Bitcoin spot ETFs saw a single-day net inflow of $433 million, led by BlackRocks IBIT, reflecting strong institutional investment enthusiasm and market confidence.

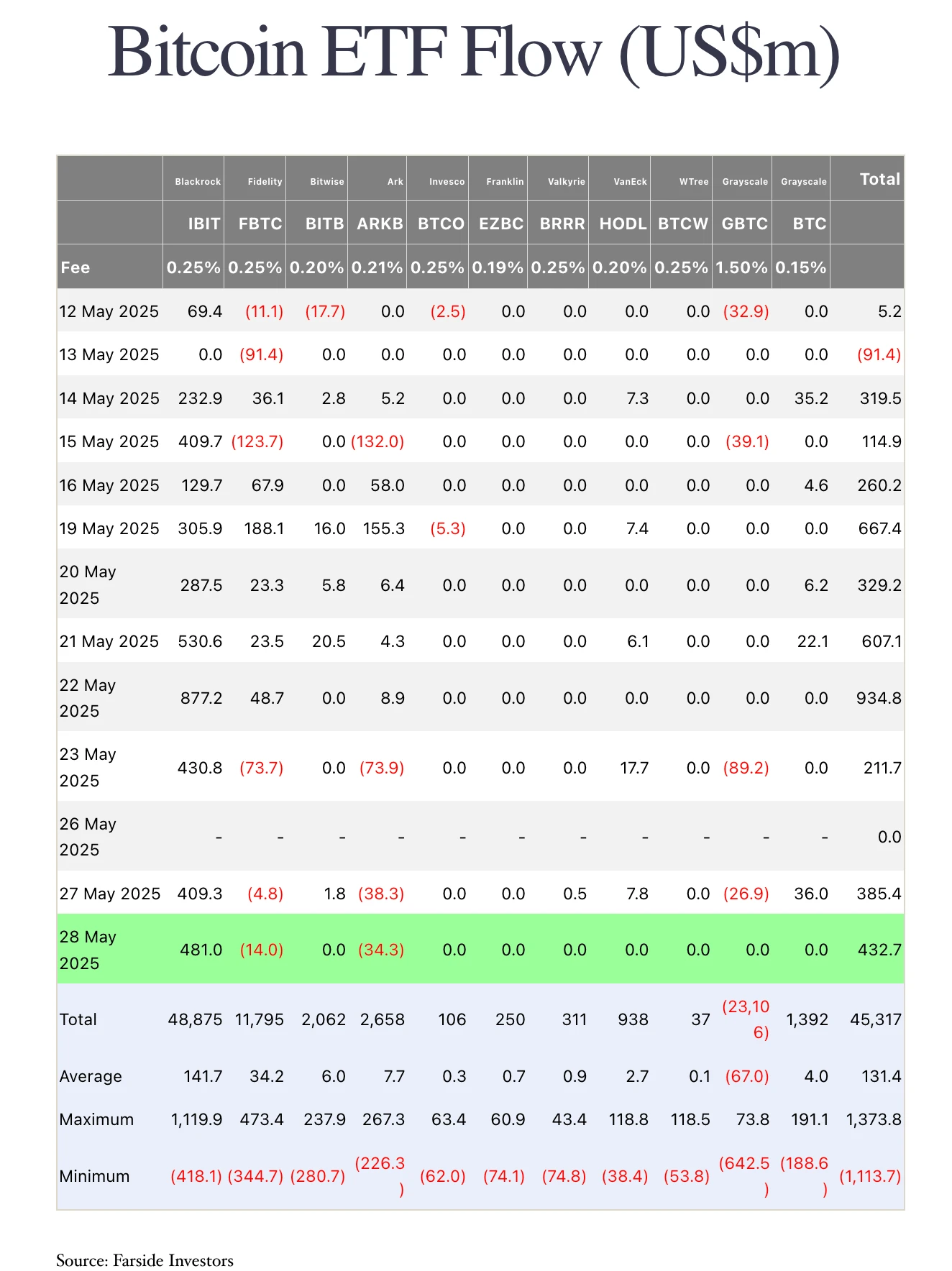

Despite ARKBs net outflow of $34 million, total assets under management for Bitcoin spot ETFs still reached $130 billion, showing the growing mainstream adoption and its profound impact on market liquidity.

