Infinex, which raised 60 million yuan, joins Zuilu, and quickly introduces the rules and interaction methods of the four modules in one article

Original | Odaily Planet Daily ( @OdailyChina )

Author|Nan Zhi ( @Assassin_Malvo )

On May 16, Infinex announced the launch of Yaprun Season 1 and issued $600,000 worth of µPatrons to Season 0 users. At the same time, Infinex stated that the Yaprun 0-3 activities and the Kaito community will issue a total of $6 million worth of µPatrons .

Infinex has raised a total of $67.7 million , and the open airdrop incentive activity may be seen as a precursor to TGE. Therefore, this article will sort out Infinex's business, background, and current interactive content.

Business Analysis

According to the official definition, Infinex is a "new type of Crypto application designed for humans". Specifically, its business is closer to "chain abstraction". During the use process, a series of complex concepts such as wallet addresses, cross-chain bridges, mnemonics, gas, etc. will be abstracted . Users do not need to master or even know these concepts. They can seamlessly access more DeFi-like applications like using CeFi products.

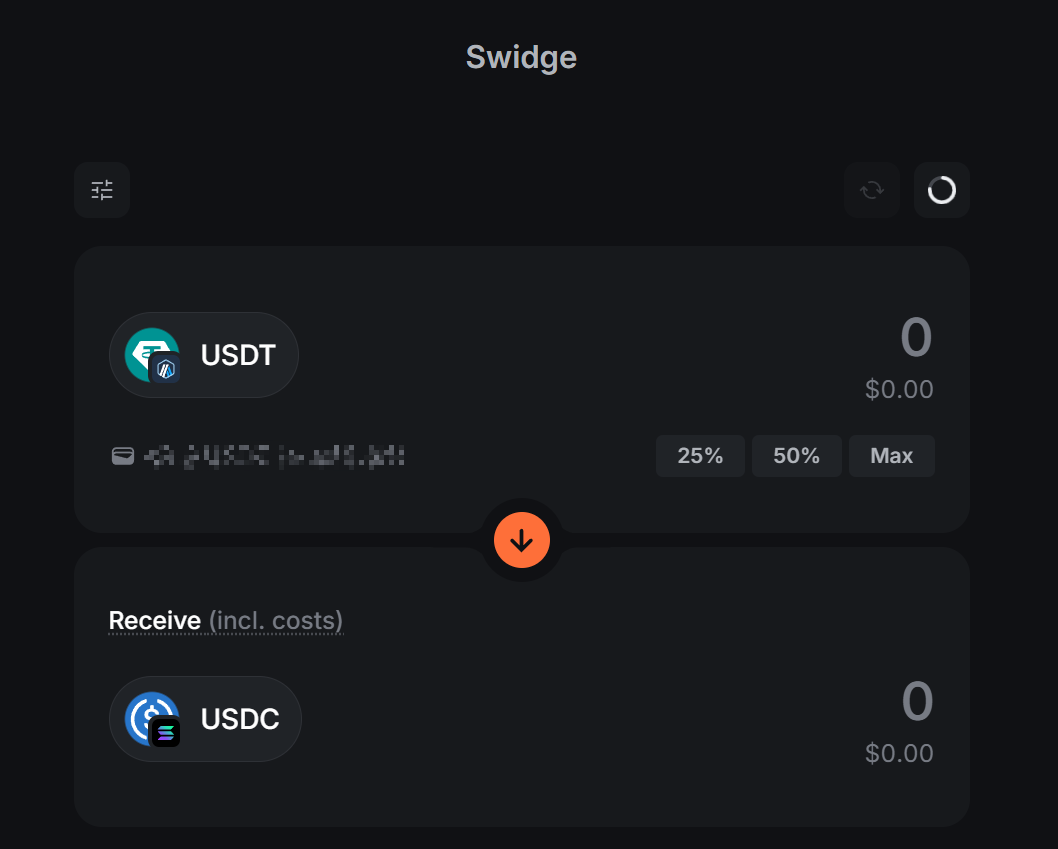

Currently implemented applications include cross-chain exchange (Swidge) and some seamless DeFi applications. For example, users can quickly exchange USDC on the Arbitrum chain for SUSDE on the Solana chain and automatically enter the Ethena ecosystem to earn interest.

