that connect to exchanges, Grok does not place orders or manage positions. It can tell you that sentiment or narratives are changing, but it cannot tell whether your strategy is "aggressive long" or "conservative defensive."

Some developers are building automated warning scripts that connect to Grok, but these systems still require manual review or connection to third-party execution platforms. In short, Grok is a signal scout, not a full-fledged trading engine.

No awareness of charts or technical indicators

Although Grok 3 has begun to try to parse some market data and basic graphics, it does not yet have complete technical analysis (TA) capabilities. If traders need precise TA, they still need to use tools such as TradingView, professional robots, or ChatGPT that can understand and explain TA.

For example, Grok might tell you: “SHIBA is trending.” But it won’t say: “This is a bullish flag on the 4-hour chart.” To make those kinds of judgments, you’ll also need TradingView, CoinGlass, or an AI hybrid analysis system.

Susceptible to noise and manipulation

Grok gets its data directly from X, which means it reads unfiltered public content, which may include:

False information;

KOL collective shilling;

Emotional induction or "fishing heat".

In the Meme coin market, there are often projects or communities that deliberately increase the amount of mentions, create fake popularity, and spread false news. If Grok is used without discrimination, such false signals may be misjudged as buying opportunities, but in fact they are just selling traps. This is also one of the biggest risks when using Grok for trading: relying on "what the crowd is saying" rather than "what the market is doing."

Small currencies have weak signals

Although Grok is good at discovering hot topics, it has limited support for unpopular altcoins or niche DeFi projects. If a coin has very few mentions on X, the signal returned by Grok may not be representative or even irrelevant.

Therefore, for the analysis of low-market-cap tokens, it would be more effective to use on-chain tools such as Nansen or TA software.

No built-in risk control capabilities

Grok cannot identify traders’ position sizes, stop-loss settings, or risk tolerance, so it will not remind users if they have over-positioned, chased highs, or bucked the trend. This is also a common misunderstanding among many novices, who believe that AI tools can automatically avoid risks. In fact, AI can only point out market hotspots, and whether it is worth following up still requires judgment.