At present, the assets managed by Bitcoin spot ETFs account for 6.11% of the total market value of Bitcoin, with a cumulative net inflow of US$45 billion, becoming an important bridge connecting cryptocurrencies and traditional finance.

Bitcoin spot ETFs saw a net inflow of $433 million, led by BlackRock IBIT, showing strong institutional interest and market confidence. Although ARKB saw a net outflow of $34 million on the day, total assets of Bitcoin spot ETFs have reached $130 billion, reflecting the continued increase in mainstream adoption and its profound impact on liquidity.

Currently, the assets managed by Bitcoin spot ETFs account for 6.11% of the total market value of Bitcoin, becoming an important bridge connecting the crypto world and traditional finance, with cumulative net capital inflows reaching US$45.3 billion.

Bitcoin is gradually being accepted by traditional finance, and Bitcoin spot ETFs have become a key tool for investors to gain exposure to Bitcoin.

On May 28, 2025, U.S. time, the total net inflow of Bitcoin spot ETFs reached US$433 million in a single day, showing that investor confidence continues to increase and interest in this asset class is also increasing.

What is a Bitcoin Spot ETF?

A Bitcoin spot ETF is a fund that is listed and traded on a traditional stock exchange, such as Nasdaq or NYSE. It actually holds Bitcoin and closely tracks the market price. Unlike futures-based ETFs, spot ETFs do not involve complex derivatives or additional fees.

It provides investors with a simple and direct way to invest in Bitcoin - no need to learn blockchain technology, no need to worry about private key management, just invest through a regular brokerage account.

As of press time, the total assets under management (AUM) of all Bitcoin spot ETFs has reached US$130.291 billion, accounting for 6.11% of the total market value of Bitcoin.

Its historical cumulative net inflows reached US$45.344 billion, proving that funds continue to flow into these funds, thereby driving the liquidity and recognition of Bitcoin in traditional finance.

