Odaily exclusive interview with Arkham: Creating a closed loop of on-chain intelligence transactions and reconstructing the decision-making chain of the crypto market

Original | Odaily Planet Daily ( @OdailyChina )

Author: jk

Before 2024, most users still had the impression of Arkham as a "crypto intelligence platform" - it was famous for its accurate wallet labeling and on-chain fund tracking capabilities, and had repeatedly revealed core address information related to government coin sales, hacker attacks, and whale operations. However, when Arkham officially launched its centralized exchange function in 2024 and promoted compliance and expansion globally, its identity began to undergo a fundamental change.

In this exclusive interview, Odaily had an in-depth conversation with Arkham founder and CEO Miguel Morel , reviewing the development trajectory of this emerging company since its establishment. He talked about Arkham's transition from a simple on-chain analysis tool to a trading platform, how to build an AI-driven data labeling system, strategies for facing global regulatory challenges, and how to continue to maintain the execution of a "small but elite" team after the user scale exceeded 6.5 million.

In an era when the crypto market is reshaping trust and efficiency, Arkham is trying to become a portal that integrates intelligence and transactions. Their ultimate goal is to make people think of Arkham first instead of opening Etherscan when they want to "check a transfer".

Odaily: Let’s start with the basics. Can you briefly talk about Arkham and your entrepreneurial history?

Miguel Morel: I founded Arkham in January 2020 with the original vision of bringing more transparency to the cryptocurrency space. Before that, I was working on a stablecoin project. You know, when your product is an ERC 20 token, you naturally want to understand who the users are and who is using your token.

If this is a utility token, you’ll also want to monitor market makers’ behavior, the inflow and outflow of tokens on exchanges, and what the big holders are doing — are they holding? Are they selling? Are they buying for some reason? And who are these users?

Trying to identify who is behind certain wallets and who is leading the behavior of these addresses on multiple chains was a very common but difficult thing to do at the time. Because tools like etherscan can't really do these things. And you have to switch back and forth between multiple blockchain browsers. For example, if you want to check Tron information, you have to use TronScan, and if you want to check Ethereum, you have to use etherscan.

So my idea is to integrate all of this into one product, which is Arkham - a multi-chain block explorer. You can view real transaction activities on all major chains on it, and we will also analyze the actual owners behind these addresses for you and upload relevant tags. Users only need to log in to the platform to complete these studies for free.

This is the starting point of Arkham. After we officially launched the product in July 2023, we began to share the product with friends, partners, and some market makers, trading companies, and token project teams we knew. We told them that if you want to track the on-chain dynamics of token holders or investment projects, this platform is a good choice.

From that point on, our user base started growing rapidly. Between August and December 2023, we had 10,000 users. In 2024, from January to July, we had already surpassed 1 million users. Now, we have over 6.5 million registered users.

Judging from usage and traffic, I am almost certain that we are now one of the largest blockchain analysis services in the crypto space. This is the origin story of Arkham.

The protagonist of this interview, CEO Miguel Morel, at the Token 2049 Conference in Dubai

Odaily: Let's talk a little bit about the transformation. Most of our viewers are familiar with Arkham, which is the 2023 version. Because most of the exposure now, such as US regulation related to Bitcoin, ETF-related content, and even major events like the German government's sell-off, basically everyone gets information through Arkham; but few people know about Arkham's product line on exchange services in 2025. Can you briefly talk about this transformation?

Miguel Morel: Of course. We started by analyzing the user base and the overall market, and found that the vast majority of people using our platform are actually crypto traders. Although many journalists use Arkham to research projects and understand industry trends, and we do have a lot of institutional users, if you look at the majority of our millions of registered users, the vast majority are retail or professional traders. They will buy and sell crypto assets on different platforms based on the on-chain intelligence we provide.

So we thought, why not provide trading services directly to these people? So we added a function to directly trade cryptocurrencies on the Arkham platform, which is why we later decided to build a centralized exchange.

Now, in Arkham’s analytics platform, if you are viewing a token’s page or tracking the dynamics of an on-chain asset transfer, you can not only see the details, but also click the “trade” button directly. If you find that someone is selling a token and you want to short it, just click the trade button on Arkham, complete the KYC certification, and you can directly trade spot or contract in supported regions.

We have found a very suitable product-market fit here: a large number of traders who already use our on-chain intelligence have their own needs for a safe, reliable and transparent trading platform. So we are now trying to satisfy this type of users, providing both intelligence and analysis, as well as complete trading services.