Project Financing

Infinex was founded by Kain Warwick, the founder of Synthetix, and raised $67.7 million through NFT sales in September 24. Public buyers included institutions such as Wintermute and Solana Ventures, as well as industry figures such as Solana founder Anatoly Yakovenko and Aave founder Stani Kulechov.

Project NFT Infinex Patrons

Infinex sold 43,244 Infinex Patrons, the NFT used for financing, with a total of 100,000. However, the current floor price of the NFT is 2.42 ETH, worth about $6,600, which means that the total market value of the NFT has reached $660 million .

The recent new coin market is bleak compared to previous years. Even new projects listed on Binance often have a circulation market value of only tens of millions of dollars. Therefore, the current price of this NFT is not worth buying, and users are recommended to obtain the remaining unsold NFTs through other channels.

Yaprun

As mentioned above, Infinex airdropped $600,000 worth of µPatrons rewards to Yaprun users in Season 0. In fact, µPatrons here refers to the smallest unit of Infinex Patrons. The value of the incentive is converted by the value of NFT. One µPatron is equivalent to one millionth of a Patron NFT. However, it should be noted that µPatron is currently not redeemable, and its realizable value may need to wait for TGE confirmation.

Yaprun’s total incentive value is $6 million, with Season 0 accounting for 10%, the ongoing Season 1 accounting for 15%, and the subsequent two seasons accounting for 25% and 30% respectively. The remaining 20% will be distributed to the Kaito community, including Genesis NFT holders and Kaito stakers.

Cross-chain Swidge and seamless DeFi

Swidge is very simple, that is, directly exchanging tokens from chain A to chain B across chains. Currently, a total of 12 chains are supported.

In addition to cross-chain, Swidge is actually a hidden "money-making" artifact. Currently, there is no fee for withdrawing money from Infinex (including network fees) , so users can withdraw funds from low-cost chains, then exchange them for tokens of other chains, and then transfer them out from Infinex.

For example, transferring USDT directly from Binance to the Ethereum mainnet requires a handling fee of 3 USDT, while transferring from Binance to Polygon only requires a handling fee of 0.02 USDT, and then exchanging USDT across the chain to the Ethereum mainnet on Infinex consumes about 0.4 USDT. Finally, the total cost of free withdrawal is only 0.42 USDT, which is much lower than the 3 USDT directly withdrawn from the exchange.

It is recommended that users combine it with other projects that require capital flow to reduce costs while achieving "killing two birds with one stone".