May 28 Highlights: Fund flows show divergent sentiment

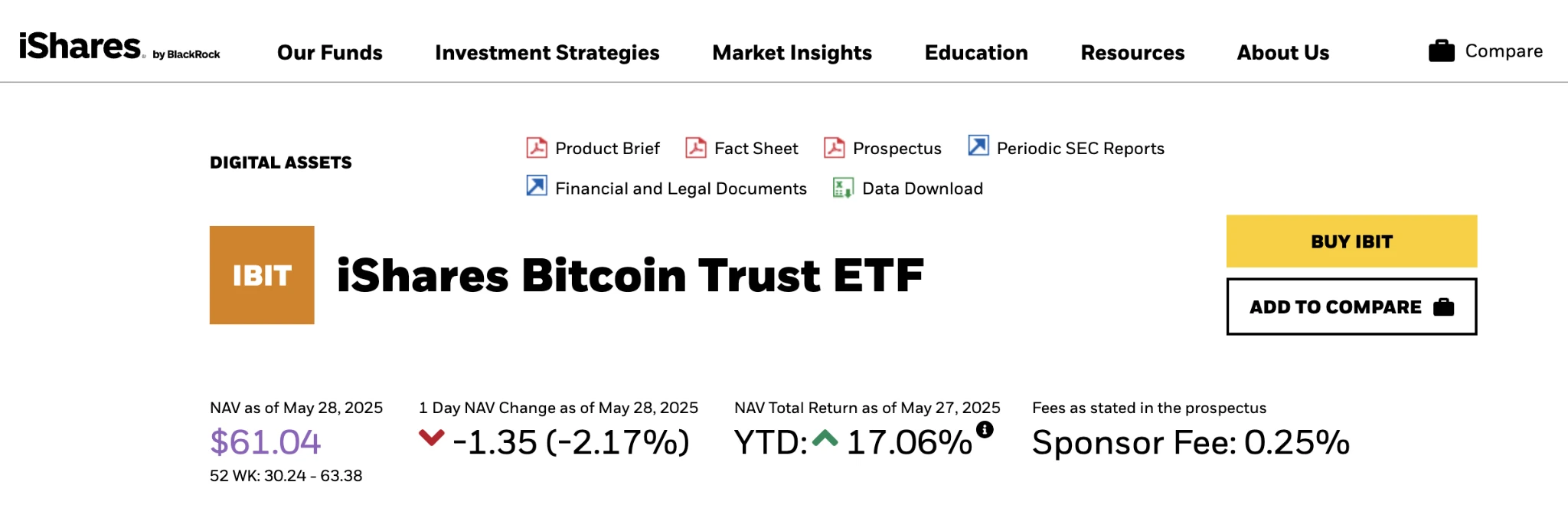

On May 28, the Bitcoin spot ETF had a single-day net inflow of $433 million. The strongest performer was BlackRock’s IBIT ETF, which had a net inflow of $481 million on the day.

As the worlds largest asset management company, Blackstones involvement in crypto assets has added trust and legitimacy to the Bitcoin market. IBITs current cumulative net inflow has reached $48.875 billion, demonstrating its dominant position in the market.

This also shows that more and more institutional investors view Bitcoin as a tool to hedge against inflation or diversify assets and are increasing their allocations.

In contrast, the ARKB ETF jointly launched by Ark Invest and 21 Shares had a net outflow of $34.29 million on the day, which was the largest single outflow on the day. But even so, ARKBs cumulative net inflow still reached $2.653 billion, a solid performance.

