BTC breaks through the $110,000 mark again in the short term. What will happen next?

Original | Odaily Planet Daily

Author | Azuma

With the positions of the “open” whale James Wynn being sniped out, the market seems to be back on track again. (For details, see “ From whale to ant, the fall of the legend of on-chain contract James Wynn? ”)

From last night to this morning, the market has seen another sharp rise. OKX market data shows that BTC briefly broke through 110,000 USDT, reaching a high of 110,650 USDT, a 24-hour increase of 3.95%; ETH also strengthened this time, breaking through 2,700 USDT, reaching a high of 2,727.9 USDT, a 24-hour increase of 8.36%; SOL, which has performed relatively flat recently, also broke through 160 USDT in the short term, reaching a high of 161.83 USDT, a 24-hour increase of 5.21%.

In addition to BTC, ETH, and SOL, altcoins also showed a general rise. Perhaps influenced by the "SEC Chairman emphasized that an exemption policy is being formulated for DeFi", the DeFi sector has risen particularly prominently. As of the time of writing, AAVE is temporarily reported at 288.2 USDT, a 24-hour increase of 13.87%; UNI is temporarily reported at 7.2 USDT, a 24-hour increase of 13.5%; MKR is temporarily reported at 2012 USDT, a 24-hour increase of 14.2%.

As the industry rises, the total market value of cryptocurrencies has also grown rapidly. According to CoinGecko data, the total market value of cryptocurrencies has exceeded 3.563 trillion US dollars, up 2.1% in 24 hours. Cryptocurrency users' trading enthusiasm has also increased significantly. Today's Fear and Greed Index has reached 71, with a level of "greed".

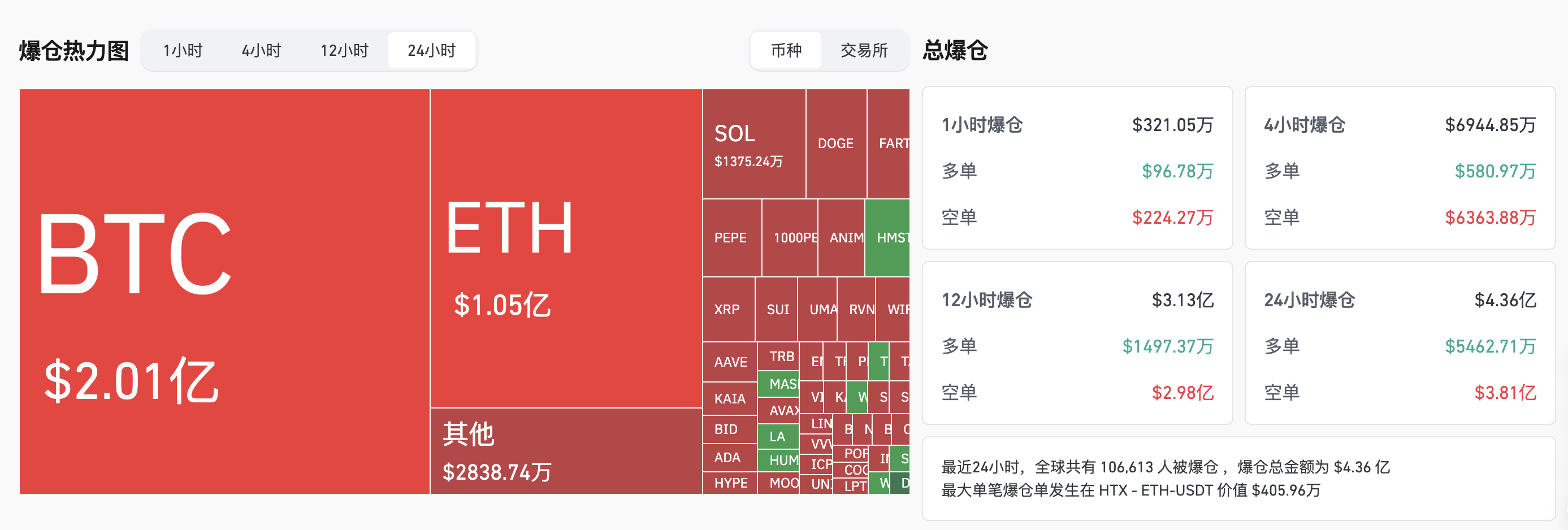

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the entire network has been liquidated for $436 million, of which the vast majority are short orders, amounting to $381 million. In terms of currencies, BTC liquidated $201 million and ETH liquidated $105 million.