This is the entire transformation process of Arkham from focusing on on-chain intelligence and analysis in 2023 to becoming a one-stop platform with both intelligence and trading capabilities in 2025.

Odaily: What motivated you to enter the US market? After all, it would be a direct challenge to Coinbase and Kraken, right?

Miguel Morel: You can say that. I am American, most of the members of the Arkham team are also Americans, and the company was founded in the United States. I have always believed that the demand for crypto assets in the United States has always existed, but this demand has been suppressed due to regulatory restrictions.

In the past few years, the US SEC and related regulatory agencies have taken a very tough stance on the crypto industry. We can cite some examples at random: whether it is Coinbase, Kraken, Gemini, or token projects such as Ripple, the US government has almost taken the initiative to intervene and prosecute them.

This has led to a situation where there is a clear gap between global crypto products and services and the products that U.S. users can actually access. So we decided to seize this opportunity: before the new administration came to power, we had already spent a whole year building the infrastructure in advance. Now, this new administration is obviously more friendly to the crypto industry and is even promoting some crypto-related projects, which finally gives us the opportunity to provide services to users in the way we want.

Of course, it is still not possible to provide perpetuals trading to retail investors in the United States, but I believe this is the direction of the future. You know, in the United States, the stock market already has a variety of mature investment tools such as futures, options, and derivatives. From the perspective of information transparency, the crypto market is actually clearer than the stock market.

So when the US market gradually opens up, regulations become clearer and projects are allowed to operate in compliance, we hope to be at the forefront of this wave and provide complete products and services to US users.

Odaily: Can I understand that you will definitely continue to expand from the 17 states that Arkham currently covers to all 50 states in the future?

Miguel Morel: Yes, that is exactly our goal.

Odaily: You just mentioned that many traders naturally transition from intelligence acquisition to centralized trading, which is a very natural process.

Many readers who trade now complain that since the collapse of FTX, many trader-friendly technology products have disappeared. For example, the tokenized stocks that FTX once supported, as well as the interface settings and functions that are very suitable for high-frequency trading, are gone.

Do you have plans to meet this demand? Are there any specific technical functions currently doing this? Do you have any plans in this regard in the future?

Miguel Morel: Of course, this is a very core area of strength for us at Arkham. We have over 1,000 institutions using our intelligence and analytical tools to guide their trading behavior.

Long before we launched our exchange functionality, thousands of top trading institutions, hedge funds, and market makers (both traditional financial institutions and crypto-native institutions) were already using Arkham’s data. These users are our “base”.

We work with them mainly through APIs to gain a deep understanding of the features and experiences they really want in these products. Our goal is to serve two directions at the same time:

On the one hand, there are retail users . We are currently developing a mobile app that allows users to trade Arkham directly on iOS or Android. Currently, the platform only supports the web version. This is our product direction for ordinary users.

On the other hand, we are also actively improving the trading capabilities and liquidity configurations required by institutions, and providing services to institutions with large amounts of capital and complex transactions.

We are indeed drawing inspiration from products that were praised by users in the past but disappeared after the collapse of FTX, and we also see that many existing platforms are not investing enough in these areas. Therefore, we attach great importance to user feedback, and it is this feedback that drives the direction of our product decisions.

Odaily: Can I understand the future user usage scenario in this way? For example, they are paying attention to an asset in a certain crypto market, and suddenly a notification pops up on their phone, and they can directly trade after clicking on it - can this be imagined?

Miguel Morel: This is exactly what we envision. Although it may not be fully realized in the first version, the vision of the final version is to deeply integrate our existing intelligence analysis system with the exchange function.

Ideally, users can set up dashboards on the platform, set on-chain tracking targets, create alerts, and then once triggered, they can immediately initiate transactions based on these real-time on-chain intelligence. This is our vision for the final product form of Arkham - a complete closed loop with seamless linkage between intelligence and transactions.