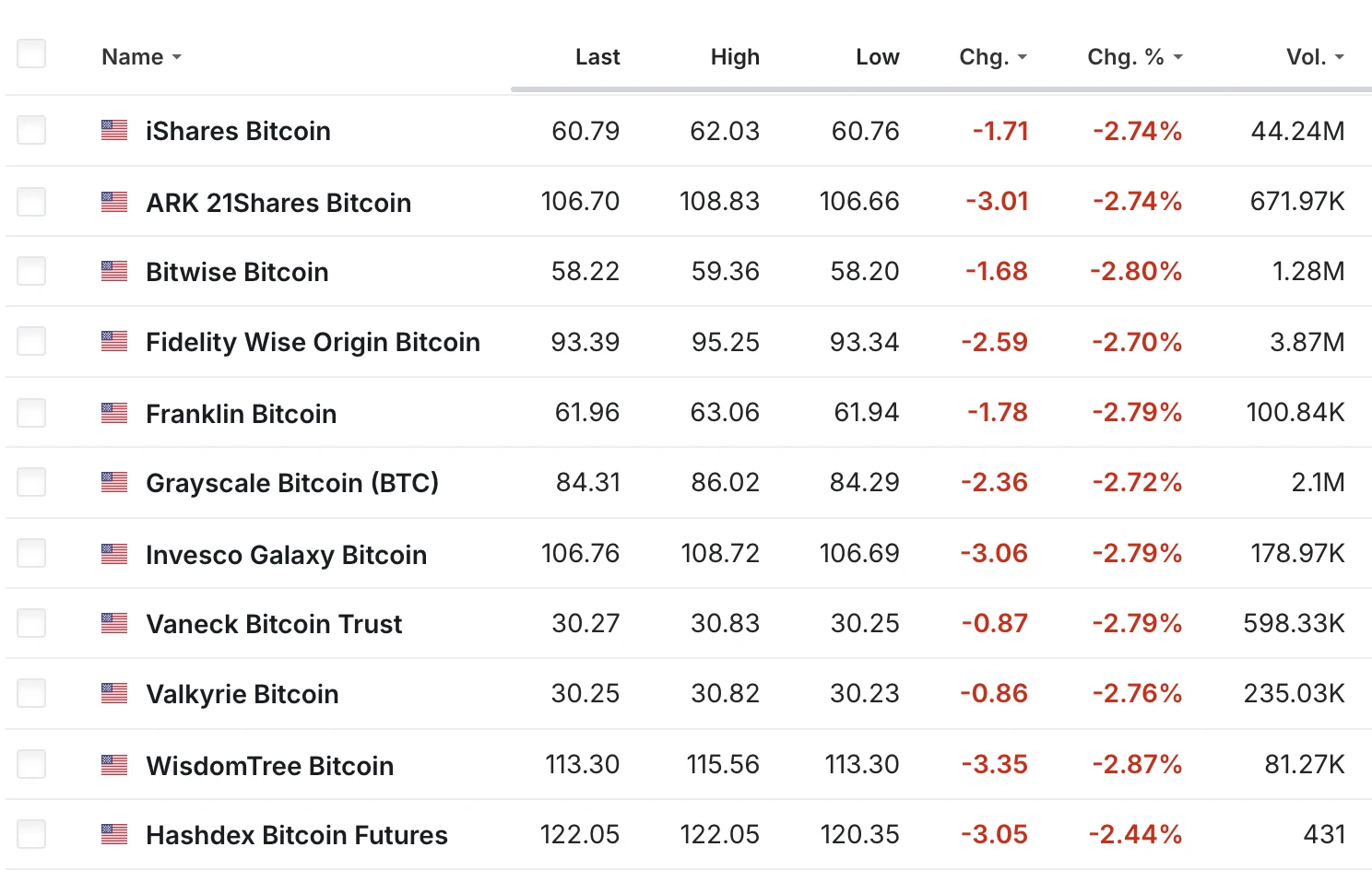

Such outflows may simply be short-term profit-taking, or investors may be shifting funds to stronger-performing products such as IBIT, reflecting the increasingly fierce competition within the market.

What do these capital flows represent?

The $433 million in net inflows shows that investors’ confidence in Bitcoin remains strong. Bitcoin is seen by some as “digital gold” and a safe-haven asset amid high inflation, frequent interest rate changes and geopolitical tensions.

The strong performance of IBIT also reflects the trust of large financial institutions. The outflow of ARKB reminds us that short-term changes in market sentiment may quickly affect the capital flow of specific ETF products.

Investors may choose between ETF products based on fees, liquidity, or the credibility of the management team.

Currently, the Bitcoin spot ETF holds 6.11% of the total Bitcoin in circulation, which means that its impact on the spot market is very real. When investors buy ETF shares, the fund needs to simultaneously buy real Bitcoin as support, which will drive up the spot price.

The cumulative net inflow of US$45.344 billion proves that these ETFs have brought huge liquidity to the crypto market and successfully built a bridge to the traditional financial system.

Opportunities and risks for investors

Bitcoin spot ETFs offer many conveniences. They allow ordinary people to easily invest in Bitcoin without having to master complex technology or manage digital wallets themselves. Most of these ETFs are regulated by institutions such as the US SEC, adding a layer of trust to the market.

The involvement of large institutions like BlackRock also brings stability and credibility. But risks still exist.

Bitcoin is still a highly volatile asset by nature, and ETF prices may fall rapidly due to policies, news or macroeconomic events. In addition, most ETFs charge management fees, which may affect actual returns in the long run.

Investors need to carefully assess their risk tolerance and make a reasonable balance between potential gains and losses.

The future of Bitcoin and ETFs

Looking ahead, Bitcoin spot ETFs are expected to continue to grow and further deepen their integration with traditional finance. The net inflow of $433 million on May 28 and the current total assets of $130.291 billion show that this market still has a lot of room for growth.

The success of IBIT reflects the power of institutional funds, while the net outflow of ARKB reminds us that the market is still in dynamic competition. As regulations continue to be optimized, more financial institutions may launch their own Bitcoin ETFs in the future to further expand the market.

For investors, Bitcoin spot ETFs are a convenient way to enter the crypto space. But to achieve long-term success, you must understand market trends, closely track capital flows, and always be aware of risks.