Analysis of the reasons for the rise

Regarding the specific reasons for the rise in the market, apart from the clear positive news of the DeFi sector, there does not seem to be much news about the overall market. In contrast, the traditional financial market did not see a similar trend yesterday, and the S&P 500 and Nasdaq indexes closed almost flat last night.

Combined with the analysis of many professionals, the driving force behind this rise seems to be more derived from the accumulation of sentiment from a number of recent "small positives" and the internal structure of the cryptocurrency market.

Well-known trader Ansem said on X last night that his interest in cryptocurrency investment has never been so high. Many companies such as Strategy are buying billions of dollars worth of Bitcoin on their balance sheets (Last night, Strategy announced that it would increase its holdings by 1,045 BTC; Circle IPO was oversubscribed 25 times and has risen 5 times since its opening; Plasma 's public offering with a valuation of $500 million was filled in two minutes; Polymarket will reach a cooperation with X; the US government is actively pursuing regulatory clarity...

Bitfinex analysts pointed out in a report on Monday that after Bitcoin fell 10% to around $100,000 and more than $1.9 billion in leveraged positions were liquidated in the crypto derivatives market in the past week, the crypto market has now gained a firm foothold and is expected to start a new round of increases.

Caleb Franzen, founder of Cubic Analytics, also said: "It is most appropriate to describe this wave of market as 'peaceful rise'. Simply put, it continues to make higher highs and lows. As long as there is any sign of weakness, buyers will enter the market to defend the trend."

In addition, some traders adopt a minimalist analysis strategy, believing that everything except the broad money supply (M2) is noise. As shown in the figure below, in this 78-day offset BTC price and M2 data comparison chart, BTC's trend almost completely follows the increase and decrease of M2.

Ironically, the now-defeated giant James Wynn was once a believer in the M2 theory, but with his aggressive operations, his floating profits of hundreds of millions of dollars have disappeared. For this reason, some traders who are partial to conspiracy theories believe that this rise is a continuation of the market two weeks ago, and the volatility in the past two weeks is just because some forces are sniping James Wynn's huge positions. Now that James Wynn has fallen into the dust, the market should return to its original path.

Next, focus on CPI

This week, the Federal Reserve enters a blackout period before its monetary policy meeting in mid-June, so there will be basically no public speeches by Federal Reserve officials.

There is no doubt that the news that will have the greatest impact on the market this week is the May CPI data to be released at 20:30 on Wednesday night. Wintermute trader Jake O also pointed out: " The data before Wednesday is light, and the CPI data will provide new clues for US inflation. "

E-zi is finally hard, will the copycat season come?

Looking back at the rebound in the past two months, the performance of ETH, which has been in a long-term downward trend in this cycle, can be said to be unexpectedly amazing. First, the recent rebound of ETH from its low point has even exceeded that of BTC; second, the discussion sentiment around ETH has gradually shifted from FUD to more bullish voices.

You can find many answers to the reasons for ETH's rise. For example, SharpLink Gaming hopes to build a growth flywheel similar to Strategy around ETH; for example, the Ethereum Foundation has finally shown some reform momentum and started to "slim down" itself; and for example, Trend Research and other institutions are openly bullish and increasing their positions...

As a "barometer" of altcoins, the strong rise of ETH has rekindled the market's hope for the "altcoin season" that seems to never come again. In this regard, many traders believe that as the industry's attention continues to rise, funds may overflow into altcoins, but they also emphasize that there will no longer be a "general rise in all coins", and only a small number of protocols can attract the inflow of these funds.

Ansem wrote on X: “The vast majority of altcoin/BTC trading pairs have fallen to historic lows, while industry attention has never been higher - this divergence will lead to a high concentration of funds in a very small number of protocols (not just BTC). ”

Another well-known trader , Eugene, also posted on his personal channel that looking back at the development of altcoins in the market, especially after the Meme coin craze and HYPE, the market rules are clearly visible. Projects with the following three characteristics will receive a market premium: a sustainable growth business model (preferably independent of the bull and bear cycles of the crypto market); extremely low token inflation through an unlocking mechanism (sell-off by investors or teams); teams that value the interests of token holders, usually by using part of their income for open market token repurchases (note: this is fundamentally different from the destruction of tokens with no actual value).

Eugene added that there are very few project tokens that meet all three criteria at the moment, HYPE is one of them, but it is foreseeable that the next batch of market winners are in the making.