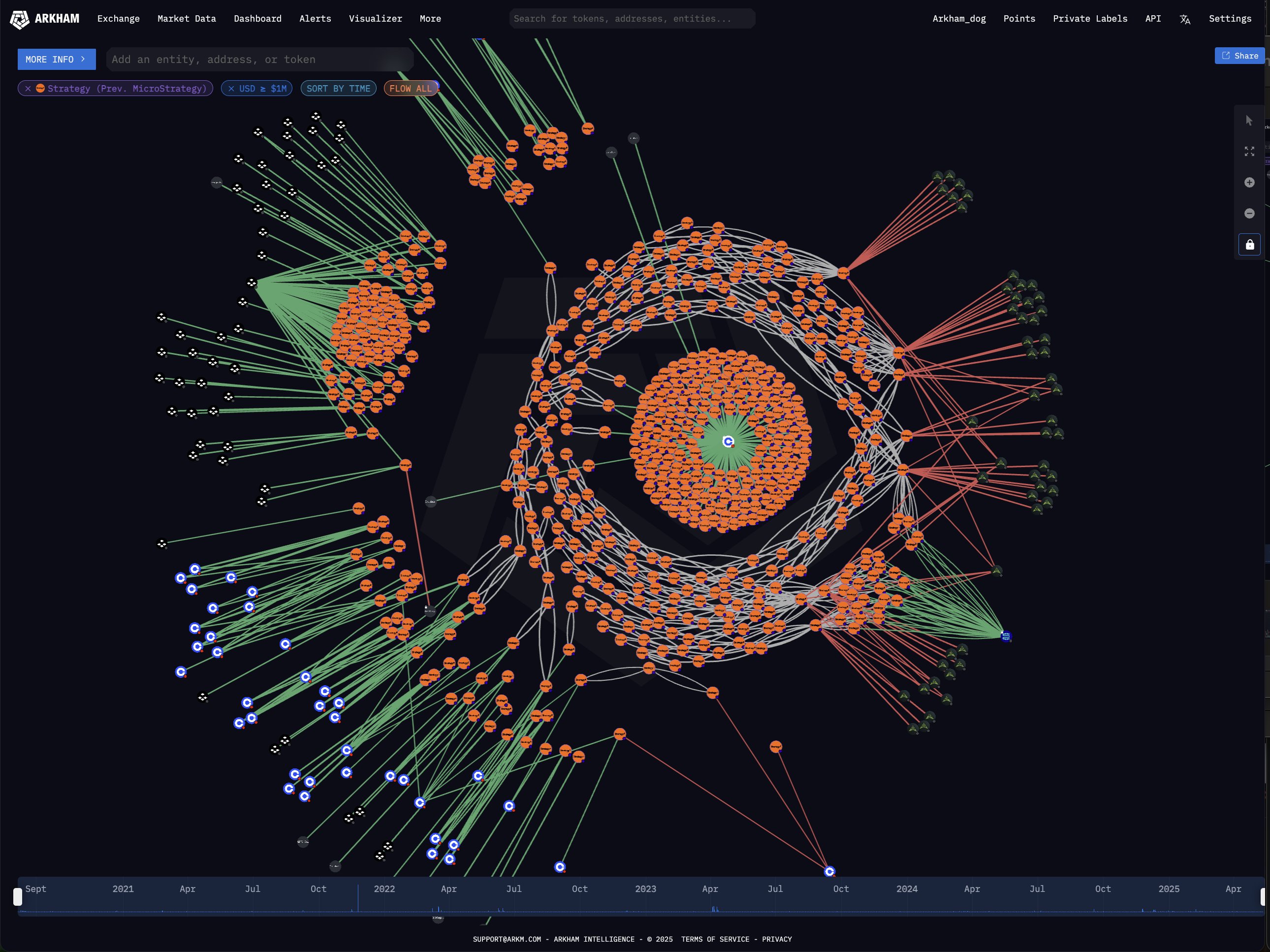

Arkham’s address tracking of MicroStrategy’s Bitcoin holdings. Source: Arkham

Odaily: Will AI functions be incorporated into this process?

Miguel Morel: Of course. In fact, most of the wallet tags on Arkham are automatically generated by AI.

In fact, long before the AI wave in the industry, we were already recruiting data scientists to build our own machine learning models and heuristic algorithms to achieve large-scale wallet tag attribution recognition. For example, we have now labeled about 2.5 billion wallet addresses on the Arkham Intelligence platform - it is impossible to complete this workload manually.

So 99% of the intelligence information you see on Arkham now, and even the Arkham data push you see on social platforms such as Twitter, are generated by AI.

This AI capability has been deeply embedded in our products and is used to improve user experience. The mobile app we are developing will of course continue to use this technology route.

Odaily: Do you find anything fun or interesting in the product building process?

Miguel Morel: I think a lot of the interesting things about Arkham are actually related to the positioning of our product. Some people find it interesting, while others think that what we do is a bit sensitive or even controversial.

For example, there have been voices saying that Arkham is the "eye in the sky" or "spy tool" or "exposure tool" etc. I think these statements are actually deliberately portraying Arkham as a more controversial project than it actually is.