Earn

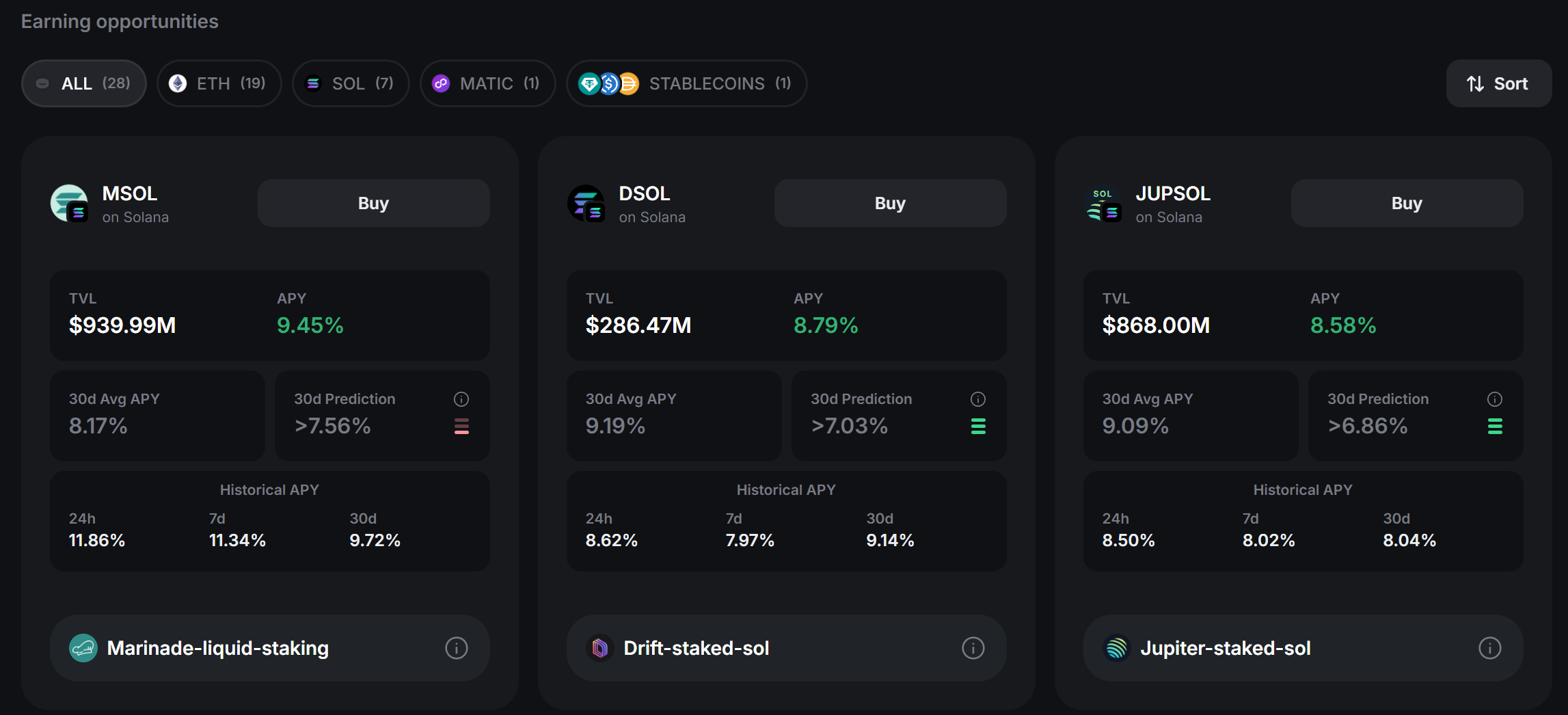

In addition to the cross-chain exchange Swidge, another currently available module of Infinex is Earn. Users can withdraw assets from the outside to Infinex, or Swidge corresponding assets internally, such as JUPSOL, JITOSOL, etc., which will automatically enter the interest-bearing link.

However, it should be noted that Swidge and Earn do not have clear points or other incentive methods, and it is unknown whether they are included in the airdrop assessment, but users are advised to interact regularly.

Bullrun

In addition to Yaprun, the only part of Infinex with clear points is Bullrun, a game that predicts the rise and fall. To participate in the game, you need to deposit more than $250 in assets to Infinex . After the deposit, you can get 1 card pack every day . After opening it, you can get cards representing 30 cryptocurrencies such as BTC, ETH, SOL, etc.

A new round of the game will start at 08:00 (UTC+ 8) every day and last for 24 hours. Users can choose 5 cards the day before and predict that the tokens corresponding to these 5 cards will rise. For every 1% increase, 100 points will be gained, and for every 1% decrease, 100 points will be lost . Only two identical cards can be used in each round, and the points income of the second card will be reduced by 50%, which means that the operation of all-in single tokens is not allowed .

At the same time, users can lock their cards in the current round, that is, stop the score change of a certain token, and lock the score at the rising high point. For example, if the price of BTC is 100,000 US dollars at 08:00 and rises to 101,000 US dollars at 12:00 on the same day, you will temporarily get 100 points at this time. If you choose to lock the card at this time, the 100 points for the day will be fixed, and the subsequent rise and fall will have nothing to do with you. Assuming that the price falls back to 100,000 US dollars the next day, users who have not locked their cards will not get points, and you will still have a fixed score of 100 points, and vice versa.