From our perspective, what we do is to make the already public, transparent, and auditable information on the chain truly "usable". The crypto industry has always claimed that it is more transparent than the legal currency system and the traditional banking system, but in fact, for a long time, no platform has truly transformed this transparency into a function that users can use.

This is an underlying feature of the blockchain, but no one has ever used it before. We may be the first to truly turn this public data into a product that is actually helpful to traders and ordinary users, which is why we have been able to gain so much user support and form the Arkham community.

Of course, there are still some people who oppose us, especially those who focus on privacy. They may emphasize the "privacy" side more, but often ignore the other side of encryption technology - that is, openness, transparency and auditability.

We believe that these two are two sides of the same coin. Although they are working on the "privacy" side, and we are working on the "transparency" side, this does not mean that we are opposites. Although we may encounter some "hostility" sometimes, we always believe that what we are doing is beneficial to the entire industry, and we are also continuing to prove our value to the outside world.

Odaily : What you just mentioned is actually another key question I was originally going to ask - "How did you do it?" For example, sometimes you can summarize all the addresses involved in a hacking incident and link them to other incidents; for example, you can also track the wallet addresses involved in institutions such as the United States and German governments, or track wallets related to celebrities such as Trump - these are very complex chains, as you said, it is impossible to accomplish manually.

This is one of the most common questions our users ask: How do you get this information? How do you ensure it is accurate? And why should we trust the data provided by Arkham?

Miguel Morel: We have many sources of information, but the core data source of Arkham is actually the blockchain itself.

The data in the blockchain is completely open, transparent, and verifiable. Addresses never exist in isolation, they are always connected to other addresses. If a new address does not receive any assets, it is meaningless. Once it receives funds, these funds must come from other addresses. This "fund flow" constitutes the basic logic for us to identify and associate addresses.

So what we are doing is to systematically track the inflow and outflow of crypto assets and study where they come from and where they go. Behind these flow relationships, there is actually a lot of information that can be inferred, such as who are the insiders of a project and which are the hot wallets or cold wallets of the exchange.

In addition to on-chain flow data, we also combine off-chain information sources, such as court documents, government reports, regulatory documents, etc. For example, if MicroStrategy announces that they bought $100 million worth of Bitcoin in January, another $100 million in March, and another $500 million in December, we can go to the chain to find out if there is a wallet group that matches this time and amount pattern. By combining on-chain and off-chain data, through machine learning and heuristic algorithms, we can infer the ownership of these addresses and mark them.

In addition to on-chain data, we also combine public information, such as court documents, government reports, SEC disclosure materials, etc. For example: MicroStrategy publicly stated that they bought $100 million in Bitcoin in January of a certain year, another 100 million in March, and another 500 million in December. Then we can go back to the chain to find the address groups that have transferred money of corresponding scale at these time points and perform pattern matching. What Arkham does is to combine these on-chain data with off-chain information, use the machine learning model and heuristic rules we built to connect them, and finally generate address labels.

The most important point is: this information is public.

Anyone can see these tagged data on the Arkham platform, and they are exactly the same information I see. If anyone finds an error, they can submit feedback. Moreover, most of the wallets we track are well-known exchanges, funds, and wealthy people. Sometimes after we generate the labels, reporters will report on these wallets. Almost no one raised any objections to us from these tagged entities.

I've been doing Arkham for five years now, and I can count on one hand the number of times someone has come to us and said, "This is the wrong label, this is not me."

This also indirectly proves the accuracy and influence of Arkham platform labels. Sometimes, even after we mark an address on the chain, it takes a long time for third-party information to confirm the true ownership of the address. So this process is not only accurate, but also often ahead of the times.

Odaily: At Odaily, we have observed a clear trend: Before 2023, the US regulatory environment was very strict, and the SEC sued everywhere, especially against crypto companies that provided services in the United States. Since Trump returned to the political core, the regulation has been significantly relaxed. The SEC is now beginning to listen to the voice of the industry and is much more open.

What do you think of the current regulatory landscape? Where might it be headed in the future? How will Arkham respond?

Miguel Morel: I think overall, the regulatory environment is still cautious and even skeptical of the crypto industry.

Take ourselves as an example. We currently only conduct business in 17 states in the United States. If we want to operate fully, we need to submit applications to other states and obtain various licenses such as money transmission licenses (MTLs) to ensure that we operate in compliance with the framework permitted by law.

Looking around the world, the regulatory rules for cryptocurrencies vary greatly from country to country. Some jurisdictions do not allow the provision of contract products at all; others only allow access to users through "reverse solicitation" but do not allow direct marketing. This has led to a very fragmented and complex set of compliance challenges facing the entire industry.

Nevertheless, I think the general trend is positive, especially the United States is gradually promoting a more constructive crypto regulatory system, which will have a demonstration effect on the world. The reason why many countries have strict regulations is that they are highly dependent on international institutions such as the United States, the World Bank, and the International Monetary Fund (IMF) in their financial systems. These institutions have determined to some extent what is "compliant" and what is "unacceptable" globally.

Therefore, if the United States begins to show goodwill towards crypto assets, other countries will gradually follow suit, relax policies and increase inclusiveness, so that the crypto ecosystem and entrepreneurs can truly grow healthily.

As for Arkham, if I had to do it all over again, I would still choose the same path, repeat the same strategy, and continue to focus on what we are doing.

Odaily: What do you think is the biggest difficulty in the process of starting a business? In addition to the compliance issues we just mentioned, what other challenges are there?

Miguel Morel: Recruiting. Recruiting is a very big challenge. It is very difficult to find smart, motivated, and talented people who are willing to work to the standards we demand of Arkham.

We are a lean and efficient startup team. We don't want to fall into bureaucracy, nor do we want to become a large, bloated, lifeless company. We want to stay small and lean, stay vibrant, and continue to create excellent products. The only way to do this is to recruit only top talents, true A+ level members.

But once you really set your hiring standards at this high, you’ll quickly find that very few people actually meet this standard. You’ll quickly run out of connections. You’ll also realize that it’s impossible to hire such people through LinkedIn or cold emails. Even most of the people who apply through our website don’t meet this standard. They’re just ordinary people looking for a job, but not looking for a career that can become their life’s mission.

The people we are looking for must be those who are willing to take this job as their lifelong career and pursuit. We now have a team of about 50 members. Judging from the number of applications, we receive a lot of resumes, but very few people are actually accepted by us. This is also one of the most difficult things we encountered in the process of starting a business.

Odaily: Speaking of competition, what do you think of the current competitive environment? After all, there are thousands of centralized exchanges in the market, some of which are more general and some are aimed at professional traders. How do you view your competitors?

Miguel Morel: I think our biggest competitor right now is actually ourselves.

We need to constantly polish our products to make them better and better; we need to continue to find the right talents; and at the same time, we need to keep the team lean and restrained. This is what I often tell the team - our biggest battle is fighting ourselves and fighting inertia.

Often, when a project achieves some initial success, such as we now have millions of followers on Twitter and millions of registered users on the platform, it is easy for people to have a "take a break" mentality at this stage. But if you really want to expand your business, you can't stop. So the most important thing is to constantly remind yourself and your team not to be satisfied with the current achievements, but to continue to push the business forward.

As for external competitors, the biggest rivals are still traditional centralized exchanges. Although these exchanges have a huge user base, they generally have serious regulatory burdens and often do a poor job in user experience, especially for token projects, market makers, and large traders.

So our goal is to provide these user groups with a completely better alternative - whether it's product experience, service level, or transaction transparency.

Odaily: Let’s talk about the competition on the on-chain intelligence side: There are obviously more and more on-chain data analysis tools on the market. What do you think of the competition in intelligence analysis?

Miguel Morel: To be honest, although there are many names on the market now, the actual traffic of these platforms is very low, especially compared with the user interaction we get on social media, official websites and platforms.

In my opinion, our real competitors are not these “intelligence” platforms, but traditional blockchain browsers like Etherscan, TronScan, and SolScan. Their user base and traffic are much higher than most on-chain analysis tools.

So for us, what we really want to surpass are these browser-level products. Take Ethereum as an example. Now if you transfer an ETH and someone asks you to "give me proof", you will most likely send him an Etherscan link. Our goal is to make people send Arkham links instead of Etherscan links in the future. This kind of "default cognition" level of influence is what we really want to benchmark and pursue.

Odaily: Last question - what are your plans for the next 12 months? Are there any key milestones worth looking forward to?

Miguel Morel: Of course. Our next goal is to enter more countries and regions and expand the scope of our service jurisdictions as much as possible.

We currently prioritize markets that are more friendly to the crypto industry, but we also hope to challenge those regions with stricter regulations but huge market size and officially provide services under the premise of compliance. For example, the UAE's VARA license is a focus on our roadmap, and we are planning to advance in this direction to further enter the Middle East market.